Amazon’s influence on retail media

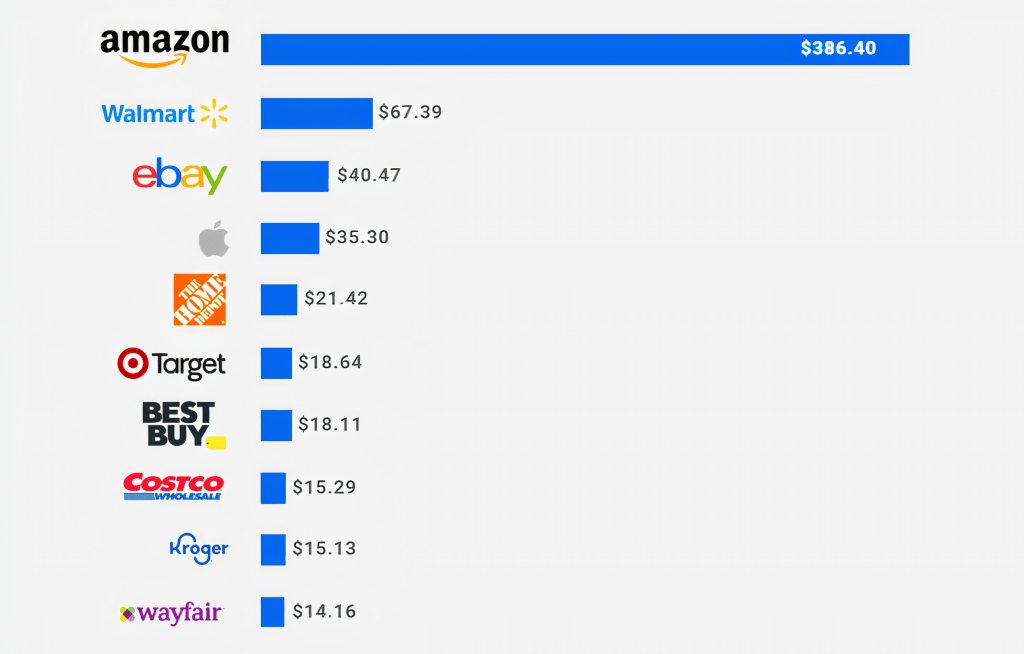

Amazon dominates the CPG ecommerce marketplace to a dramatic degree.

It’s worth looking at the figures to appreciate just how commanding their lead is.

Top 10 US retailers, ranked by ecommerce sales

Source

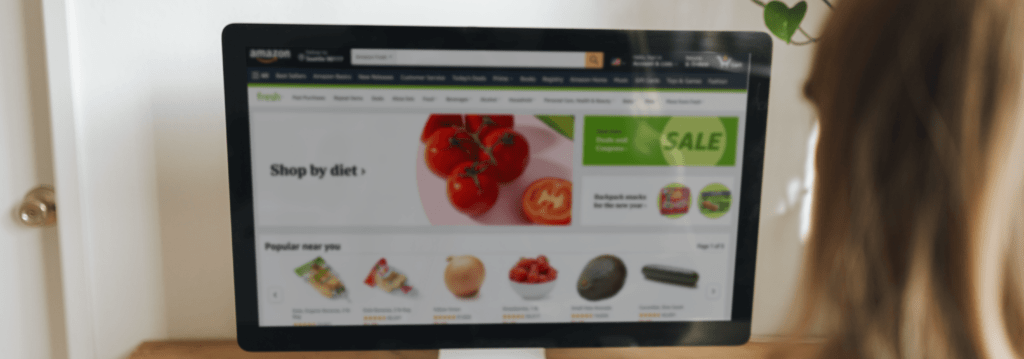

Despite the fact that Amazon shares very little data with brands–which means that there’s a lot of deduction and guesswork necessary when deciding to advertise with them, Amazon remains unavoidable. That said, they have streamlined the process of placing ads, making it as easy as possible for advertisers even while retaining tight control over exactly how brands can advertise on their platform.

Amazon is, in fact, continually morphing into a media company. By allowing advertisers to capitalize on the data it owns–without giving them access to it–brands can reach customers very effectively and this is an increasing source of revenue for Amazon.

