A challenged but valuable channel

HoReCa visitation rates in The Netherlands are lower than many of its European neighbours. Three quarters (74%) of Dutch consumers visit bars, restaurants, and similar venues monthly. But only a third (31%) visit weekly. This is notably lower than markets like Italy (59% weekly) and Great Britain (43% weekly).

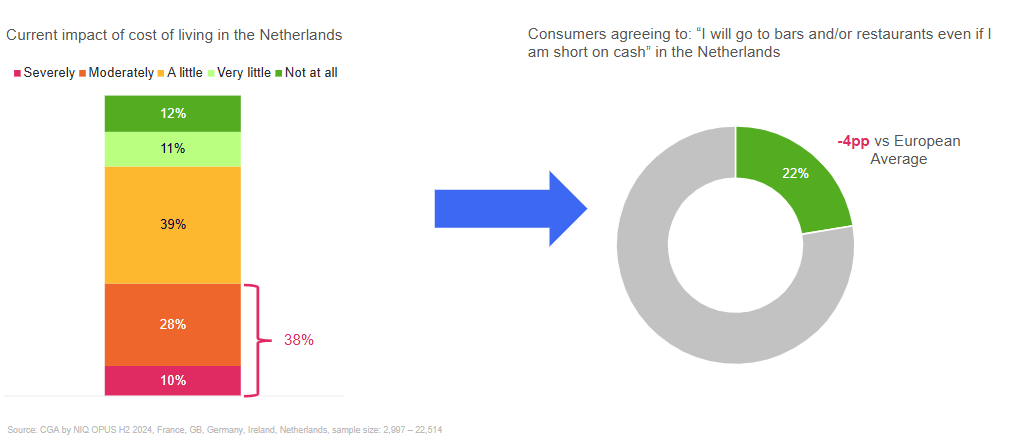

A key factor influencing this trend is the ongoing cost-of-living crisis, which impacts more than one in three Dutch consumers, leading to tightened spending habits and reduced frequency of social outings.

On the other hand, certain demographics remain highly engaged with the HoReCa, providing a strategic focus for drinks brands and venue operators looking to strengthen their position.

For this purpose, younger Gen Z and Millennial consumers, white collar workers, and city dwellers demonstrate higher spending power and a stronger commitment to social experiences. As a result, these groups represent the best opportunities for engagement and revenue growth.

Targeting the right moments

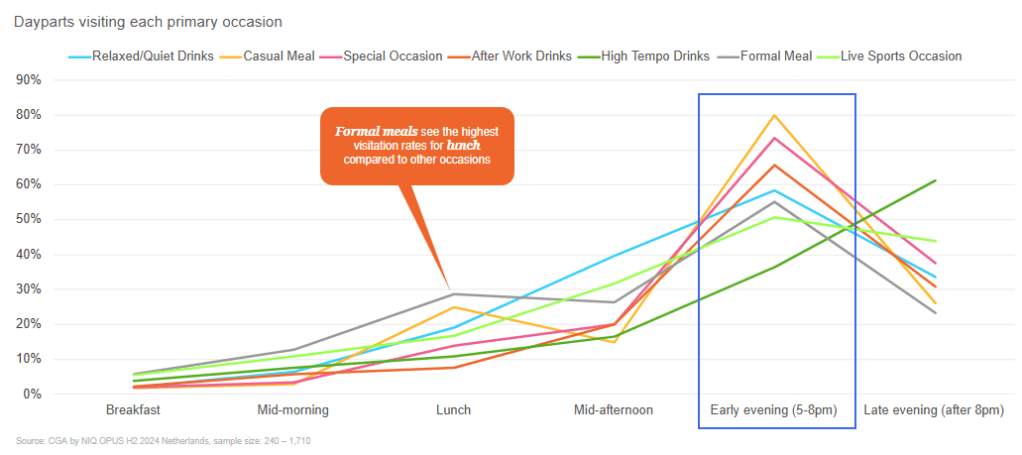

Early evening between 17:00 – 20:00 is a prime visitation window, making it ideal time for promotional activity and brand engagement.

Food-led venues currently drive the majority of Dutch HoReCa footfall, with three quarters (75%) of consumers visiting restaurants and half (48%) eating in cafés.

Yet there’s an opportunity to grow drink-led occasions, when Gen X and Boomers over-index for casual and relaxed outings, and for after work drinks, high tempo occasions and live sports viewing when Gen Z and millennials make up a higher % of the crowd.

The rise of health-conscious drinks choices

Beer (43%), wine (44%), and soft/hot drinks (45%) dominate the Dutch drinks market, with spirits (16%) currently being outpaced by no- and low-alcohol alternatives (19%).

Health-consciousness is a rising trend, influencing consumer choices and generating demand for products perceived as healthier. This shift presents an opening for brands to adapt their portfolios and develop innovative offerings, such as cocktails with lower alcohol content and functional benefits.

Addressing cost sensitivities

38% of Dutch consumers say they’re impacted by cost-of-living increases. In addition, less than a quarter (22%) of Dutch consumers say they’d continue going out even when short of money – -4pp lower than the European average.

Accordingly, affordability plays an important role in HoReCa decision-making, highlighting the need for carefully calibrated pricing strategies to encourage greater engagement without compromising profitability.

Conversely, Gen Z consumers visit venues more frequently, whereas Millennials exhibit the highest spending power. Furthermore, Millennials form almost three quarters (72%) of the white-collar workforce, making them a prime target for premium offerings and tailored marketing efforts.

A positive outlook for 2025

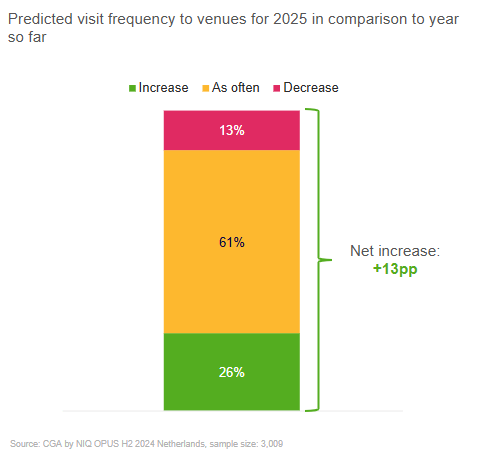

The Dutch HoReCa sector is showing signs of recovery, despite current challenges. Predictions for 2025 indicate an increase in visit frequency, with a quarter (26%) of consumers expecting to visit venues more often than they have in the past year. This is a clear sign for the sector to leverage these insights to refine strategies and capitalise on emerging consumer behaviours as market conditions stabilise.

Explore NIQ’s HoReCa solutions

Click here to discover NIQ’s HoReCa consumer insights offering to support winning brand strategies and opportunities across The Netherlands.

For the latest HoReCa news and insights – sign up to The Measure, NIQ’s On Premise newsletter

Get our latest thought leadership, events information, and more delivered straight to your inbox