Assortment

Analysis in the US

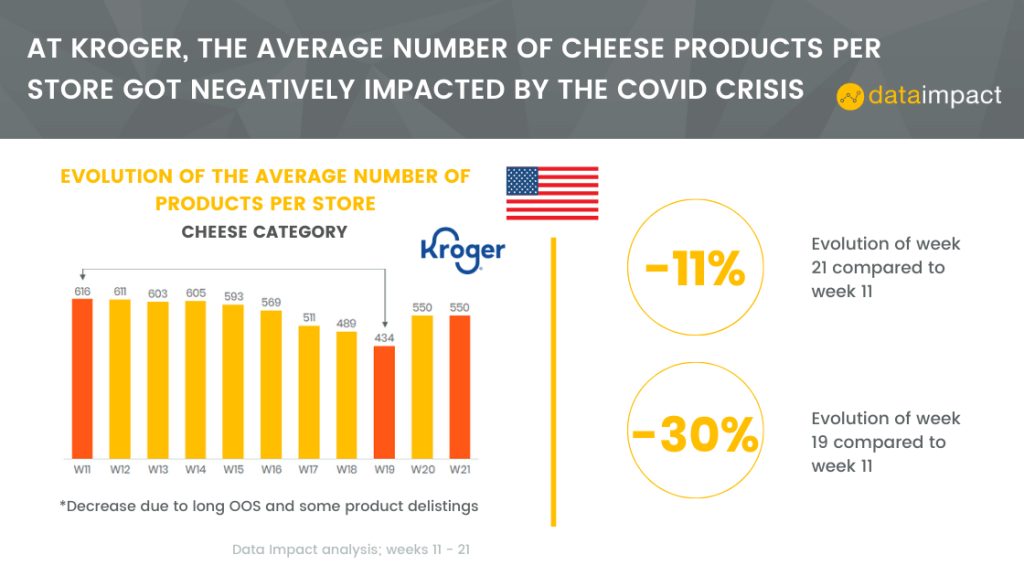

In the sheet below, we zoomed in on the cheese category at Kroger, US.

You can see the average number of products decreasing until week 19 and then rebounding. However, without reaching its level before the Covid-19 crisis. (March 9, 2020 to May 24, 2020)

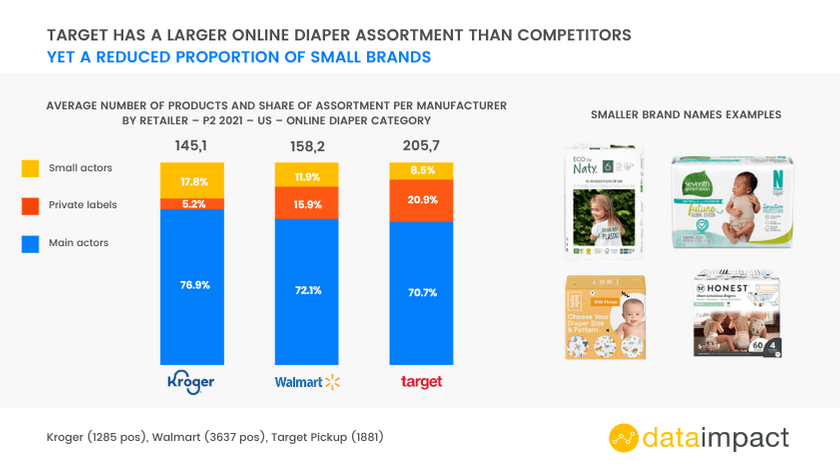

Our analysis of over 6800 online stores yields market insights our competitors can’t provide. Look at our study of the American diaper category for an example of what full-scale data collection generates.

Our category-wide share of assortment tracking is the most granular in the industry and is visualized clearly and simply with our user-friendly dashboard.

