It’s here, and 16 months ahead of time. This September, beverage alcohol sales will expand to convenience stores, gas stations and even more grocery stores in Ontario. “The response from the public, from stakeholders, from small businesses has been absolutely overwhelmingly positive,” said Ontario Premier Doug Ford in late May, upon announcing the change.

This change presents a giant opportunity and challenge for CPG companies. Beverage alcohol companies that have wanted to sell in c-stores and gas stations now have a chance to capture their share of this multi-billion-dollar market. Beverage alcohol companies and manufacturers of snacks, sweets and other c-store staples already in the stores will have to defend their right to keep their products on the shelves.

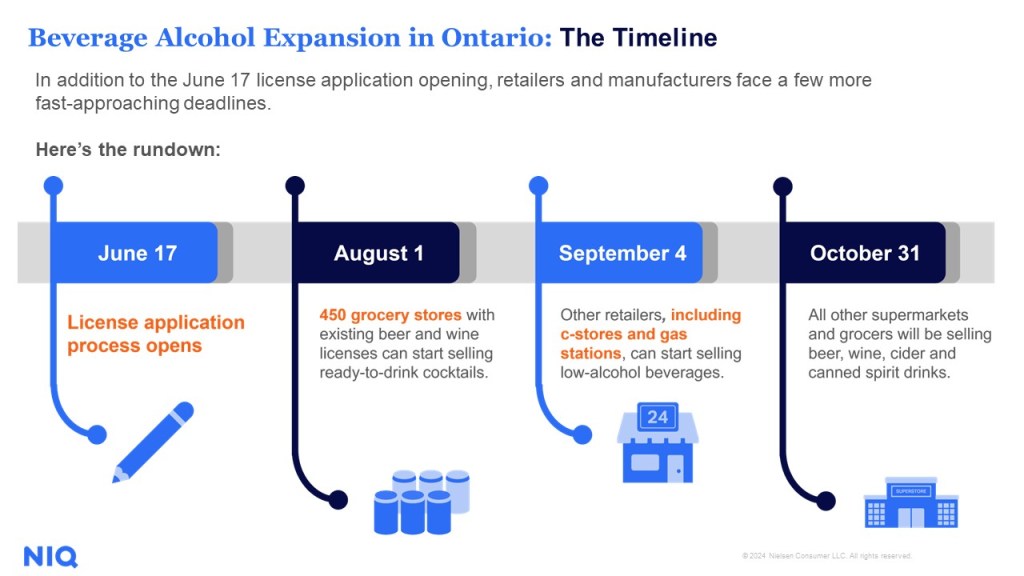

The race to the shelves starts June 17, when retailers can begin applying for licenses. The accelerated schedule means everyone involved will have much less time to think through and do all that needs to be done. Many CPG brands will need to trim, expand or re-evaluate their display footprints on Ontario’s retail sales floors, not to mention planning and executing marketing strategies for the new space and new customers.

It’s a lot to cheer for, and a lot to swallow. CPG companies must move quickly to make the most of this opportunity, and data and insights can certainly help. By fall, 8,500 new locations across the province will be offering low-alcohol products and more retailers will be able to sell beer packs of any size. The timeline is tight, with relevant deadlines in August, September and October.

Challenges and How NIQ Can Help Meet Them

From now until fall, both beverage alcohol and non-beverage alcohol companies will be working overtime to get the right fit in convenience stores. Retailers will have to find space for the new beverage products, and that will come at the expense of other beverages, snacks and other popular c-store offerings. CPG companies already in the stores will have to defend the space they have in them; companies who want to enter the market will have to do the same.

For beverage alcohol companies, NIQ’s assortment modeling can help demonstrate the value of their category and brands to gain their share of this newly available shelf space and position themselves as a retailer’s first-choice partner. Assortment modeling can also quantify incremental sales potential for retailers who make room for a beverage alcohol company’s products. Just as crucially, it can project and thus minimize losses that would occur should the retailer choose a competitor’s offerings.

For non-beverage alcohol companies, NIQ’s assortment modeling can help defend and hang onto their current floor space allocations. The modeling can quantify the financial risks to retailers of delisting a product or mistakenly rationalizing its category. It can also help manufacturers identify competitor brands, SKUs and categories that could be reduced with less negative impact on a department’s sales, thus helping retailers make better choices.

This news is huge for the industry, in more ways than one. Companies in and out of the space need to move quickly, efficiently and smartly.

Excited to explore further?

Contact an expert for an in-depth exploration of how NIQ’s assortment modeling can help your brand capitalize on this once-in-a-career opportunity