How the pandemic changed the rules of the retail game in India

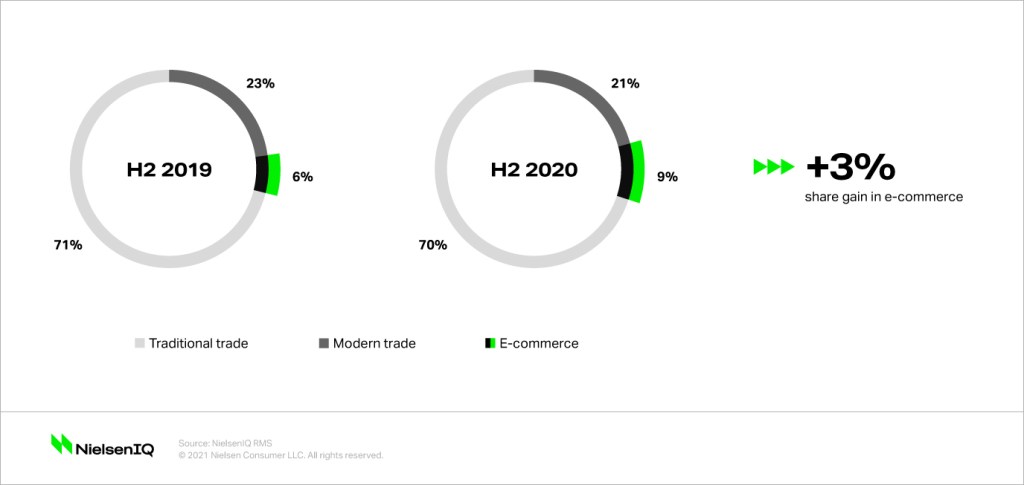

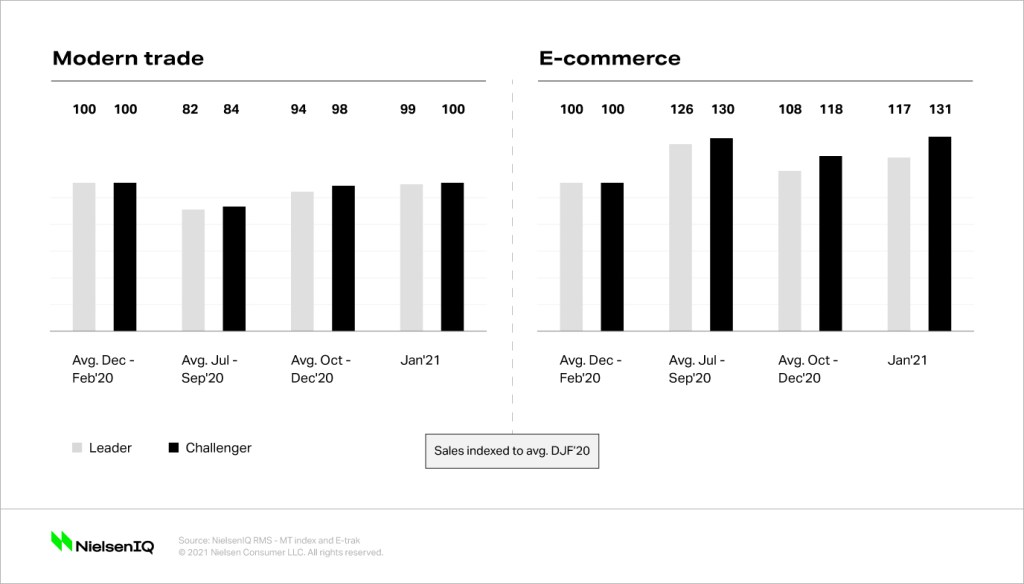

COVID-19 changed the rules of retail in India. Shopping patterns and habits were disrupted as consumers favored the convenience and safety of online buying over physical store visits. Organized brick and mortar players with an online presence found success by selling through their own websites, e-commerce marketplaces, and partnerships with logistics companies for home delivery.

