Understanding the Shifts in Consumer Behavior

To reclaim lost sales in the competitive food and beverage landscape, brands must first understand the evolving behaviors driving consumer choices. Shaped by economic pressures, technological advancements, and shifting priorities, today’s shoppers are navigating the market with heightened expectations for convenience, value, and transparency. Recognizing these shifts is essential to crafting strategies that resonate and drive meaningful engagement.

Here are 4 shifts in consumer behavior reshaping the face of retail:

1. Inflationary Pressures Continue

Inflationary pressures continue to dominate consumer concerns, with rising food prices being the most pressing issue for 36% of shoppers.2 Coupled with increased housing costs (15%) and broader economic uncertainties, consumers are adjusting their purchasing habits to navigate a financially challenging landscape.2 Food and beverage sales in the Food Channel have reflected this strain, experiencing a -1.8% decline in the past year, with unit sales falling at a -3.6% compound annual growth rate (CAGR).3 These trends underscore the mounting pressure on households to stretch their budgets while maintaining essential purchases.

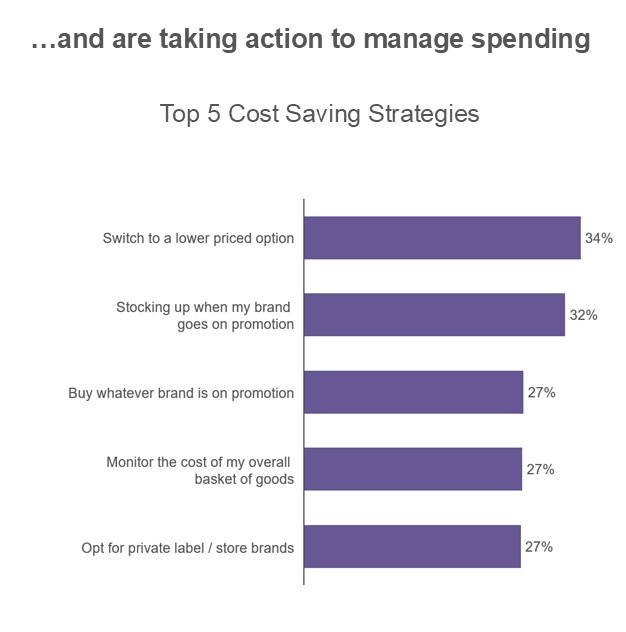

To manage their spending, consumers are taking deliberate actions to shop more strategically. A striking 87% of shoppers report having changed how they shop, employing an average of 3.9 savings strategies.2 These approaches range from switching to value-oriented channels and private-label brands to seeking out promotions and buying in bulk. Despite these efforts, the Food Channel has borne the brunt of this shift, with units falling -2.4% over the past year.3 For brands, these shifts highlight the need to address value-conscious behaviors by aligning pricing, promotions, and product offerings to regain relevance and drive growth in a challenging economic environment.

2. Health and Wellness Go Medical

The rapid adoption of GLP-1 medications is transforming health and wellness trends, with significant implications for the food and beverage industry. Originally developed to manage diabetes, these medications are increasingly being used for weight loss, with 36% of users seeking its appetite-suppressing benefits.4 By 2030, household usage of GLP-1s is expected to double, driving a shift in consumption patterns. After 7 to 11 months of sustained GLP-1 usage, its appetite-suppressing effects reach their peak, leading to a noticeable decrease in food consumption and related spending. Remarkably, users who started GLP-1 treatments within this timeframe account for nearly one-quarter of the Total Store unit decline, underscoring the broader market impact of these medications.4

However, this challenge presents a unique opportunity for brands to innovate and cater to the evolving needs of GLP-1 users. Rapid weight loss associated with these medications often leads to a significant reduction in muscle mass. To address this issue, some brands are leading the charge with new product developments that provide essential nutrients and support muscle preservation for GLP-1 users. For emerging and established brands alike, developing nutrient-dense, protein-rich products tailored to these consumers represents a promising avenue for growth in the health and wellness category.

