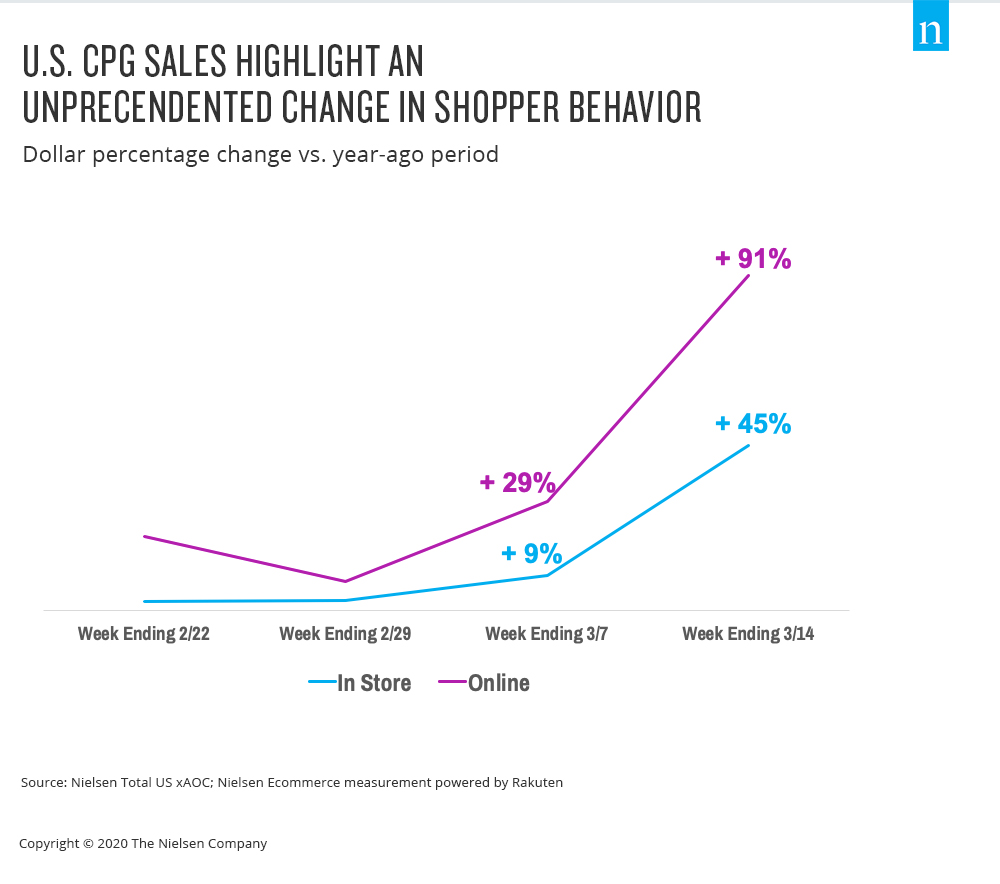

As the novel coronavirus (COVID-19) continues to disrupt industries and businesses around the world, the consumer packaged goods (CPG) industry is operating in uncharted territory. Amid widespread health concerns, federal travel restrictions, and local movement limitations, the industry is facing the greatest, and fastest, change in shopping behavior ever.

