Shifting Landscape in FMCG

After years of impact caused by the pandemic and the cost-of-living crisis putting pressure on consumers, they have become increasingly resilient, future-focused and cautious with all forms of spending, signalling the formation of new habits.

Consumers have become more home-centric, waste-avoidant and planning their shopping lists in advance. However, one of the trends that have also emerged from this context is that Australian consumers have also been actively shopping around more and more to find better deals and ranging options for their purchasing occasions, leading to the growth of alternative channels.

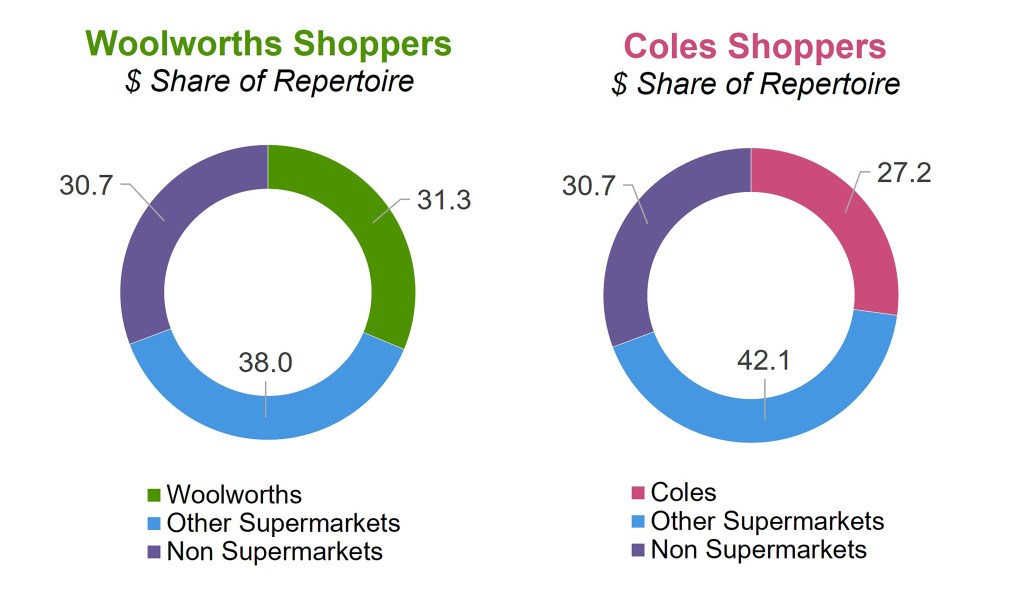

FMCG companies often investigate what happens in specific retailers assuming consumers are loyal to them, but this could lead to misinterpretations as cross-shopping is usually underrated. As an example, the Woolworths shopper spends 68.7% of their baskets outside of Woolworths, while the Coles shopper is not that different – they spend 72.8% of their baskets outside of Coles. In reality, very few consumers are exclusive shoppers for Woolworths and Coles, even when we look at short time periods such as 4 weeks: only 2.0% of shoppers for Woolworths and 1.7% for Coles.

