US Shoppers Fight Headwinds to Continue Lifting the Retail Sector

Every six months, NielsenIQ checks in with consumers on the top concerns impacting them and how those concerns are shifting and what tactics and strategies retailers and brands need to deploy to address the trends. Sherry Frey, Vice President of Product Insights, NielsenIQ, revealed the latest analysis in the Fresh Research: New Consumer Behaviors and Habits to Watch session titled “The State of the U.S. Grocery Shopper” at Groceryshop 2024 in Las Vegas.

The leading concerns for US consumers have been consistent during the last several quarters, with rising food prices in the top spot and increasing utilities, increased housing costs and the potential for an economic downturn following closely behind. When it comes to money, NIQ asks consumers how they feel about their financial security and, the latest results painted a bleak picture. “Now, we have only 6% of consumers who are self-identifying as thriving while we have the greatest percentage of people who are struggling and cautious,” said Frey, adding that there are many high-income consumers living paycheck to paycheck.

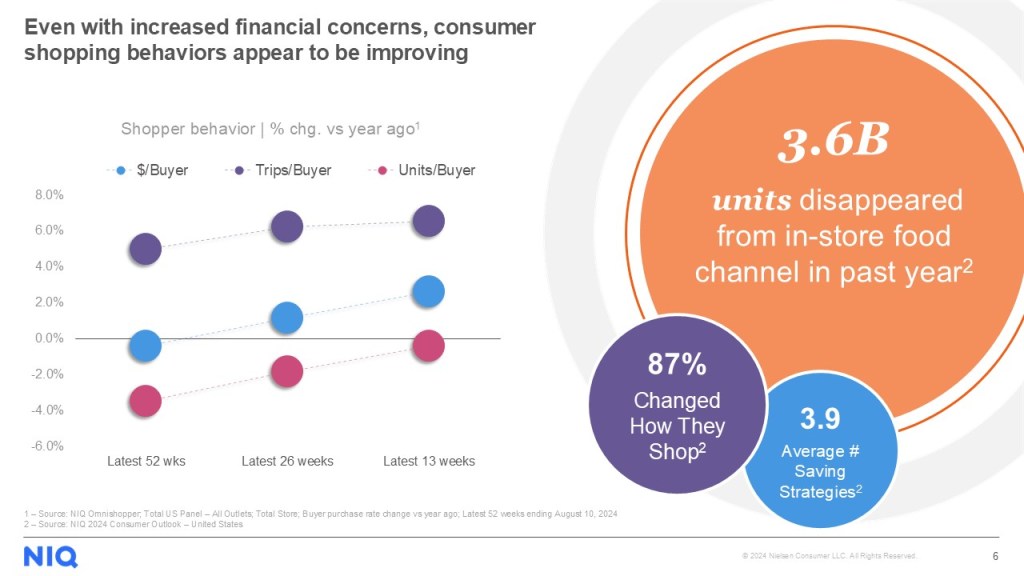

Not a great start, but consumer prospects are much more positive over the longer term. Shoppers have been shifting strategies in the last few years, changing retailers, shopping deals and reducing impulse purchases. But the last 13 weeks (about 3 months) have begun to paint a more positive picture for the store, especially the perimeter, with the greatest growth in produce, deli and dairy. In fact, in terms of consumer behavior, there has been stronger growth in “ingredient” categories over “convenient” categories, said Frey.

