Do Germans love their cars? They sure do. Do they spend a lot on outfitting and tuning them up? Well, it depends…

Surprisingly, it not only depends on the social group and individual consumption preferences, but also on consumers’ place of residence. So, take control and gain Vorsprung durch … market knowledge.

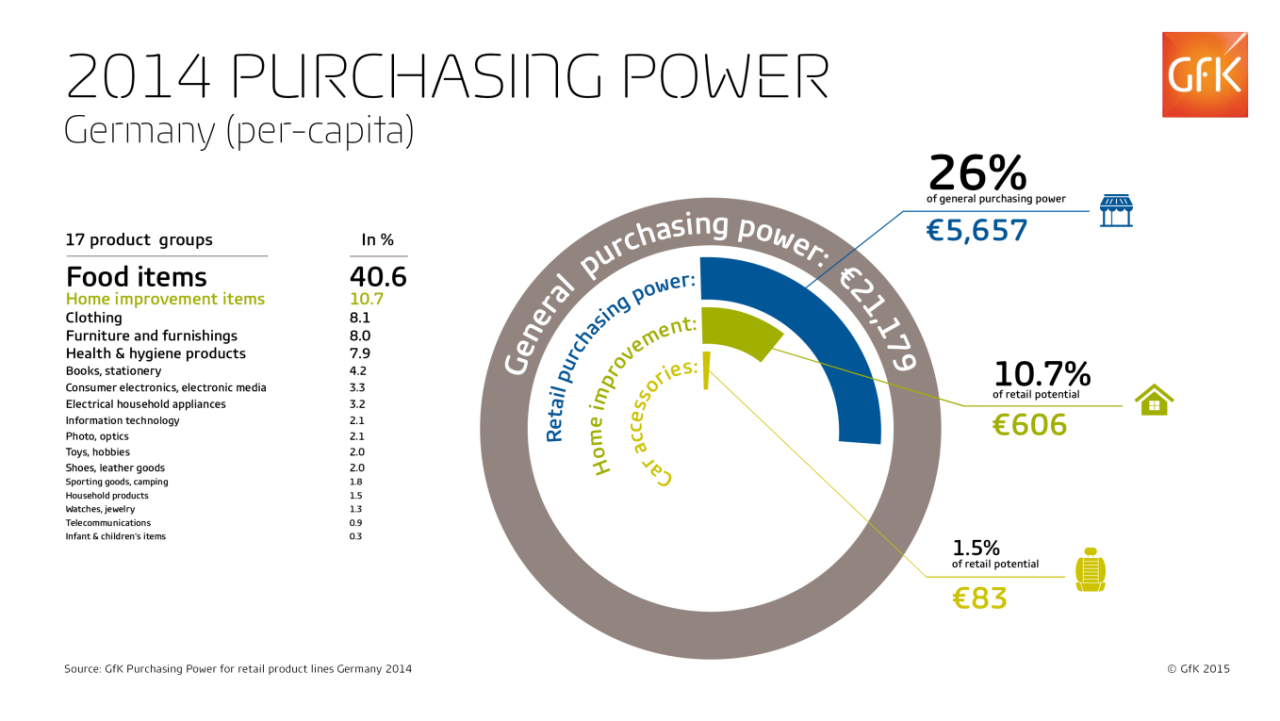

We’ve conducted a study on the regional retail-line purchasing power in Germany, and it reveals huge regional differences in spending potential. On average, in 2014 Germans have €83 per capita available for automobile accessories – mainly tires, but also upholstery/seat covers, helmets and gear for motorbikes, etc. That is approximately 1.5 percent of their available income for retail purchases in physical or online stores.

The potential for retail-lines is often related to the general purchasing power, but regional consumption preferences lead to a unique share among the retail-lines in each region.