3. The Rise of Social Shopping

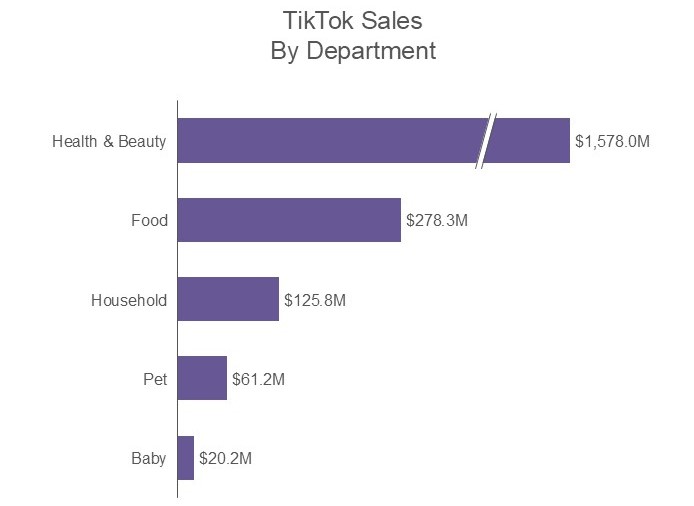

Social shopping is transforming how consumers discover and purchase products, with platforms like TikTok leading the charge. Over 62% of TikTok users are familiar with TikTok Shop, and just as many are open to making purchases directly through the platform, creating exciting opportunities for brands to reach new audiences.5 TikTok’s unique blend of short-form content and influencer marketing drives exposure for emerging brands, allowing them to break into the market by leveraging viral trends. In fact, shopping on TikTok generated over $2 billion in CPG sales in the past year, with categories like health and performance food products accounting for nearly a quarter of food sales.6 For brands, leaning into social shopping platforms represents a dynamic way to build awareness and capitalize on viral success.

The influence of younger shoppers, particularly Gen Z, is accelerating the adoption of social and tech-enabled shopping experiences. This demographic is highly receptive to new retail technologies, with 68% of shoppers expressing positive sentiments about AI-driven personalization tools.7 Gen Z also embraces third-party apps and platforms to streamline their shopping journey, further solidifying the role of technology in retail. While social shopping is still in its early stages, its rapid growth underscores its potential to reshape the market. Brands looking to thrive in this new era should prioritize integrating social commerce strategies and utilizing emerging technologies to create personalized, seamless shopping experiences that resonate with younger consumers.

4. Foodservice Returns

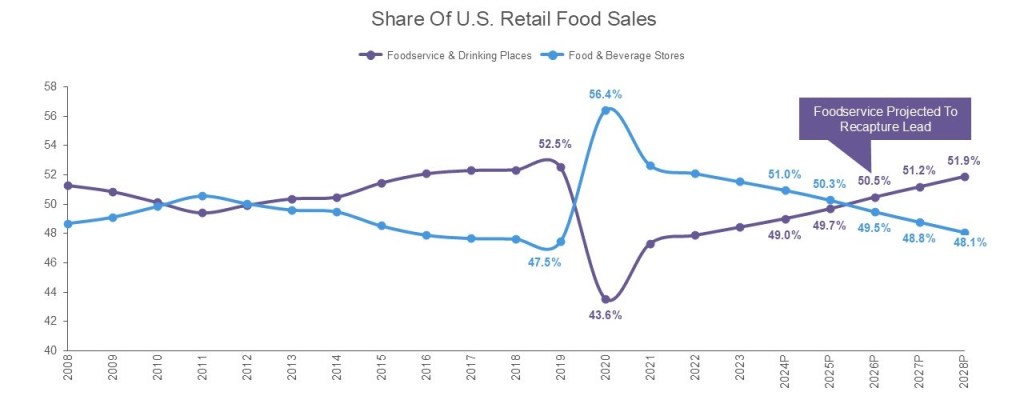

The foodservice industry, excluding alcohol, is on track to approach an impressive $1 trillion in sales this year, reflecting its crucial role in the US food ecosystem.8 With projected sales of $955.2 billion in 2024, up 4.5% from the previous year, the sector continues to demonstrate resilience and growth despite economic pressures.8 Inflation and high menu prices have fueled much of this growth, yet these same factors are beginning to temper the rate of expansion. Even as macroeconomic challenges persist, foodservice and drinking places are reclaiming their share of US food sales, reversing the dramatic trend that began in 2020 when at-home cooking and stockpiling became the norm.