Generations are Shifting Sales, Boomers Remain Important

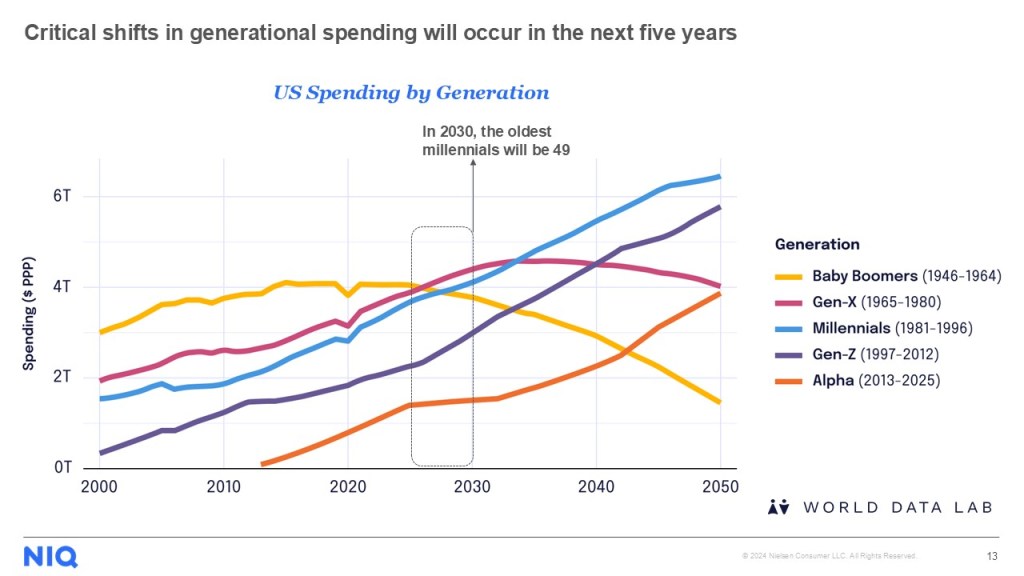

In the next five years, there will be critical shifts in population spending. Two populations that are key to watch as they transition through life stages are Millennials and Baby Boomers. Frey, said,“Keep your eyes on the Millennials” as they currently drive much of the growth, especially online shopping growth.

For retailers and brands, understanding how the generations are shifting is critical. While Boomers are still the largest sales segment, Millennials represent 43% of sales growth in the channel, while Gen Y sales are expanding more than most might expect, with much of that growth happening online.

In the next five years, Frey said, Boomers will begin their spending decline but still will be a force in the market. Meanwhile, she said Gen X will peak around 2033 and Millennials have a solid 30 more years of growth.

“In the next five years, there will be critical shifts in population spending. Two populations that are key to watch as they transition through life stages are Millennials and Baby Boomers. Frey, said, “Keep your eyes on the Millennials” as they currently drive much of the growth, especially online shopping growth”.

Sherry Frey, VP, Product Insights, NIQ

Health & Fitness is Strengthening

While consumers pulled back on “Better ForTM” products (better for health, better for society and better for the planet) during hardest inflationary times (in 2022 into Q3 of 2023), growth is once again outpacing conventional food and beverage growth at retail. Consistent growth over time has now allowed these products to capture nearly 10% of volume across the food and beverage categories.

