Are consumers shopping Amazon’s October Prime Day?

The first day of Amazon’s Prime Early Access Day—which kicked off on Tuesday, October 11—was more buzz than bust. New NielsenIQ analysis of day one of Amazon’s two-day deal event is showing that despite lackluster social excitement, deal-hungry consumers showed up and shopped.

According to Genevieve Aronson, NielsenIQ’s Global Head of Thought Leadership, “This second deal day push from Amazon is fueling an early holiday shopping season that is very different from year’s past. This year’s rush is less about the fear of whether gifts will be available on shelves due to supply chain issues and more about the affordability of all things holiday and beyond. As high inflation lingers and cost of goods continue to rise, U.S. consumers are leaning into discounts and deals to get through this year’s holiday season. Consumers are getting a head start on holiday shopping to spread out spending and taking advantage of discount deal days.”

Consumers return to Prime Day

NielsenIQ’s read into what many are dubbing Prime Day 2.0 shows that 60% of consumers who shopped during day one of Amazon’s Prime Early Access Day were returning consumers who also shopped Amazon Prime Day in July.

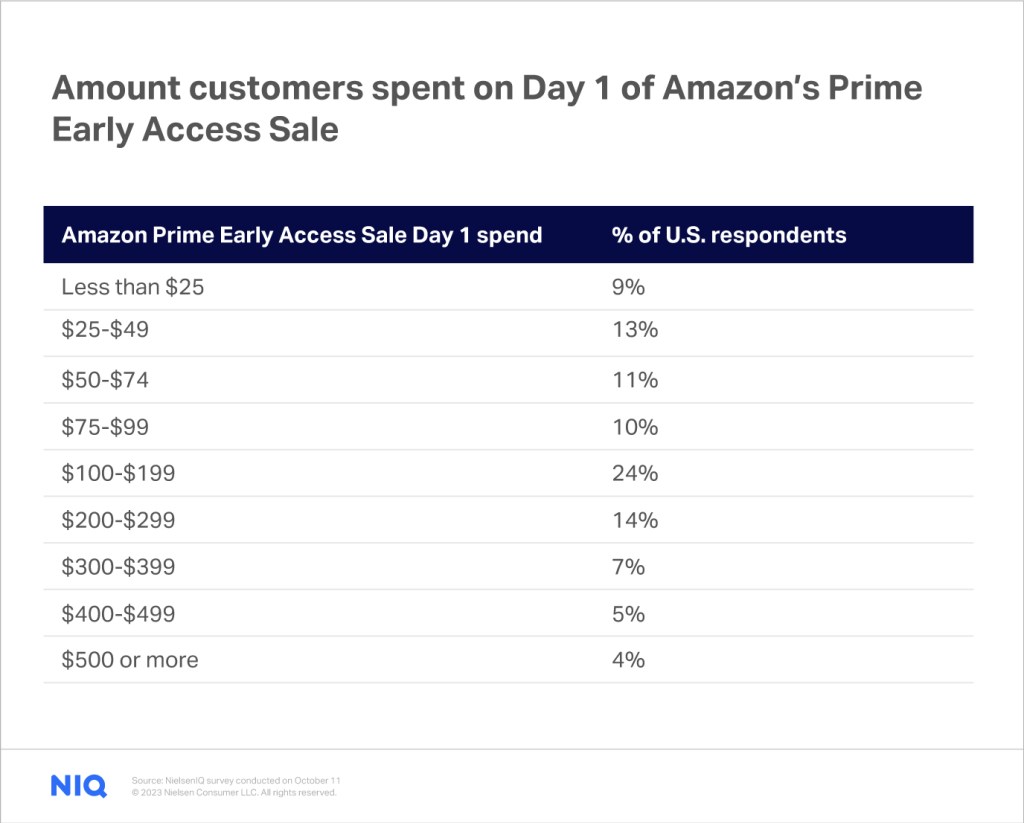

How much did consumers spend on day one?

From a spend perspective, a majority of consumers surveyed indicated that they spent under $200 and spent on deals that they perceived to be strong. In fact, 52% of consumers stated that the deals they saw on day one were actually stronger than what they saw during Amazon’s original Prime Day shopping event in July. That said, in comparison to the social excitement and fanfare that was built around Prime Day in July, Amazon’s fall event fell a bit flat.

BUST: Amazon Prime Day’s sequel was less of a blockbuster holiday shopping moment and more of a subdued Black Friday prequel

Day one of Amazon’s Fall Prime Day event wasn’t really a holiday blockbuster. Consumers approached Amazon Prime Early Access Day with multi-purpose intensions that stretched across holiday and everyday shopping needs.

