Market Analysis: Electric Vehicles

Electric vehicle (EV) sales have been steadily rising over the past decade, reshaping the landscape of the automotive industry and contributing to significant advancements in sustainable transportation. This market analysis of electric vehicles delves into the current state of EV sales, examining the factors driving their growth, the challenges that remain, and the future trends anticipated in this dynamic market.

From government incentives and environmental concerns to technological innovations and consumer adoption rates, we will explore how these elements interplay to fuel the surge in EV popularity.

Join us as we navigate through the electrified highways EV Market Analysis and uncover the key insights that every investor and industry player should know.

EV Demand

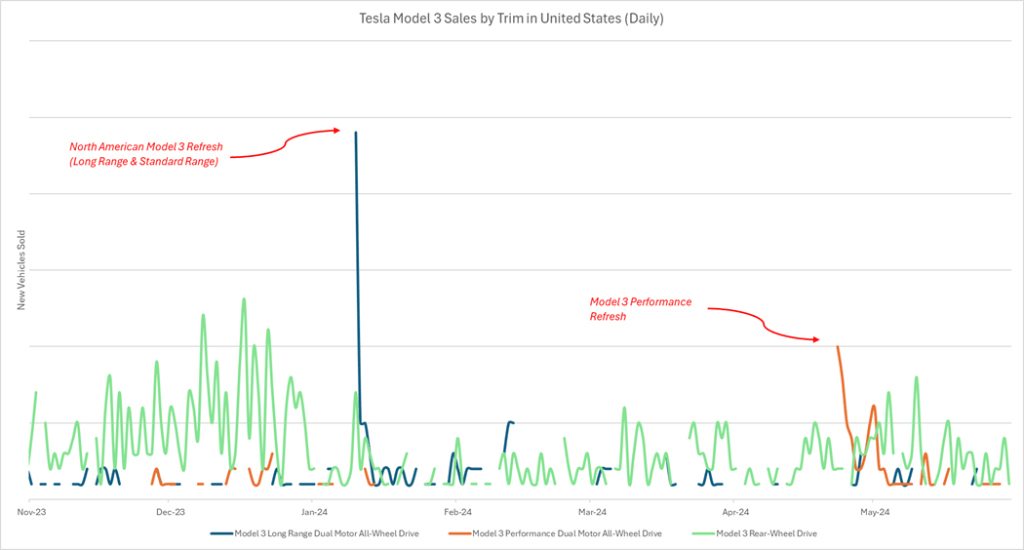

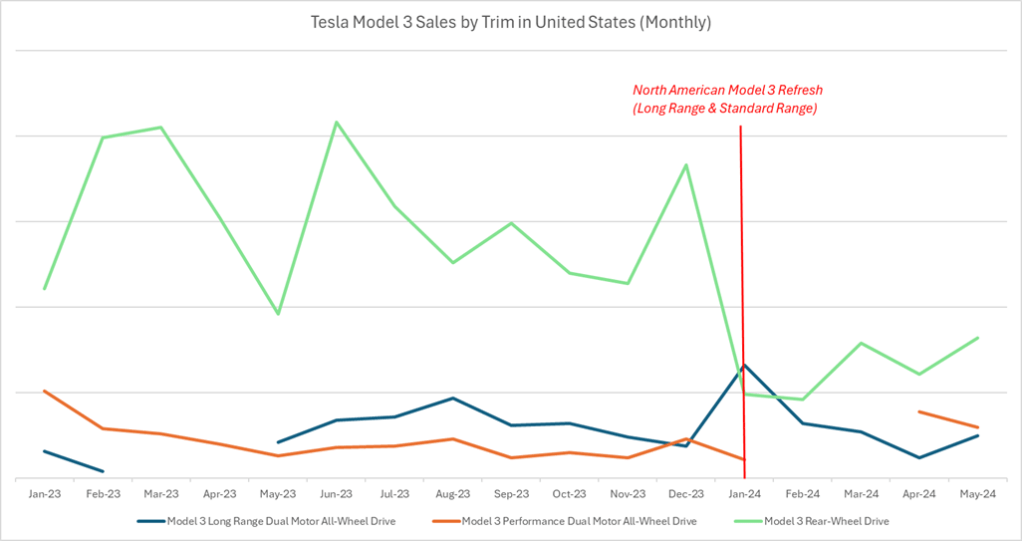

In January 2024 Tesla (TSLA) released the highly anticipated Model 3 Refresh to the North American market, months later than in other markets. This data highlights the initial spike in orders immediately following the launch of the Rear-Wheel Drive (RWD) and Long Range All-Wheel Drive (LR AWD) trims on January 10th and the performance trim on April 23rd 2024.