Store Brands and Assortment in Focus

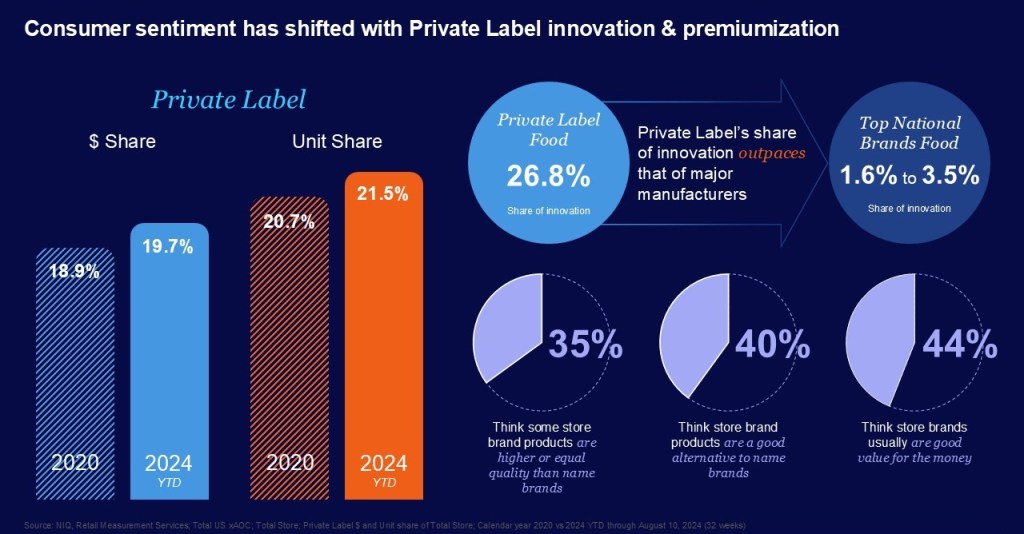

Private label continues to grow, now representing 22% market share. “The journey from generic products to present day store brands shows an evolution from no-frills, basic goods to innovative, high-quality products with premium packaging and graphics that have potential to challenge shopper justification for buying national brands,” Frey said.

At the same time, 40% of consumers think store brands are a good alternative to national brands, with 72% of high-income consumers agreeing. Retailers’ top private brand strategies over the next six months are increasing display and facings and adding new items. Store brands are a force to be reckoned with as they begin to behave like national brands by increasing promotions and discounting prices.

Frey said the industry continues to see shelf simplification, pointing to a study earlier this year that found 40% of retailers are planning to reduce SKUs in 2024. There has been an 8% drop in UPCs on the shelf this year with the greatest declines in household care, dairy and baby care. On the plus side, there is improved on-shelf availability.

What all this Means for Retailers and Brands

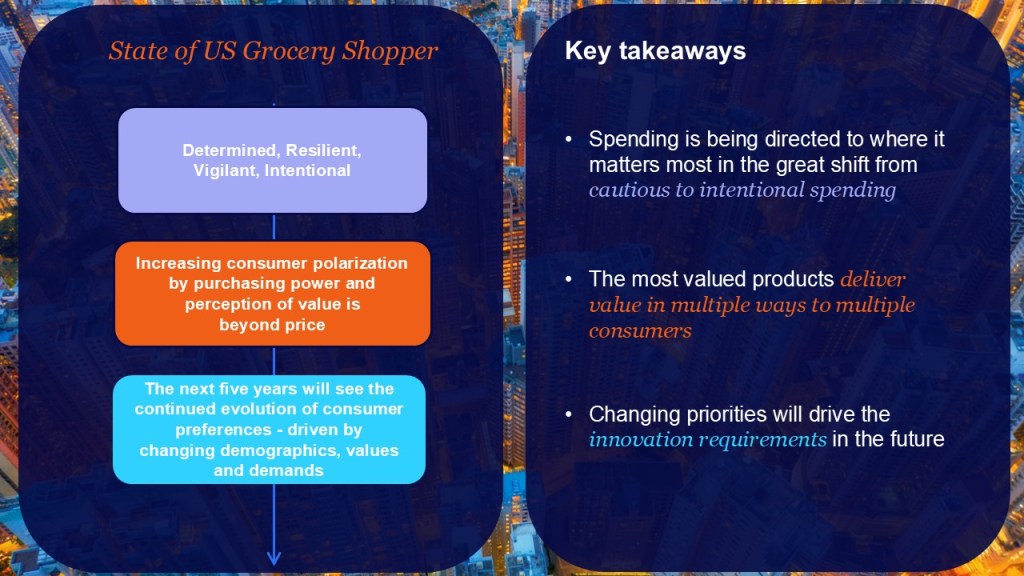

While consumers are feeling increasingly challenged personally, they are coming back to the store with both dollar and volume increases in food. While they are cautious, they are also showing the resiliency in prioritizing areas of health, whether it be Better For™ or even the growth of the perimeter. Spending is more intentional than ever, and consumers are looking for products that meet their needs in multiple ways. Understanding shopping demand through data analysis has never been more important, especially as the consumer demands are shifting quickly, driving innovation and service requirements.

Interested in more insights? Read our latest report.

Mid-Year Consumer Outlook: Guide to 2025

Want more insights? Read this comprehensive look at the state of consumers, we dive into spending shifts, ongoing disruptions, and what companies should anticipate as they gear up for 2025.