A Season of Change in U.S Grilling

Despite some changes wrought by the pandemic, current grilling trends indicate a return towards long-term habits, and satisfaction with current standards. There is no doubt that consumers value their grill and what they do with it, although those activities remain very traditional.

Even though this view of outdoor cooking may persist among certain demographics, there are obvious opportunities to enhance the grilling experience for consumers. The opportunity in new cooking platforms, new foods to cook outside, and new ways to add excitement to the grilling environment are viewed by the market as the next frontier in transforming the grill into a more all-purpose, and more valuable, home appliance.

A Surge in New Grilling Tech

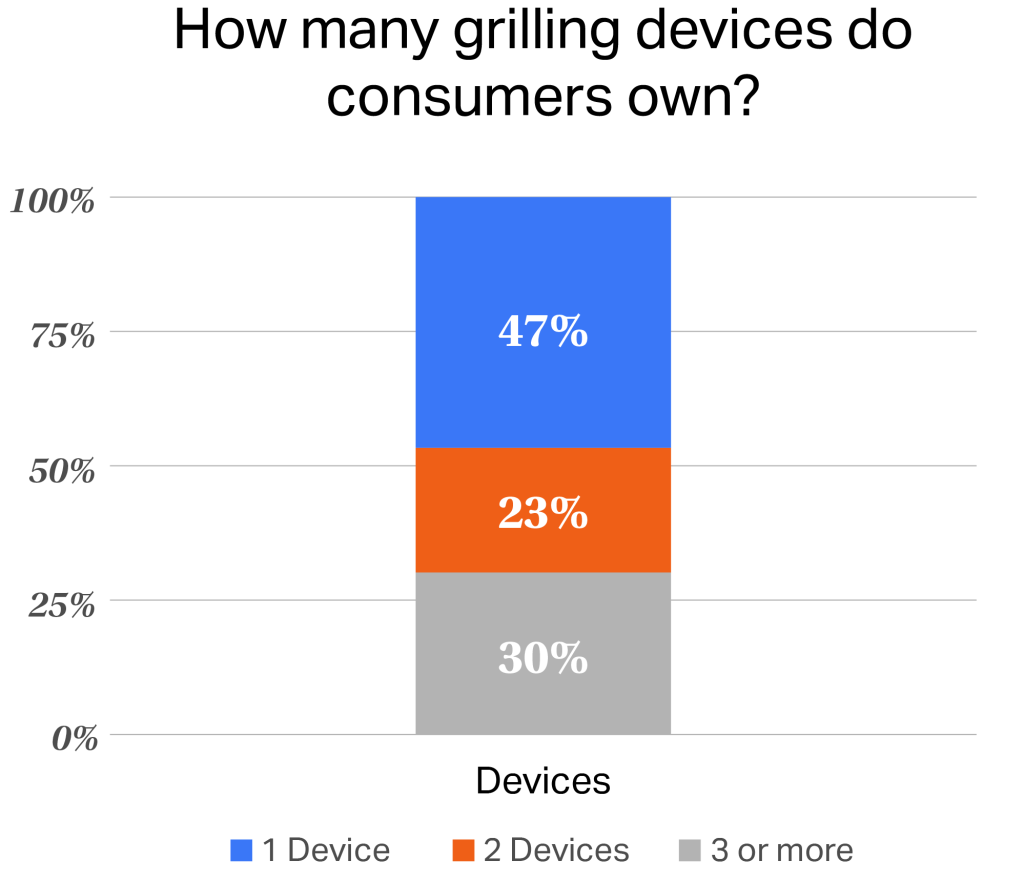

The entrance of electric grills, outdoor ovens, smokers, hybrid grilling devices, pizza ovens, and outdoor flat-top griddles available at retailers such as Lowe’s and The Home Depot speaks to the industry’s desire to leverage behaviors observed during the pandemic into more longer-term opportunities for change. Yet even after the surge in grilling technology during the pandemic, 47% of consumers own just one grilling device among gas, electric, charcoal, smokers, and griddles.

