Prime Day 2025: What You Need to Know

By doubling the usual two-day format, Amazon’s event now more closely mirrors the duration of other major retail promotions. Scheduled just after the July 4th weekend, the timing is designed to capture early summer demand and maximize shopper engagement.

The scale of Prime Day shouldn’t be underestimated by manufacturers and competing retailers. In 2024, Amazon’s order totals on Day 1 of Prime Day were 296% higher than its daily average for the year, while Day 2 saw a 287% increase (Source: NIQ – Digital Purchases). Prime Day now accounts for six of the ten largest single sales days in Amazon’s history, occupying the top five spots, with Black Friday 2024 ranking sixth.

Source: NIQ – Digital Purchases

Note: Black Friday and Cyber Monday are two of the five days that make up the Cyber 5 weekend.

In 2024, although Prime Day experienced more moderate growth compared to other major sales holidays, it still far exceeded other two-day events in terms of its share of Amazon’s total annual sales. Remarkably, the two-day Prime Day event rivaled the scale of the entire five-day Cyber 5 weekend, which includes Thanksgiving, Black Friday, the weekend following, and Cyber Monday.

The sales volume generated during Prime Day represents a tremendous opportunity for brands to tap into heightened shopper attention and demand. What began as a simple promotional event is now celebrating its tenth anniversary—and has grown into one of the most powerful tentpole retail moments of the year.

Top 5 in Single Day Sales

Prime Days from 2022-2024 account for the top five sales days in Amazon history, surpasing 2024 Black Friday and Cyber Monday.

Key Prime Day Categories

/cil//columscolum

While the scale of Prime Day is impressive, brands need to be strategic in how they engage with the event. The first step is understanding the key product categories and market dynamics that define Prime Day. This is essential for determining the appropriate level of investment, promotional activity, and resource allocation.

Here’s what we saw across categories last year:

Source: NIQ – Digital Purchases

Leveraging measurement data to analyze the most successful Prime Day categories, and drilling down into subcategories and specific items, enables branded manufacturers to better assess the opportunities this event presents. Reviewing last year’s top-performing categories also provides valuable insight into which categories are likely to lead in 2025.

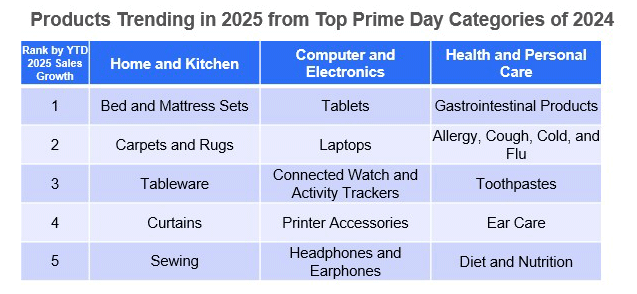

Drilling down to product-level offers even greater insights:

Source: NIQ – Digital Purchases

These products have shown the highest year-over-year sales growth in 2025 (year-to-date) within the top Prime Day categories from 2024. While Prime Day is a highly promotional event—where top sellers are often driven by the most aggressive advertising or deepest discounts—consumer interest and demand also play a critical role. So far in 2025, these items have emerged as key products to watch heading into the July 8–11 event.

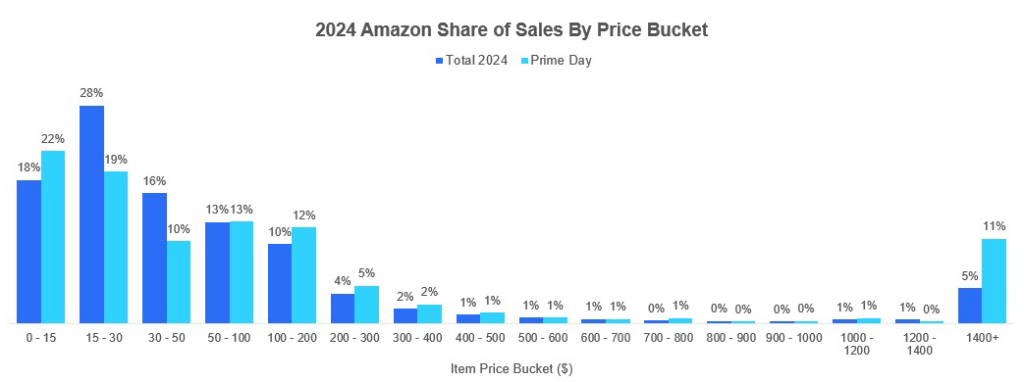

Another key trend from 2024 to watch this year is the Prime Day “barbell effect.” Last year, both low and high average selling price (ASP) items significantly over-indexed compared to their performance across the rest of the year.

