In 2018, meal kit mania took the U.S. grocery retail market by storm. Seemingly overnight, these easy-to-use/easy-to-prepare boxes—filled with fresh, pre-portioned ingredients for consumers to create a healthy home-cooked meal—were popping up everywhere.

What started as a mostly web-exclusive offering, aimed at delivering fresh, time-saving options, has now grown into a multibillion-dollar industry that stretches across retail’s omnichannel landscape. Over the past year, a deluge of acquisition and collaboration deals between kit manufacturers and retailers has created a groundswell of media conversation, consumer awareness, and retail distribution points for meal kit offerings. According to the latest NielsenIQ data, 187 new meal kit items were introduced within in-store retail outlets alone during the 52 weeks ended Dec. 29, 2018. But, as more and more meal kits come to market, is consumer demand keeping pace?

Today, millions of consumers have easy access to meal kits through both online and in-store retail, an despite chatter of instability within meal kit businesses, the data shows that consumer demand is strong. Meal kit users have increased 36% over the past year. In fact, NielsenIQ panel data shows that 14.3 million households purchased meal kits in the last six months of 2018, reflecting a marked increase of 3.8 million households from the end of 2017. And there is still a lot more interest beyond that, with 23% of American households saying they would consider purchasing a meal kit within the next six months.

As meal kits went in-store, so did shoppers

Last year, as more and more meal kit providers made their way into brick-and-mortar stores, sales of in-store full meal kit offerings garnered $93 million over the 52-week period ending Dec. 29, 2018. At the same time, in-store meal kit users jumped by 2.2. million households in less than a year, accounting for 60% of growth in meal kit users. While the majority of meal kit sales did still occur online in 2018, growth occurred both exclusively in-store and within the combined online/offline space.

Who is today’s meal kit shopper?

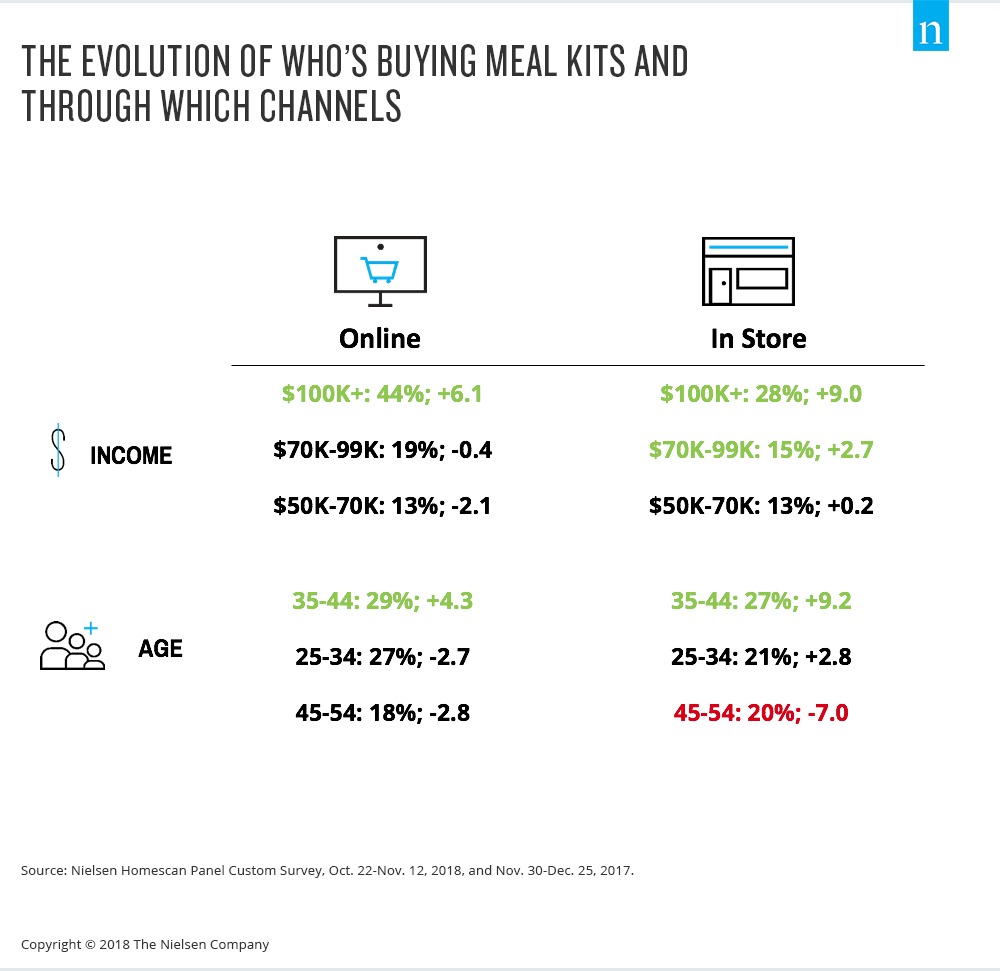

Overall, affluent consumers earning an annual income of over $100k drove meal kit growth across online and in-store in 2018. Compared with 2017, these consumers increased their online meal kit purchases by 6 points and their in-store purchases by 9 points. Across both outlets, growth is also being led by consumers age 35–44, who showed a 4.3-point increase in meal kit purchases online and a 9.2-point increase in those bought in-store. Meanwhile, meal kit purchases from older consumers age 45–54 declined 2.8 points online and 7 points in-store over the past year.

Meal kits ended 2018 on a high note, and since meal kits cater to the consumer need for fast and fresh, demand will likely endure into 2019. Consumers are showing a continued interest in meal kits, amid the diversification of distribution channels. However, retailer and meal kit players should take note of shifting purchasing preferences occurring as this category continues to grow and mature.