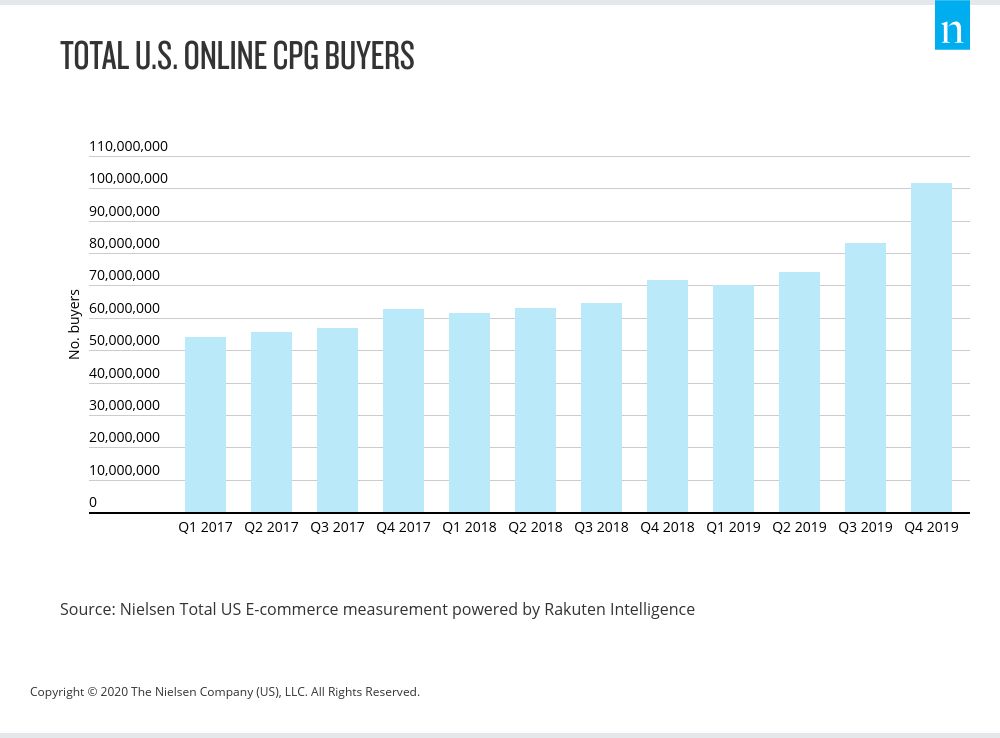

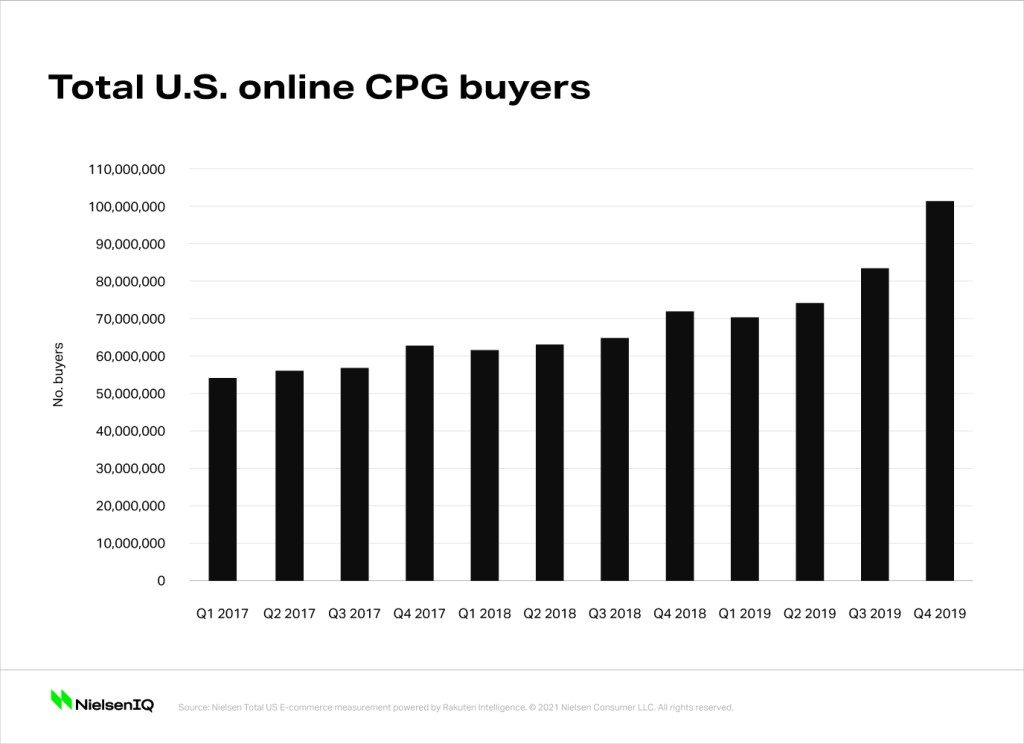

With improvements in technology, infrastructure, and experience, coupled with a reduction in barriers to trial, such as delivery length or shipping costs, buyer adoption of online CPG shopping has consistently increased over the last two years. Yet while those factors have resulted in pervasive consumer behavior changes, COVID-19 has caused another step change in the way consumers shop.

Total U.S. CPG sales increased $8.5 billion during the two weeks ended March 21, 2020

For the two weeks ended March 21, 2020, total U.S. CPG sales (in-store and online) increased $8.5 billion from the two weeks prior. For context, that’s 15X the average rate of change for a typical two-week period. That said, this purchase behavior aligns with what we would expect from consumers in restricted living situations.

Yet as the weeks pass by, not all departments and categories are seeing the same consistent sales spikes. With restaurants and bars across the country shuttered for the imminent future, it’s not surprising that consumers are spending more on food at grocery stores as families eat more meals at home. In categories that have experienced week-over-week sales declines, such as the coveted toilet paper (down 29%), it’s unclear how much out-of-stocks contributed to the sales decline, vs. how much resulted from a one-time surge that has pacified the immediate short-term need. In total, week-over-week growth of consumable products in-store increased 21%, while sales of non-consumable products decreased 2%.

What’s surprising is that the exact opposite trend occurred online: Sales of consumable products declined week-over-week and sales of non-consumables increased. With reports of significant delays in delivery availability and consumer accounts of canceled orders due to too many out-of-stock items, the reality is that online fulfillment was unprepared for the massive surge in demand.

In fact, a recent NielsenIQ survey found that by the time concerns about the spread of COVID-19 reached critical mass in mid-March, approximately one-quarter of shoppers said they expected to shop online more frequently—or for the first time—in order to avoid germs in public places. Furthermore, we expect the rate of interest in online shopping to continue. In the two weeks ended March 21, upward of 35% more people had shopped online for CPG items compared with a typical week. While grocery was a leading driver the week ended March 14, non-consumable items have carried the mantle the following week.

This means the industry is now at a critical juncture. If historical behaviors hold true, the growth of online shoppers will sustain after they make their initial purchases. For that to happen, however, retailers will need to ensure positive customer experiences, including proper management of out-of-stocks and delivery delays.

Historical behaviors aside, the reality today is that so much of the situation remains unknown. The outcome will depend on how long the situation lasts and what economic ramifications it causes. It’s a “new normal” for everyone, which means things will remain unsettled for the immediate future. For example, forecasting sales and shipment allocations three months from now may be just as challenging as planning for the next two weeks. That means manufacturers and retailers need to leverage available assets and resources to make the most up-to-date and informed decisions while adjusting appropriately as the situation unfolds. And while the online growth is astounding, point-of-purchase is relative, based on the category, and understanding behaviors in the total marketplace—both online and offline—is critical.

For more information, visit our COVID-19 resource site or click for more information about the new solutions available to assist with addressing the changing consumer behavior patterns, demand planning, navigating supply chain disruptions, and global consumer sentiment and behavior during the pandemic.