Away-from-home dining plays a critical role beyond sustenance, serving as essential gathering spots that foster social connection and community. For many, restaurants and bars represent more than just a place to eat or drink—they’re integral to daily life and personal well-being. In fact, one in five consumers would be lost without these spaces.9 As foodservice establishments continue to recover and adapt, their importance as social hubs underscores the need for brands and operators to create experiences that go beyond the plate. From menu innovation to fostering inclusive and inviting atmospheres, the opportunities for foodservice providers to deepen their impact and recapture consumer loyalty are vast.

Key Strategies for Reclaiming Sales in the Digital Era

In the rapidly evolving retail landscape, reclaiming food and beverage sales requires a strategic approach tailored to today’s digitally driven consumers. By focusing on omnichannel integration, building trust, and maximizing trip size, brands can effectively capture lost market share and drive sustained growth.

With that in mind, here are 3 key strategies to consider:

1. Master the Omnichannel Environment

Success in the digital era hinges on mastering the omnichannel environment by seamlessly integrating in-store and online purchasing experiences. Consumers expect a cohesive journey, whether shopping from a desktop, mobile device, or brick-and-mortar store. This requires a robust online presence that includes strong search optimization, impactful social media engagement, and dynamic product listings. High-quality imagery, detailed descriptions, and a competitive pricing strategy are crucial for attracting digital shoppers and encouraging them to complete purchases. By making the transition between physical and digital touchpoints effortless, brands can meet consumers where they are and capture their attention more effectively.

2. Build Consumer Confidence

In a competitive market, trust is a cornerstone of consumer loyalty. Brands can enhance consumer confidence by prominently displaying guarantees of quality and freshness, reassuring shoppers of the reliability of their products. Real-time supply chain visibility—showing the journey from store to door—adds another layer of transparency that today’s consumers crave. Additionally, improving delivery packaging options is essential for maintaining temperature-sensitive products, such as perishable food items. Highlighting these packaging benefits during the checkout process helps shoppers feel secure in their purchases, further strengthening brand trust.

3. Activate Through Trip Size

Maximizing each shopper’s trip is a key strategy for reclaiming sales. Brands can encourage larger baskets by offering dynamic product bundles or discounts that align with consumer needs. Tiered shipping costs and exclusive discounts for orders that cross specific thresholds incentivize shoppers to add more to their carts. Moreover, targeting abandoned cart shoppers with time-sensitive incentives or purchase reminders can turn potential losses into confirmed sales. These targeted strategies not only drive immediate revenue but also create a more engaging and rewarding shopping experience for consumers.

Reclaim the Food and Beverage Market:

Your Next Steps for Success

In today’s evolving market, reclaiming food and beverage sales can feel like an uphill battle for many brands. As in-store sales decline and consumers shift to digital platforms, businesses must optimize online visibility, enhance channel integration, and embrace emerging trends like social shopping.

For more in-depth strategies and insights, be sure to check out our The Omni Edge: Positioning Your Business For Leadership In The New Era Of Retail webinar, where we dive deeper into how consumer-centric innovation and adapting to changing behaviors can drive growth, capture lost market share, and foster long-term loyalty within the competitive retail landscape.

Sources:

1 – NielsenIQ Omnishopper | Syndicated US for Manufacturers | Total Client Dataset – Commercial | Total US All Outlets | 52 Weeks Ending 06/15/24

2 – NIQ 2024 Consumer Outlook vs Mid-Year 2023 Survey, US Market

3 – NielsenIQ Retail Measurement | US NIQ Total Store Excluding Fresh – 444 – Monthly (Synd) | Entire Dataset | 52 Weeks Ending 08/10/24

4 – NielsenIQ, Homescan GLP-1 Panel Survey; Total US; Total Outlets; All Departments, % of Buying Households, Latest 52 weeks ending January 2024

5 – TikTok Marketing Science Global TikTok Shop Research 2023 (US Results) conducted by Materia

6 – NielsenIQ OmniSales | Syndicated For US Manufacturers | Entire Dataset | 52 Weeks Ending 07/27/24

7 – FMI – The Food Industry Association, US Grocery Shopper Midwinter Trends 2023. n=1,519

8 – Technomic, Inc.; McMillanDoolittle LLP

9 – CGA by NIQ, US Reach 2024, Sample: 1,241