Audiobook sales have continued to surge in the UK in 2024, and based on our monthly Books & Consumers survey, they’re projected to reach 35m units for the year, with spending set to exceed £250m for the first time. Fiction, non-fiction and children’s are all tracking ahead of previous years by more than 20%, and based on results to August, both fiction and non-fiction have already surpassed full-year sales for every year from 2012 (when current tracking began) to 2019.

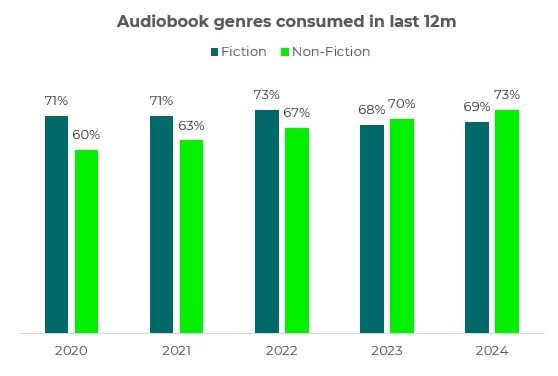

While we use our monthly survey to measure market size based on consumer purchases, we also have an annual study called Understanding the UK Audiobook Consumer, which provides more insights into audiobook listening and consumer behaviours. According to 2024 results, 73% of audiobook consumers listen to non-fiction, while 69% listen to fiction. 2023 marked the first year that non-fiction overtook fiction, but both sectors did gain in 2024, just more so for non-fiction. Five years ago, the margin between the two was 11% points, shown below, so that does suggest that non-fiction hasn’t replaced the fiction listening, just encroached on it a bit, with the latter only dropping 2% points compared to 2020.

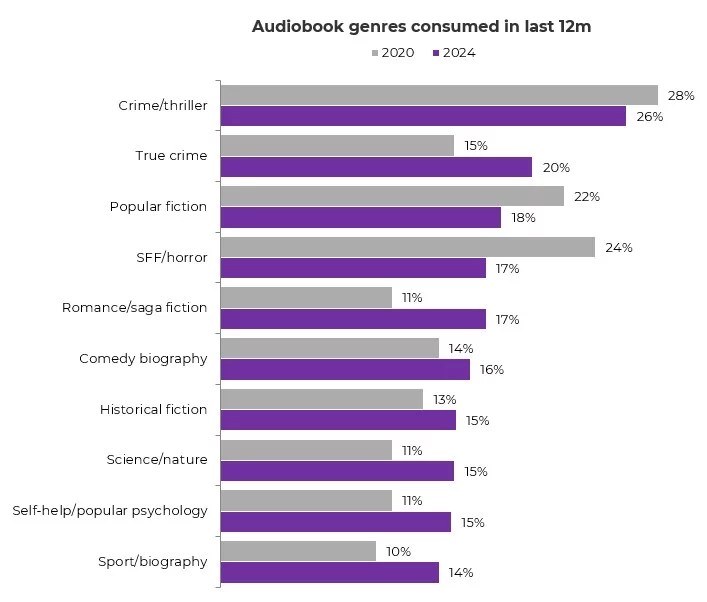

Taking that down to more specific genres, crime/thriller remains the most popular type of audiobook overall but has dropped over the last five years. It’s joined by popular fiction and science fiction/fantasy/horror with decreasing consumption, although still enough listeners to make the top five genres overall. Within the top ten, shown below, romance/saga fiction and true crime have gained most significantly since 2020, with true crime rising to second (and first for male audiobook consumers aged 18-54) and romance to fifth (and first for female 18-34s). Crime/thriller sits atop the list for male 55-84s and female 35-84s and is a top three genre for all groups. For the growing genres, sport/biography and science/nature rank the highest for male 18-54s, comedy biographies for both male and female 35-54s, historical fiction for 55+ and self-help popular psychology for female 35-54s.

In the survey, we also ask audiobook consumers about whether they listen to podcasts, and if so, what kinds. Only 11% of audiobook consumers in 2024 said they never listen to podcasts, with just over half listening at least weekly, so there’s certainly a connection between these different listening formats. Personally I can say that I started with podcasts and they were my gateway to audiobooks! But do consumers listen to the same types of audiobooks and podcasts, or do they differentiate between the two?

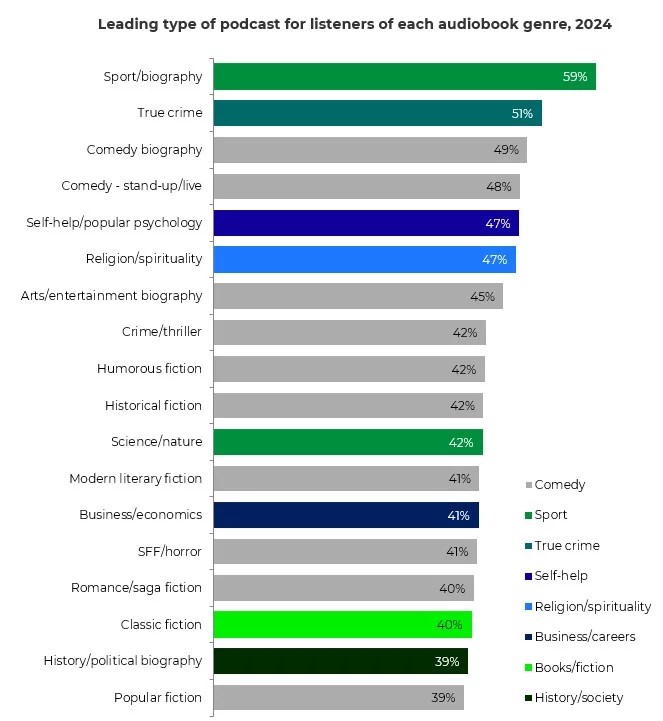

For audiobook consumers who listen to podcasts, comedy ranks the highest overall, and as shown below, comedy podcasts are the top category for listeners of most leading fiction genres, as well as arts & entertainment biographies and, fittingly, both comedy biographies and live comedy audiobooks. The one fiction genre to diverge is classic fiction, with these listeners preferring podcasts about books/fiction. Listeners of different non-fiction audiobook genres tend to keep their listening interests aligned across formats, with the top podcast category matching the genre. Science/nature is the exception, as sport podcasts are the most popular among science/nature audiobook consumers, which is more of a reflection of the listeners themselves: science/nature audiobooks are most popular with men under 55, as mentioned above, and sport is the top podcast category for male listeners overall. Sport also shows the most prominent overlap, with 59% of those who listen to sport audiobooks also consuming sport podcasts, followed by 51% for true crime. True crime podcasts are second only to comedy for female audiobook consumers, compared to sixth for male consumers, at 30% and 24% respectively, but it’s interesting to note that when it comes to audiobooks, that reverses, with 22% of men listening to true crime, ahead of 18% of women. So even with such a close relationship between audiobook and podcast listening, opposing patterns can emerge!

For more audiobook insights, including sources, discovery & purchase influences, listening circumstances & locations, demographics and much more, the Understanding the UK Audiobook Consumer 2024 report is available now, and you can view a preview here. If you have any questions or would like to purchase, please contact infobookresearch@nielseniq.com.

We also have a concurrent audiobook study running in Australia, Understanding the Australian Audiobook Consumer, available now. If you are interested in this report or would like to know more, please click here.