State of FMCG in MEA

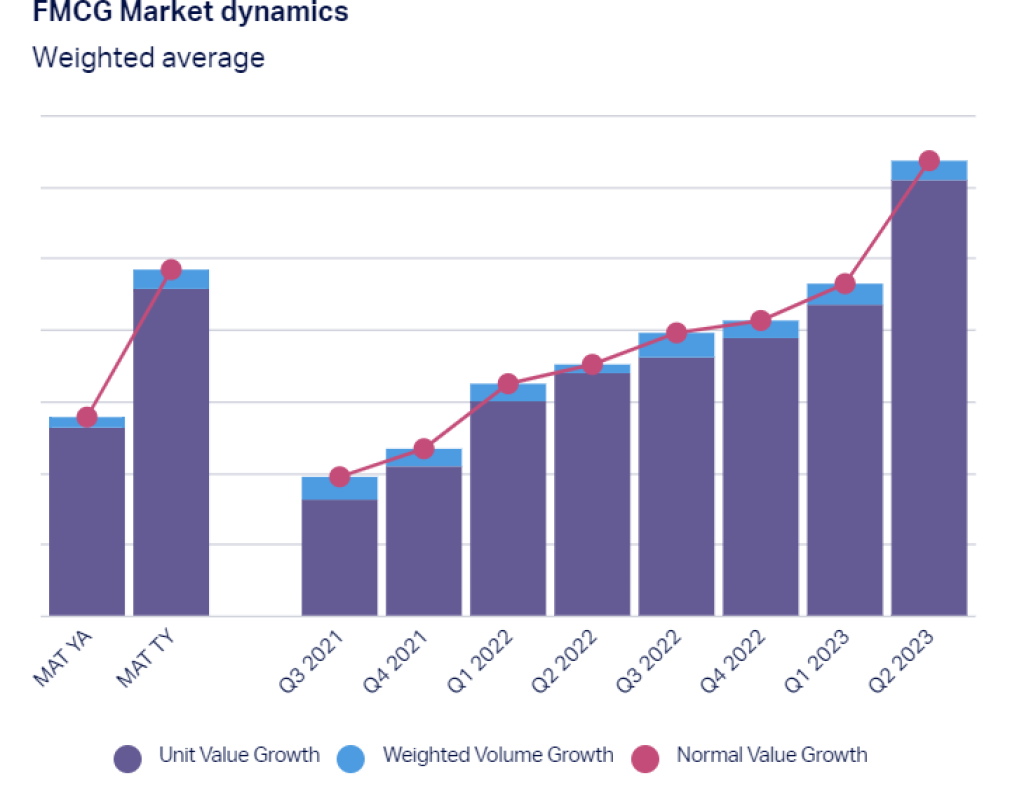

Africa Middle East (MEA/AME) FMCG value is at an all-time high of 63.5% in Q2 2023, driven by high inflationary markets, mainly Lebanon and Türkiye. Value growth (excluding these 2 markets) is at a modest 13.3% in Q2 2023, indicating that prices are increasing but at a slower rate.

Although inflation percentage increases are forecasted to slowdown, it’s important to remember that what we’re seeing is more of a deceleration rather than a decline. The simple reality for many is that the compounding effects of inflation mean that consumers continue to maximize their purchasing power, which can be clearly seen from the flat volume growth numbers for the past 4 quarters in the Africa and Middle East region.

Even though we are experiencing high cost of living challenges, the silver lining has been that unemployment rates are at low levels. Additionally, we’re seeing the re-opening of borders, and tourism is rebounding in the Middle East especially, bringing some relief after years of restricted travel.

In the short term, FMCG brands should re-look at all avoidable price increases, as many shoppers may continue their heightened focus on budgeting, value, and trade-off approaches that have worked for them so far. Retailers could benefit from traffic-generating offers in key categories, and differentiation, innovation, and finding unique space for private labels away from the “cheaper alternative” will drive grocery dynamics in the near future.

Spending more but buying less: How will inflation impact FMCG?

Much of the world is bracing for recession. According to NielsenIQ’s Mid-Year Consumer Outlook 2023 survey, up to 62% already feel like they’re living in a recession, with 48% of these consumers expecting this economic downturn to last for 12 months or more.

