The connected car will be a reality within a few years, as enhanced safety, economy and entertainment become standard features of most new vehicles. So how do Americans feel about the car of the future?

In this extensive global project carried out at the end of 2014, we interviewed 5,800 consumers in six key markets – Brazil, Germany, China, Russia the UK and the USA – to find out what the future really looks like for consumers, automotive manufacturers and the wider supply chain. We asked Americans about their attitudes towards driving now and their thoughts about expected future innovations.

Despite being the country associated with open highways, road movies and Route 66, just 50% of Americans feel happy driving. The only nationality less happy is the British at 43%. That is despite the fact that more Americans than any other nationality in our study fall into the category of “light driver”, spending only one to two hours per week in the car. 40% of Americans do this, while 40% of drivers in China and Russia spend seven or more hours a week behind the wheel.

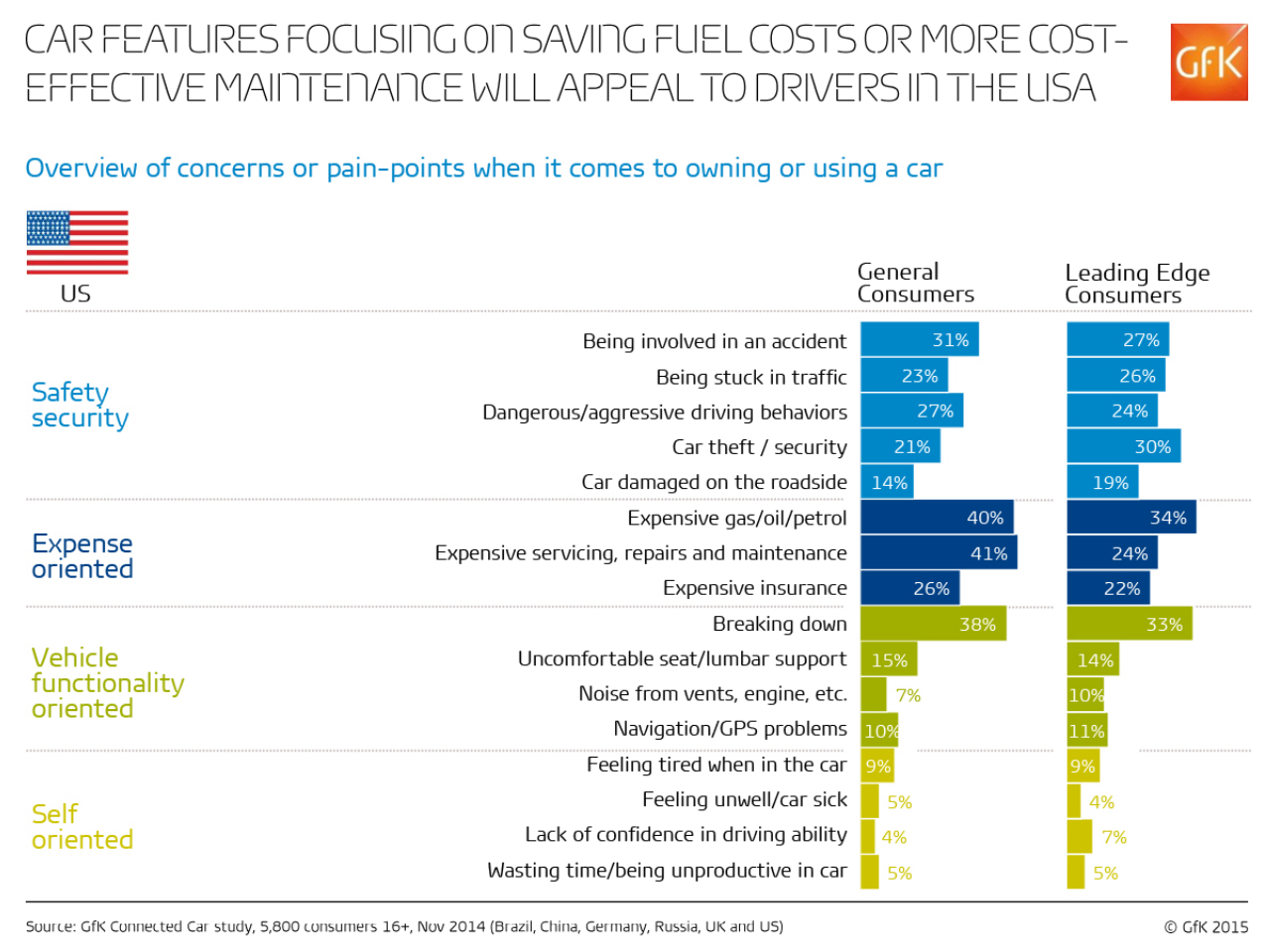

Driving pain-points

The top pain-points for consumers in the U.S. relate to the expense of running a vehicle – the high cost of maintenance, servicing and repairs (41%). The cost of fuel (40%) and the fear of breaking down (38%) are the following key concerns. Being involved in an accident comes fourth on their list at 32%.

