Prior to the pandemic, dining outside of the home was a beloved pastime, with diners relishing the opportunity to relax and socialize, and enjoying that they didn’t have to prepare the meal themselves. But with the global implementation of social distancing measures, lockdowns, and the subsequent closure of millions of cafes and restaurants, consumers were forced to rethink eating-as-entertainment and the ways they approached making meals at home. The result: more households reported they were ‘cooking for fun’ and were paying closer attention to catering consumer goods purchases. “Due to COVID related restrictions on how we live our lives, the past 18 months have resulted in an increased perception of the value of appliances in the home,” says Paul Hide, Chief Executive of AMDEA, the UK trade association for appliance manufacturers.

A look at the catering consumer goods market over the last five years

The catering consumer goods market was already burgeoning prior to the pandemic. Home kitchens have increasingly become high-tech in recent years, leading to greater spending on both large and small appliances. And with catering technology evolving by leaps and bounds, consumers feel compelled to constantly upgrade their kitchen with new – and better – products.

According to data on catering products from Statista, the global major appliances market (comprising fridges, microwaves, ovens, and more) grew steadily from $76.1 billion in 2015 to $84.1 billion in 2020, and is forecast to be worth $102.6 billion by 2024. A similar upward trend was observed for the global small kitchen appliances market (covering blenders, mixers, food processors, electric juicers, and more), which grew from $87.2 billion in 2015 to $110.1 billion in 2020, and is forecasted to be worth $116.2 billion by 2024.

‘Stay at home’ accelerates market growth

Because of the aforementioned side effects of the pandemic, today’s consumers are more likely to whip up their own meals from scratch. With health concerns now front of mind due to COVID-19, consumers desire to eat better; additionally, there is a growing appreciation of cooking as a hobby. According to GfK’s Health, Hygiene & Wellbeing study, 70% of global consumers in 2020 said they cooked for fun at least weekly, marking an increase of 10 percentage points from 2019. Even inexperienced home chefs are getting on board: 35-40% of consumers globally turned to home-cooked meals for the first time as a result of the pandemic. This is especially notable as amateur chefs represent a huge opportunity space for brands, driving demand for catering consumer goods and kitchen essentials that simplify cooking tasks, such as food processors and stand mixers.

Correspondingly, sales of catering consumer goods have increased significantly over the past year, especially as consumers seek to bring experiential luxury into the post-pandemic home. “Volume sales of large appliances, based on AMDEA’s sell-in tracking, have risen by over 20% versus last year, and are also up 17% versus pre-pandemic 2019 sales. Our forecasts suggest that, overall, 2021 volumes for large appliances will be between 10% and 14% higher than last year,” says Hide. His views are supported by GfK research, which shows that the global sales value of TCG products grew by 22.7%% YoY in July 2021, driven by the “stay at home” trend.