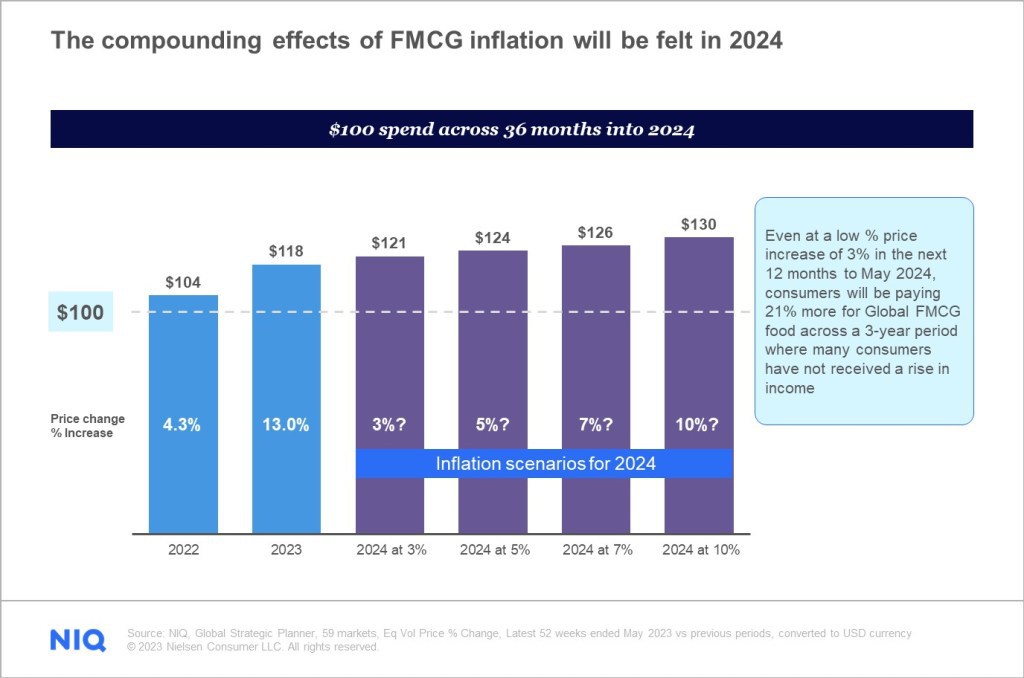

All 2024 projection potentials are NielsenIQ scenarios with 3%, 5%, 7%, and 10% gains on $100 based on previous periods’ actual value increases. Even at a low percent price increase of 3% in the next 12 months to May 2024, global consumers will be paying 21% more for global FMCG food across a 3-year period where many consumers have yet to receive a rise in income.

Compounding inflation has had different trajectories around the world. In the last 3 months, the Kingdom of Saudi Arabia (KSA) and the United Arab Emirates (UAE) markets saw 4% and 7% average price increases in modern trade, respectively; however, the FMCG unit value change rate in both markets has slowed.

Saudi shoppers spend most of their time shopping in hypermarkets and supermarkets; however, there is a noticeable tendency (11%) for faster growth in smaller-sized retailers, such as grocery and convenience stores. Compared to typical supermarkets, the grocery price increase is substantially lower in these smaller format businesses.

On the other hand, due to decreasing price points and people’s desire for good value for money, consumption in Egypt is shifting to supermarkets in both FMCG and beverage baskets. Consumption is moving to local manufacturers in 43% of categories, and 58% of local manufacturers are cheaper than global ones.