Source: NIQ – Digital Purchases

Amazon has made a deliberate push to expand its assortment of lower ASP (average selling price) items as a growth strategy. These products, combined with Amazon’s rapid delivery capabilities, position the company to meet a broader range of shopper needs. Importantly, Amazon believes its modern, enhanced logistics network can now support these lower-priced items profitably, something that has historically been a challenge in e-commerce.

At the same time, it’s worth watching the upper end of the price spectrum this Prime Day. The appeal here is intuitive: many consumers intentionally wait for Prime Day to make high-ticket purchases at a discount, making it a key moment for premium product sales.

The Prime Day Shopper

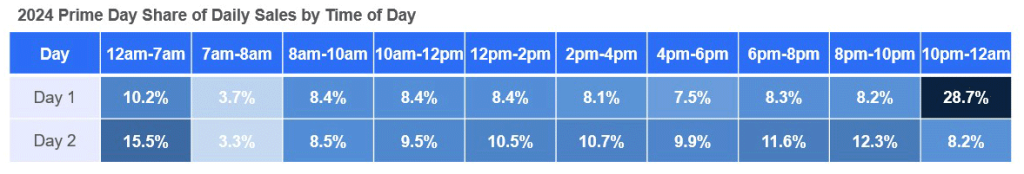

Understanding shopper behavior can make or break your Prime Day planning. During the 2024 two-day event, the most popular time to shop was at night—specifically between the two days—highlighting the importance of maintaining visibility and promotional momentum throughout the entire event window.

Source: NIQ – Digital Purchases

Note: All times CST, share of sales of representative day

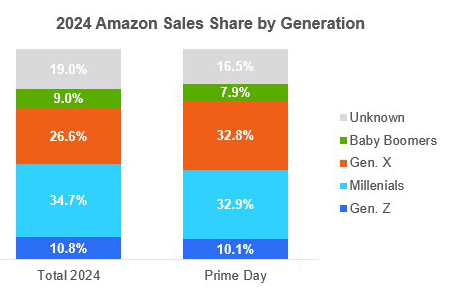

Understanding who Prime Day shoppers are is just as important as knowing when they shop. Generation X shoppers, in particular, accounted for a higher share of sales during Prime Day compared to their typical share throughout the rest of the year.

Source: NIQ – Digital Purchases

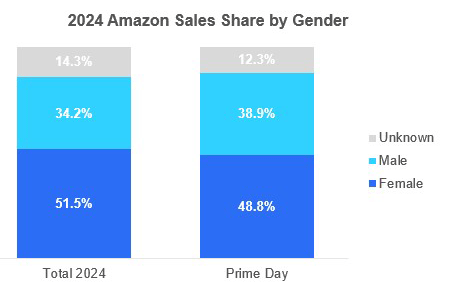

Men also over-indexed on Prime Day, accounting for a larger share of Amazon sales compared to their typical shopping behavior throughout the rest of the year.

Source: NIQ – Digital Purchases

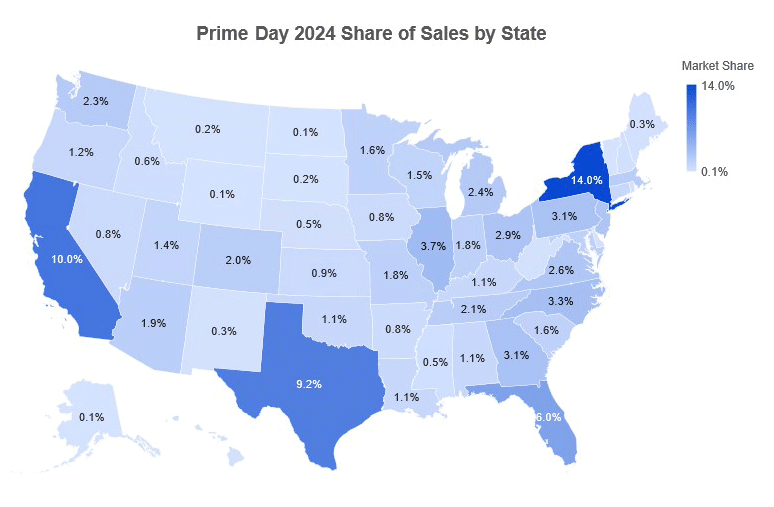

From a geographic perspective, the most populous states in the U.S. unsurprisingly recorded the highest sales volumes during Prime Day.