Building a luxury kitchen with top catering consumer goods

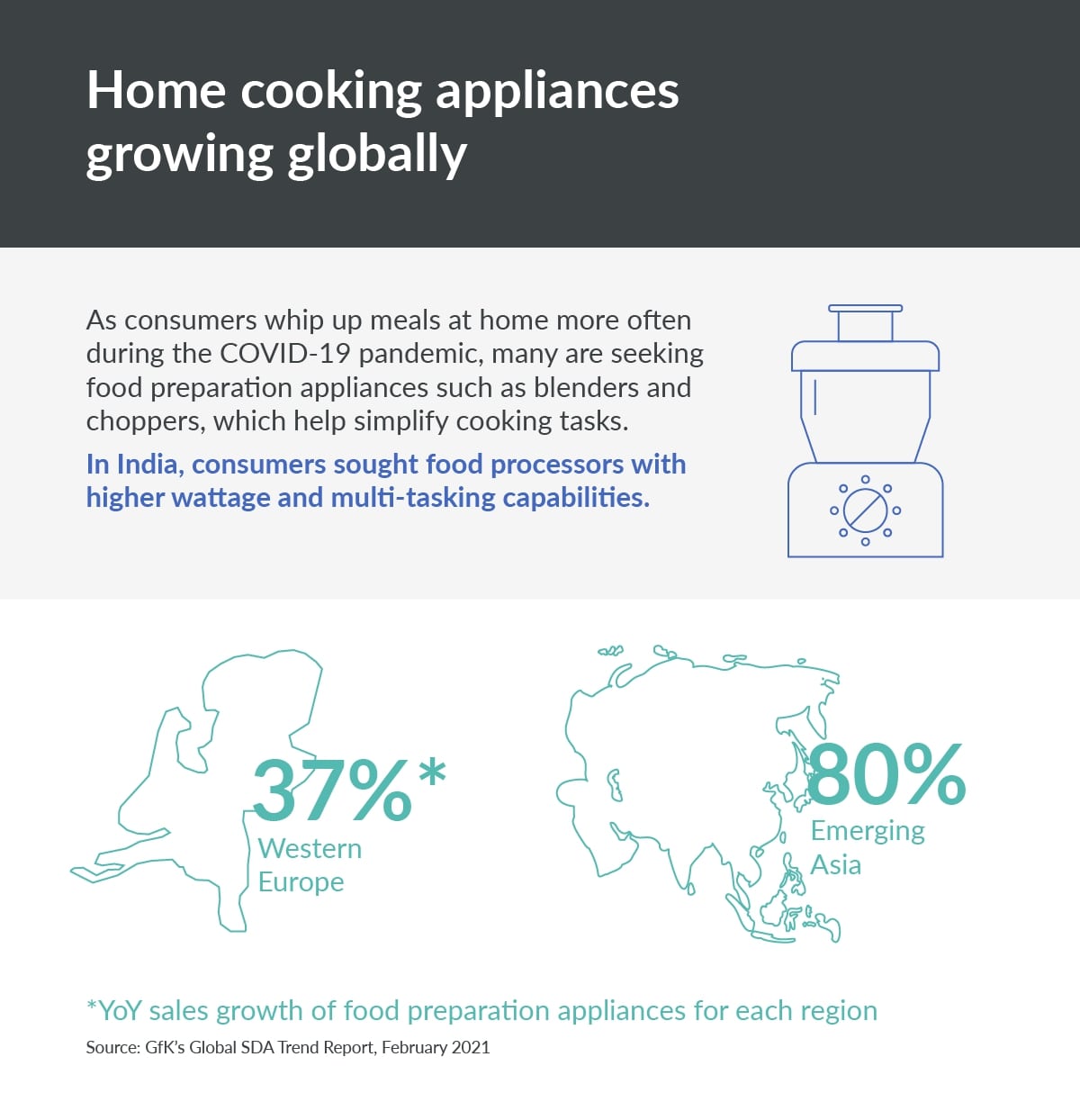

So, which home catering consumer goods are enthusiastic cooks spending on? For starters, consumers have been investing in food preparation appliances such as blenders and choppers, which help simplify cooking tasks. This category has seen extraordinary growth globally, particularly in Western Europe and emerging Asia: in 2020, the YoY sales growth of food preparation appliances for each region stood at 37% and 80% respectively. In India especially, consumers sought food processors with higher wattage and multi-tasking capabilities.

The pandemic has also prompted a reevaluation of our lives – and lifestyles – with many consumers seeking to clean up their diets. According to GfK’s China Home Appliances White Paper 2021, 74.7% of consumers in China say they “will cook more at home as it’s better for health and wellbeing”. Sales of healthy cooking appliances such as hot-air fryers have grown much faster than other related appliances such as deep fryers. According to data from NPD Group, the 13-week period ending 27 June 2020 saw the sale of nearly 2 million more air fryers in the US, compared with the same period in 2019. Aldi in the UK is tapping into the trend: in March 2021, it launched its Ambiano compact air fryer for £29.99 – a fraction of the cost of higher-end counterparts.

