Understand shoppers to deliver sustainable growth in challenging times

Everyone who works in retail knows how challenging the current economic environment is for consumers. However, it is possible to drive market share by understanding and adapting to the strategies shoppers are using to cope with the cost-of-living crisis. That means analyzing their behavior and getting into their mindset to create the strategies that best position you for sustainable growth.

Here are our five routes to grow market share:

(1) Follow the customer journey

Sales data can identify what is selling and where, and how that is changing. This will empower you to adapt your product portfolio and promotional tactics to stay relevant. Weekly sales data can show you what the market is doing and how you are performing. Monthly sales data can uncover emerging trends over time. By enhancing sales insights with knowledge of what drives consumer decisions you can ensure your retail offer – and how you communicate it – is optimized to maximize your chances of driving greater market share.

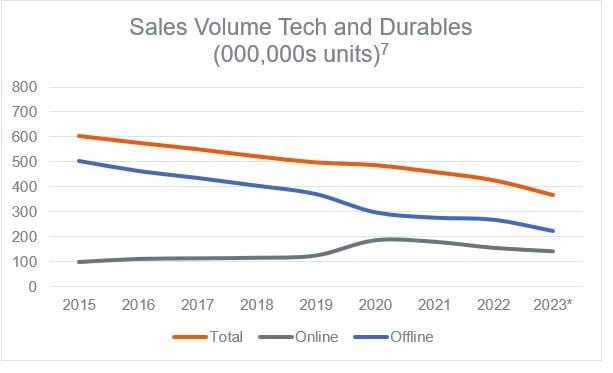

For instance, the data from 2020 to 2023 in the chart below might suggest that the trend in sales volume was driven by COVID and the cost-of-living crisis. But including the trend back to 2015 reveals a long-term decline in sales volumes. Only survey-based questions such as ‘What was the reason for the purchase?’ can help uncover the drivers of the decline.

(2) Visualize your potential customer

As the number of shoppers with money for discretionary spending falls, competition for their wallets intensifies. Analysis of GfK survey data from 2018 to 2023 shows that today, higher earners contribute the greatest proportion of spend across Tech and Durables. In 2023, high earners represented 34.4% of spending, up from 23% in 2018. The proportion of spending for medium-low and medium-high earners hasn’t fluctuated much, but the share of spending by low earners has fallen from 17.3% in 2018 to 13% in 2023. Get to know your target customer by matching their profile to your brand offer.