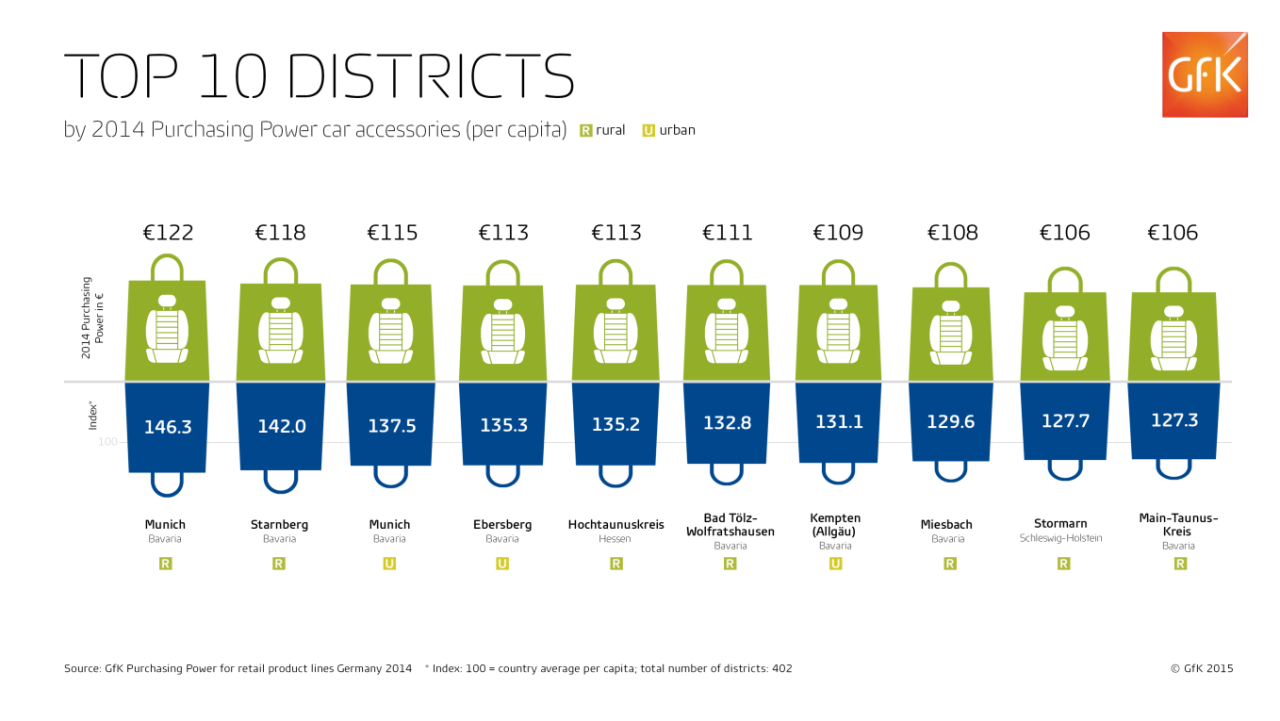

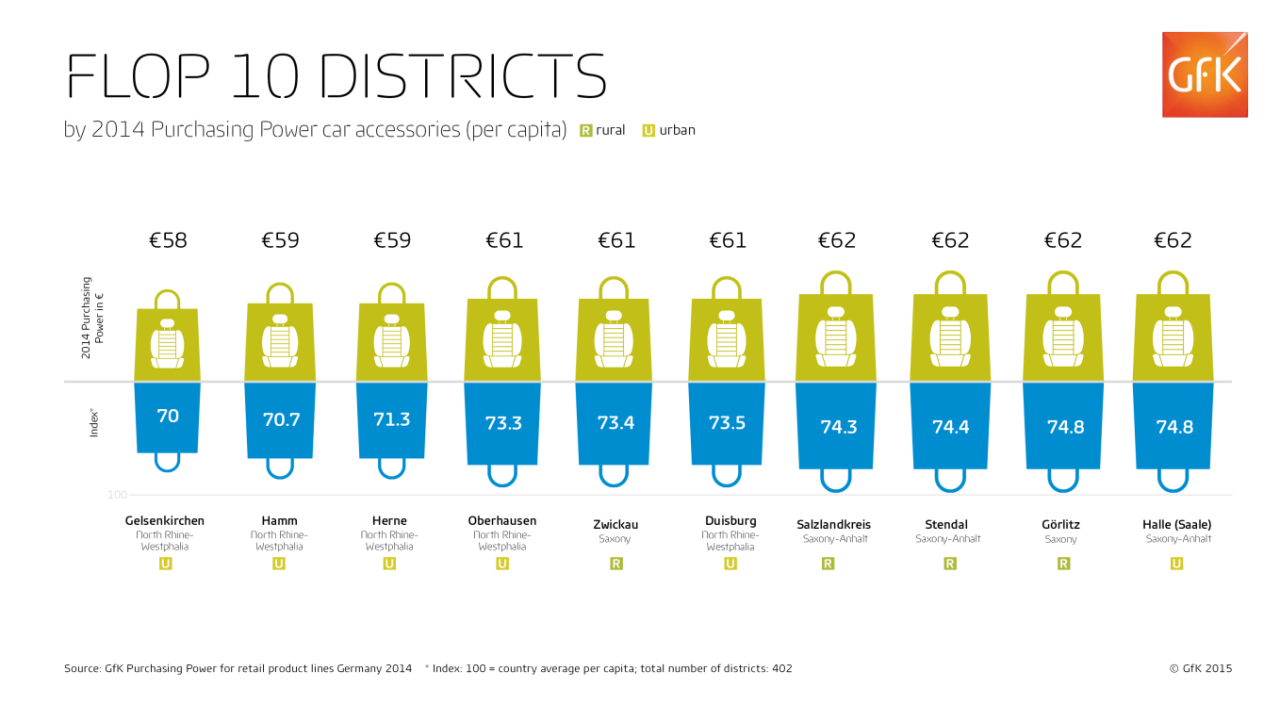

The regional potential for car accessories varies between €122 per capita in the rural district of Munich, and €58 on the other end of the spectrum in the urban district of Gelsenkirchen in North Rhine-Westphalia. Differently put: Driving to the future is much easier in Munich.

