An overview of FMCG market trends

NielsenIQ recently unveiled its FMCG Quarterly Snapshot for Q4 2023 (OND’23), shedding light on the performance of India’s fast-moving consumer goods (FMCG) industry.

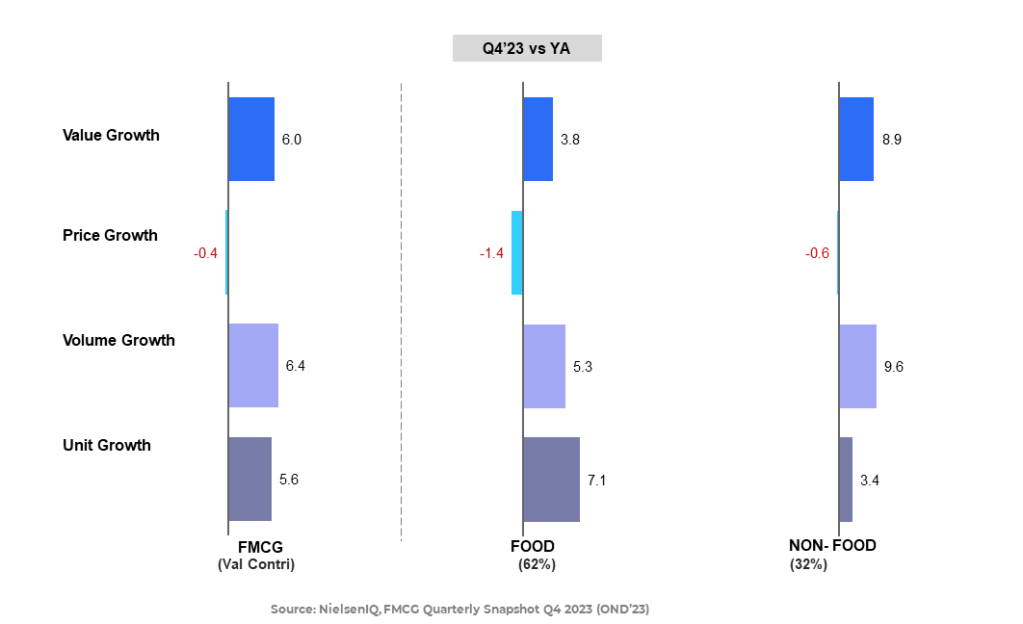

According to the latest report, the Indian FMCG industry experienced a noteworthy 6% growth in value during Q4 2023, primarily attributed to a 6.4% increase in volume. This surge in volume indicates positive consumption patterns across various regions of the country, reflecting robust demand for FMCG products at an All-India level.

A comparative analysis with the same period last year reveals a significant uptick in volume growth, with Q4 2023 registering a 6.1% increase compared to Q4 2022. While these figures underscore the sector’s resilience and capacity for expansion, the report also highlights a moderation in consumption growth when compared to sequential quarters, signaling a nuanced trend in consumer behavior within the FMCG space.

Roosevelt Dsouza, NIQ Head of Customer Success – India, observed, “For the first time in 2023, consumption gaps between urban and rural markets are narrowing down. The North and West regions are contributing to this phenomenon. The favorable interim Union Budget 2024-25, supporting several economic boosters for the rural sector, should bode well for companies with a rural strategy.”

Dsouza continued, “Despite a sequential-quarter decline, the rural recovery narrative continued to evolve throughout the year. In Q4 2023, we observe an uptick in consumption, primarily driven by habit-forming categories in food and essential home products. These categories have thrived despite flat to negative price growth, indicating resilience and sustained demand.”

Bridging the Urban-Rural Divide

For the first time in 2023, the consumption gaps between urban and rural markets are narrowing down, with rural areas witnessing a commendable 5.8% growth, closely approaching the urban growth rate of 6.8%. The North and West regions are crucial contributors to this harmonious development.

The positive impact of the interim Union Budget 2024-25, focusing on rural economic boosters, is expected to amplify this trend, presenting opportunities for companies strategizing in rural markets.

Modern Trade Continues to Shine

In the retail sector, Modern Trade maintains its high double-digit growth at 16.8%, showcasing resilience and sustained demand.

However, Traditional Trade experiences a decline, with consumption registering at 5.3% in Q4 2023, down from 7.5% in the previous quarter. Despite challenges, the upward momentum in Modern Trade adds a promising dimension to the overall market scenario.

Contrast in Consumption Trends

There is a sequential slowdown in volume growth, particularly in urban markets, while rural markets experience a slight decline during Q4’23 compared to Q3’23. Notably, Modern Trade remains a stronghold, contributing significantly to the positive momentum.