Source: NIQ – Digital Purchases

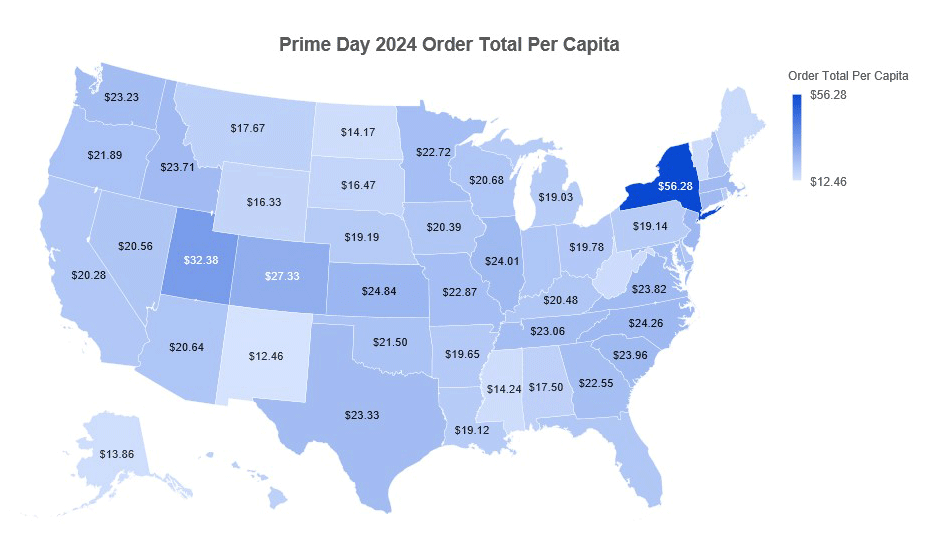

But, when normalizing order totals on a per capita basis, New York stands out. Its shoppers spent more on Prime Day than those in any other state.

Source: NIQ – Digital Purchases

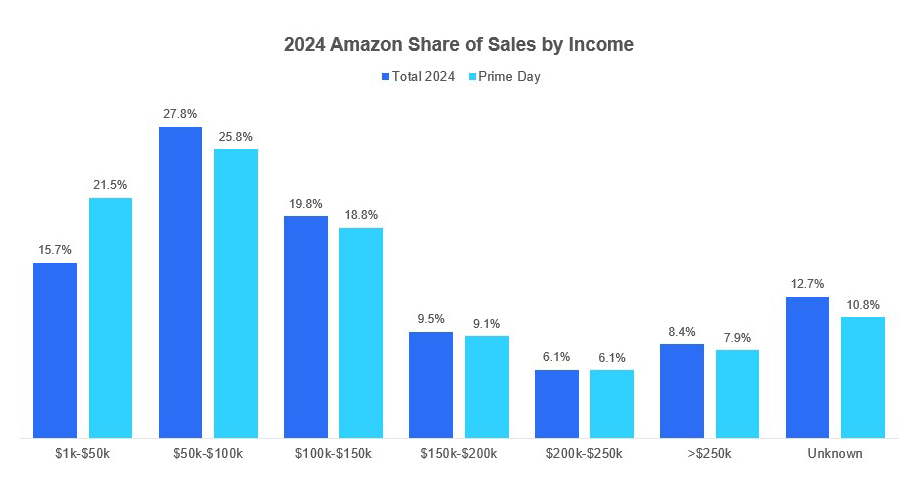

Finally, Prime Day sees increased engagement from lower-income shoppers, with the only income bracket to over-index being those earning less than $50,000 annually.

Prime Day and Your Business

By now, participating brands have already locked in their Prime Day 2025 strategies. But final execution matters just as much as planning. Key areas of preparation include maintaining adequate inventory levels, executing strategic promotional campaigns, securing retail media funding, and ensuring digital shelf readiness. Success during the event also depends on having the right teams and resources in place to manage execution in real time.

Equally important is post-event analysis. Measuring retail sales performance and digital shelf metrics from Prime Day 2025 will help brands refine their strategies for future Prime Days and other major tentpole events—such as the fast-approaching Cyber 5 period.

Prime Day 2025 isn’t just a sales event—it’s a strategic pillar of the annual retail calendar. The brands that win will be those who combine data-driven planning, real-time execution, and sharp post-event analysis.

NielsenIQ will publish a comprehensive Prime Day recap following this year’s event. So, be sure to sign up below to receive the report. It’s an essential first step in planning for your next Amazon sales opportunity.

Be the first to see Prime Day 2025 results.

Sources

- NIQ – Digital Purchases