Consumer priorities and preferences have shifted

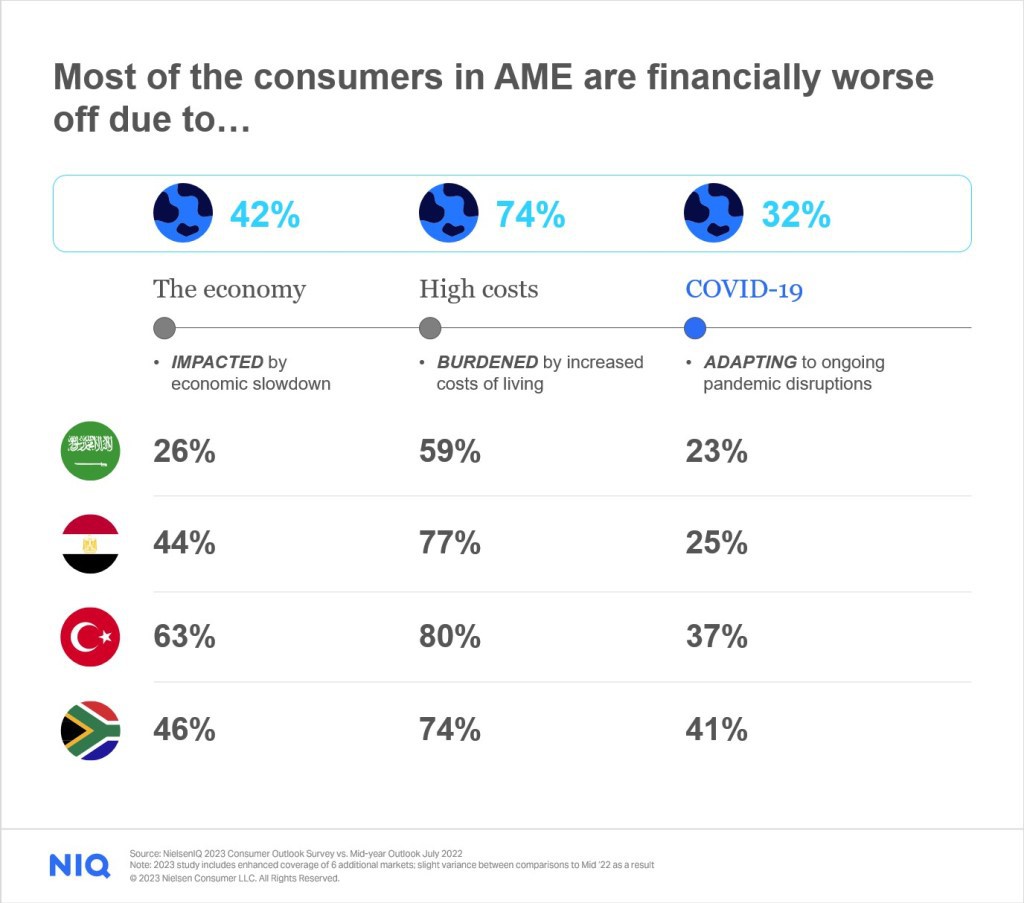

NielsenIQ’s Mid-Year Consumer Outlook 2023 survey shows that 34% of global consumers say they are in a worse financial position this year versus 39% in January 2023. Compared to the global average, consumers feel less financially secure in Türkiye, South Africa, and Egypt. At the same time, only KSA outperforms the global average of MEA major markets, accompanied by the lowest percentage globally that local consumers think they are in a recession.

MEA consumers are constantly skeptical, uncertain about the future, and prepared for extremes. An incredible 74% are financially worse off due to increased living costs. Another 42% say it’s an economic slowdown.

