Air fryers, they’re everywhere! It definitely seems that way, with the latest kitchen device craze promising less time, less energy and less money for delicious meals. The increased interest in air fryers can certainly be seen on UK bookshelves: of the top ten cookbooks across 2022 and 2023, four were specific to air fryers, with two more mentioning air fryer recipes in their blurbs. (The outliers were One and 5 Ingredients Mediterranean by Jamie Oliver, Bored of Lunch: The Healthy Slow Cooker Book by Nathan Anthony sitting just below the author’s air fryer book in the chart, and Pinch of Nom Comfort Food by Kate & Kay Allinson, who are bringing out an air fryer book in 2024.) Over 2,000 ISBNs with ‘air fryer’ in the title sold at least one copy in 2022 or 2023, adding up to 1.3m in volume sales, nearly a third of which came from Bored of Lunch: The Healthy Air Fryer Book. In the first four months of 2024, cookbooks with ‘air fryer’ in the title have sold 425k copies, slightly up from the 2023 equivalent of 423k, but while more than half of sales at this point last year were from Bored of Lunch, that’s dropped to just over a quarter in 2024. So consumers may have their favourites, but the options are expanding.

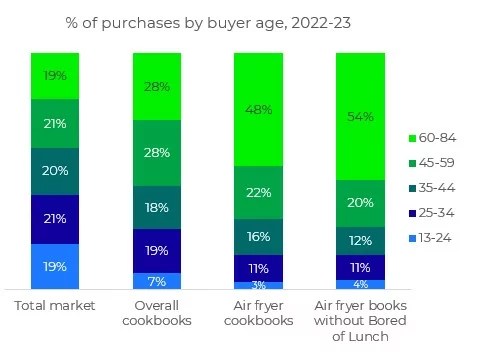

And who are those consumers? According to the results from our monthly Books & Consumers survey, cookbooks with ‘air fryer’ in the title skew older than the overall cookery market, with nearly half in 2022-23 bought by those aged 60-84 (compared to under 30% of total cookbooks). The Bored of Lunch books (including both The Healthy Air Fryer Book and The Healthy Slow Cooker Book) diverge from that, with 35-44s the most prominent buyers, so removing Bored of Lunch boosts the 60-84 share of air fryer books even higher, to over 50%. That’s an interesting juxtaposition, to have a significant audience for the top author while the wider trend is more popular with a different age group, but that variety in consumer can potentially prolong the air fryer cookbook wave. The new Pinch of Nom book could introduce yet another angle, as the largest buying group for their past cookbooks has been 45-59s.

Male consumers bought a higher share of air fryer books than overall cookbooks in 2022-23, at 48% vs 42%, although for the end user, the male share drops to 44% of air fryer cookbooks. Overall about 30% of air fryer books were bought for others, a large proportion of that coming from Christmas gifts, with spouse/partner the most popular recipient, followed closely by parent(s) at double the share of overall cookbooks. Whether self-purchases or gifts, a quarter of air fryer books were bought for use by women aged 65+.

Other buyer demographics reflect the age profile, with a third bought by retirees, behind the two in five bought by those working full-time, and nearly three-quarters bought by those who don’t have children in the household. Buyers sit more in the salary ranges between £15k and £45k than book buyers in general and are more likely to be white and living in the suburbs. A large proportion were bought by consumers who say they cook/bake in their free time but not as many as for overall cookbooks (63% vs 72%), which could partly be those buying for others but I think also highlights the appeal of air fryers as easy and time-friendly for those who don’t want to spend as much time in the kitchen.

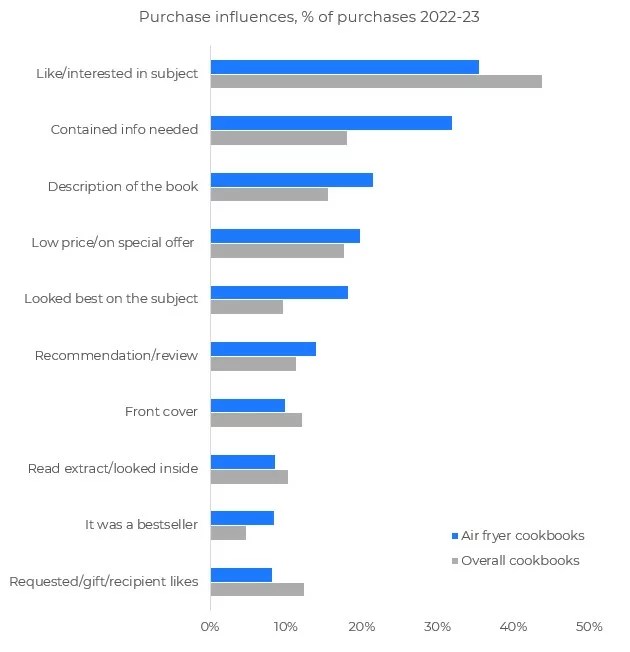

And with so many cookbooks promising to save time and energy, how are buyers finding and choosing their air fryer books? Discovery is very online so far, with 30% found via browsing online booksellers, and 15% browsing general search engines. When deciding what book to purchase, content is key: subject ranks as the highest influence, although less so than overall cookbooks, with contained information needed and best on subject especially more likely to sway buyers compared to the wider cookery market, alongside the blurb and low prices within the top five.

Given how rapidly sales are growing (only 26k air fryer books were bought in the first four months of 2022, vs 425k in 2024), we’ll likely see the consumer base continue to evolve, along with changes in discovery and path to purchase, but knowing and understanding the initial audience for a prominent trend is always beneficial. We’ll have to wait and see what the 2024 data reveals, watch this space for updates!

Data extracted from the BookScan UK Total Consumer Market (TCM) to 27 April 2024, and the Books & Consumers survey to December 2023. For more information, please contact infobookresearch@nielseniq.com.