Indonesian consumers proceeding with caution

Indonesian consumers are polarized between those who have been impacted by inflation and those that haven’t. The overall majority of consumers however are cautious, leading them to carefully spend. This cautious spending has driven Indonesians to seek discount options. In fact, the most popular strategy for consumers in Asia Pacific to manage household grocery expenses is to shop online, followed by selecting the lowest price from their repertoire.

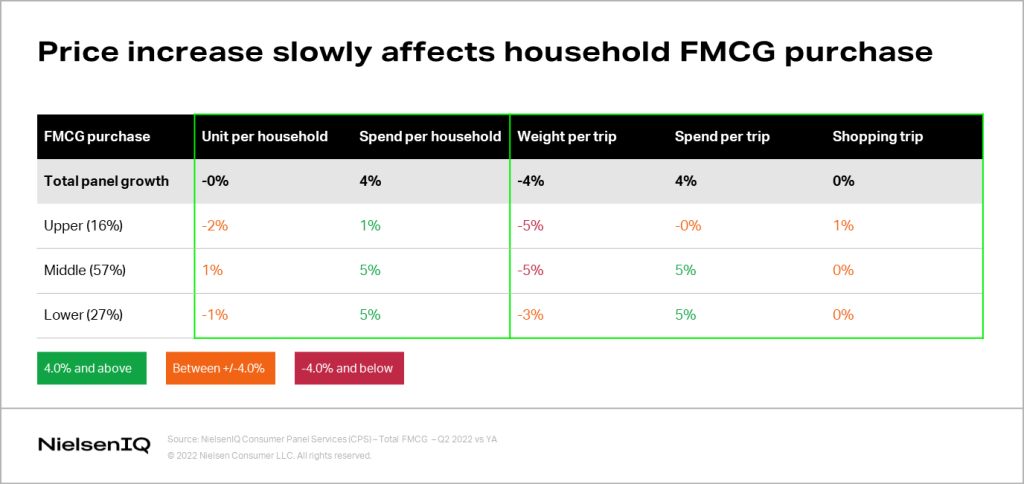

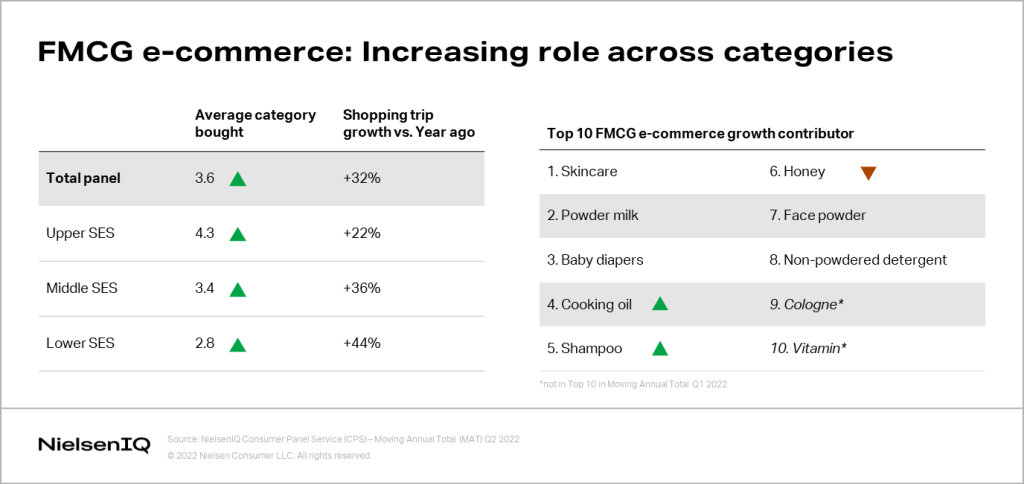

When we look at our Consumer Panel Service data, we see that price increases have gradually affected household FMCG purchases, but the impact is different for different SES (Socioeconomic Status).

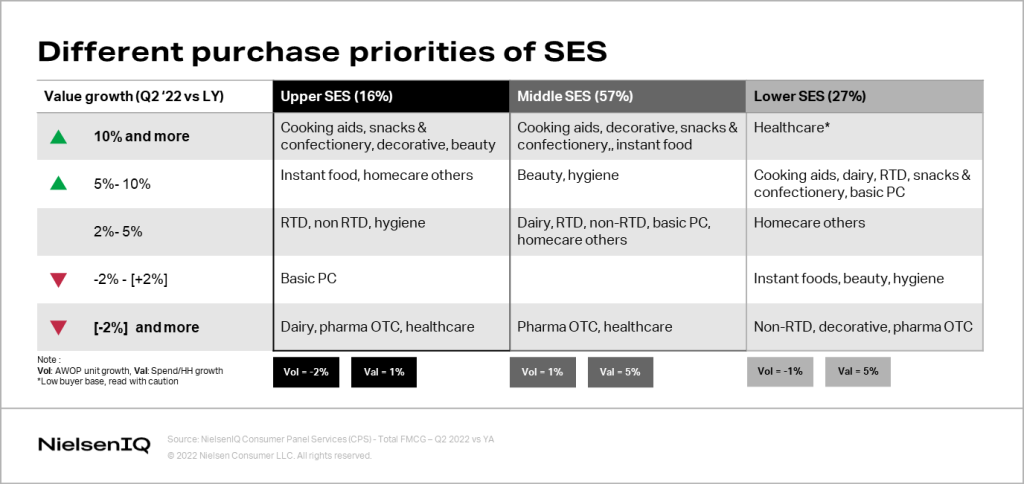

Overall, the Upper SES have been maintaining their spend with a tendency to purchase a smaller pack, while the Middle SES have been trying to manage their basket portfolio despite spending being hampered by price increases. The Lower SES on the other hand has limited options to face the impact of price increases.