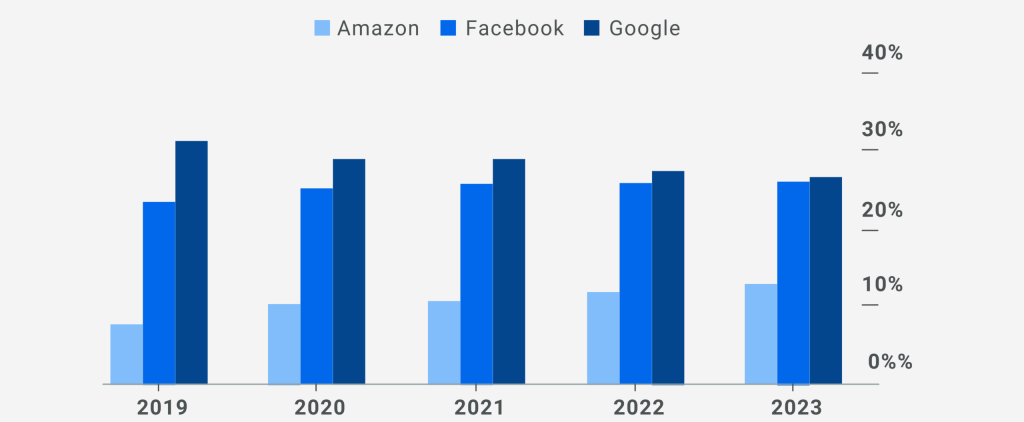

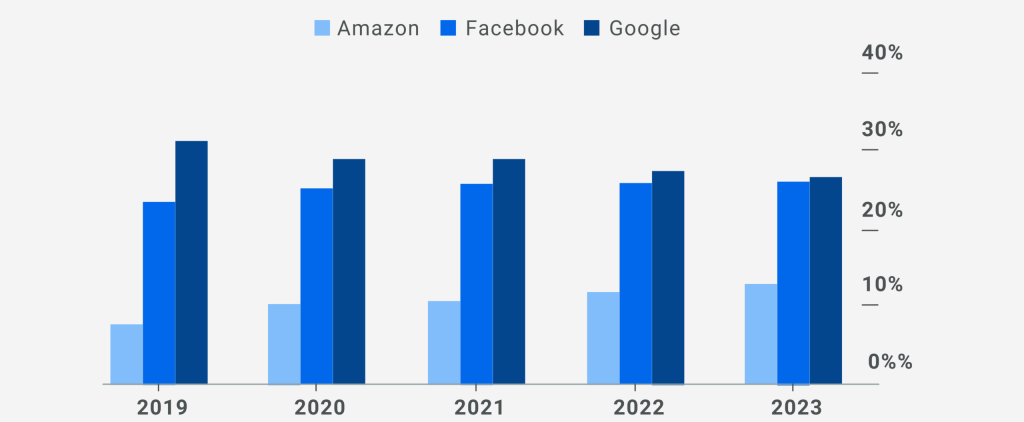

Amazon has been successfully gaining online ad share while two other digital behemoths have been losing it.

Despite the fact that Amazon shares very little data with brands–which means that there’s a lot of deduction and guesswork necessary when deciding to advertise with them, Amazon remains unavoidable. That said, they have streamlined the process of placing ads, making it as easy as possible for advertisers even while retaining tight control over exactly how brands can advertise on their platform.

Amazon is, in fact, continually morphing into a media company. By allowing advertisers to capitalize on the data it owns–without giving them access to it–brands can reach customers very effectively and this is an increasing source of revenue for Amazon.

Amazon has been successfully gaining online ad share while two other digital behemoths have been losing it.

Advertising on Amazon

As mentioned, Amazon offers unrivalled scale and ease of use with their self-service ads, similar to Google Ads. Brands bid on keywords and then pay every time an ad is clicked.

At Data Impact, our support team accompanies brands in customizing their platform to monitor the KPIs they choose such as share of voice, digital shelf analysis, optimizing availability and pricing, and estimating market share and increasing performance on Amazon.

