The golden stores of the past

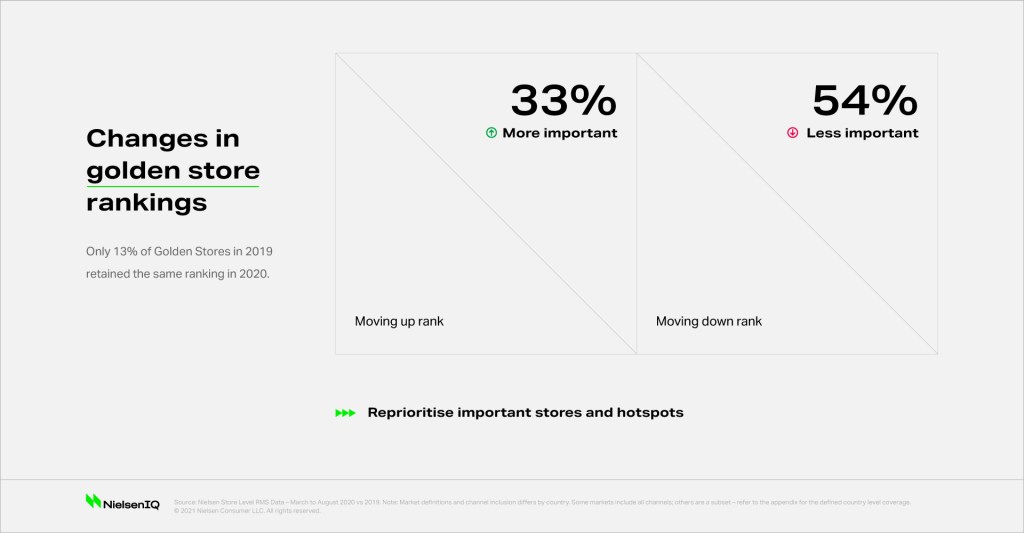

Golden stores typically account for 80% of sales, but it’s clear that they are going through a significant change. In South Africa, 35% of modern trade and convenience stores accounted for 80% of consumer spending between March and August of 2020, representing a massive 9% increase compared to 2019. This indicates greater fragmentation of golden stores’ importance. Only 13% of golden stores in 2019 retained the same ranking in 2020 with significant shifts in importance for the rest.

Within that overall figure, the composition of changes is significant. There were clear shifts from a 2% movement of stores falling out of the golden store category and 2% from new stores moving into the golden store category. This figure, from new and old golden store shifts, totals a considerable 14% change within modern trade stores.

In addition to these movements, existing golden stores (those present in 2019 and 2020), have also changed rank (importance) as the growth source flipped. The solid core representing 24% of stores saw a 16% growth rate whilst the core at risk (9% of stores) are declining at 9%. Net result is that we see the average growth rate of 4% is not consistent across all stores and in total 39% of stores have experienced a decline in sales whilst 61% of stores are showing positive gains in sales.

In our pre COVID-19 world, store choice was essentially built around work hubs and transit routes. But today, because of covid-related health concerns, quarantines, and ongoing self-isolation, that store choice has been pushed out of busy commercial centers into outer lying areas and far closer to where people live. It is this, seemingly innocuous shift that has tipped the retail landscape on its head.

Looking into the future

This trend will continue as markets resettle and consumers rebase their home, work, and travel routines and while we are likely to see many people return to work, and a natural return to some old shopping behaviors, there will be huge populations of people who will not. We are seeing a hybrid future that revolves around work flexibility, changes in daily routines, fragmentation of shopping, rise of e-commerce, new stores, and channels.

Retailers need to reconsider existing store formats, locations, and expansion plans which may require them to abandon old, relocate, build or rebuild, or acquire based on retail gaps. Similarly, manufacturers need to recalibrate for the stores that now matter most, ensuring that their products are available and serve consumers where they are currently shopping. Both need to recalibrate for the shift of channel and store growth. They need to go where spend has gone and will continue to go, adjusting their trade and product dynamics to meet consumers’ needs where they are now shopping.

What the future holds

- Stores will lose share – retailers will need to rethink their real estate strategies, the types of stores they need in specific locations.

- E-commerce will be an increasing part of the store repertoire and there’s a possibility for the physical stores to play a role in fulfilment of local needs to increase efficiency.

- Brands in the wrong stores will lose share and will need to review and align their route to market and the types of products consumers will demand/buy will differ with new location needs.

- Changing channel market shares are a reality – necessary to adapt to interim flux but be prepared for changed permanent needs in the future.

- Understanding the changing flux, where it’s occurring and the impact on your stores and brands has never been more critical.

COVID-19 has radically changed our shopping and lifestyle choices. Consumers are having new behaviours that affect the retail landscape and future growth. It is time for all of us to examine the future trends and align accordingly.