This omnichannel behavior is a massive opportunity for brands. With ~9 in 10 households buying across multiple channels, it’s more crucial than ever for companies to have the most up-to-date POV on their customers.

The real question is how relevant your insights are and how are you acting on them?

Trend Spotting in the Wild: What the Data Is Telling Us

From a trend perspective over the last three years, households don’t appear to be shopping in more retail channels for their FMCG products. In fact, the average number of channels per household has held steady at ~11. This stability suggests that consumers have established a consistent pattern in their shopping habits, preferring to stick to a familiar set of channels rather than exploring new ones. However, this doesn’t mean that consumer behavior is stagnant. On the contrary, there has been a significant shift from in-store shopping to online shopping within these established channels.

For example, the number of buyers for online Grocery has increased by 40.1%, for warehouse/club by 50.7%, and for pet products by 27.7% over the last two years. This shift indicates that consumers are increasingly valuing the convenience and accessibility of online shopping. They are moving away from the traditional in-store experience and embracing the digital marketplace. This trend is particularly evident in categories where online shopping offers distinct advantages, such as grocery and pet products, where consumers can easily compare prices, access a wider range of products, and enjoy the convenience of home delivery.

What this means for your products is that you need to ensure you offer the right value proposition to compete for consumers both in-store and online. This involves optimizing your assortment, pricing, and innovation strategies to cater to the preferences of omnichannel shoppers. For instance, you might need to offer exclusive online deals to attract digital shoppers or ensure that your in-store experience is seamless and engaging to retain traditional shoppers. Additionally, understanding key behaviors such as channel shifting, trip consolidation, and household penetration in niche categories can help you tailor your strategies to meet the evolving needs of your customers. Categories showing high growth in 2025, such as non-alcoholic beer and organic baby food, highlight the importance of staying ahead of trends and leveraging data from panels to spot these trends faster and make informed decisions.

From Behavior to Breakthrough: How to Build Faster, Smarter Products

To build faster, smarter products, leveraging real-time data is crucial. By identifying white space, companies can pinpoint gaps in the market where their products can thrive. Validating demand before investing ensures that resources are allocated efficiently, reducing the risk of launching products that do not resonate with consumers. Understanding usage occasions by channel allows brands to tailor their offerings to meet the specific needs and preferences of their customers, enhancing the overall shopping experience and driving higher engagement.

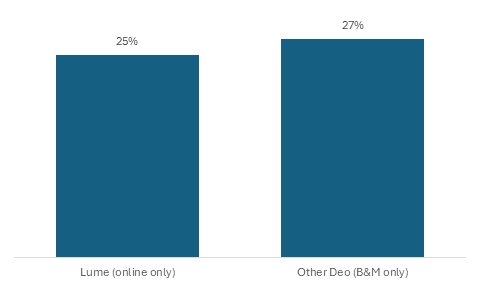

Online results are a strong indicator of in-store new product introduction. Strong trial and repeat rates for online new item launches can be a significant predictor of success when products are subsequently launched in brick-and-mortar stores. For example, the Lume whole body deodorant brand launched exclusively online. During its “online-only” launch period, the brand showed repeat rates to rival brick-and-mortar launches for other deodorants. During Lume’s online launch, they achieved 25% repeat rates, compared to a competitor launching in-store, which achieved 27% repeat over a similar time period.

This indicator supports the decision to launch Lume In-Store across multiple retailers. From a business perspective, Lume’s Brick & Mortar launch resulted in significant incrementality to the brand’s total business.

Download the full article

Fill out the form to read the rest of the article.

What to Watch: Category-Specific Pitfalls & Opportunities

n the realm of category-specific pitfalls and opportunities, it’s crucial to recognize that relying solely on in-store insights means missing out on a significant portion of the picture. For instance, pet parents are increasingly shifting toward online purchasing, and the nature of their online digital carts is becoming more premium. Online baskets have seen a 7.3% increase compared to the previous year, while in-store baskets have declined by 2.9% over the same period. This trend highlights the growing preference for online shopping among pet owners, who are willing to spend more on premium products when shopping online. Brands in the pet category need to adapt to this shift by offering high-quality, premium products online and ensuring a seamless shopping experience to capture this lucrative market.

In the personal care category, brand loyalty varies significantly between in-store and online sales. Established brands, which have their origins in-store, tend to have higher loyalty in-store than they do online. Conversely, newer or niche brands, which owe their launches to the online channel, have high loyalty online but experience lower loyalty when sold via in-store channels. For example, among niche femcare brands, loyalty can be as much as 20 percentage points higher for online sales than when the same brands are sold in-store (64% vs. 43% in the latest 52 weeks). These trends have important implications for how to launch new items and brands to maximize resulting loyalty. Brands must carefully consider their launch strategies, leveraging the strengths of both online and in-store channels to build and maintain customer loyalty.

In the food and beverage category, consumers are shifting more of their ‘staples’ purchases to online compared to ‘treats.’ Products such as pasta, dried beans, rice, and grains are shifting at a rate four times faster than products like ice cream. This indicates a preference for convenience and bulk purchasing online, while treats are still often bought in-store. Brands need to tailor their strategies to these consumer preferences to optimize their sales across channels. By understanding these category-specific trends and adapting accordingly, brands can better position themselves to meet the evolving needs of their customers and capitalize on emerging opportunities.

Quick Checklist: Is Your Panel Provider Helping You Stay Ahead?

- Does your panel have enough sample to capture new and smaller brands, and niche categories to provide the full picture of emerging trends?

- When claiming to expand their panel, does your panel provider recruit new panelists, or simply accept panelists from their “pool” who were previously unacceptable to them?

- Do the panelists from your provider accurately balance according to key demographics, such as income, age groups, ethnicities, etc., such that insights gleaned will be valuable to creating business strategies?

- With 91% of shoppers engaging in both in-store and online shopping, from an omnishopper lens, does your panel capture the full consumer journey and the path to purchase? Does your panel cover 100% of e-receipt purchases?

- Without data accuracy and alignment of the panel data to actual sales performance (i.e., a Truth Set), your business risks making decisions on inaccurate or exaggerated data. Does your panel provider’s data reflect actual purchasing behavior and trends?

- Does your panel provider update demographics and psychographics at least once per year?

- How engaged are the panelists from your provider, in terms of reporting frequency/completeness for both in-store and online purchases, which is a top determinant of maintaining data integrity?

- Does your panel exhibit unexplained fluctuations in data and/or KPI trend inconsistencies, suggesting there are problems with data collection, participant engagement, or methodology?

- If your panel provider is falling short on any of the above, do you have the right one?

The Future Belongs to the Fast Movers

In today’s rapidly evolving market, the ability to act swiftly on insights is what sets successful brands apart. With $1.5 trillion of omnichannel opportunity in the U.S. alone, staying on top of shifting omnishopper trends is not just beneficial—it’s essential. Consumers are no longer shopping in a straight line; they are zigzagging across channels, toggling between .com and in-store, subscription and DTC, mass, and specialty. This omnichannel behavior presents a massive opportunity for brands to capture and retain customers.

In the end, winning in today’s market isn’t about having the most data—it’s about acting on it, fast. Treat omnichannel insight as a growth engine, not a lagging indicator. By staying ahead of trends and leveraging comprehensive data from panels like NIQ’s Expanded Omnishopper Panel, brands can make informed decisions that drive growth and innovation.

Sources:

1 – NIQ Report – The Ultimate Guide to Omnichannel