Assortment

Analysis in the UK

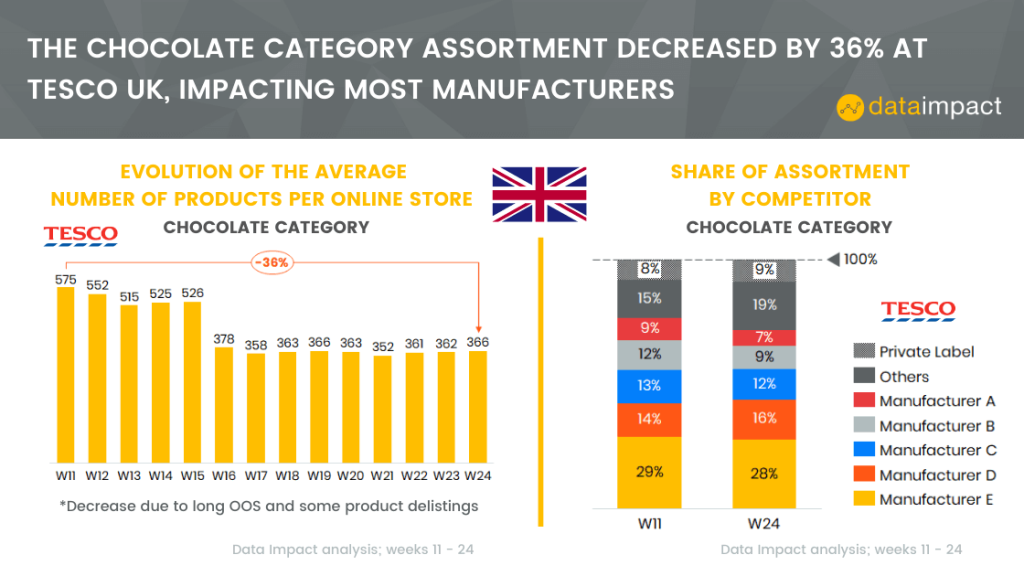

We chose an example from the UK market, specifically from the retailer Tesco. As you can see below, the chocolate category assortment decreased by 36% which impacted most of the manufacturers. (March 9, 2020 to June 14, 2020)

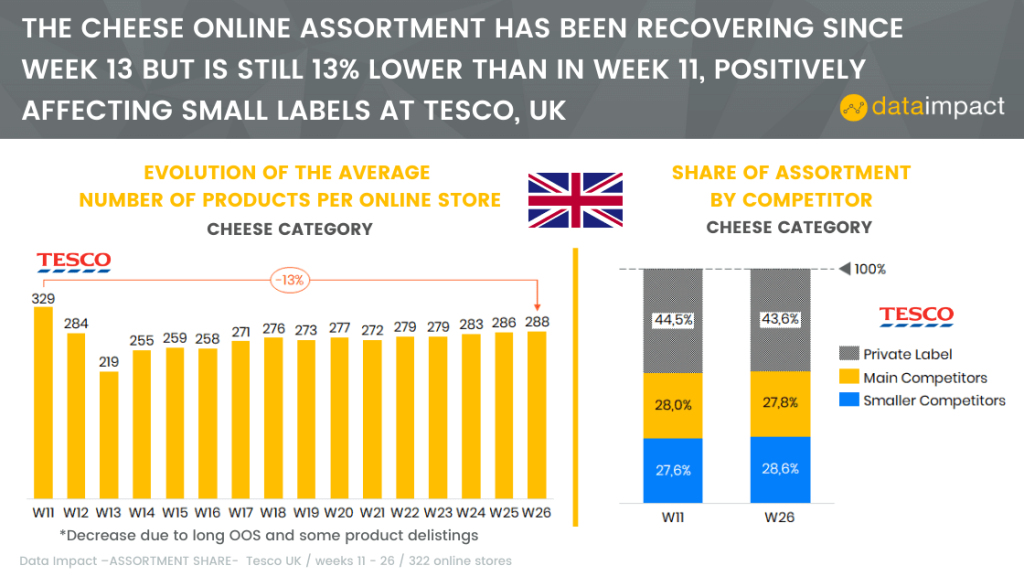

In continuing the analysis in this country, we checked how the cheese online assortment has been evolving at Tesco. After analyzing 322 different online stores, we noticed that the cheese online assortment has been recovering since week 13 but is still 13% lower than in week 11, positively affecting small labels. (March 9, 2020 to June 28, 2020)