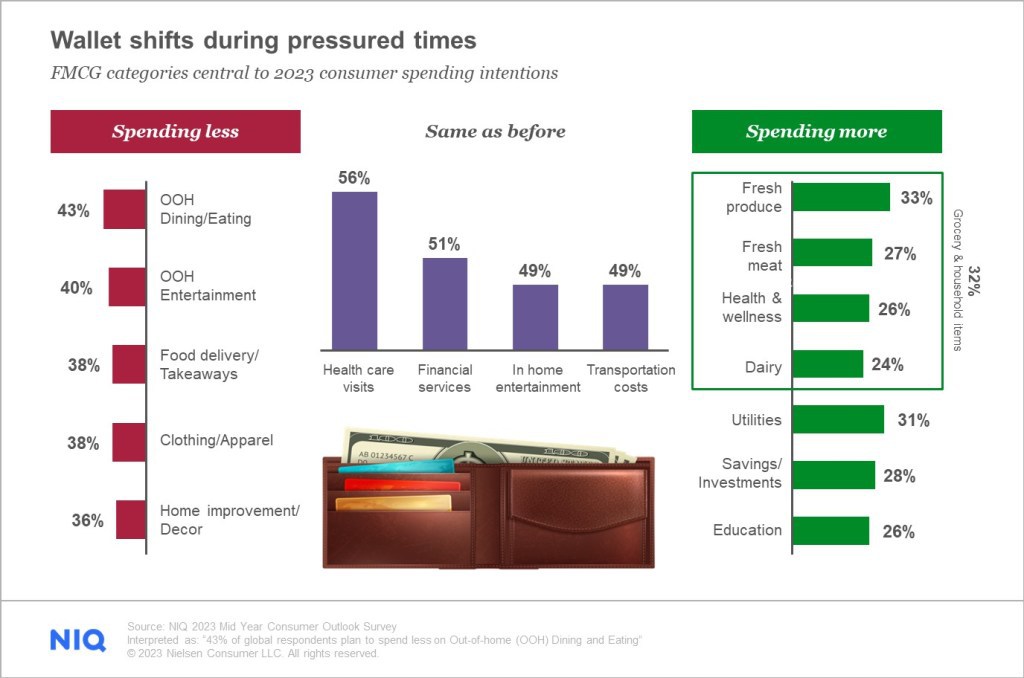

Consumer behavior is expected to change as customers feel the pressure of rising prices. According to the NielsenIQ Consumer Outlook survey, many MEA consumers claim to cook more at home, spend less on out-of-home (OOH) consumptions and entertainment, and choose between several discretionary expenditure categories, such as apparel and grooming.

Consumers are clearly under financial stress compared to a year ago, yet resiliency is visible. Consumers are committed to maintaining or even increasing their spending on categories they believe will propel them toward prosperity in the long run (i.e., savings/investments, education, and debt repayment). Groceries and household products are among the top categories people want to spend more money on this year, which is great news for consumer goods firms throughout the world.

Sustainability will be at the top of consumer and corporate radar in 2023

Despite the effects of global inflation and a redefined set of customer values and expectations, the region’s manufacturers and retailers are seeing an awakening of their growth mindsets. From climate change to extreme weather events, preserving natural resources and global ecosystems, and more — it’s clear that sustainability will be a top priority in the future.

NielsenIQ UAE & KSA C-Suite survey shows that 73% of respondent retailers plan to invest in environmental causes as part of their corporate social responsibility. At the same time, 58% of respondent manufacturers plan to invest in local communities as part of their corporate social responsibility. Other important investment areas include environmental causes, climate change, and education.

Buying products with sustainable credentials, recyclable packaging, and using refillable containers are all very conscious actions to live more sustainably, and it’s becoming even more important for MEA consumers. Sustainable products that are more competitively priced and have more apparent labeling/packaging are among the more popular ways consumers ask companies to help them make better choices. However, consumers are more likely to buy brands that also offer a personal health benefit along with the benefit to the planet.

It’s clear that brands also need to make it easier for shoppers to discover and purchase planet-friendly products by making their sustainability attributes accessible on a product page. Those that do will be rewarded with new shoppers — NielsenIQ data shows that almost two-thirds of shoppers would switch from a brand they usually buy to one that provides more in-depth product details than what exists on the physical label.

