Our Understanding the UK Audiobook Consumer study turned ten years old in 2025, giving us a decade of insights into this exciting and evolving market. Since the first survey in 2016, the audiobook market has nearly tripled in size, now accounting for one in ten books bought in the UK. The market is still growing and the audience is still expanding, with 2025 survey results showing that two in five audiobook consumers had started listening in the last 12 months. Curiosity remains the top factor leading to people trying audiobooks, but 2025 showed an increasing number driven by recommendations from friends/family, keeping busy/entertained, self-improvement/learning new skills, multi-tasking and samples – showing there are many, often converging, paths that end in that first (and hopefully not last) listen.

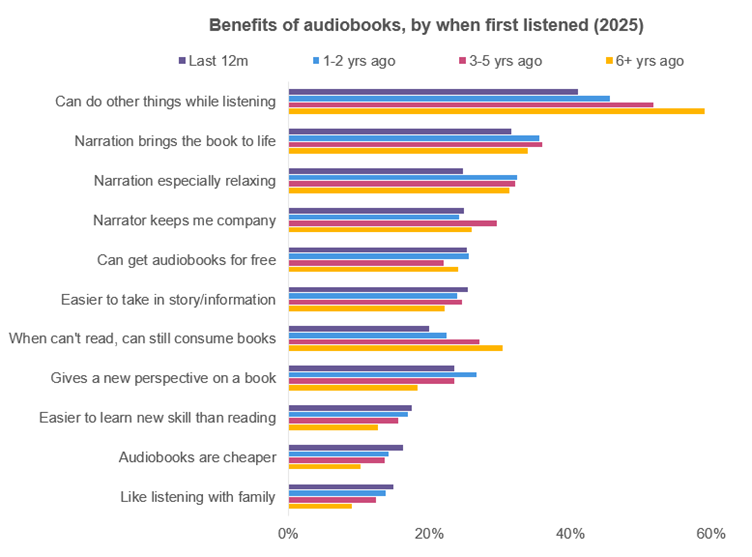

So, what keeps consumers coming back beyond the first listen? The top benefit in 2025 corresponds to one of those initial paths, multi-tasking! Being able to do other things while listening is what people like the most about audiobooks, and increasingly so the longer someone has been an audiobook consumer. Nearly 60% of respondents who have been listening for 6+ years chose this has a benefit in 2025, compared to just over 40% of those who started listening in the last 12 months. More established listeners were also much more likely to choose ‘when reading not an option, can still consume books’, so convenience is a strong factor for those sticking around, with different takes on the narration also ranking high.

For the newer listeners, the ability to multi-task and the narration are still at the top of the list, just to a lesser extent, shown in the graph above. They’re relatively more likely than the longstanding listeners to appreciate being able to get audiobooks for free or to view audiobooks as cheaper, but also to think it’s easier to take in a story/information and learn a new skill via audio, as well as to like listening with children/as a family. Much like the initial drivers to audio, the benefits are varied, but this does show a pattern of a growing appreciation for both multi-tasking and narration the longer consumers use the format, combined with newer listeners taking advantage of offers and increasing accessibility, as well as focusing better with audio.

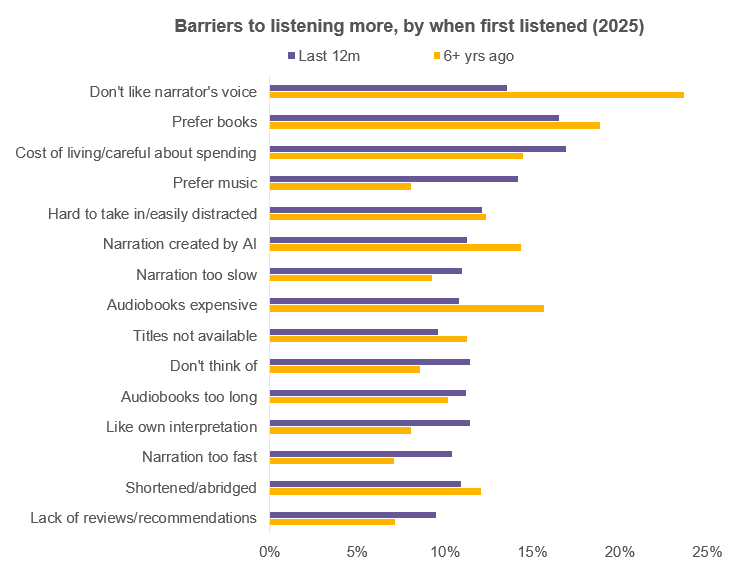

On the other hand, what stops consumers from listening more? Just as narration is a leading benefit, not liking the narrator’s voice puts people off the most, especially for those who have been listening longer. For the group that’s been listening for 6+ years, that’s followed by a preference for reading books and the perception that audiobooks are expensive. The newest listeners are most likely to have the cost of living/being careful about spending as a barrier, closely followed by a preference for books and then a preference for music, all ahead of not liking the narrator’s voice. More established listeners have of course had more time to develop their opinions about narration (they’re also more likely to be put off by AI-generated narration) while newer converts could still be figuring out their narration preferences, although the pace of the narration appears to be a greater issue for the latter.

Two of the factors impacting newer listeners are more about visibility, with around 10-11% saying they don’t think of audiobooks as an option and there aren’t enough reviews/recommendations, while the earlier adopters are more likely to be stopped by title availability. So while the audiobook market and audience has expanded very quickly in recent years, this suggests that there’s still room for more awareness/coverage and more choice, to keep attracting new listeners and retain existing consumers. Circling back to the initial reasons for trying audiobooks, the growth in recommendations from friends/family is certainly a good sign!

The Understanding the UK Audiobook Consumer study examines behaviours and attitudes of listeners and buyers, based on an annual survey of 2,000 audiobook consumers aged 18-84. For more information and to purchase the report, please contact infobookresearch@nielseniq.com.