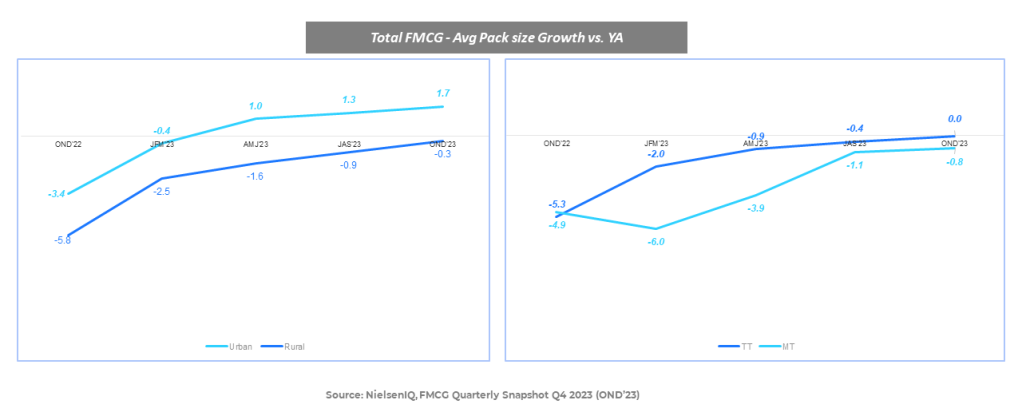

Rural Recovery and Pack Size Dynamics

The rural recovery narrative continues in Q4 2023, particularly in habit-forming categories like biscuits and noodles. Average pack sizes in rural areas are on the recovery path, with a growing preference for larger packs. This contrasts with urban markets, where a persistent preference for larger packs is observed.

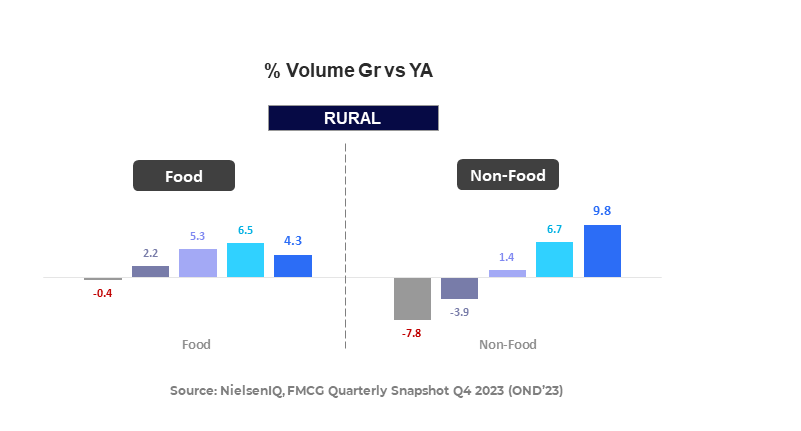

Non-Food Categories Lead the Charge & Spark Rural Resurgence

Non-Food categories outpaced Food categories in consumption growth, with an 8.7% increase. In contrast, the Food sector’s growth was just 3.8%, reflecting a slowdown compared to the previous quarter.

Noteworthy in the food sector is the resilience of habit-forming categories such as biscuits and noodles, thriving despite flat to negative price growth, signaling sustained demand.

The Non-Food sector witnessed an encouraging resurgence, with volume growth reaching 9.6% in Q4’23 compared to the previous year.

Rural areas contribute significantly to this growth, with a rate of 9.8% in Q4’23. Home Care and Personal Care categories in rural areas play a pivotal role in driving Non-Food consumption growth.

FMCG 2024 Outlook

Looking ahead, despite challenges, the FMCG market in India remains resilient and is poised for a 4.5%-6.5% growth in FY24. The industry’s ability to navigate complexities and adapt to evolving market dynamics underscores its significance in the Indian economy, offering promising opportunities in the future

In conclusion, NIQ’s Q4 2023 Snapshot portrays a dynamic FMCG landscape in India, where urban-rural convergence, Non-Food sector resurgence, and Modern Trade’s continued strength define the industry’s growth narrative. The optimistic outlook for 2024 signals a robust future for the FMCG sector, emphasizing the industry’s adaptability and enduring significance.

Get The Full View of India’s FMCG industry

In a dynamic marketplace environment, brands and retailers require the most accurate and trusted data-driven actionable insights to unlock growth opportunities.

Schedule a consultation with us to explore how our insights can empower your business decisions.