While the initial demand was strong we see that overall Model 3 unit sales were down following the refresh looking at the same data plotted monthly.

One likely reason for the decline in sales is that the RWD and LR AWD trims no longer qualify for the $7,500 federal EV tax credit. The lack of this credit can be a major deterrent for prospective customers especially when Tesla’s other mass market vehicle, the Model Y, does qualify. As Tesla seeks to balance their high production rate with demand, frequent price changes and incentives are expected to continue, which may have a significant impact on future sales.

Interested in additional reports on the EV market?

Rivian R2:

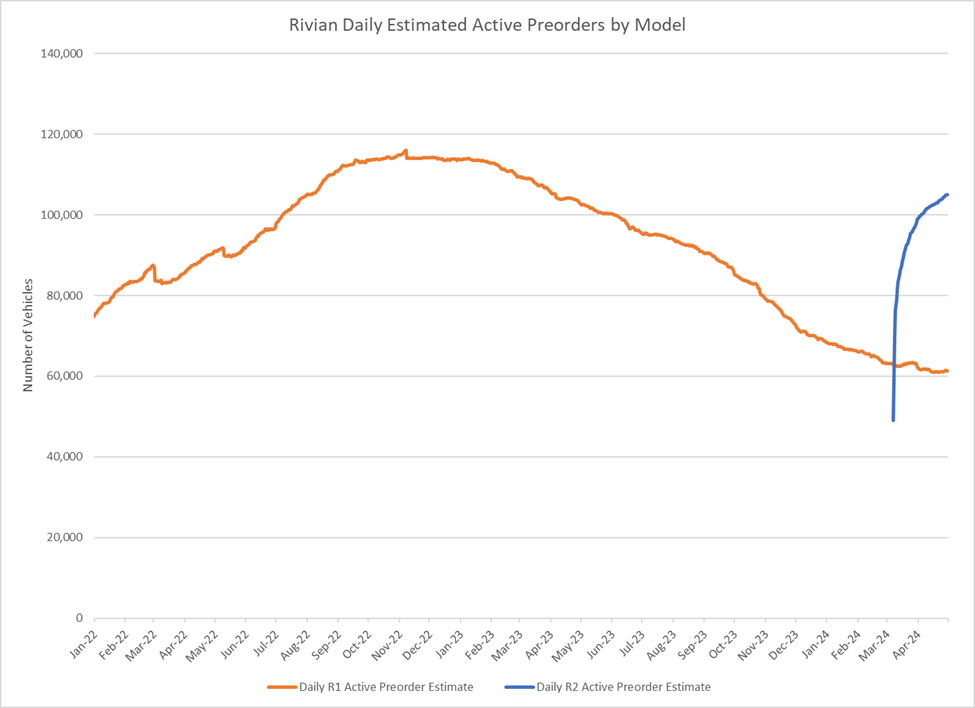

Rivian (RIVN) announced their newest vehicle, R2, on 3/7/2024 with massive initial demand. Rivian CEO RJ Scaringe announced that over 68,000 reservations had been received for the new lower priced model in less than 24 hours following the launch. Our data highlights the scale and pace of this initial demand relative to Rivian’s two existing consumer facing vehicles (R1T & R1S). We observed that total R2 reservations exceeded total R1T orders within the first two days alone.