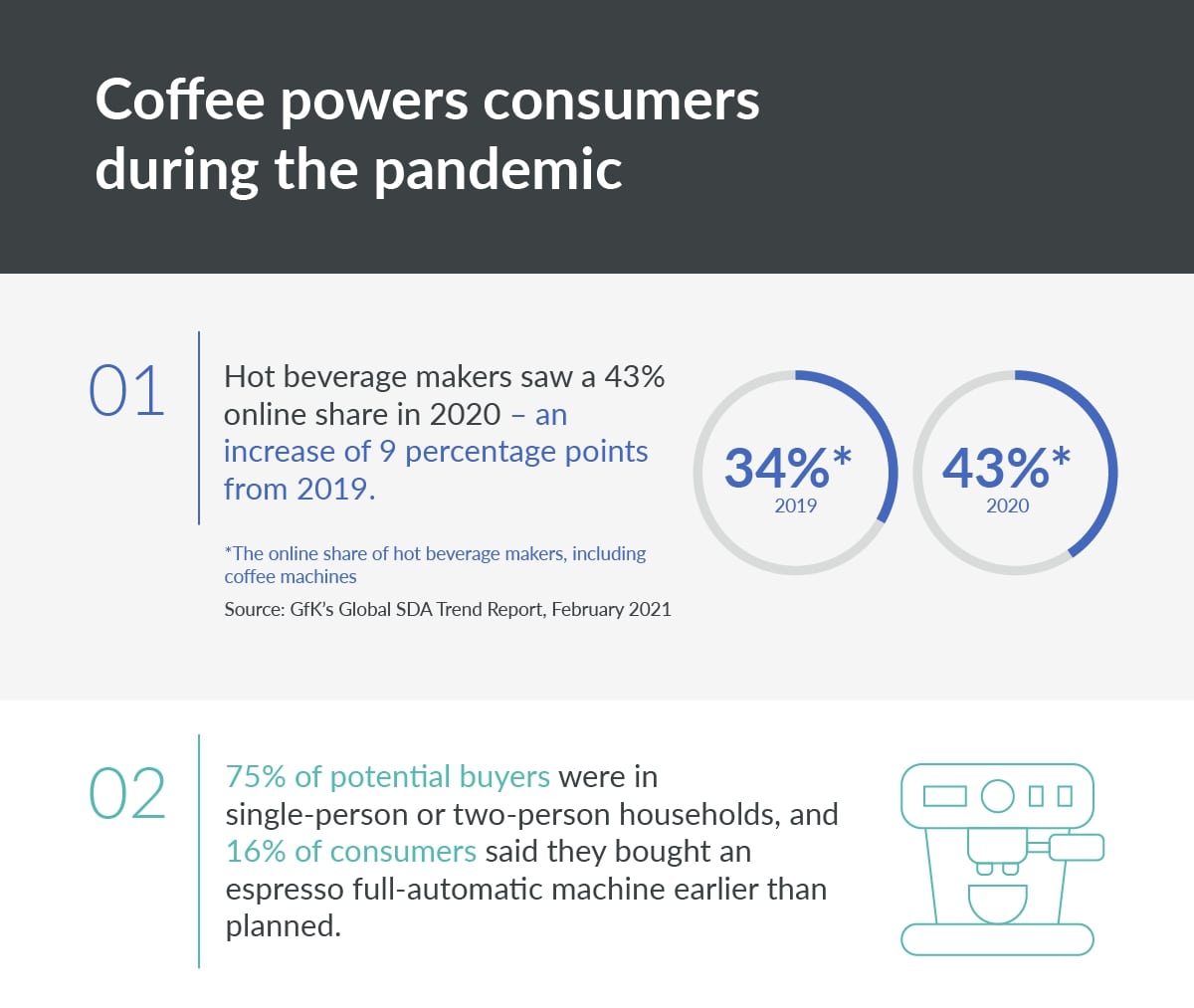

Coffee makers, too, are in high demand. According to GfK’s Global SDA Trend Report, hot beverage makers saw a 43% online share in 2020 – an increase of 9 percentage points from 2019. 75% of potential buyers were in single-person or two-person households, and 16% of consumers said they bought an automatic espresso machine earlier than planned. Clearly, with working from home becoming the norm during the pandemic, and with many coffee shops and cafes closed due to lockdowns, consumers feel the need to invest in quality coffee – and good coffee machines – to power them through their working day. De’Longhi recently launched a new coffee machine called the De’Longhi La Specialista Arte, with high-end features including a latte art wand and a temperature control system.

