Young Japanese are known around the world as trendsetters – in the world of anime, manga or music, for instance. You may be surprised to know that Japanese young people are trendsetters for tire prices as well.

Our recent study showed that when it comes to tires, young people are more price sensitive than older Japanese. That’s one reason young tire buyers recently invested before a sales tax hike from 5% to 8% that took effect in April 2014.

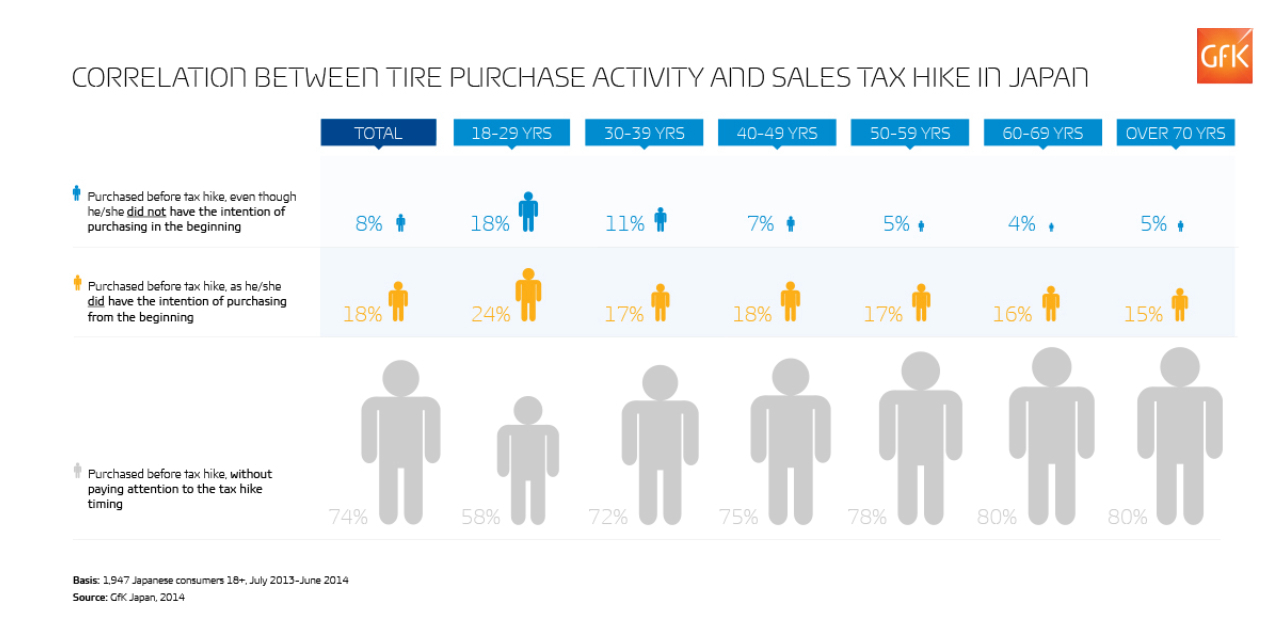

In a GfK Japan Consumer Survey in June 2014, we found that one fourth of tire purchasers bought when they did because of the upcoming tax hike. We also saw that the younger the purchasers were, the more they took the tax hike into account. Some 42% of the younger generation – up to age 29 – ended up making a purchase.

So what does this mean for the Japanese tire aftermarket?

It’s a clear sign that each manufacturer and each supplier needs to be ready for the next tax rise, scheduled for October 2015. By taking a strategic approach with marketing and promotions, tire makers can increase their sales. There may be particular opportunity for those who target young people, who have lower incomes and are price sensitive.

A bit more about our study: Our target group was drivers in Japan over 18 years old who have purchased replacement tires within the past year. Our goal was to understand the trends in tire purchasing.

The GfK Japan automotive team timed our study around the tax rise, which was the first in 17 years, to show our expertise in understanding consumer purchasing behaviors. Detailed results can be found on the chart below.

Get more insights

Ryo Tomita is Business Manager, Automotive at GfK in Japan. To gain the full insights and benefits from our detailed study of the Japanese tire market, contact us.

For more about our offerings, visit our Automotive and Retail Sales Tracking pages

AUTOTALK newsletter

Discover latest industry insights, market data and how Auto and Consumer trends will affect your business. Sign-up for AutoTalk.