The health check that could save a brand’s life in today’s cost-of-living crisis

By Trevor Godman and James Pitcher

Taken from a webinar co-presented with Campaign UK

How strong brands can help navigate today’s economic turmoil

According to the GfK Consumer Confidence Barometer, UK consumer confidence is at a 50-year low. So what does your brand need to do to navigate the turmoil?

Firstly, you have to manage your brand in today’s challenging environment; rising inflation means people can buy less with the money they are earning. Added to that, it looks like we are heading for a recession over the next two to three years. So, consumers are concerned about their own personal finances, and their behaviour is changing in response to their worries. One route we know people are taking is to cut back on discretionary spending. For many, the first thing to go has been TV subscriptions, but we’re also seeing that households are limiting expenditure on groceries. Now is the time for all brand managers to understand this changing behaviour and to respond.

Brands must respond according to their positioning, values and audience

How consumers react to this situation will be different as there is no one single reaction. People set their priorities differently. For instance, some will economise on grocery brands by downgrading to cheaper brands to save for that all-important summer holiday. Others will sacrifice the big family vacation to retain the budget for their favourite grocery brands and a meal out once a fortnight. There are other alterations too. In Germany for instance, sales of organic produce have fallen steeply as cost-conscious shoppers look to save their cents.

All brands are different too, so there’s no single path for them either. The response depends on your positioning, values and audience. By understanding the health of your brand and your ambitions for it, you can plot your brand’s path to success through this period of turmoil.

Healthy brands deliver financial returns

As a brand manager, you have to justify your company’s financial investment in your brands to the CFO and Board. GfK’s Brand Architect research shows that strong brands drive sales, secure market penetration and provide a solid foundation for new product launches. Our poll of experts agreed with that sentiment. When it comes to value, strong brands justify a price premium, deliver margin and reduce the cost of sale to get your products listed at retail. When it comes to promotional spend, not only do they minimise the need for deals and offers because consumers actively choose your brand, but they help avoid competitive campaigns because consumers believe your brand offers value. Strong brands survive by retaining customers and securing their lifetime value.

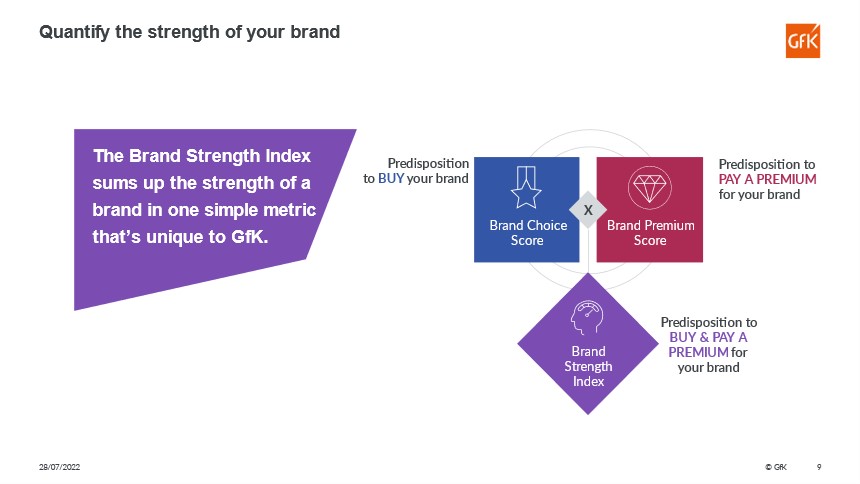

What we can see is that a strong, healthy brand has many facets. Measuring this is at the heart of any brand health check. To provide a rounded understanding of what a healthy brand means requires metrics that represent both volume and value. Traditionally brand trackers have prioritised sales volume and struggled to represent value effectively. GfK’s Brand Architect examines whether a brand can make money by predicting its brand value. We ask, ‘What levers do you need to pull to drive brand success?’ and sum up the strength of the brand in one metric. It represents consumers’ predisposition to buy and pay a premium for your brand, going way beyond how many units are sold.