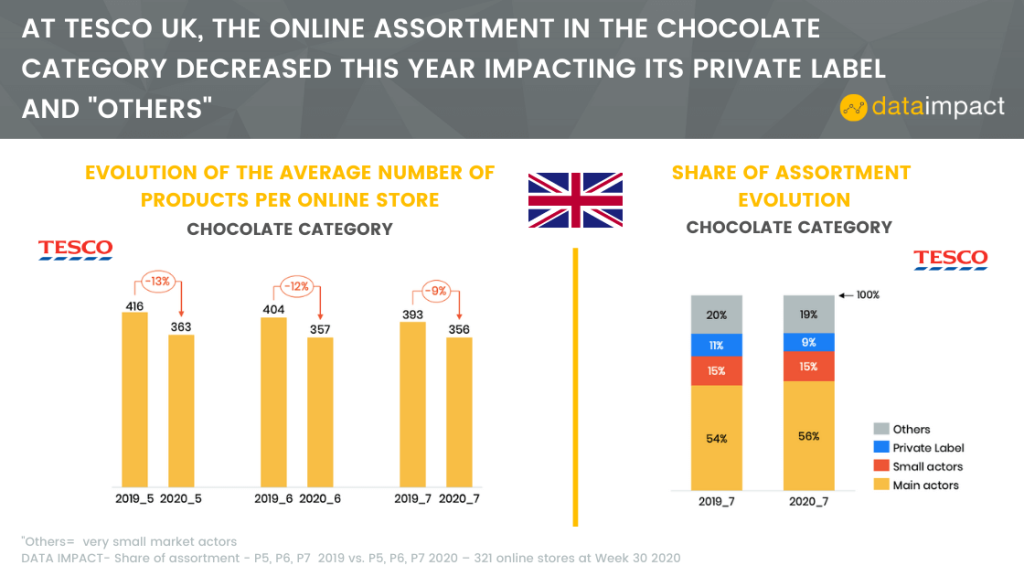

After analyzing 321 different online stores of Tesco UK, we observed a decrease in the online assortment of the chocolate category this year compared to last year. The chocolate category’s online assortment decrease impacted mainly Tesco’s private label and very small market actors. (P5 – P7 : June 01, 2020 to July 15, 2020)

To give you a view of the evolution of assortment for an other retailer, we analyzed 125 online stores of Sainsbury’s. This sheet portrays a general increase in the size of the online beer assortment, occurring in week 30. This increase of 32% will have an impact mainly on large manufacturers. (June 22, 2020 to August 23, 2020)

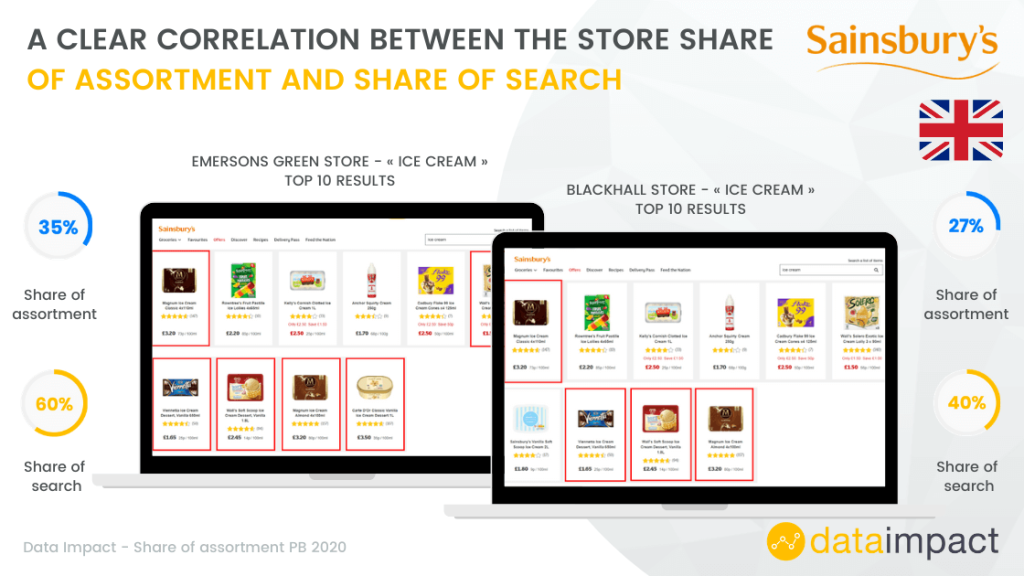

We then decided to focus on a search-based analysis. The sheet below portrays important disparities between different online stores of Sainsbury’s in the ice cream category. It displays a clear correlation between the store’s share of assortment and share of search. Higher the manufacturer’s share of assortment, the higher the chance of its product being in the TOP 10. (Two last weeks of July, 2020)

