Retail’s New Growth Lens

In today’s dynamic retail landscape, knowing where to grow is just as important as knowing what to sell. The traditional market prioritization methods built around static demographics—such as age, gender, family size, education, and occupation—are no longer sufficient to capture the complexities of consumer behavior.

This is where spatial intelligence emerges as a game-changer to decode where, how, and why growth is happening.

By integrating location-based consumer insights with conventional demographics, retailers can identify untapped hotspots and optimize investments in new stores, product placement, and targeted marketing. This article explores how spatial data is changing the rules of retail expansion.

Why Spatial Intelligence Matters

Retail growth is deeply linked to how cities evolve. Urban development, infrastructure, and population patterns shape consumer behavior in ways that go far beyond static demographic data. By applying a spatial lens to retail strategy, we can decode these patterns and move toward more data-driven retail store expansion that elevate business performance.

- Night-time light density – A powerful proxy for economic activity and urban vibrancy.

- Built-up space (20% weight): Signals commercial and residential density—critical for new store viability.

- Open spaces: Land without buildings, like parks and natural areas.

- Road networks – Offer a view into connectivity, accessibility, and local planning.

- Points of Interest (POIs) – Indicate consumer movement and spending zones; includes educational institutions, banks, malls, and more—each reflects trade area insights critical for retail planning.

- Micro-market income estimates – Adds nuance to market segmentation using spatial data.

Case in Point: Kozhikode’s Retail Potential

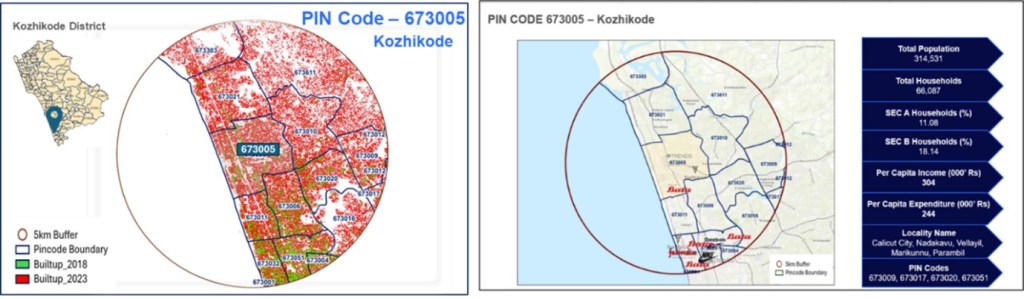

Consider the town of Olavanna in Kerala’s Kozhikode district. When ranked by demographic indicators alone, it stood at 534th among Class 1 towns (population ≥100,000). However, with spatial insights factored in, its rank surged to 24th. This dramatic shift was largely due to rapid built-up growth, highlighting how spatial analytics can redefine market prioritization strategies.

NIQ experts further zoomed into Kozhikode’s PIN code 673005, creating a 5KM catchment area analysis. This micro-market profile included demographics, income, spending habits, and the presence of key apparel and footwear brands—essential inputs for retailers looking to assess market readiness and competition before expanding.

Rethinking Market Potential: A Smarter Lens

High population doesn’t always translate to high-potential. Without the right urban infrastructure, even populous areas can underperform. Spatial intelligence shifts the focus from theoretical potential to evidence-based opportunity—enabling more accurate go-to-market plans.

✔ Smarter Expansion Strategy

Prioritize cities, towns, and PIN codes based on real economic activity—not just population data.

✔ Informed Campaign Targeting

Understand consumer environments in high-density zones to sharpen your marketing approach.

✔ Competitive Intelligence

Uncover market gaps and analyze trade profiles through Points of Interest (POIs), urban density, and income tiers.

✔ Actionable Micro-Market Maps

Drill down to 5KM catchment areas to evaluate store locations and plan inventory around true demand.

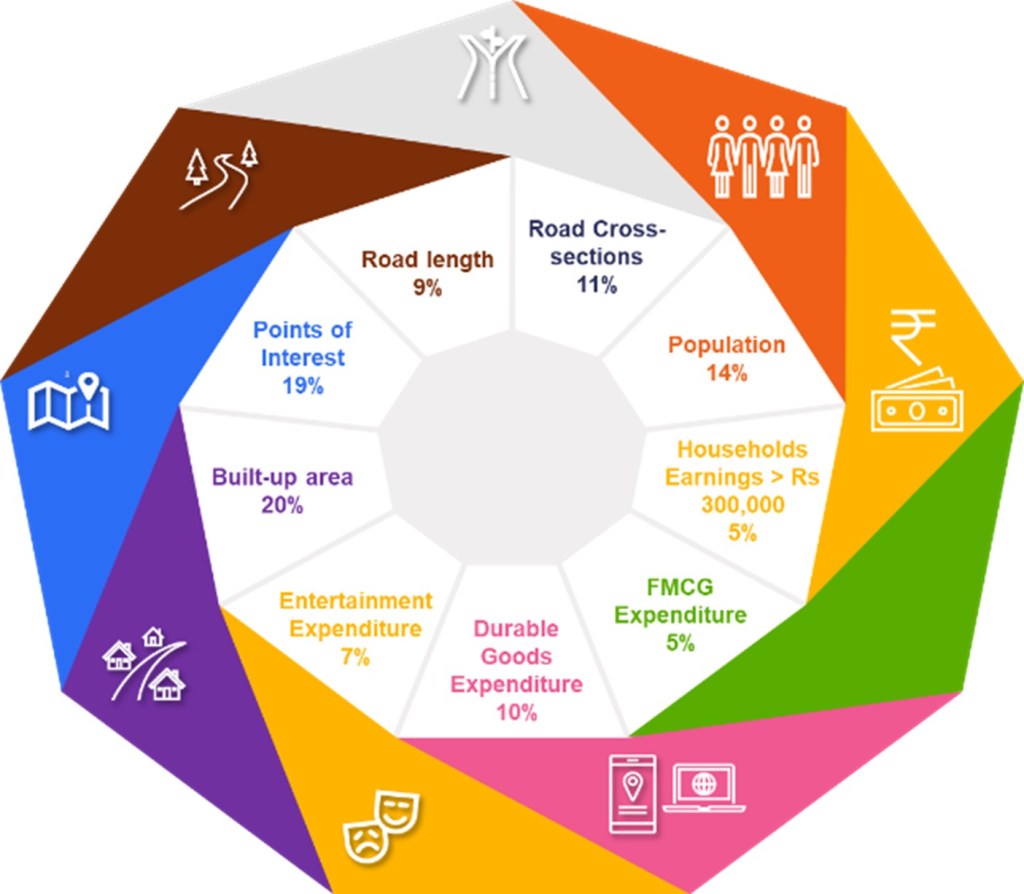

From Insights to Action: NIQ Precision Wheel

NIQ’s advanced Precision Wheel combines geospatial variables with income and expenditure data to uncover high-opportunity micro-markets, allowing retail leaders to make smarter, location-led decisions.

Our data modeling shows that built-up areas carry the highest weight at 20%, with Points of Interest closely following. Collectively, spatial variables contribute to 60% of the overall market potential assessment, underscoring their pivotal role in identifying retail growth hotspots.

To build a comprehensive solution, these insights can be layered with Retail Measurement for FMCG, Tech and Durables market intelligence, giving brands the tools to make data-led investment decisions.

Unlock Hidden Growth Markets.

Learn how we’re helping leading brands uncover hidden growth hotspots and redefine their go-to-market playbook powered by NIQ Precision Wheel.