50% of consumers surveyed noted that they shopped Amazon’s Early Access Day to find deals on holiday gifts for family and friends, while 44% of consumers surveyed indicated they were looking for gifts for themselves.

However, 44% of consumers noted that they were opting to skip holiday shopping for everyday essential shopping instead, with 25% of consumers specifically focused on finding grocery deals.

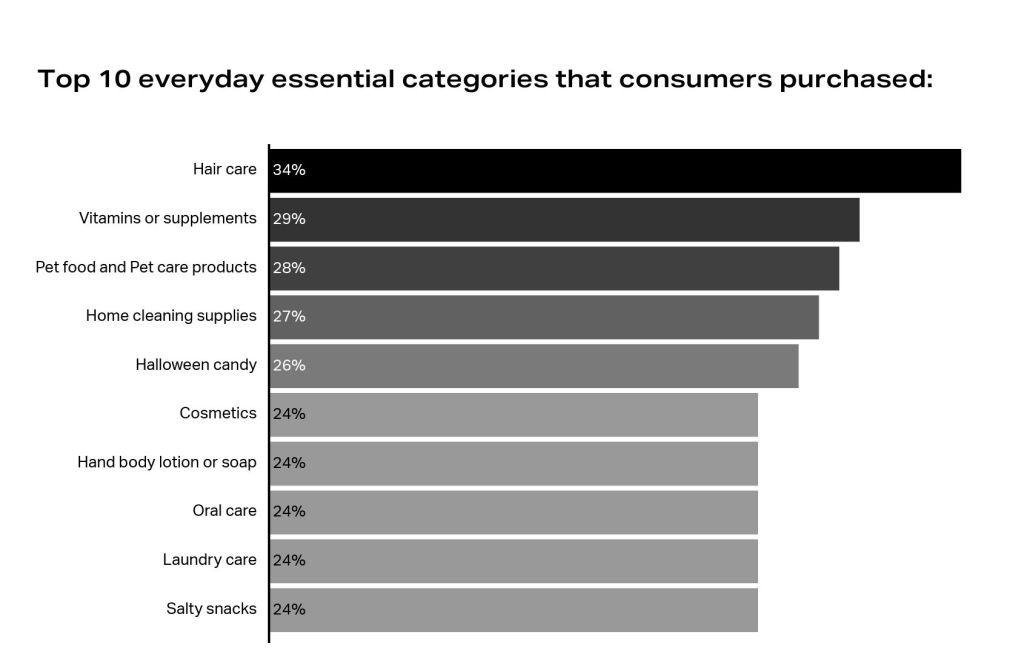

BUZZ: Consumers came to conquer deals on everyday essentials

The mission to find deals on hair care was a standout focus for over 1/3 of consumers.

See which top 10 everyday essential categories consumers focused on on day one of the sale:

BUZZ: Private label’s popularity continues to show

Despite conversation around Amazon cutting back on their private label offerings, consumers did opt to shop private label. Across everyday essential items, here are the top categories where consumers chose to purchase Amazon’s private label offerings.

Top 5 private label category purchases:

- Beauty (Cosmetics + Haircare)

- Pet

- Home Cleaning Supplies

- Vitamins + Supplements

- Oral Care

BUZZ: Obvious deals on typical holiday finds like toys and tech were trending

What did consumers buy?

51%

Clothes/apparel

40%

Toys

34%

Tech gadgets

31%

Kitchen appliances

31%

Gift cards

BUZZ: Amazon has become a hot spot for fiscally responsible fashion

51% of consumers surveyed stated that they specifically shopped Amazon Prime Day 2.0 to find discounts on clothes/apparel. Thanks to social media trends from platforms like TikTok, Amazon fashion dupes have grown in popularity, with consumers looking to Amazon to deliver fashion looks for less.

“Consumers are facing a cost-of-living crisis and are becoming savvy to sales and deal finding,” Aronson explained. “Amazon’s Fall deal day may not have driven huge holiday momentum, but it did make a dent in everyday, deal shopping. The lack of social excitement around Amazon Prime Day 2.0 may be a larger sign of consumer fatigue. Perhaps this October deal day moment felt a bit too familiar and lacked differentiation from July’s event. Retailers and manufacturers should take note that consumers are wallet strapped, they are weary of non-meaningful deals and are actively editing choices and downshifting.

However, in this era of thrift, consumers are not looking to skimp on experience. If anything, consumers are hungry for new experiences, inexpensive thrills, memorable moments that can bring a bit of joy or delight to their day—whether that’s through a new spin on an online deal day or in-store, experiential interaction. What new experience can you provide? All eyes now turn to Black Friday and Cyber Monday.”

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.