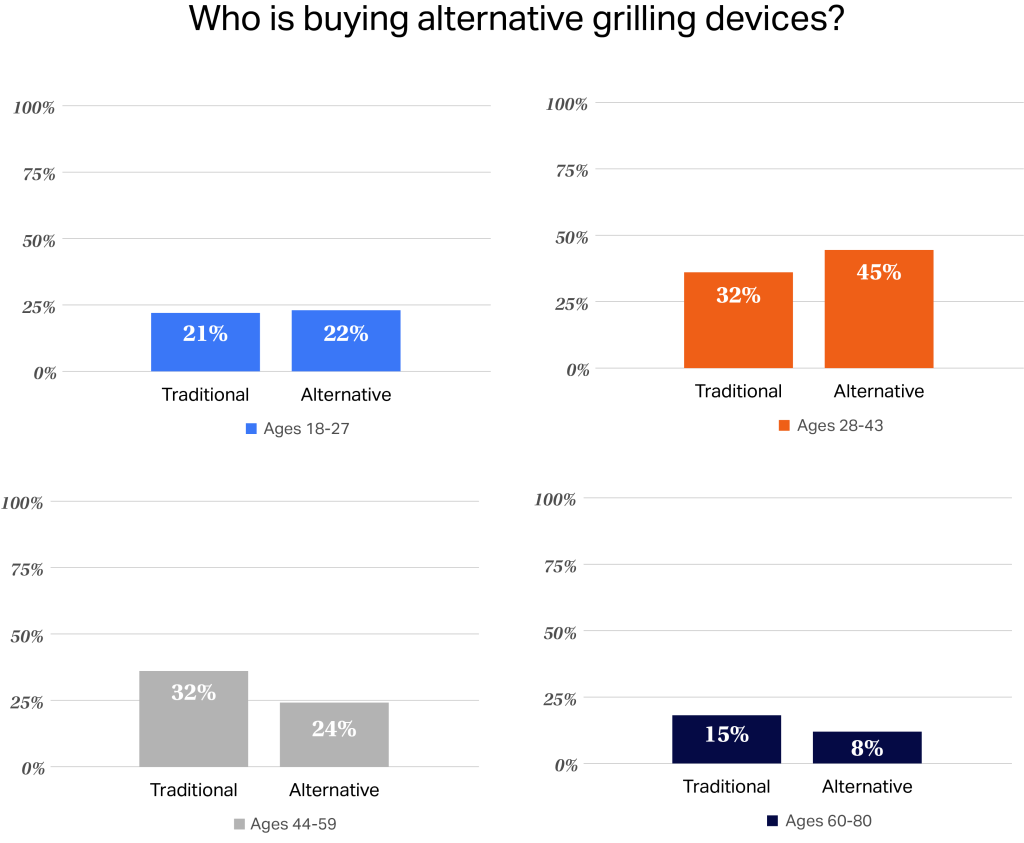

Thinking about this in terms of classic grilling vs. all the new alternative devices that have become available, there is a clear correlation between electric ownership and the expected easier acceptance of newer technologies by younger adults. In fact, 28–43-year-olds now own over 45% of the ownership of alternative devices.