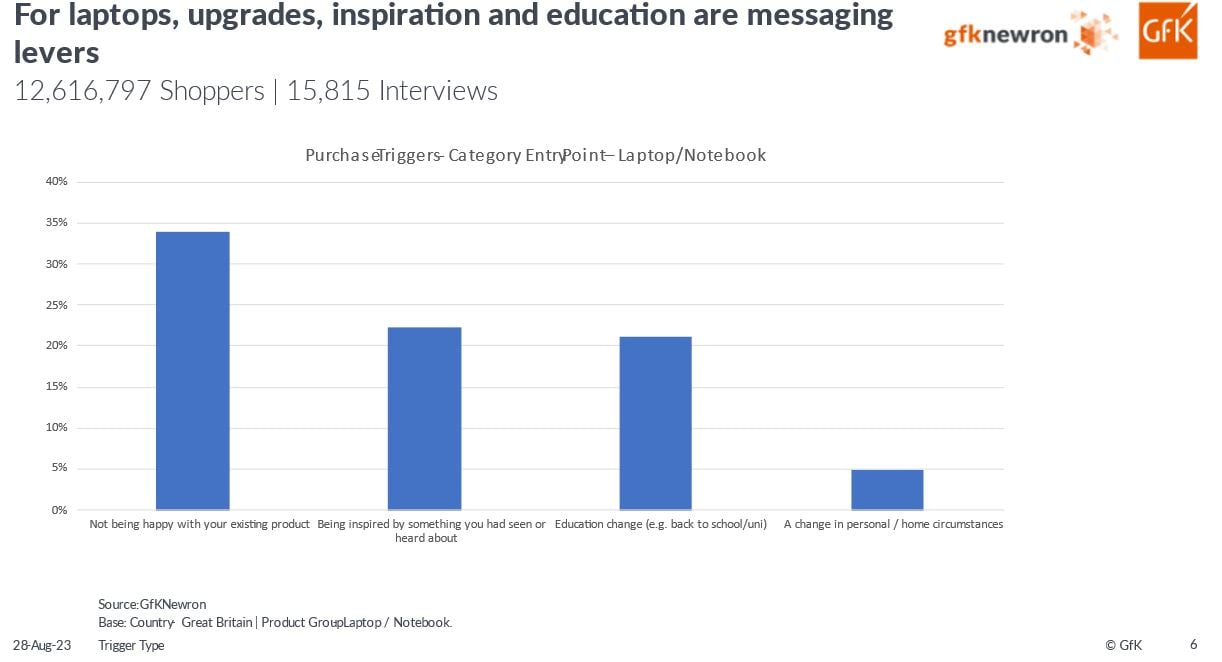

(3) Marketing messages that resonate

In markets where sales volumes are falling, the only way for retailers to grow their share is to differentiate the offer. If you’ve followed and deconstructed the purchase journey with survey data, you have the insights to understand consumers’ missions and purchase triggers. For example, the survey data below reveals that dissatisfaction with the current product is the top trigger for purchasing a new laptop. Using key triggers in your marketing storyline will resonate as consumers will recognize the situation. This will help ensure your retail brand is front of mind when consumers are ready to buy.

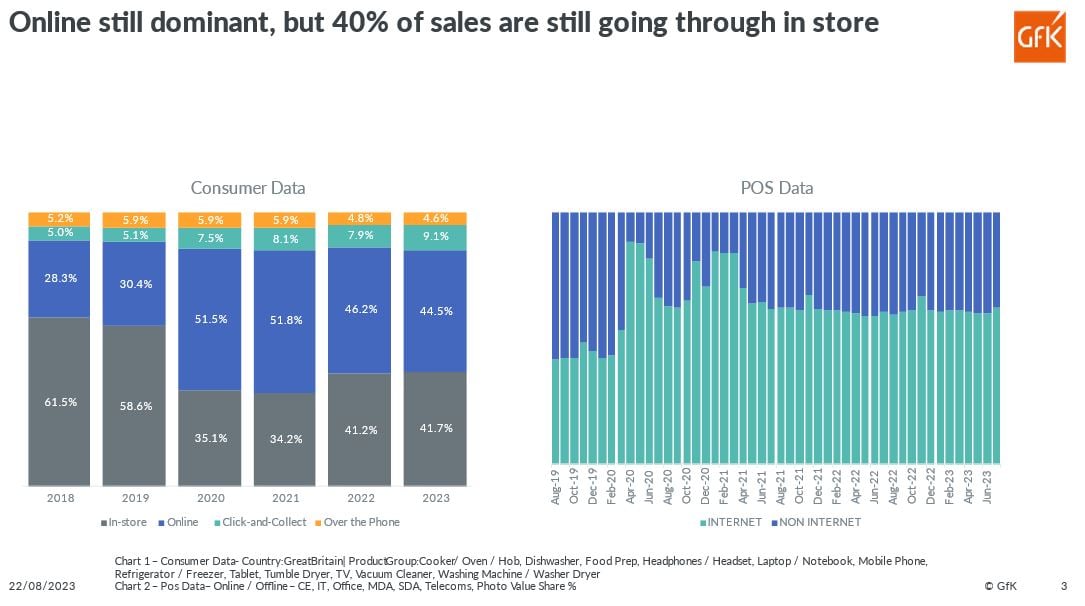

(4) Get the channel right

While COVID delivered a surge in online sales for T&D, our survey and sales data reveal that the share for in-store has bounced back to 40% so offline remains a key channel. To succeed, retailers need to do more than being front of mind, it’s essential to convert mental availability into sales by optimizing the online and offline experience. Surveys will get to the heart of what drives a great experience for consumers.

(5) Break down brand barriers

Your brand is already responsible for 30% of sales, but strong brands are better at coping when markets are stressed as they have less reliance on discounting to drive sales (GfK Brand Architect). Surveys can help you understand the good, the bad and the ugly of your brand offer – and then address them. A consumer-led approach will test internal assumptions and drive investment elsewhere to course-correct. According to GfK Brand Architect, the six drivers of Brand Choice for Technology products are relevance, fair price, differentiation, experience, trust and accessibility in descending order. Make sure you know and emphasize the strongest elements of your brand and tackle the weaker areas.

Retail has always been a competitive, challenging market. Today with high inflation, a cost-of-living crisis and macroeconomic and environmental issues, it can seem impossible to grow share. At GfK, we believe that data, insight and market expertise can provide the guidance and direction needed to survive and thrive in demanding environments. Understanding and adapting to consumer behavior is key to creating the strategies that best position you for sustainable growth in stressed markets. Find out more>>