Consumer sentiment holds steady

Consumers are expecting positive change in the new year, especially in the wake of parliamentary elections. The data for the third quarter of 2023 confirm some stabilization in the sentiment of Polish consumers. Consumer optimism — measured by the Consumer Confidence Index (CCI) in September 2023 — remains above the psychological barrier at 100.9 points, but compared to the previous months (July: 100.8; August: 100.9), there are no significant changes. A certain stagnation in consumer sentiment is also confirmed by the GfK Consumer Sentiment Barometer reading. The index for September equals -4.6 units, which means an increase by only 0.1pts compared to the previous month.

Inflation indicators for Q3 2023 confirm a slowdown in price increases. According to Statistics Poland, the prices of consumer goods and services in September 2023 increased by 0.4% compared to the previous month, August 2023. However, prices increased 8.2% compared to the same month last year, September 2022. The level of inflation, measured by NIQ based on the most important food and drug categories in the same period, is equal to 11.1%. Thus, we are still dealing with high prices, and what is more, we are ahead of the year end, where prices are most likely to grow further.

Prices polarize holiday spending intentions

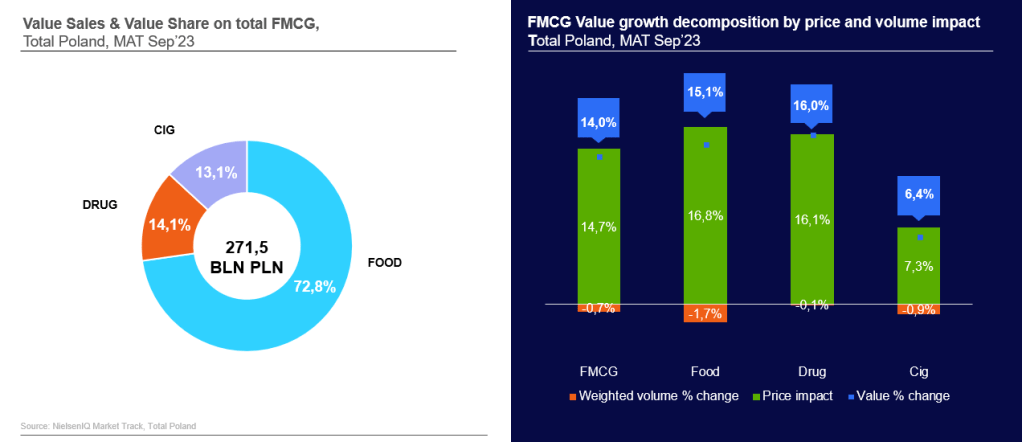

The increase in prices is still visible if we look at the sales dynamics of the FMCG basket. According to NIQ data, the value of the FMCG basket in the last 12 months (MAT September 2023) was worth 271.5B PLN, a 14% sales value increase year on year. However, all this growth is price-driven, as FMCG volume sales are down by (-0.7%), with food and beverages declining by 1.7%.

Those volume declines are not surprising. Still, more than half of the population claims that they are forced to cut back on spending to stay within the household budget. Despite the slightly improved confidence, only 13% of Polish consumers plan to spend more this Christmas. Half of Poles are going to spend the same as last year, and over a third of intend to spend less than last year. With rising prices, this may mean further volume declines. Many people who plan to spend less this holiday will buy less to stick to budget, will look for lower-value gifts, or buy fewer gifts (or nothing) for themselves. One in five will ask their guests to contribute in at-home celebrations, while one in ten will opt for homemade over store bought gifts.

Those who will be able to afford to spend more this Christmas will mainly spend on special meals and ingredients. Another frequent reason to spend more is simply hosting more guests, and only one in three consumers are planning to buy more valuable gifts this year.

Almost half of consumers declare that they shop in discount stores more often to cope with their household budget. Discounters’ importance is growing in FMCG sales of both food and drug categories, respectively rising by 2.5pp and 1.1pp. In both cases, the pace of their growth is maintained from Q2 2023.

“To sum up, the polarization of our society is progressing. To attract the largest group of consumers this holiday season, manufacturers and retailers must flex their propositions to both polarities of consumers: those with comfortable financial situations and those who are more vulnerable, who are analysing every purchase with surgical precision.”

— Konrad Wacławik, Retailer Vertical Leader.