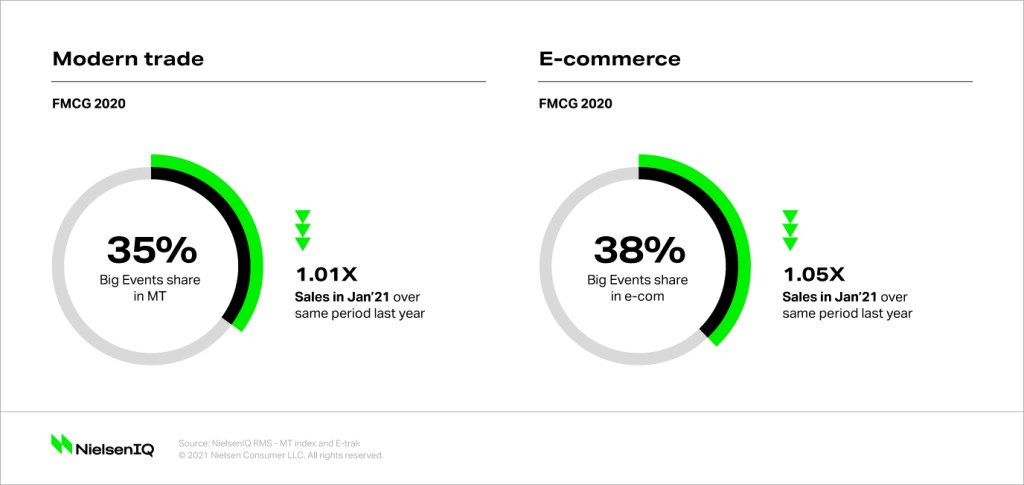

While Modern Trade experienced a robust revival in recent months, it faced a big slump in sales during the pandemic due to strict enforcement of lockdown rules.

Big Events have always been about sizable foot traffic, stores crowded with shoppers, and discounted merchandise across categories. However, changing shopper preferences and habits have dramatically altered channel dynamics.

The challenge now for retailers is to re-imagine and re-invent Big Events for this new, mixed digital and in-person age that is here to stay. Retailers should leverage these new online consumer shopping preferences by integrating both physical and digital platforms to enhance the overall shopping experience.

The pandemic reset shopper’s current and future priorities

The prolonged period spent quarantining and working from home has led to a homebody consumer mindset. This mindset lends itself to a focus on purchases in the essentials and home-entertainment categories with non-essentials taking a back seat. One of the first steps for retailers to adapt is to redefine what constitutes essentials in shoppers’ baskets.

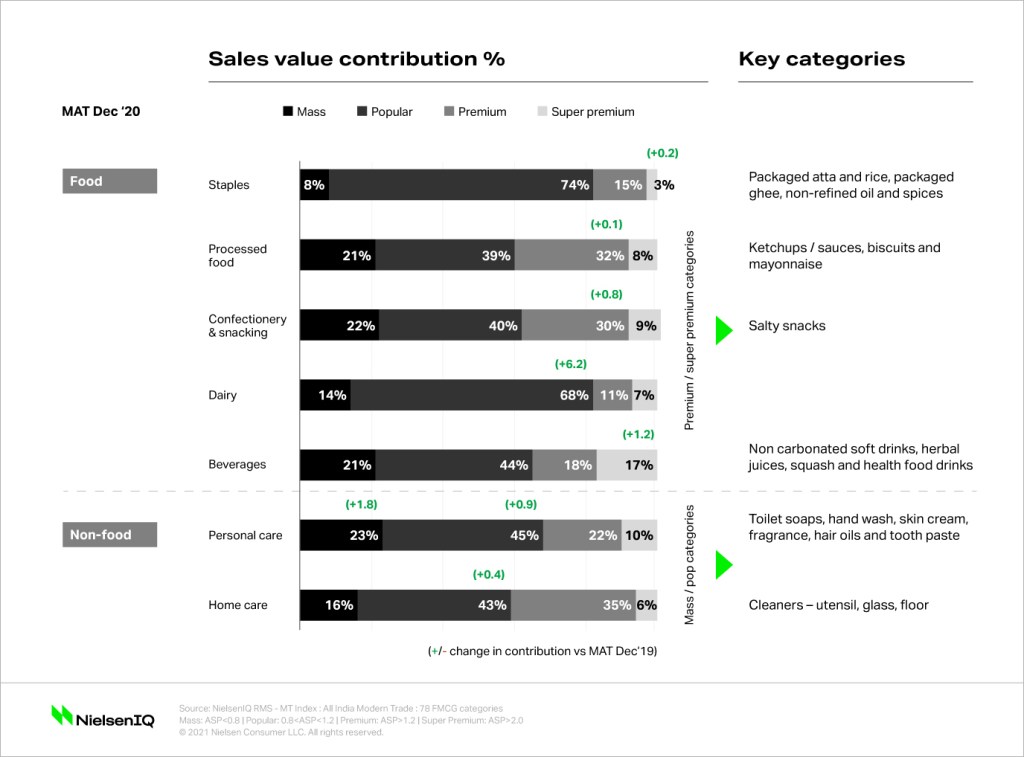

With health, hygiene, and in-home eating gaining traction, core essential categories saw traction in sales, even post-lockdown and during recent Big Events. Food categories like biscuits, snacks, and ketchup and sauces as well as non-food categories like floor and toilet cleaners, handwash, sanitizers, toilet soaps, and toothpaste all saw increases.