The primary types of ads offered on Amazon

- Sponsored ads that appear adjacent to organic results when shoppers conduct a search

- Sponsored brand ads that display a brand logo with multiple products

- Sponsored display ads that target shoppers based on their behavior and demographics, as opposed to keywords

Amazon’s Customer

Contact feature

In 2021, two significant developments were put in place.

First, Amazon’s Seller Central began to allow brand owners to respond directly to reviews with three or less stars through the Customer Contact feature.

This equips brands with the ability to manage low ratings themselves by offering a refund or clarifying product issues.

Second, as of October 2021, the Search Analytics Dashboard began providing sellers with anonymized data.

The insights this data offers will help brands optimize their listings, improve inventory planning, plan their product development roadmap, and generally grow their business on and off Amazon. As always, AMZ is protecting their walled garden by not giving the data itself to brands, but it’s finding new ways to allow them to benefit from it.

Amazon brand analytics

The Amazon Brand Analytics suite of aggregated data reports provides advertisers with insights without divulging shopper identities. It includes reports for repeat purchase behavior, market basket analysis, item comparison, alternate purchase behavior, and demographics. For some years now, Amazon has also offered brands a search terms report that includes search frequency rank, click data, and conversion share, and recently they’ve added the Search Analytics Dashboard that provides a deeper analysis of shopper journeys for brands.

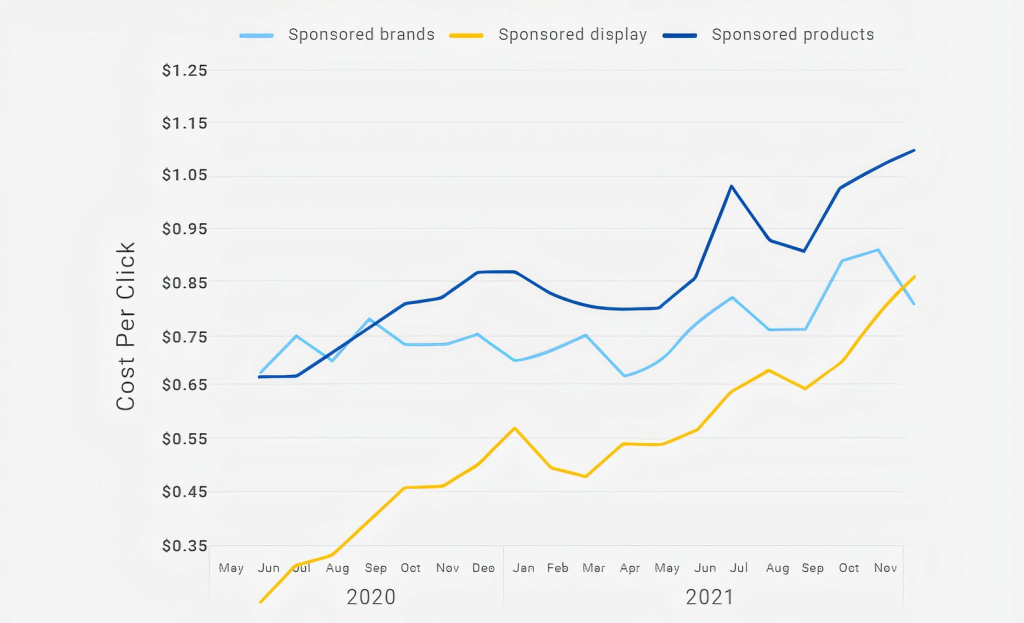

Amazon advertising: cost per click by ad type

And, not surprisingly, as the infographic above illustrates, the cost of advertising on Amazon has been increasing steadily as its value as an eretail media platform continues to grow.

About Data Impact

We help manufacturers improve their digital commerce.

By collecting over 60 billion data points per day, Data Impact offers the most granular, and therefore insightful, overview of the online CPG marketplace. We collect data at every single online site that major retailers list products, and render it in a simple, clear dashboard with a user experience our clients rate highly.

Our support team accompanies brands

in customizing their platform to monitor the KPIs they choose such as share of voice, digital shelf analysis, optimizing availability and pricing, and estimating market share and increasing performance on Amazon.