Building a strong brand for both choice and premium

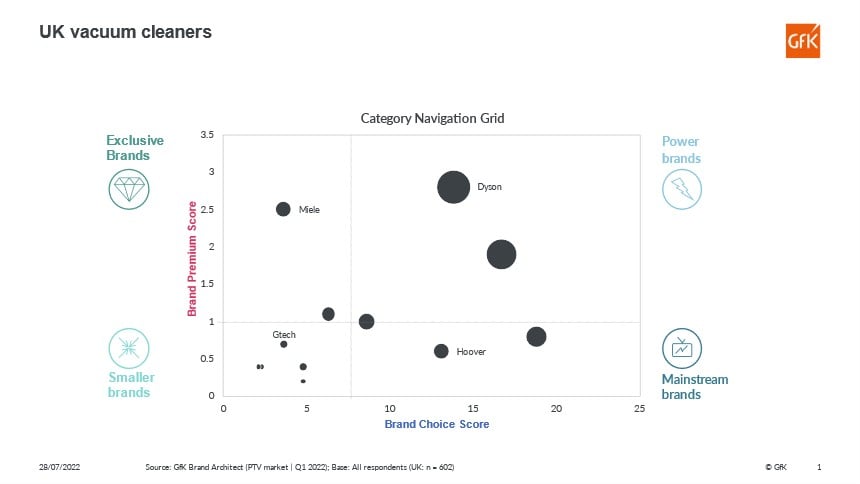

In the Brand Architect approach, we evaluate by both Brand Choice (predisposition to buy your brand) and Brand Premium (predisposition to pay a premium for the brand). We combine these two factors to create one overall score for brand strength. By helping you understand where your brand is positioned, we can show you how to reach your ultimate business goals. We use a Category Navigation Grid like the one below which shows the approach in action using the vacuum cleaner market as an example.

To build a successful brand you need to understand what is driving both brand choice and brand premium. Critically, our analysis shows that the brand perceptions that drive brand premium are very different to those that drive choice and reveal a new level of insight to brand measurement. To drive brand choice and volumes, you need to deliver on the basics: product, price, and trust. To achieve a brand premium, you have to go further and offer something unique, exclusive or tangibly different from the competition. You might also want to reinforce your own beliefs and values.

Brand Architect: Measure what matters

Knowing what makes a brand strong means you can focus on what matters most to consumers. In Brand Architect, we measure these four brand pillars to uncover what is important to your customers:

- Mental Availability: how easily a brand comes to mind at the moment of purchase

- Brand Knowledge: what people think about the brand, its value and products

- Brand Attachment: the strength of people’s emotional connection to the brand

- Brand Experience: recency, quality and consistency of consumer experience

You use this approach to strengthen your brand and succeed in today’s challenging times. The following two case studies show Brand Architect in action.

UK Gin market case study: Beyond Brand Strength KPIs

The UK gin market has seen growth in recent years, and in particular, in the more expensive, premium brands. But as consumers’ incomes shrink in real terms, what can we expect in this saturated category and which brands have the best chance of success?

We’ve measured brand strength in the gin market’s three tiers: mass market, mid-tier and premium. Our Brand Strength Index shows Gordon’s to be by far the market leader, with two second-place ranked brands: Tanqueray and Bombay Sapphire.

Gordon’s has a dominant Brand Choice score, over-indexing for ‘affordably priced’, ‘meets my needs’, ‘sets the standards’ and ‘is a brand I trust’. However, when we look at Gordon’s Brand Premium, we can see it has an advantage over its mass-market competition – meaning it is likely to be relatively immune to promotional activity from brands available at the same price point.

Competition heats up in the exclusive quadrant where there are many premium brands. In this illustration, we focused on Malfy. Our analysis reveals the Italian gin brand to be performing well at Brand Premium, but not so on Brand Choice. Like Biggar Gin and Aviation American Gin, it has a low Mental Availability score – it doesn’t come to mind easily when people think about buying the spirit. Thus, there is work for the brand owners to do here to build brand strength by focusing on its unique brand assets such as its distinctive logo, packaging and design.