NielsenIQ also tracks the order backlog (Total orders net of cancellations and deliveries) for Rivian vehicles, and we are estimating that the R2 has racked up a total backlog of over 100,000 active preorders through April 30th, 2024. This figure not only surpasses the R1 total backlog but appears poised to continue growing due to a low order cancellation rate of just over 3% .

Although overall electric vehicle sales have slowed in recent months, The enthusiasm for R2 demonstrates demand remains strong for lower priced options – the R2 has a $45,000 starting price.

Inventory Buildup

Electric Vehicle sales have slumped in 2024 leaving manufacturers with excess supply. In order to promote sales of this excess supply EV makers are often forced to sell unsold inventory at a discount. The Tesla Model Y and Lucid Air give insight into how automakers are coping with less demand than much of the market had anticipated.

Tesla Model Y:

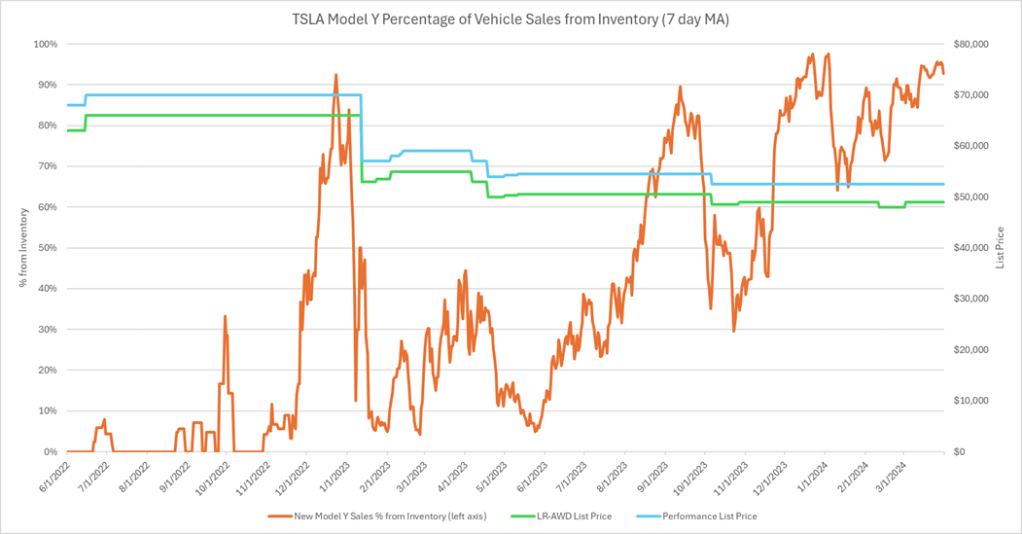

NielsenIQ tracks the percentage of Tesla vehicle sales which are sold from inventory vs those which are sold as custom orders that are configured on the website. Tesla will often incentivize customers to purchase inventory vehicles with discounts, free supercharging, and faster delivery times. When custom order sales do not keep up with the pace of vehicle production Tesla is forced to offload these excess vehicles at a discount.

Throughout the past few years, the percentage of Model Y sales from inventory has fluctuated greatly but has on average been increasing. In 2024, custom order Model Y sales have only accounted for 10-30% of total Model Y sales and at times even less than 10%.

When layering on the list price for the Model Y, NielsenIQ data shows that increasing inventory sales percentages are often a leading indicator of base price reductions. The Model Y’s pricing has been relatively stable over the past year and may be pressured further down as a result of the inventory buildup.

Customers are also awaiting the release of the refreshed Model Y, which is expected to incorporate many of the same features as the newly refreshed Model 3 and this is likely a driving factor of lower custom order sales and the resulting increased inventory levels.