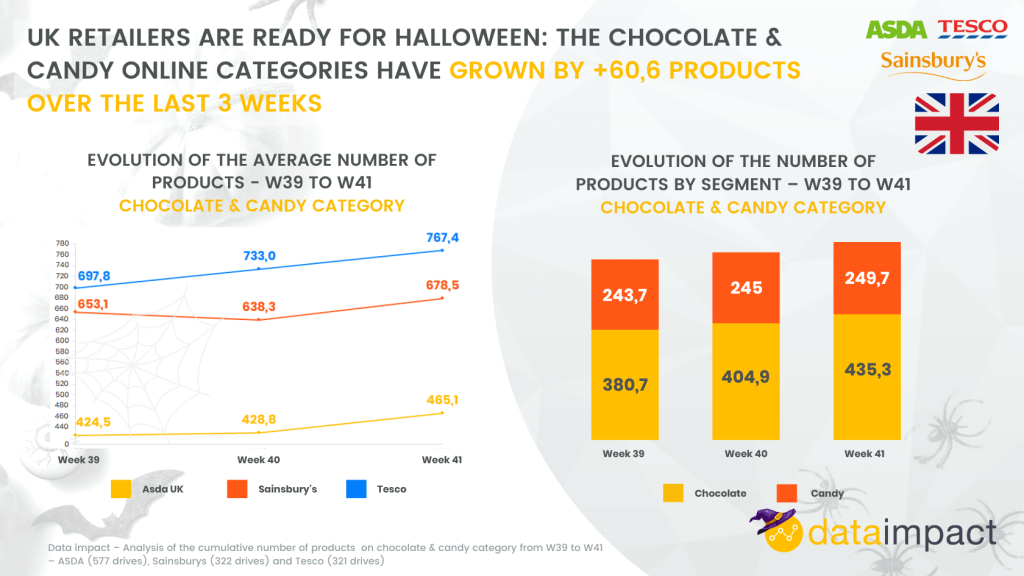

Halloween went around the corner and UK retailers showed that they were ready!

The chocolate & candy categories have grown by +60,6 products in the last 3 weeks at Asda, Tesco & Sainbury’s. (September 21, 2020 to October 11, 2020)

It’s the chocolate season!

Looking into the retailers in the UK, the seasonal online chocolate products increased for Halloween and remain elevated for the Christmas season!

Retailers analyzed: Asda, Sainsbury’s & Tesco

#chocolate #christmas

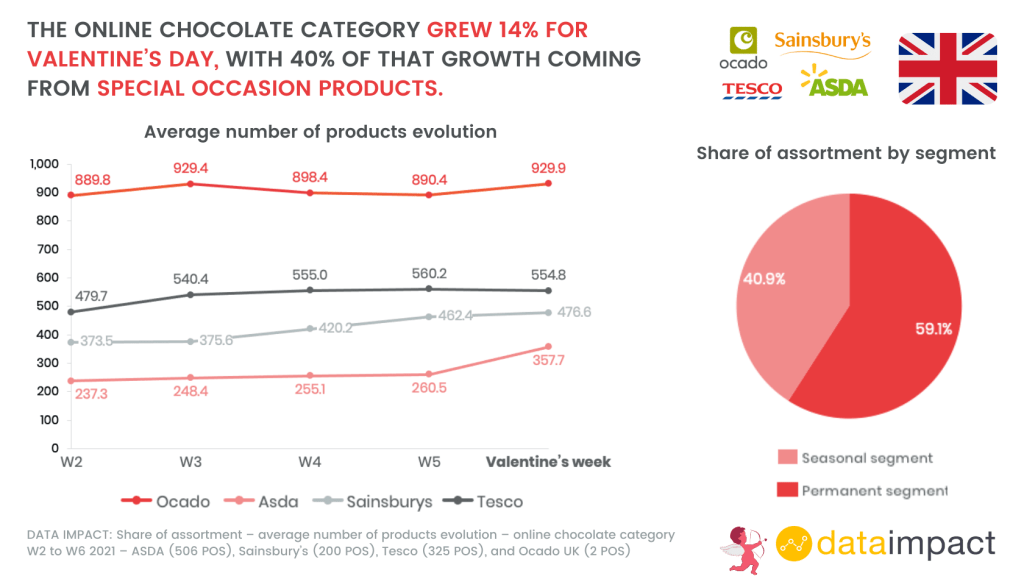

The online chocolate category grew 14% for Valentine’s day, with 40% of that growth coming from special occasion products.

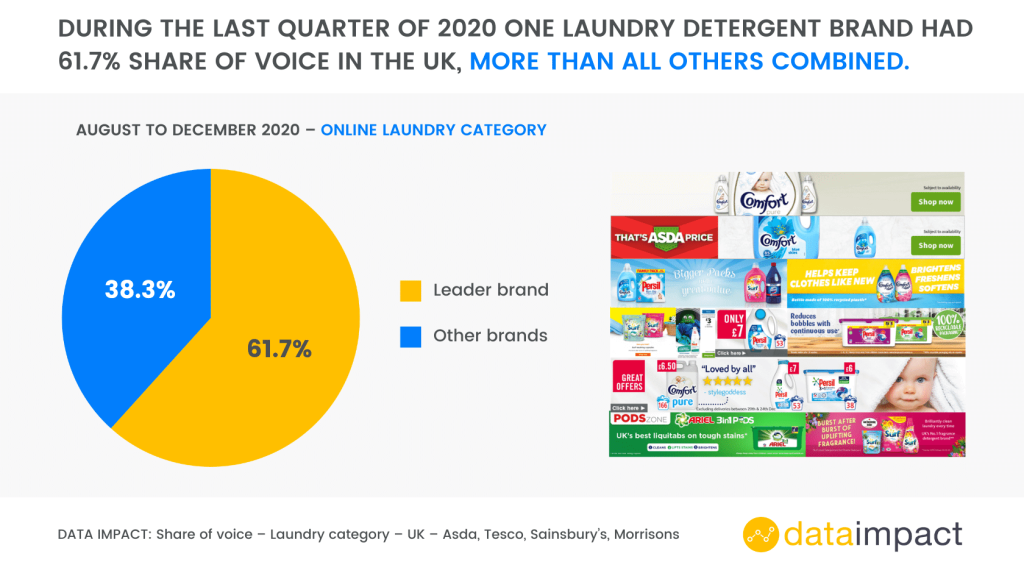

During the last quarter of 2020, one laundry detergent brand had 61.7% share of voice in the UK, more than all others combined.