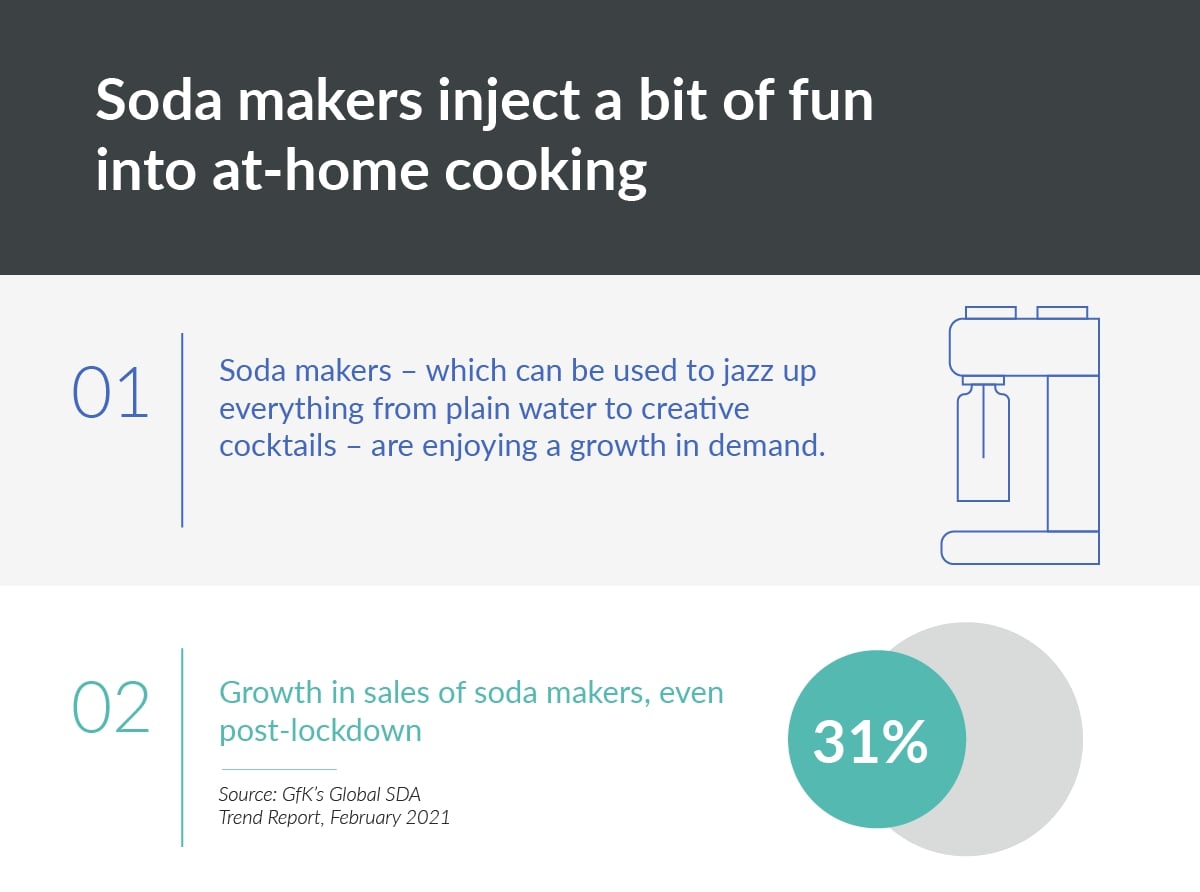

As eating at home becomes embedded in our lifestyles, consumers are looking to inject some fun into their cooking. This has translated into higher spending on nonessential kitchenware and catering consumer goods – think bread makers and soda makers. For instance, GfK data shows that sales of soda makers increased by 31% even post-lockdown. Brands are capitalizing on this shift in consumer behavior: in early 2021, SodaStream launched the DUO in Germany – a dual-system water carbonator fitted with both a glass bottle (for home use) and a plastic bottle (for on-the-go drinking).

Finally, as new technologies such as 5G enter the mainstream, consumers are gravitating towards smart home catering products with sophisticated capabilities – and brands are taking notice. According to data on catering products from GfK’s China Home Appliances White Paper 2021, retail sales of smart fridges grew from a market share of 27.9% in 2019 to 33.5% in 2020, and in July 2021. And Keurig launched its first WiFi-enabled coffee machine, the Keurig K-Supreme Plus Smart, which automatically detects coffee pods and adjusts brew settings.