The number of Bavarian districts in the top 10 is remarkable, while the “flop 10” ranking is dominated by districts in North-Rhine Westphalia, Saxony-Anhalt and Saxony. Targeting marketing in Bavarian regions is a much safer investment than spending a lot on winning over the inhabitants in most regions of eastern Germany and NorthRhine-Westphalia. These market regions still have way to go.

Total HP is important

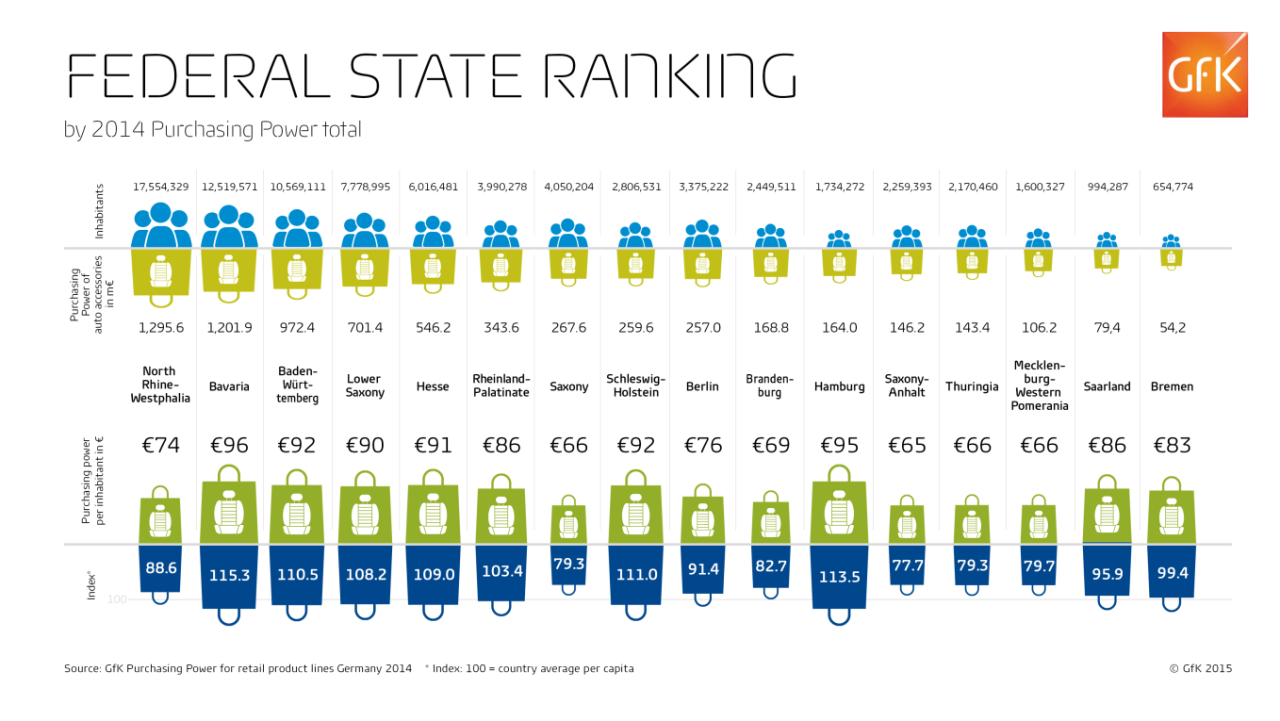

Like horsepower in cars, the total potential of a market is a very important indicator. A ranking of the German federal states by the purchasing power of automobile accessories yields another interesting perspective on where retailers and manufacturers are likely to make the highest turnover. (NB: Purchasing power is measured at consumers’ place of residence, not at the point of sale. But when looking at larger market regions like the German federal states, with this retail-line it is fair to assume that any potential that is turned into turnover will be “near home”, and not in a distant shopping location).

Thanks to its many inhabitants, North Rhine-Westphalia takes the top place, despite a sub-average per-capita purchasing power for car accessories. And with an only slightly above-average per-capita potential, Rhineland-Palatinate achieves a total potential of €343 billion, placing it well ahead of Schleswig-Holstein, which features a per-capita potential 11 percent above the national average but has 1.1 million fewer inhabitants.

If you have a passion for excellence, such facts are important for expansion and retail network planning as well as category management.

Nevertheless, if you want a better way forward, to understand your regional markets, you need to know – like with cars – what is behind their “horsepower”. E.g. is it based on a 6-cylinder engine (high per-capita purchasing power), or on an overbred 3-cylinder – corresponding here to a low per-capita purchasing power that is only boosted up to an impressive total by sheer number of inhabitants.

In this way, you can be sure to conceive investment, expansion and marketing strategies which keep your success going and going and going, just like a German quality car.

Download

Download our German purchasing power for automobile accessories map here.

Get more insights

Markus Frank is Senior Sales Consultant, Geomarketing at GfK in Germany. To gain the full insights and benefits from our detailed study contact us.

For more about our offerings, visit our Automotive and Geomarketing pages.

AUTOTALK newsletter

Discover latest industry insights, market data and how Auto and Consumer trends will affect your business. Sign-up for AutoTalk.