Retailers analyzed: Asda, Tesco, Sainsbury’s, and Morrisons.

Our category-wide share of assortment tracking is the most granular in the industry and is visualized clearly and simply with our user-friendly dashboard.

Assortment

Analysis in Belgium

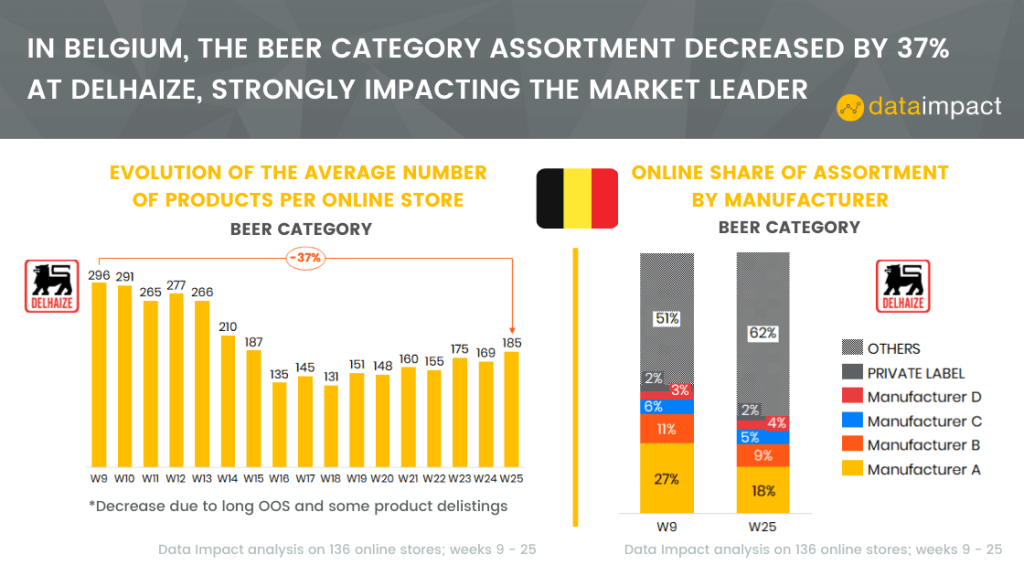

To continue our weekly analysis, we went to Belgium to see what has been happening with the beer category at Delhaize. After analyzing 136 different online stores, we noticed that the beer category assortment decreased by 37% which strongly impacted the market leader. (February 24, 2020 to June 21, 2020)

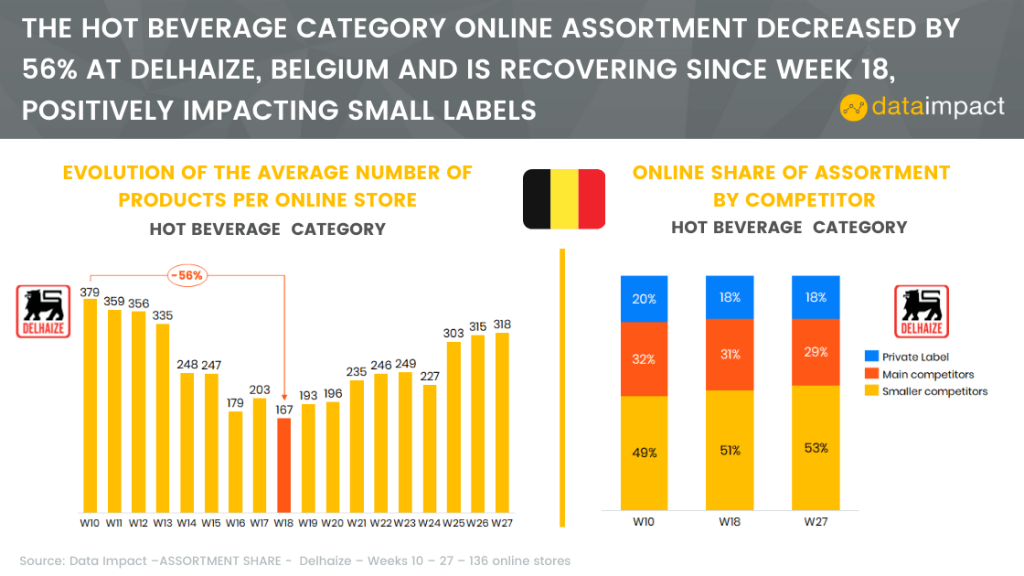

For the same retailer Delhaize, and the same number of online stores, we noticed that the hot beverage category assortment decreased by 56%. However, the situation seems to be improving with a positive impact on small labels. (March 2, 2020 to July 5, 2020)