TCG brands struggle to meet demands for catering products

However, manufacturers are struggling to keep up with the surging demand, and decreased staffing and factory shutdowns have only compounded the problem. This has resulted in shortages of kitchen appliances across the globe, with Electrolux informing investors during a recent conference call that it is facing “unusually low inventory levels”. In light of this, brands are ramping up production, with GE claiming that it is manufacturing appliances in the U.S. “around the clock”. Retailers, too, are pivoting from displaying items in showrooms to direct-to-consumer deliveries.

Additionally, the supply shortage combined with increased demand is pushing retail prices up. In March 2020, Jason Ai, the president of Whirlpool in China, told Reuters that the company was having difficulty sourcing the processors that power its microwaves and fridges. In many cases, manufacturers had little choice but to pass on the cost to consumers. According to data on catering consumer goods from GfK’s China Home Appliances White Paper 2021, the average price for fridges in China in December 2020 was CNY3,379, marking an increase of 4.4% YoY.

Hide expects prices to continue increasing in line with global shortages. “Raw material costs, labor costs, shipping costs are all increasing globally and inflationary pressure is on the rise. This isn’t expected to change in the short term,” he says.

In light of this, brands can consider exploring premiumization strategies, emphasizing the superior quality and/or exclusivity of their products to justify higher prices. According to GfK research, a dishwasher with a “B” energy label commanded an average price of EUR1,119 in 2021 – almost twice that of a dishwasher with a “C” energy label (EUR602). Additionally, GfK research shows that 44% of global consumers agree “it is important to indulge or pamper myself on a regular basis”, so brands can tap into the consumer appetite for higher end products that boost their profit margins.

What’s next in catering consumer goods?

Cooking at home will be the new normal moving forward: GfK’s China Home Appliances White Paper 2021 shows that 92% of Chinese consumers say they will cook more at home in the future. Likewise, a poll by market research firm HUNTER reveals that among Americans who are cooking more, 71% say they will continue to do so even when the COVID-19 crisis ends.

With cooking becoming more of a hobby, the catering market looks set to grow further in the near future. “We expect demand to remain strong for the next two to three years, as economies continue to recover from the pandemic shutdowns and governments stimulate consumer spending,” says Hide.

Additionally, we expect to see more brands in the catering space embedding sustainability in product design. For instance, in September 2021, a global major appliance company announced that smart features for its products will be downloadable via the App Store. This means that consumers can easily upgrade their appliances instead of replacing them with newer models.

All in all, the domestic kitchen has played an increasingly central role in our lives during COVID-19, and will continue to do so long after the pandemic recedes as consumers appreciate the convenience, health benefits, and fun of home cooking. In the future, we expect consumers to keep whipping up their own meals, with home dining becoming as cherished an experience as dining out. In light of this behavioral shift, savvy brands will capitalize on the burgeoning stay-at-home economy, innovating to meet the growing demand for catering consumer goods that make cooking more efficient and more enjoyable.

GfK data can help you plan your next strategic move

FAQs

How has the catering consumer goods market performed over the last five years?

Overall, both the major kitchen appliances market (comprising fridges, microwaves, ovens and more) and the small kitchen appliances market (which covers blenders, mixers, food processors, electric juicers and more) grew steadily over the last five years. For instance, the former grew from $76.1 billion to $84.1 billion between 2015 and 2020.

How has the COVID-19 pandemic accelerated growth in catering consumer goods?

During the pandemic, restaurants were forced to shutter and consumers spent significantly more time at home as a result of lockdowns. This has sparked interest in home cooking – and in turn boosted spend on catering products. In particular, food preparation tools, healthy cooking appliances, coffee machines and smart catering products experienced a surge in demand.

What’s next for the catering consumer goods market?

Overall, demand for catering products looks set to grow further in the near future, even in light of price increases. After all, the domestic kitchen has played an increasingly central role in our lives during COVID-19, and will continue to do so post-pandemic as consumers appreciate the convenience and fun of home cooking.