Model Y financing promotion

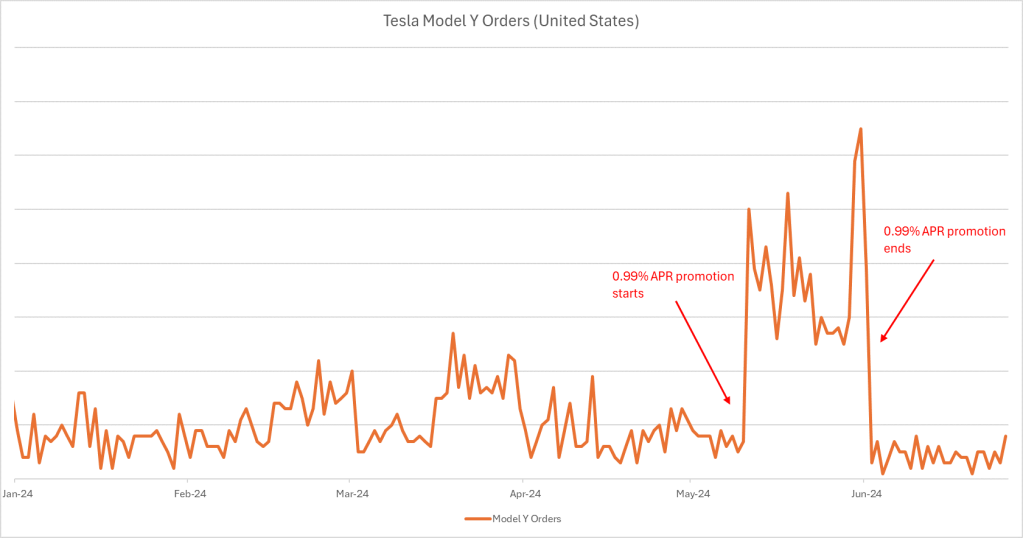

In lieu of base price reductions, Telsa has recently been offering other types of promotions to address the inventory buildup. For a 3-week period in May 2024 Tesla offered a promotional 0.99% APR financing rate on all new Model Ys sold with a 60-month financing plan. The chart below highlights the dramatic increase in sales during the promotion.

Average daily new vehicle sales were 283% higher during the promotion vs. the 4 months prior in 2024. Tesla sold nearly as many Model Y vehicles in May alone as they did during the entirety of 1Q24. This type of promotion has the ability to knock $100 off of a customer’s monthly payment so the resulting increase in sales is not surprising. These types of incentives at Tesla will be important to monitor if inventory levels continue to build.

Lucid Air:

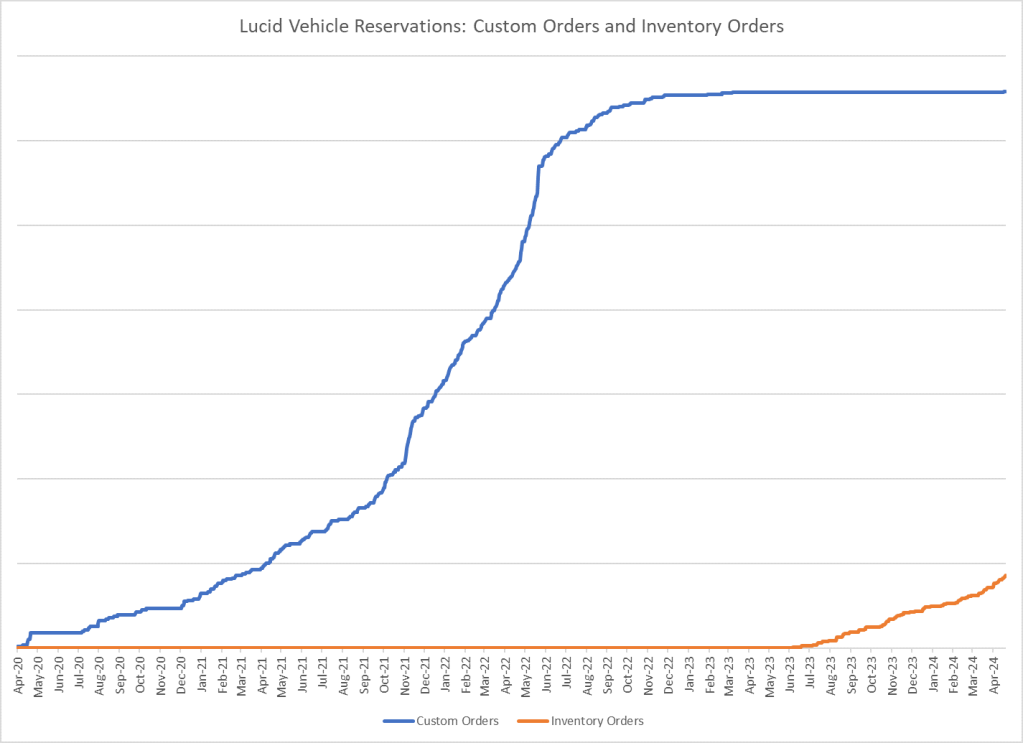

The Lucid Air has also suffered from reduced demand, though the effect on orders has been much more apparent than for Tesla. From Lucid’s initial announcement of the Air in 2016 up until recently the only option for ordering was to place a custom order. After facing reduced demand in mid-2023 Lucid began offering inventory vehicles for sale, which were often steeply discounted, similar to Tesla’s approach.

NielsenIQ data shows this trend as custom order demand falls to extremely low levels, inventory sales begin to take their place. The interesting, and somewhat troublesome, fact for Lucid is that nearly all the order volume for Lucid vehicles in the past year has been coming from the discounted inventory stock.

This indicates that either customers are unwilling to pay full price or that they are seeking out alternative vehicle options at this premium price point. This trend, should it continue, will surely be a major headwind for Lucid as they are taking in less revenue than they otherwise would when forced to sell vehicles from inventory.

Software Add-Ons:

In a divergence from the traditional auto market, car manufacturers are increasingly driving revenue growth through software packages designed to maximize the potential of modern cars. Tesla sits at the forefront of this change with multiple offerings including Premium Connectivity and Full Self-Driving Software. These subscriptions can create revenue for Tesla even after the car has been sold making it a critical growth driver. This makes subscriptions a valuable asset for Tesla during times when EV sales growth is slowing.

Tesla Full Self-Driving:

The Tesla Full Self-Driving Software package can be purchased outright for $8,000 or via a $99/month subscription. As the software becomes increasingly advanced with over-the-air updates, NielsenIQ has observed greater and greater numbers of owners taking advantage of this unique feature.