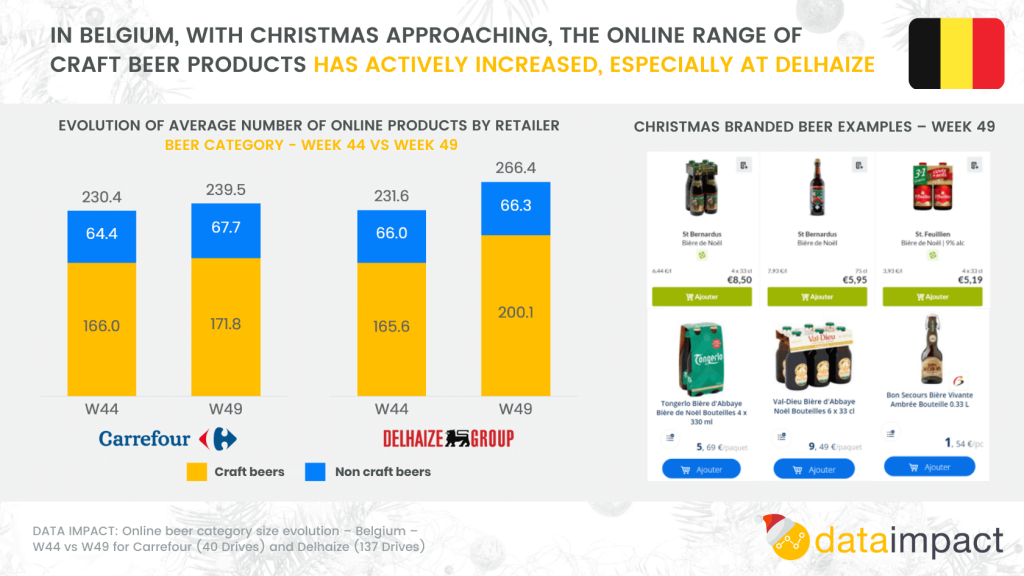

With Christmas approaching, the online range of craft beer products has actively increased, especially at Delhaize.

Cheers to that!

#christmascountdown #beer

Assortment

Analysis in France

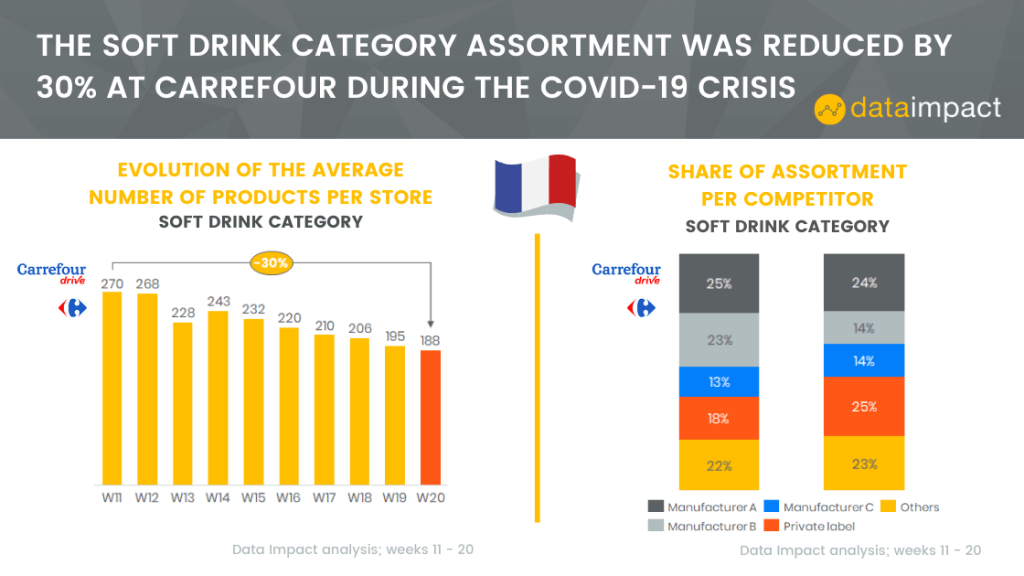

Welcome to the soft drink category Assortment at Carrefour, France. In the sheet below, you can see that the soft drink category eCommerce Assortment has been reduced by 30% due to long out of stock and certain product delistings.

