We’re well beyond the 2023 halfway mark, and as 2024 approaches, we’re keeping our promise on revisiting what’s influencing the consumer mindset and consumption behavior right now.

At the close of 2022, consumers were faced with increased uncertainty. High-profile job cuts, pandemic savings dwindling, and a general pressure on wallets prompted consumers to rethink what matters.

During the first half of 2023, higher prices and a volatile economy have mainly contributed to shifting consumer behaviors. GfK data shows that 47% of consumers switched from name brands to less expensive brands in the last 12 months – a 10 pt increase from last year.

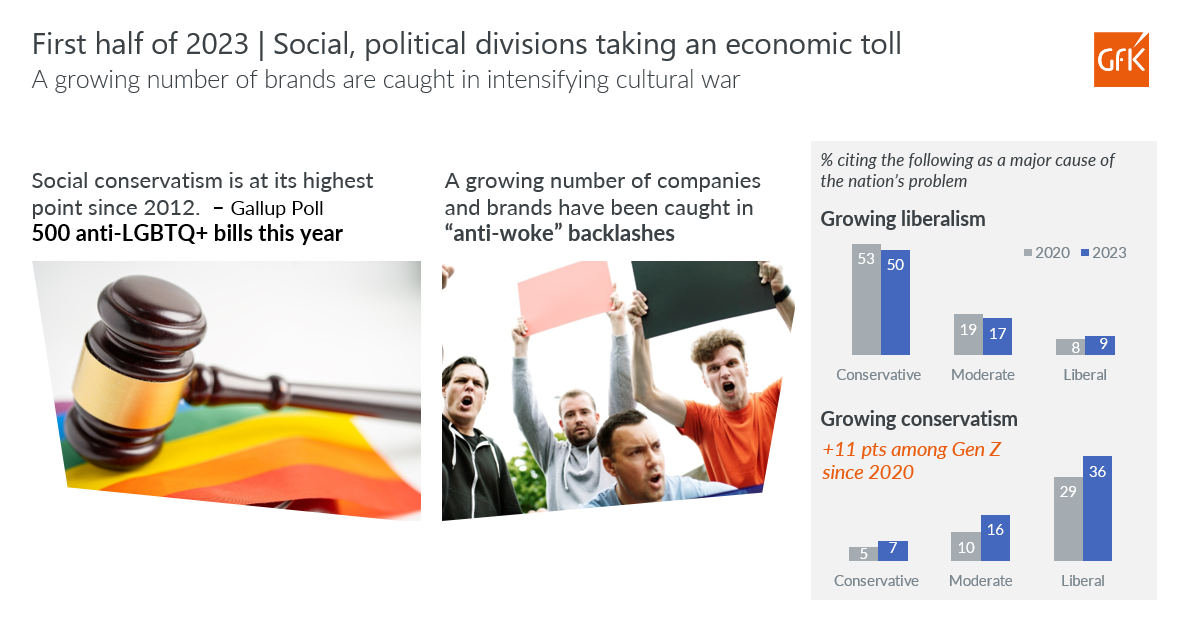

Societal shifts have also placed pressure on corporations to ‘do more’ – like aligning with consumers on ideological issues – which doesn’t always resonate. This begs the question for corporations and brands: how well do you know your key constituencies, and what’s impacting them most?

Consumers on sustainability

Last December, climate concerns were at or near highs in the U.S. Those concerns have carried through to mid-2023, but enthusiasm around sustainability and preserving our climate has taken a small hit. Societal and financial concerns have taken up space in the minds of consumers, where only 29% take the environment into consideration when making a purchase – down 3 pts from last year.

This might prompt you to think: is there a meaningful green narrative behind your brand and products that resonates with consumers?

Consumers on society

Shifting work environments and ideological debate took center stage in 2022, and that still rings true for 2023.

The job market is shifting back to a pre-pandemic state – driven by the employer – yet many consumers are still dictating their desires in line with personal preferences. In 2023, millennials were most likely to work from home all or some of the time, and boomers most likely to show up in person.

Social conservatism is at its highest point since 2012, yet more Americans are suggesting that growing conservatism is a problem. A growing number of companies have been caught in the crossfire between promoting inclusivity and alienating certain audiences, which serves as a lesson: brands need to strike a balance between understanding their consumers, and aligning with causes that don’t discredit the beliefs of any one group.

What are consumers spending money on?

Like the end of 2022, 2023 has still seen consumers craving experiences that put life front and center. Americans are going out and seeking fun activities – and willing to pay a premium to do so. Hollywood has breathed fresh air into the cinema experience with the release of record- breaking films ‘Oppenheimer’ and ‘Barbie’, bringing Americans out to the movie theater in droves. Similarly on a music front, Americans are spending big bucks on concerts, from Taylor Swift’s ‘The Eras Tour’ – which has seen unprecedented demand — to Beyonce’s ‘Renaissance Tour’, consumers are craving services that inspire and curate experiences. This summer might prompt you to think: how can I bring experiential elements into my category?

Consumer behavior is sure to shift again as the holiday season approaches. Looking back at 2023 gives marketers an opportunity to look forward and fine-tune strategies for the rest of the year — and beyond.

Catch up on our latest webinar with GfK’s consumer life team, available on-demand.