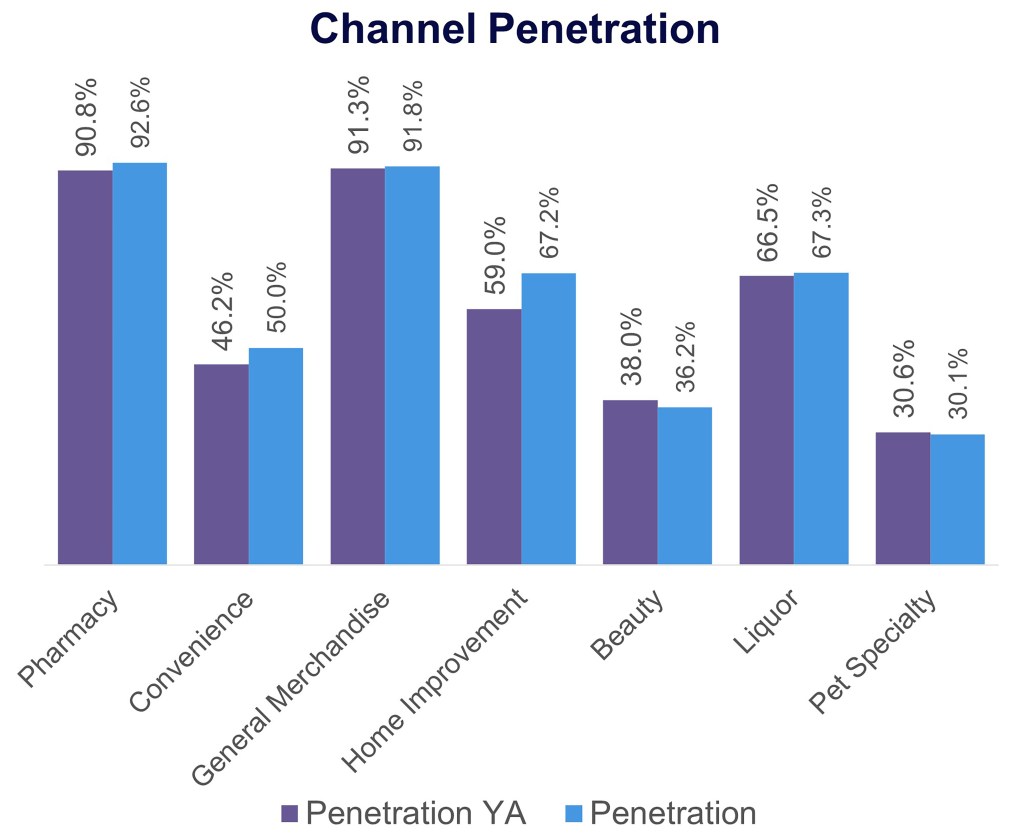

If the context suggests that understanding alternative retailers and channels is important, over recent times it has become even more crucial. Over the last year, shoppers have been looking more actively for alternatives for their FMCG occasions, leading to growth in Penetration among alternative channels such as Pharmacy, Convenience, General Merchandise and Home Improvement:

This trend generates opportunities and challenges for brands, as increasing touchpoints between shoppers and brands could generate more purchasing occasions.

Incumbent players that don’t have a strong presence at alternative channels could be at risk as leading brands should aim to be distributed everywhere the category buyer shops to be able to maintain not only high levels of physical availability through distribution and shelving, but also mental availability, remaining top of mind for consumers. Brands that don’t have a strong presence among alternative channels could be giving the opportunity that smaller and agile players are looking for to disrupt the category as they could fill this void by building a strong positioning among these channels.

Understanding the shopper

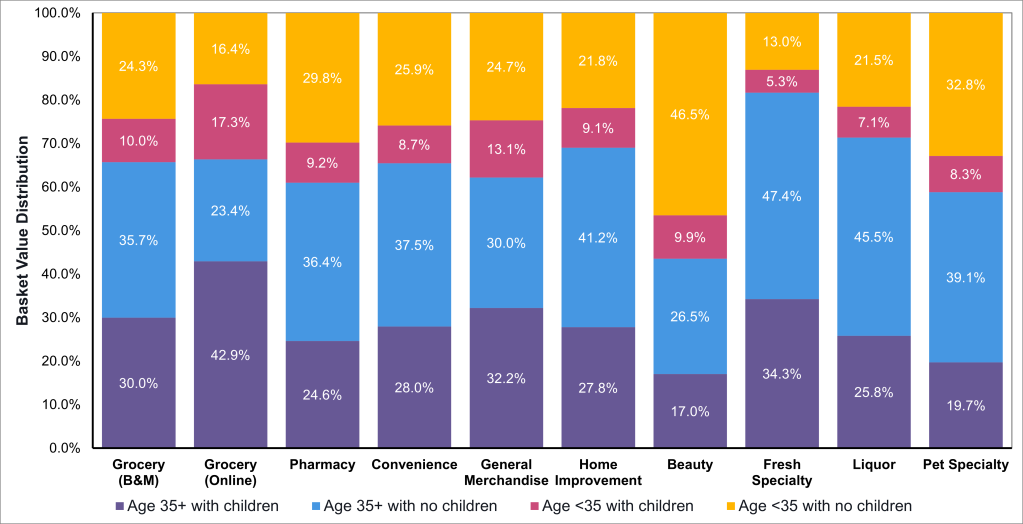

Some of these alternative channels are more appealing to specific shopper profiles and knowing the channel shopper profile could be very valuable for companies willing to innovate and start ranging specific products at new channels, potentially opening growth avenues.

The convenience offered by the Grocery Online channel is especially appealing for households with children, that correspond to 60.2% of online sales. On the other hand, Pet Specialty is concentrated on the opposite demographic profile, with 71.7% of its sales coming from households without children, potentially the profile that is most engaged with their pets and spends more on niche products, only found at specialty stores.

Looking at age groups, the Beauty channel is especially appealing to younger consumers (below 35 years old), with 56.4% of sales coming from this age group, while most of the sales for Fresh Specialty and Liquor are coming from consumers older than 35 years old (81.7% and 71.3%, respectively).

Some categories are more dependent on alternative channels than others, such as Hair Care, where nearly half of the sales are not coming from the Grocery channel. Different categories will have different reasons for shoppers to purchase at alternative channels. Often, consumers could be looking for more affordability that some channels like Home Improvement and General Merchandise can offer. However, this is not always the case, as in some categories as Hair Care, there are significant differences in the range between Grocery, Pharmacy, General Merchandise and Beauty, leading to a more occasion-driven purchase as the Beauty channel offers unique brands.

As the Australian retail landscape continues to evolve, understanding the nuances of the omni-shopper journey and the rising significance of alternative channels is paramount for FMCG success. Brands and businesses that adapt their strategies to these changing dynamics will be best positioned to capture growth opportunities and thrive in this new era of consumer behaviour.

About the Author

Marco Silva, Customer Success Director, NIQ

Marco Silva is a Customer Success Director at NIQ, where he leads a team of FMCG consultants in Australia. He is passionate about helping clients to make informed data-driven decisions to unlock growth. Marco has more than 10 years of experience at NIQ and has worked in regional roles in both Latam and APAC before moving to NIQ Australia in 2018.

Unlock the power of Omnishopper in Australia

Capture consumer purchases across online and offline channels for a complete view of changing omnichannel behaviours.