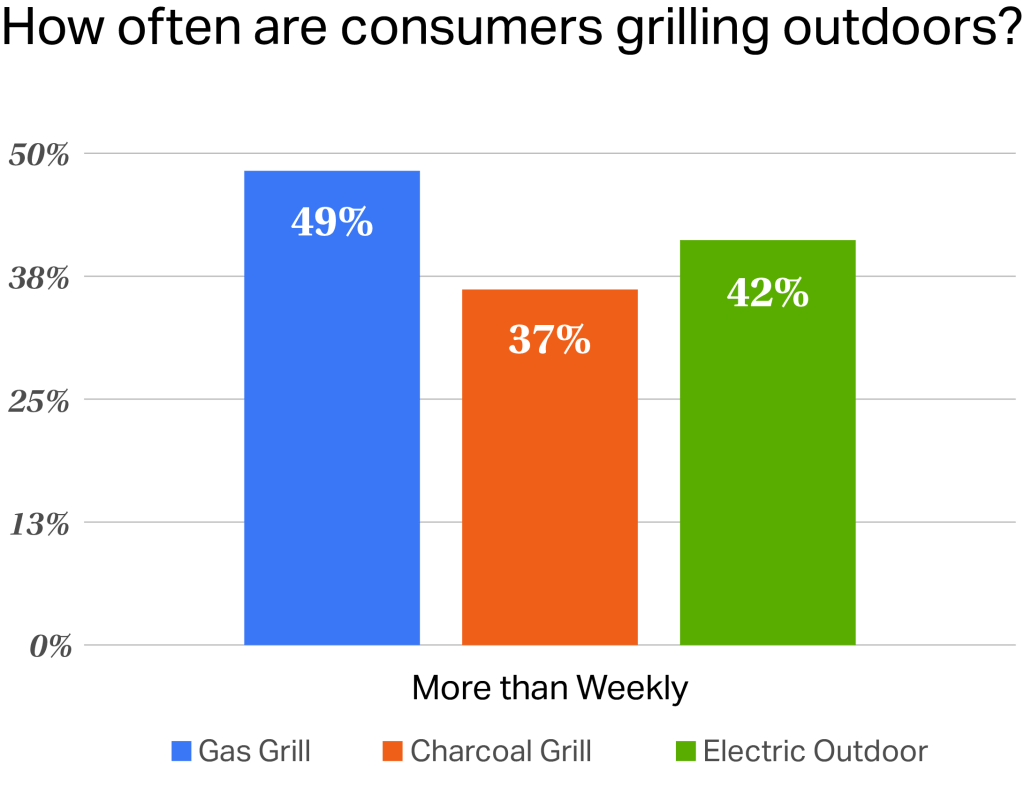

Half of the gas grill owners leverage that instant-on experience to grill more than once a week, and a significant amount of charcoal and electric users are also frequent grillers. Combined with frequency is their high rates of ownership, with gas grills being owned by 65% of all consumers. Interestingly, despite the obviously high level of grill usage, 60% of gas grill owners rely solely on a single grilling system, which represents a meaningful opportunity in the market to help consumers expand into other devices, such as griddles or smokers, to complement their grilling habits.

Opportunities Arise from New Grilling Habits

Given that gas users tend to be affluent, with 40% of gas owners having incomes above 150k, that would appear to make them an important target market for additional alternative device ownership. They are creative in their grilling habits, which should be a good sign for future expansion. NielsenIQ’s Outdoor Lifestyle Consumer Study showed that gas grill owners were the most pre-disposed to special product features such as utensil storage and side burners.

Even though consumers are clearly focused on gas and charcoal platforms, which account for almost half of all devices in use, the numbers also show lots of room for expansion. As stated earlier, only about half of households have more than one device, leaving lots of room for additional grilling. Among alternative devices (non-gas or charcoal grills), smokers represent 38% of the installed base, and griddles another 45%, indicating nearly equal interest in both types of products.

Smokers are owned by 49% of gas owners, 46% of charcoal owners, and over 50% of electric grill owners but have the strongest affinity with the affluent buyers who dominate the gas market. In fact, just like the gas grill market, 40% of the smoker market installed base consists of consumers with $150k in income, with pellet smoker owners skewing even higher than electric owners.

Smoker owners tend to be slightly more likely to use their smoker less than weekly, but overall, the smoker is heavily used, like other grilling products. Smoker owners, while not skewed as highly towards millennials (28-43 YO) as electric owners, are decidedly more youthful than either gas or charcoal owners, another strong indicator of affinity that smoker owners are younger, more affluent consumers. Interestingly, right behind smokers in their popularity with younger consumers are pizza ovens, where 54% are millennials, the same as electric grill owners.

The Rise of Smokers and Pizza Ovens

Certainly, classic charcoal and gas grilling devices dominate the market. However, The Outdoor Lifestyle Consumer Study notes that 49% of future grilling device purchases made by gas or charcoal owners are likely to be something else, either electric or a smoker or a griddle. Future buyers seem to be very focused on the product type (such as pellet smokers or gas griddles) in making their decision, as opposed to traditional attributes like price and brand. In fact, while charcoal buyers are slightly more concerned about price, and gas grill buyers are concerned about the grilling area, with 47% of the polled population owning 3 or more devices, interest clearly exists in exploring purchases of completely new types of grilling apparatus, and smokers and pizza ovens seem poised to expand dramatically as half of all respondents cite those products as likely to be their next purchase.

In Conclusion

It is apparent that consumers overall are both passionate about grilling and open to experimentation. Different demographics and income levels all expressed interest in different aspects of the grilling experience. All the data adds up to a significant opportunity to change the composition of grilling in the US, expand the market and range of products sold both to those who love the experimentation and differentiation of alternative grilling devices and for those who are currently wedded to their gas or charcoal grill.

Interested in learning more about NielsenIQ’s Lawn & Garden study?

Source

NIQ’s Lawn and Garden Consumer Study

*Spectra BehaviorScape: Penetration/Spectra 2024

Jun/MRI-Simmons Adult Usage