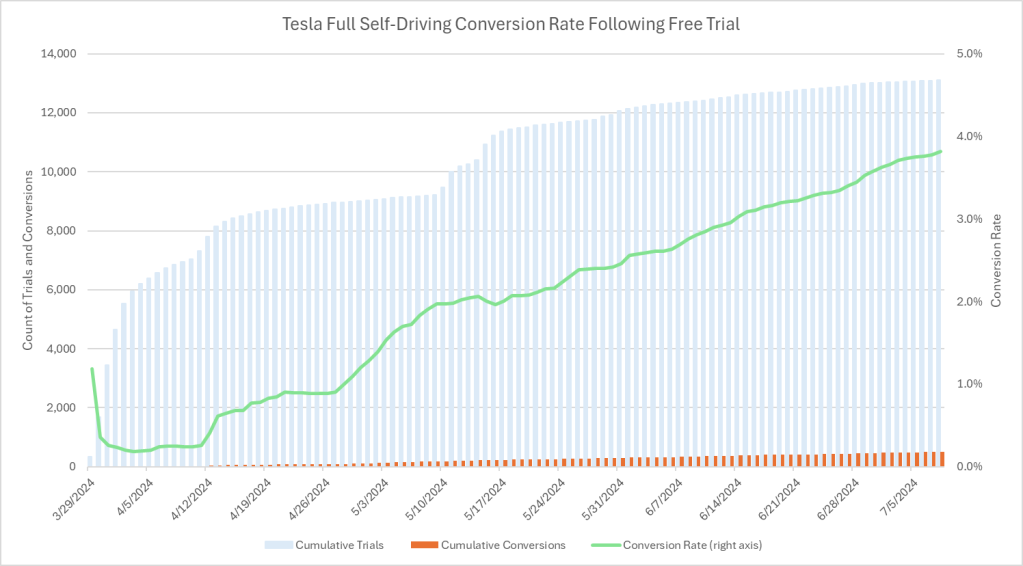

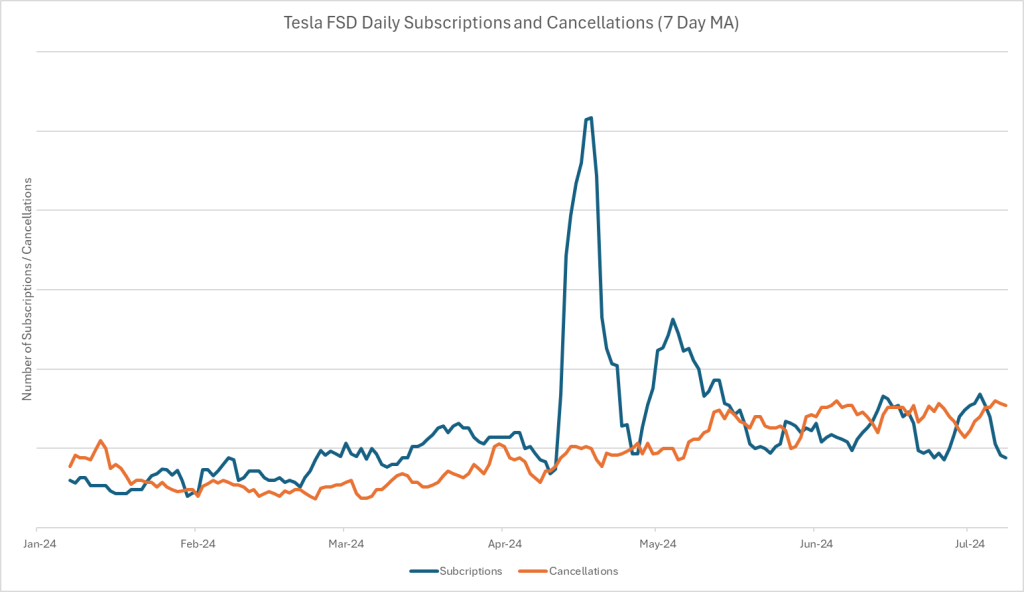

Beginning in late March 2024, in a bid to drive greater adoption of their Full Self-Driving (FSD) software package, Tesla offered a free 30-day trial to all eligible vehicle owners.

We have been tracking FSD subscriptions during and after the free trial period. Examining a sample of over 13,000 Tesla owners who initiated the trial, NielsenIQ data shows that just under 4% of those individuals subscribed as of early July 2024.

While NielsenIQ has observed increased FSD subscription activity because of the free trial, we are also seeing cancellation rates rise. For now, the net impact has been positive for Tesla. However, cancellation rates must be monitored closely in the coming months to see whether or not owners are getting sufficient value from the $99/month service.

Electric Vehicle Market Analysis Summary

An Inflection Point

The EV market has experienced dramatic change in recent years and is showing no signs of slowing down. What was once a product reserved for the luxury segment has now become available to the mass market of car shoppers. This is thanks to increased competition and the resulting lower prices.

And now, in 2024 the market has reached a major inflection point no longer constrained by supply but limited by demand. EV makers have been forced to release new models, reduce prices, and offer compelling software to entice buyers.

Stay tuned as we continue to cover the latest developments in this dynamic industry.

Want more EV data ?