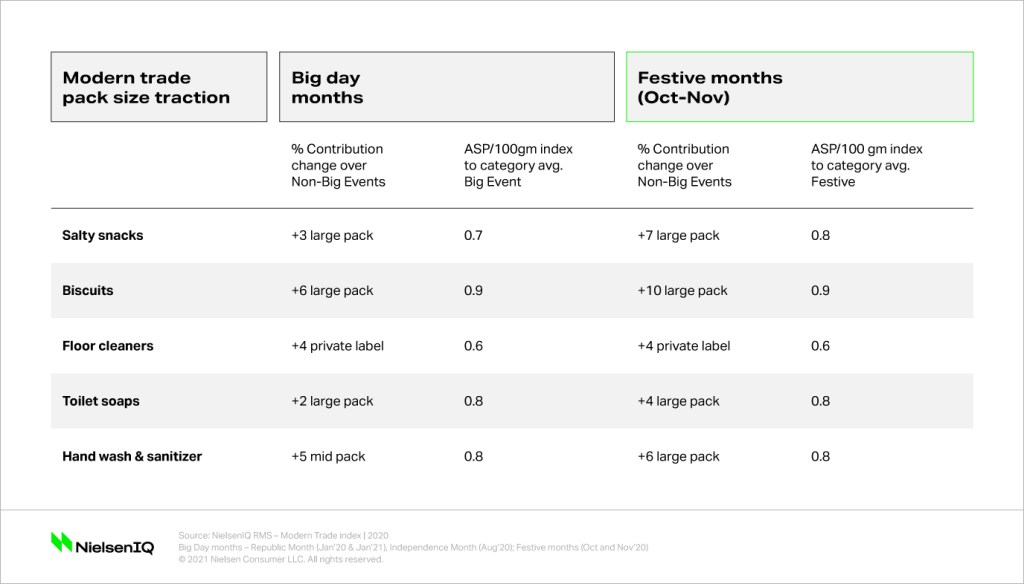

Value packs across essentials that helped manage household budgets experienced an uptick in sales. The Average Selling Price (ASP) of large packs for key categories is competitive compared to the overall category ASP.

Among the Big Events, festive months saw higher traction and consumer optimism compared to other Big Day months in 2020. Consumption of categories swelled, e.g. large packs of biscuits were 10% cheaper than overall category ASP and sales increased by +10% during the festive months.

As the pandemic rages on, shoppers will continue to prioritize health and hygiene and will be equally cautious about spending on everything, including essentials. Frequent publicity of promotions (especially on value packs), competitive pricing, and availability around these categories will be key to growth for retailers.

Navigate the complex retail landscape in India

Win in retail with actionable insights that help drive growth for your business. Book a meeting with us to learn more.

Rise of challenger brands

In the initial phase, the nationwide lockdown disrupted the supply chains of most FMCG giants. In this vacuum, agile local or small players helped manage rising demand. Pantry loading made brand preferences secondary to overall availability. Challenger brands were available, offered better pricing, and brought newness to home-locked shoppers.

This shift was felt in the home cleaners and personal hygiene categories where shoppers preferred new brands. At the same time, some shoppers premiumized in packaged food categories like salty snacks, vermicelli, and noodles, where quality over price was prioritized.

Knowing that consumers are familiar with these challenger brands, it is important for retailers to get the right assortment mix and make the right brands available to cater to current shopper needs and spends to drive greater basket value during Big Events.

