The state of celebrity Beauty brands

Celebrities are capitalizing on their clout, name recognition, and fan bases to carve out a space for themselves in the Beauty category, and many are succeeding. As a collective, the forty-three celebrity Beauty brands tracked by NIQ have surpassed $1 billion in sales for the first time in 2023, with sales of $1.1B in the last fifty-two weeks ending November 4, 2023. The sales growth of celebrity Beauty brands surpassed growth of the total Beauty category, up +57.8% while total Beauty is up 11.1% during this time.

When we look at the major Beauty and Personal Care categories, celebrity brands are prevalent in the Cosmetics and Fragrance categories and now represent 2.9% of all dollar sales in both categories. But it doesn’t stop there; celebrity brands are also entering Facial Skin Care, Body Care, Sunscreen, and even Deodorant.

Celebrity brands that find success often have commonalities that help them resonate with consumers. Authenticity always shines through with successful brands. Given the sheer volume of celebrity Beauty launches, it’s important for founders to have a clear purpose for starting the brand. Consumers want to know the “why” behind the brand. Celebrities who can connect with their followers and have authentic messaging are more likely to spark interest among consumers. One advantage of a celebrity brand is that they foster a sense of community through social media. They can use their platforms to reach a wide audience and communicate directly with their fanbase. They can be seen as a trusted source and their followers want to be a part of their community.

Overall, we see that the consumers who are most drawn to celebrity Beauty brands are the biggest Beauty enthusiasts, those who spend an average of $1,003.64 on Beauty and Personal Care per year, which is 1.25 times more than the average buyer. These buyers tend to be from large, young, diverse, higher income households. It is also a growing segment of buyers, with 20.7 million US households currently purchasing celebrity Beauty brands, and this segment grew +21.9% compared to a year ago. While there’s some consumer fatigue related to new celebrity Beauty launches, it is certainly a growing segment of the category.

What makes a successful celebrity beauty brand?

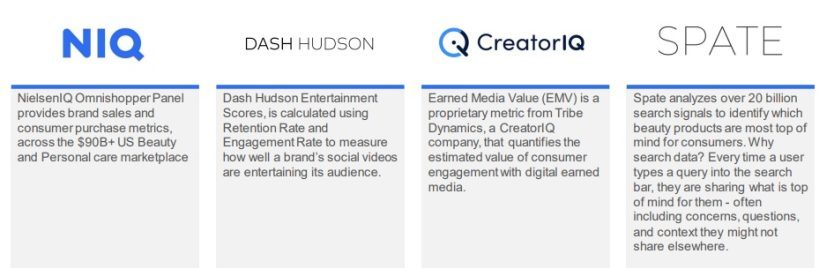

But it takes more than star power to gain staying power in an already oversaturated category. To determine the drivers of success for celebrity Beauty brands, NIQ worked with Dash Hudson, CreatorIQ, and Spate to evaluate sales performance, social, search, and media metrics. This gave us a robust view of performance, and the combination of these data sources allowed us to segment celebrity Beauty brands into five cohorts.

This unique segmentation takes into consideration yearly dollar sales, dollar sales growth and decline compared to the previous year, Instagram and TikTok Entertainment scores (based on engagement and retention rates), Google searches, and Earned Media Value (a proprietary metric measuring individual marketing campaign performance). By ranking each celebrity brand on these metrics, we were able to group them together based on the following criteria:

- Powerhouse players: These brands ranked high in total dollar sales, dollar growth, total Google search volume, and social media entertainment scores.

- Social media stars: These brands did not rank as high in total dollar sales but have high rankings in social media entertainment scores.

- Watchlist wonders: These brands are newer to the market but rank high in Google search growth compared to a year ago.

- Online opportunists: These brands are top ranking in dollar sales, but lower ranking in social media entertainment scores.

- Danger decliners: These brands rank low in dollar sales and are seeing dollar declines compared to a year ago.

What’s next for celebrity Beauty in 2024?

What will 2024 bring for celebrity Beauty? The total number of celebrity brand launches has started to fall compared to peaks seen in 2021 (19 launches) and 2022 (18 launches), but the Beauty space is still an attractive opportunity. From Lionel Messi launching Messi Fragrance to Beyonce’s much anticipated Hair Care line, we can expect to see more celebrities continue to enter the category but at a slower pace.

With the new year, our focus will shift from the wave of new celebrity brands to who is winning and losing in this space. In an upcoming NIQ report we will reevaluate the celebrity Beauty landscape to see how newcomers performed beyond the initial hype and answer the question—is there a new queen of celebrity beauty?

Be the first to get the report

Sign up now for release updates on NIQ’s 2024 Celebrity Beauty report.

Data Source: NielsenIQ Omnishopper Panel Total US Latest 52 weeks ending 11/4/2023 vs year ago