GfK has mapped the market for engine oil in Nigeria and found that major engine oil brands have an opportunity to gain share in Africa’s most populous country.

A majority of engine oil in Nigeria is sold at gas stations – roughly 70% of total market volumes. If you remove these sales from overall market volumes, though, you see that the car accessories channel is the main sales avenue in disorganized markets. Yet, within the car accessories channel, it is “unknown” engine oil brands that have the most market share.

This means major oil brands can expand their sales of engine oil in the car accessories channel. In total, Nigerians bought 44 million liters of engine oil between January and September 2014 from sellers that were not gas stations.

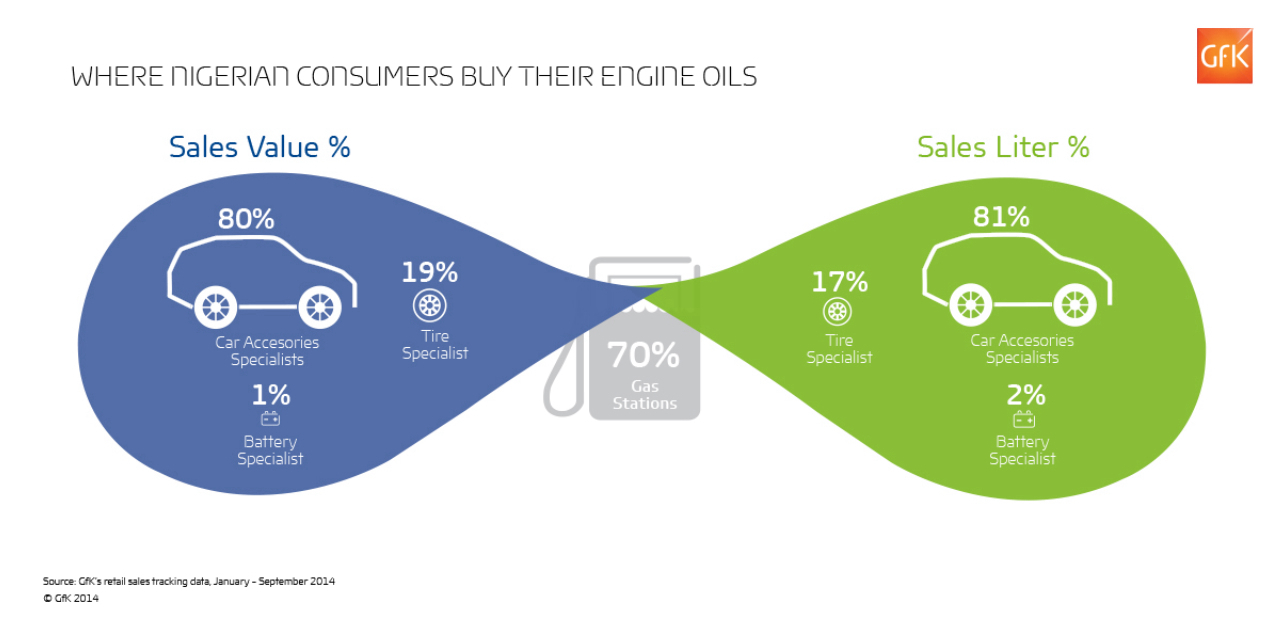

According to PPRA, the Public Procurement Regulatory Authority, 70% of total market volumes of engine oil were sold at gas stations. GfK’s recent data show that some 81% of the remaining 30% of overall liter volumes were sold through car accessory specialists. Tire specialists sold 17% (also of the remaining 30% of overall volumes), while battery specialists sold only a tiny fraction. See the figure below.

Where Nigerian consumers buy their engine oils

We see that Nigerians like to buy their engine oil from car accessory shops, if they aren’t buying from a gas station. But why?

One reason may be the choice of brands and the possibility to buy as much oil as you want. For car mechanics, this is surely an important point. In addition, shoppers benefit from the selection of car accessories available besides engine oil – e.g. these shops have more of what a mechanic or car owner needs.

As part of GfK’s panel for this sector, we have mapped engine oil sales by brand in the three channels mentioned: car accessories, tire specialists and battery specialists.

Within the car accessory channel, we see that engine oil made by “others,” or lesser-known brands, has a large share of the market, especially with car accessory specialists and battery specialists. See below.

About our research

In 2012, GfK embarked on a study of disorganized and unregulated distribution channels for oil, tires and batteries in 10 major Nigerian cities. We mapped more than 5,600 stores, many of which are very small.

GfK sees opportunity for large engine oil brands to expand their retail sales in these channels, since it is the “unknown” brands that account for most of the sales in the disorganized market.

Oil majors may be well advised to begin market expansion in the Lagos region, since our data show that unit sales in this single city were relatively equal to all sales of engine oil in the north of Nigeria since 2013.

GfK is perfectly poised to help companies gain an edge in the engine oil market in Nigeria, since we have been publishing sales data since January 2013 from our panels. In 2014, we expanded our panel to 17 cities in Nigeria.

Get more insights

Chukwudi Okorie is Business Group Manager, Automotive ISDAI Nigeria at GfK in Lagos. To gain the full insights and benefits from our detailed study of the Nigerian engine oil market, contact us.

For more about our offerings, visit our Automotive and Retail Sales Tracking pages

AUTOTALK newsletter

Discover latest industry insights, market data and how Auto and Consumer trends will affect your business. Sign-up for AutoTalk.