A rising star in the Middle East: E-commerce

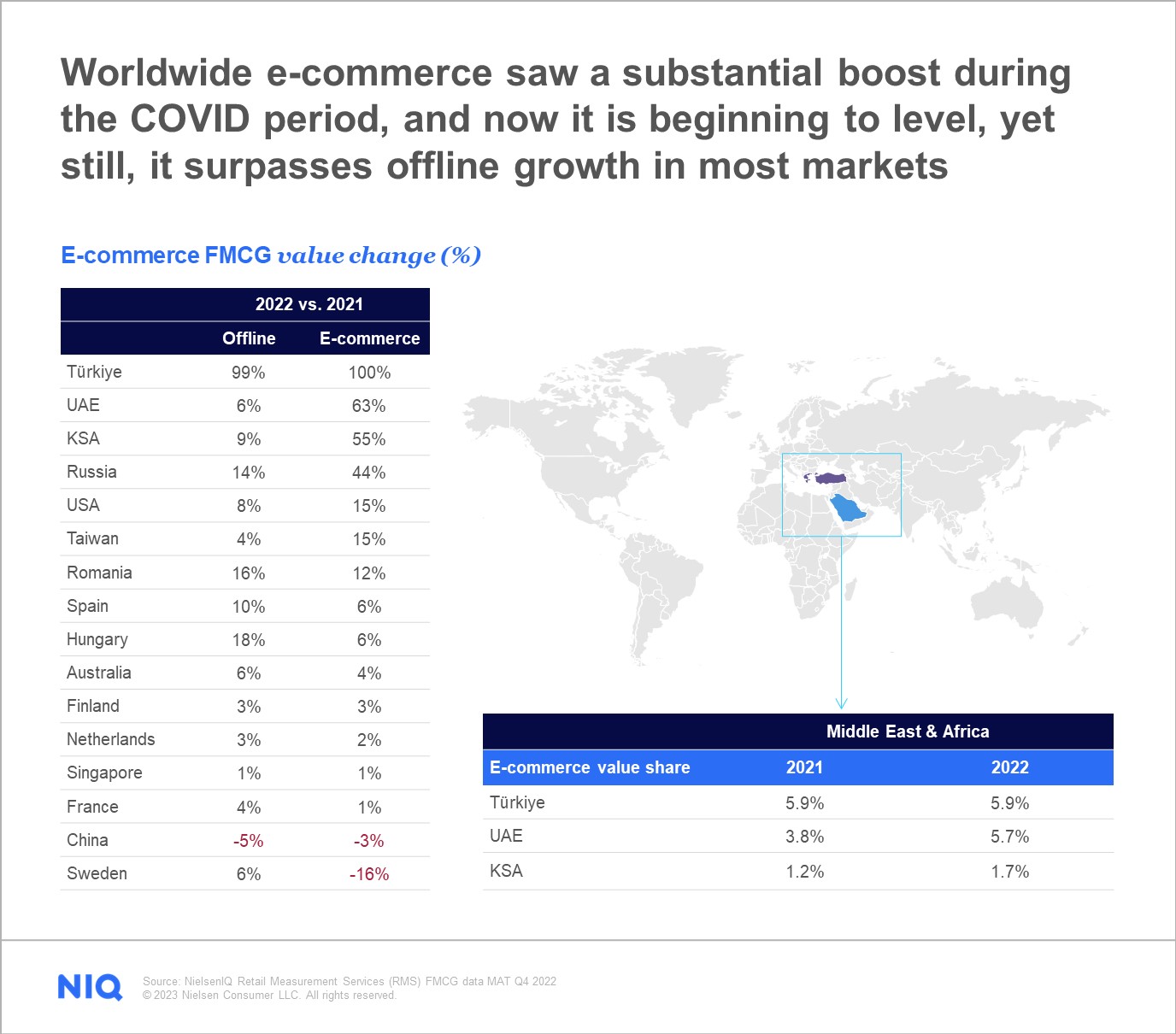

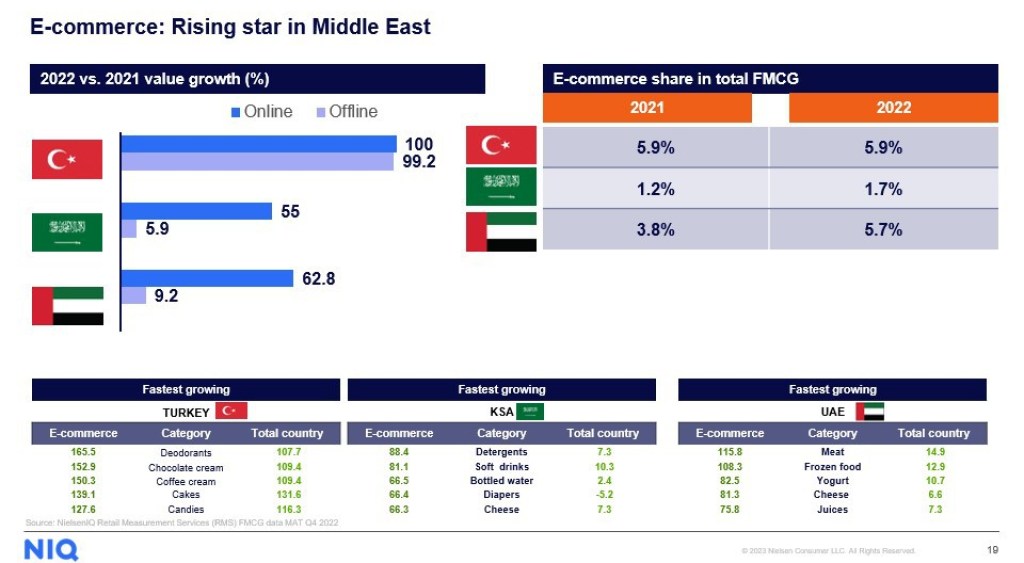

Aside from the effects of inflation, one growing star has been a valued opportunity for consumers, retailers, and businesses in 2023: e-commerce. E-commerce is not new, but the alternative possibilities of price advantage and product diversity have evolved into a core stage within the buyer’s journey under the year’s obstacles. Comparing FMCG e-commerce sales with offline sales shows that e-commerce growth is still ahead in many markets. However, we see that the growth gap of previous years has narrowed and that e-commerce has lagged behind in some developed markets such as China and France. This shows us that e-commerce growth is normalizing around the world.