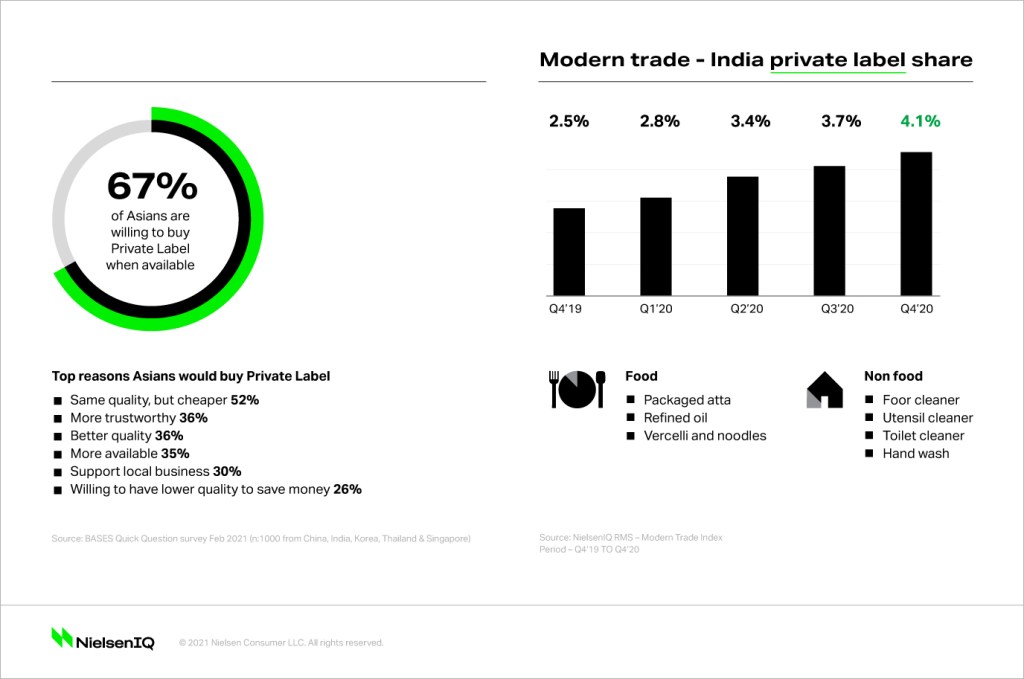

Focus on private labels

The pandemic led to obvious wallet shrinking. The double whammy of availability and supply gaps on known brands led to the emergence of private labels as the more affordable and available option for consumers.

According to the BASES Quick Question Survey from February 2021 (n:1000 from China, India, Korea, Thailand, and Singapore), 67% of Asians are willing to buy private labels when available. The preference for private labels has also increased for more financially constrained shoppers, especially in categories like household cleaners, cooking oils, hand wash, and sanitizers.

Retailers’ private labels need to be promoted in a bigger way during Big Events to capitalize on their current popularity and attract new shoppers.

Premium on few

While most of the focus has been on a redefinition of essentials for consumers, some non-essential sales have seen growth. Consumer sentiments resurged in Q4 (Oct-Dec’20) and non-essential sales increased for luxury cars, gold, and real estate buying (thanks to the work-from-home phenomena).

Overall, though, as uncertainty related to the pandemic rages, shoppers have opted for cautious spending and delaying many premium purchases while premium brands focusing on health and wellness have found success.

Relevance of fresh

Fresh categories like milk, fruits, meat, vegetables, and others have been the key drivers of repeat purchases across stores and platforms during the pandemic. With home cooking becoming a mainstay, organized retail has been a preferred destination as it is perceived to be safe for fresh food category purchases.

Many retailers have adopted the farm-to-table strategy of promoting local food and have been building the capabilities to retain shoppers’ trust and promote fresh sales. Retailers should continue to focus and provide competitive offers on fresh, especially during Big Events to drive fuller baskets and become the preferred buying destination for shoppers.

Ensuring success of Big Events for India’s retailers

To remain relevant and successful post-pandemic, retailers need to re-imagine Big Events and drive greater value and experience for their shoppers:

- Redefine the shopper basket: Health and Wellness mindsets are influencing India’s consumption habits. Retailers and brands need to redefine essentials and ensure high visibility of these categories along with the availability of the complete range. Competitive pricing, private label options for value seekers, and a good mix of premium offerings curated to shopper needs will drive basket value during Big Events.

- Festive focus: The euphoria around the festive quarter (Q4) helped the economy and consumer sentiments revive in 2020. However, the second COVID-19 wave changed consumer spending intentions again. Predictions of a brighter Q3 2021 were made as lockdowns eased and vaccinations were rolled-out to improve the economy and health. Festivals will also hopefully boost consumer spending.

- Omnichannel mindset: With an accelerated online adoption and increased need for omni-channel, retailers should focus more on providing seamless shopping experiences that will compensate for lower foot-traffic in retail locations. Big Events have always been about reaching new audiences and widening the shopper base. Omnichannel could further help retailers to extend their reach and attract new shoppers.

- Essentials: India is currently experiencing a second wave of COVID-19. The number of cases have increased and localized lockdowns have returned across the country. The ongoing pandemic and rising inflation have made essentials more of a priority for shoppers and it is important that retailers understand what now fits into the “essentials” category.

Omnichannel is here to stay

While many things have changed, one thing is certain: the new omnichannel trends and habits adopted by consumers during the pandemic are here to stay.

For retailers to continue to experience retail growth during Big Events, they will need to focus on getting their core product assortments set and utilize an omnichannel mindset to meet consumers on their own turf.