Italian TV market case study: Beyond Brand Strength KPIs

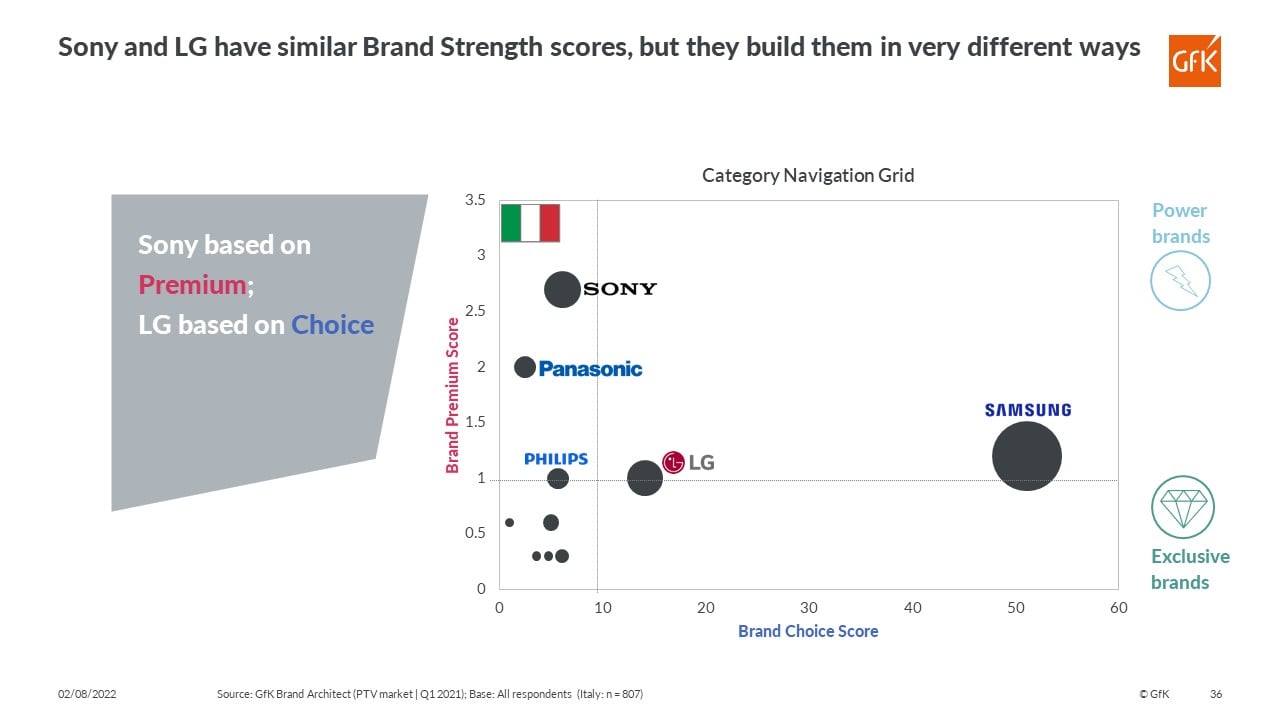

If we look at the Italian TV market, we see Samsung is the dominant brand in terms of Brand Strength, followed by Sony and LG – both joint second. However, when looking at Brand Choice and Brand Premium, we can see that Sony is considered a valued, premium brand while LG is more of a mainstream brand, with wide appeal. LG and Sony have similar Brand Strength scores, but when comparing in-market performance we see that LG is making two and a half times more revenue than Sony. Why? The products are the same, the distribution is similar, so what’s happening?

Using Brand Architect’s four pillars of brand strength we see that Sony is definitely considered a Premium Brand, but is clearly losing out on Brand Experience and Mental Availability. We would argue it has a strong heritage but some of the gloss is coming off – and it is being noticed much less than LG. This is the case in-store, as well as in fewer online recommendations which clearly indicates that some of the issues lie in trade marketing. Sony feels distant from consumers and is underperforming commercially relative to the brand strength. Our advice to Sony would be to present a consistent, positive brand experience and be seen in the right stores and channels.

Summary: Navigating your brand through the turbulence

What does the cost of living squeeze mean to your consumers and brand? If you understand what consumers think of your brand relative to the wider environment, you can plan a way through the cost-of-living squeeze. This doesn’t mean cutting back on your brand investment or on innovation as the need for branding is greater now than ever. If your brand is healthy, you can avoid price cutting and promotion and weather the storm to emerge stronger than before.

There are three points that summarise how to make sure you build, protect and maximize your brand’s strength to help you through the crisis:

- Categories, consumers and brands will all respond differently to the economic turmoil

- During times of change, the need for insight specific to your brand is greater than ever

- Understand how your brand drives revenue and margin, not just volume

Make Brand Architect part of your tools to navigate the economic storm.

Further reading:

Brand Purpose: Today’s hot buzzword or tomorrow’s growth lever?