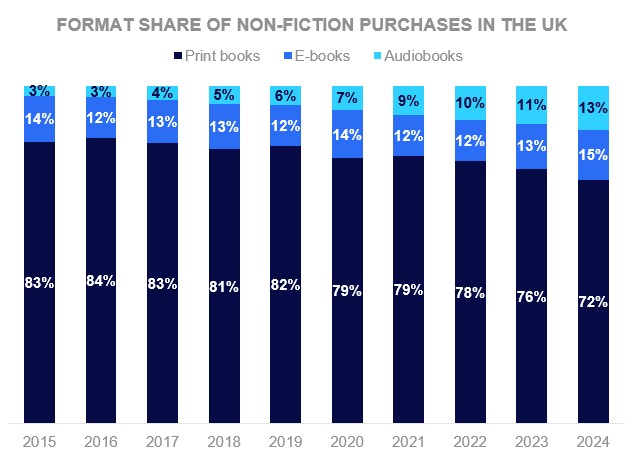

Digital has carved out its place in the book market over the years, but 2024 saw an accelerated shift for non-fiction in the UK, thanks to strong e-book and audiobook growth against a decline in print. This led to digital formats accounting for their highest share of non-fiction purchases on record in the latest year, with the print share dropping below three-quarters for the first time. E-books remain ahead of audiobooks, shown in the graph below, but the gap has narrowed: over the last five years, audiobooks have nearly doubled their share of non-fiction purchases while e-books have only gained 1% compared to 2020.

Of course, non-fiction is a varied sector, and genres within that have adapted to digital differently. A few areas still exceed 90% print share, like travel, art/photography and craft books, understandably so given the nature of these books. The categories migrating the most to digital are generally related to self-help and smart thinking; in 2024, e-books took their largest share in computing/IT/technology, while audiobooks had their largest in self-help/popular psychology.

Looking at purchase numbers, self-help/popular psychology was the top non-fiction genre overall in the latest year, and for both e-books and audiobooks, but auto/biographies led in print books. Together, the two genres made up just over 30% of non-fiction purchases, increasing to 45% of audiobooks. Within the top genres for 2024, shown below, religion also overperformed in audio, along with business/economics, although the latter takes its highest share in e-books. The biggest difference between the formats can be seen in food & drink, which is only a sliver of the audiobook market. Makes sense to me, I know if I tried a cookery audiobook, I’d spend all my time rewinding to check that I heard the measurements correctly!

Just like the genres, not all buyer groups are switching to digital at the same rate: consumers aged 60-84 still buy a significant portion of their non-fiction books in print, although their fiction purchases are the most likely to be digital among the broad age groups. While the digital share tends to increase with age in the fiction sector, non-fiction isn’t as consistent of a pattern, and in the latest year, it was 25-44s turning to digital the most, at just over a third of their non-fiction purchases.

Overall, 25-44s bought 42% of non-fiction in 2024, and that rises to just under half of non-fiction e-books, 54% of audiobooks and 60% of digital self-help/popular psychology books. They’re certainly a key part of the digital growth in non-fiction, and it’s important to understand the nuances of the market and consumers to further that growth. As we’ve learned here, the genres don’t behave the same as non-fiction in print, and the consumers don’t shape up the same as fiction in digital, so it’s about exploring and adapting findings from both sides and charting a new path forward.

Our annual report The UK Book Market in Review 2024 explores more of the print and digital books markets in the latest year. For more information and to purchase, please contact infobookresearch@nielseniq.com.