The market leaders have been strongly impacted by the situation. (March 9, 2020 to May 17, 2020)

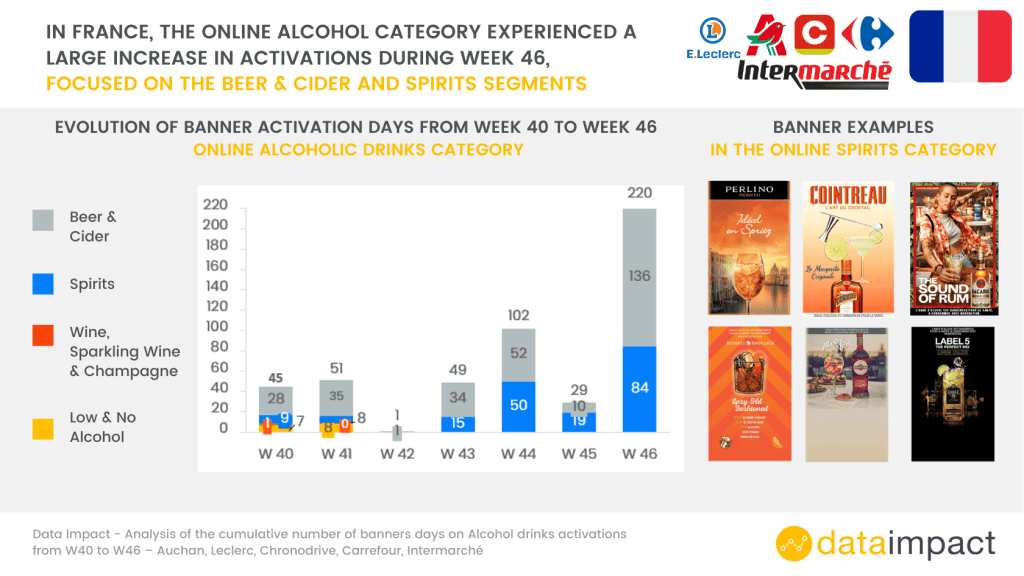

We then analysed the online alcohol category in France, and observed a large increase in banner activations during Week 46 focused on the Beer & Cider and Spirits segments.

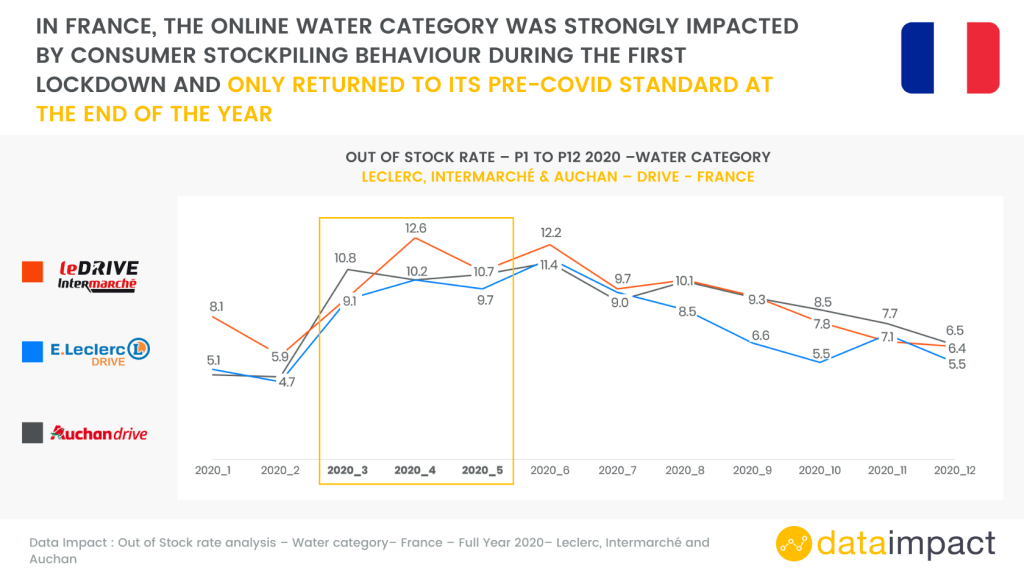

In France, the online water category was strongly impacted by consumer stockpiling behavior during the first lockdown and only returned to its pre-covid standard at the end of the year. (Online water category vs the year 2020)

Our data analysis includes category-wide share of assortment monitoring at all of the major retailers in more than 40 countries.