Türkiye and the Middle East markets stand out in growth. E-commerce’s accelerated growth in recent years in Türkiye is maintained in 2022, as well. When we look at the United Arab Emirates and Saudi Arabian markets, which are still developing in terms of e-commerce, we see a very strong growth performance compared to offline. These 3 markets stand out globally. For those countries, the food categories stand out among the largest growing groups in e-commerce, meaning shoppers are gaining more omnichannel habits.

What’s next?

The report from the World Economic Forum summarizes the top risks ranked by its global respondents in order of perceived severity. It’s not surprising that costs of living are top-of-mind in the short term. One pervasive and emerging risk that consumes both the short and long-term horizons here is the importance of sustainability. From climate change to extreme weather events, preserving natural resources and global ecosystems, and more — it’s clear that sustainability will be a top priority in 2023 and well into the future.

On the other hand, to succeed in this omnichannel environment, brands and retailers must shift their view of e-commerce from a transactional channel to a growth engine for their business to maximize their strategy with real-time data and embrace the omnichannel.

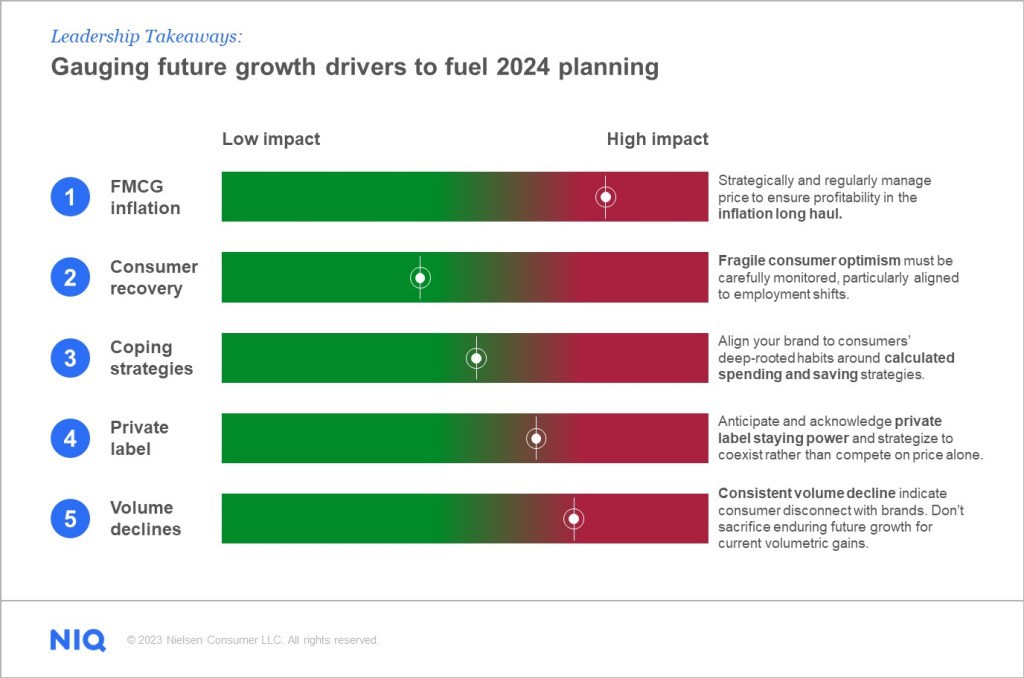

As retailers and manufacturers plan for 2024 and beyond, it’s important to monitor future growth drivers and their impact to develop strategies for success in this evolving marketplace. Understanding how consumers will react to the 5 emerging global trends outlined above and having strategies in place to help them manage their cost-of-living challenges will be essential to finding growth moving forward. The opportunity for business leaders is to comprehend how these underlying shifts and individual preferences are affecting consumers’ lifestyles and purchasing patterns, ultimately forming new ways of engaging with them as individuals.

Power your business decisions

Navigate the shifts in the retail landscape with the most accurate and trusted data in the industry to grow your business.