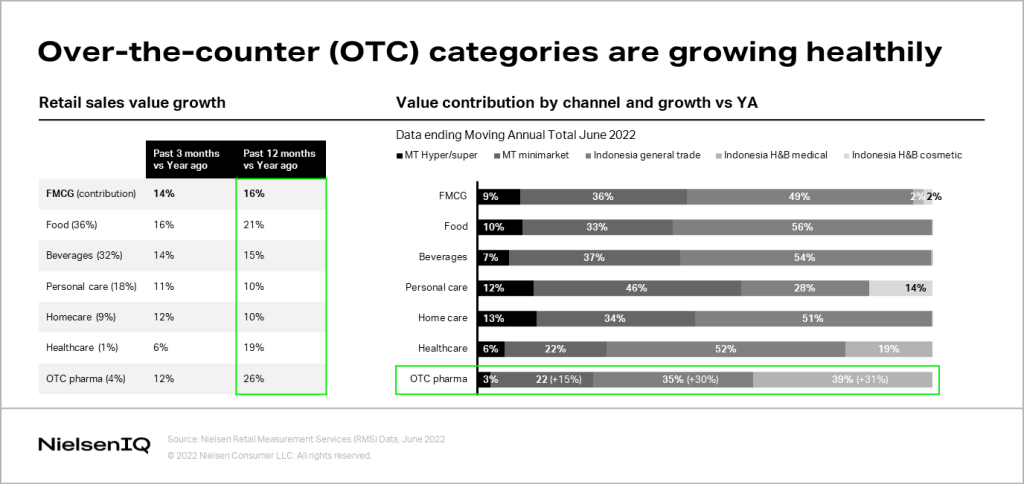

Despite facing the worst chapter of the country’s covid outbreak and rising inflation, Indonesian consumers are exhibiting signs of optimism. Amid festive celebrations, we observe notable growth in overall household spending compared to pre-pandemic levels. Also, with the easing of mobility restrictions, leisure and transportation are showing growth. The pharmacy over-the-counter (OTC) categories have also been growing healthily in the past 12 months versus a year ago, with the medical health and beauty category becoming not only a very important channel contributor but also a growth driver for OTC.

It is worth noting, however, that the optimism among Indonesian consumers does come with shifts in their purchase priorities across SES. It is important for manufacturers and retailers to understand these shifts on an ongoing basis to continuously drive value for their consumer and remain relevant to them.

Category growth is shifting toward the new normal

In terms of retail sales in Indonesia, FMCG is now continuing to grow after being hampered in 2020 by the pandemic. In fact, both FMCG and cigarette sales for example have recovered to a level that is higher than pre-pandemic levels.

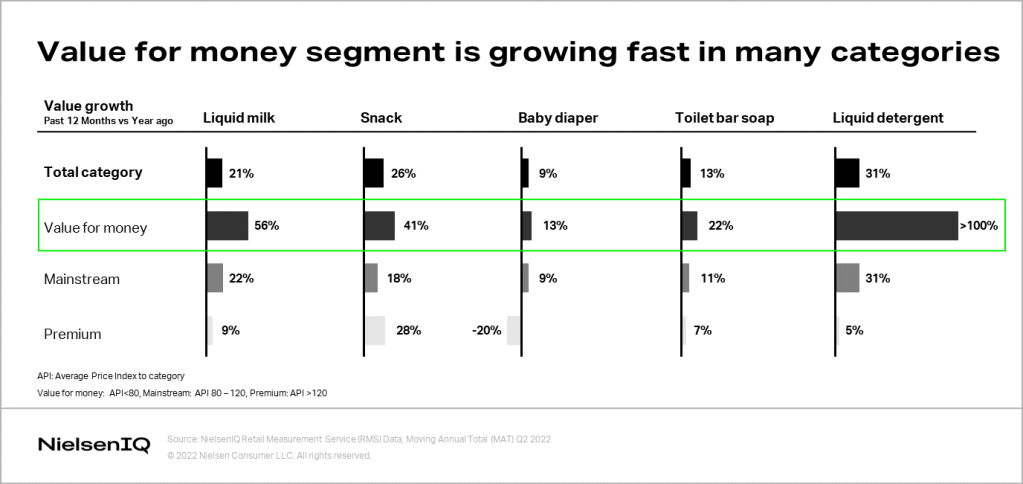

However, most of the category growth is reflecting the new normal. Healthcare and pharma categories driven by health and beauty medical stores continue to grow, the homecare category is decelerating, while snacks and beverages continue to grow quite rapidly. The only special case is cooking aid, which is declining due to the scarcity of cooking oil. We also observe that within many of the categories, the value-for-money segment is growing faster than the mainstream and premium segments.

E-commerce continues to shine as post-covid recovery continues

With consumers seeking better deals through online shopping, the e-commerce channel has continued to grow. As the Upper and Middle SES households continue to adapt to the e-commerce world, the Lower SES are also trying to adopt e-commerce to a certain extent, however, their usage of the channel is still limited.

Ushering in the new consumer era in Indonesia

Inflationary pressures have led to multiple categories experiencing price increases, as well as changes in consumption habits and priorities among Indonesian consumers. Despite having optimism in terms of their economic condition for the next six months, consumers are generally proceeding with caution. Fully understanding your consumers is crucial in order to build the optimal strategy and tackle the shifts in the retail landscape. This is where having the right data and trusted insights is an absolute must.