Assortment

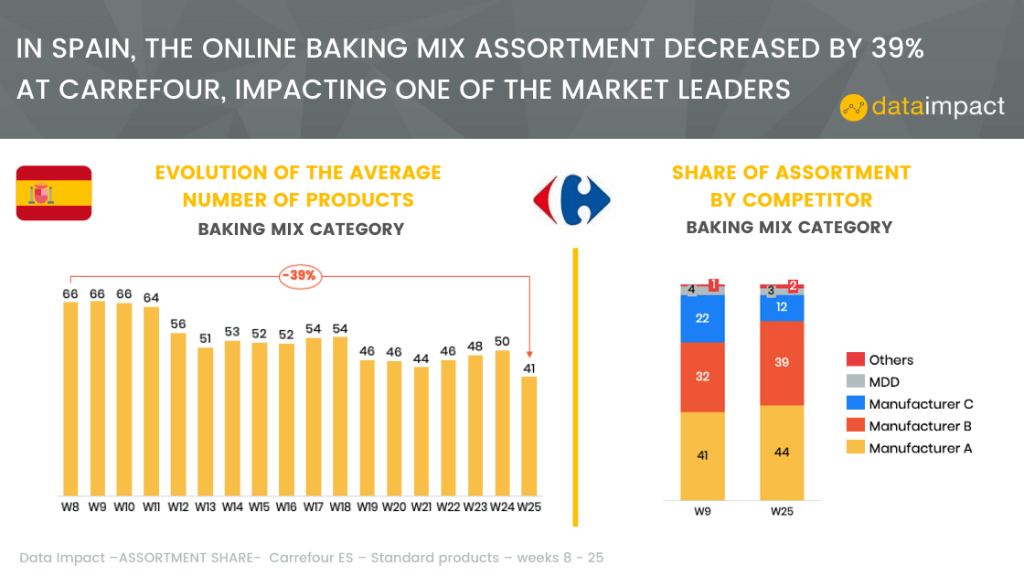

Analysis in Spain

We selected an example from Carrefour, Spain: the baking mix category. As you can see in the sheet below, the online baking mix assortment decreased by 39% during the COVID crisis. However, in this specific example, the decrease impacted only one of the market leaders. (February 17, 2020 to June 21, 2020)

Assortment

Analysis in Canada

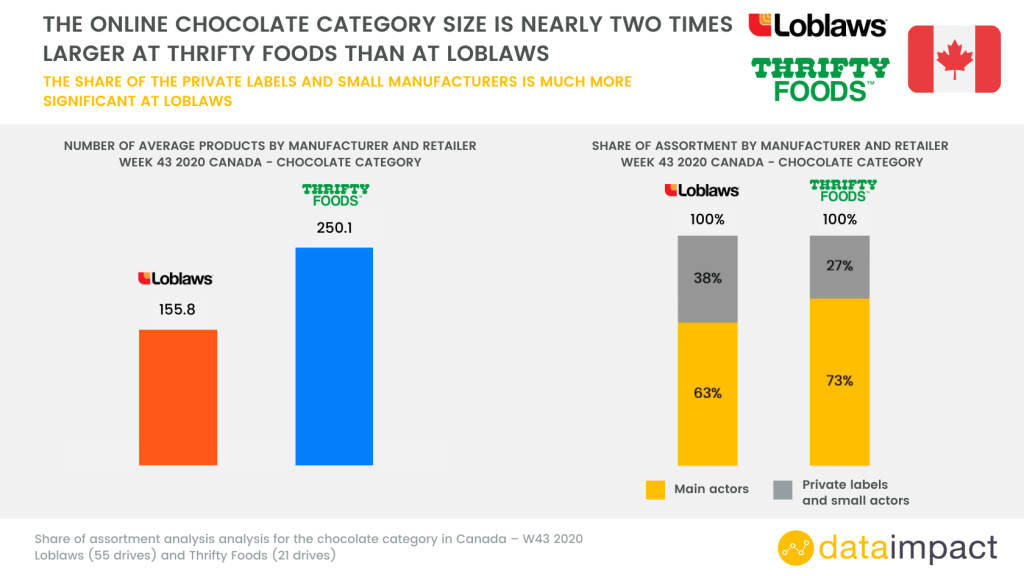

Hello Canada! We compared the online chocolate categories at Loblaws and Thrifty Foods, finding out that the online chocolate category is nearly two times larger at Thrifty Foods than at Loblaws. (October 19, 2020 to October 25, 2020)

If you want to follow the analysis sheets that come out twice a week on our LinkedIn page, you should have a look on our LinkedIn.

We hope we have brought you new knowledge. This concludes our Online Assortment Analysis page, keep in mind that it is updated day by day to guarantee you all the new trends you see in product Assortment across the FMCG eCommerce markets.

If you are also interested, we invite you to check our weekly out-of-stock analysis.