There are some differences for Leading Edge Consumers – a group of early adopters who are passionate about the auto-tech industry and influence others. For this audience, car theft and being stuck in traffic are more of a concern, while the cost of fuel, servicing and insurance are less so compared to all consumers. Looking at worries around vehicle functionality in particular, Leading Edge Consumers are more worried about noise – such as noise from the engine and vents – but less concerned about breaking down than the general consumers.

What Americans want from a car

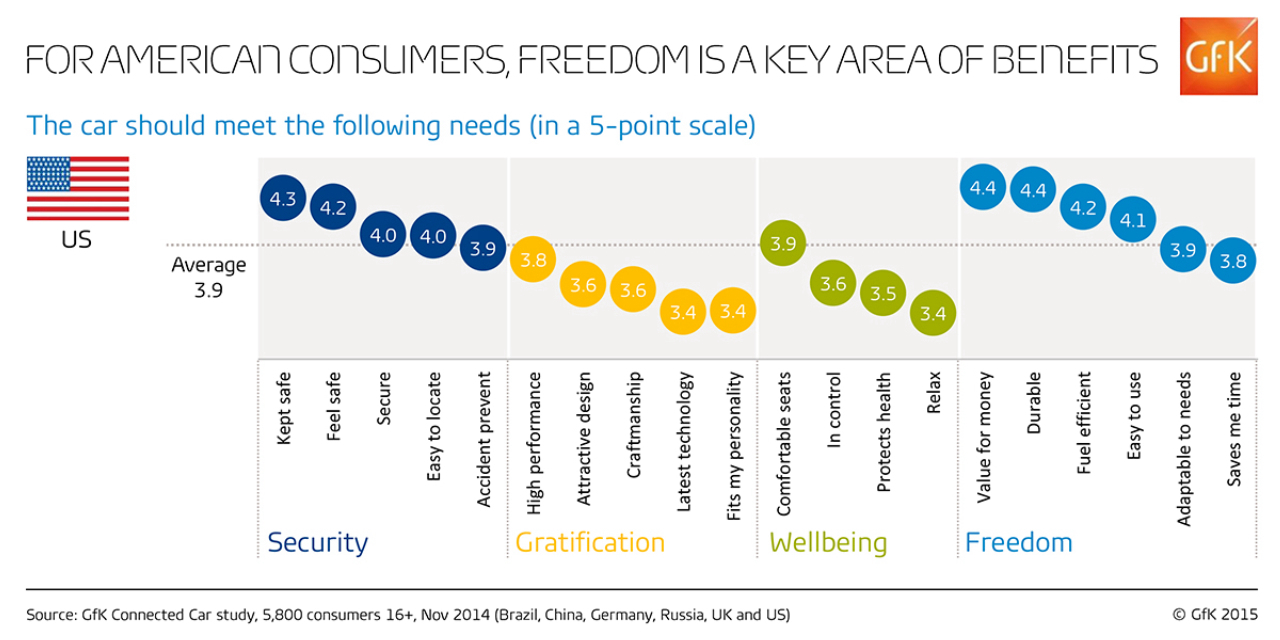

The cost aspect of running a car is not only a prime concern, but drives what Americans need and want from a car. They rank value for money and durability jointly as their number one consideration, followed by safety. The look of the car and whether it has the latest technology is less important to Americans than Russians, for example, who are highly image conscious when it comes to cars.

When we look at security, gratification, well-being and freedom as an index, we can see that freedom ranks highly – namely value for money, durability, fuel efficiency and ease of use. Gratification and well-being overall are less important and manufacturers of tomorrow’s car will want to ensure they understand these consumer viewpoints.

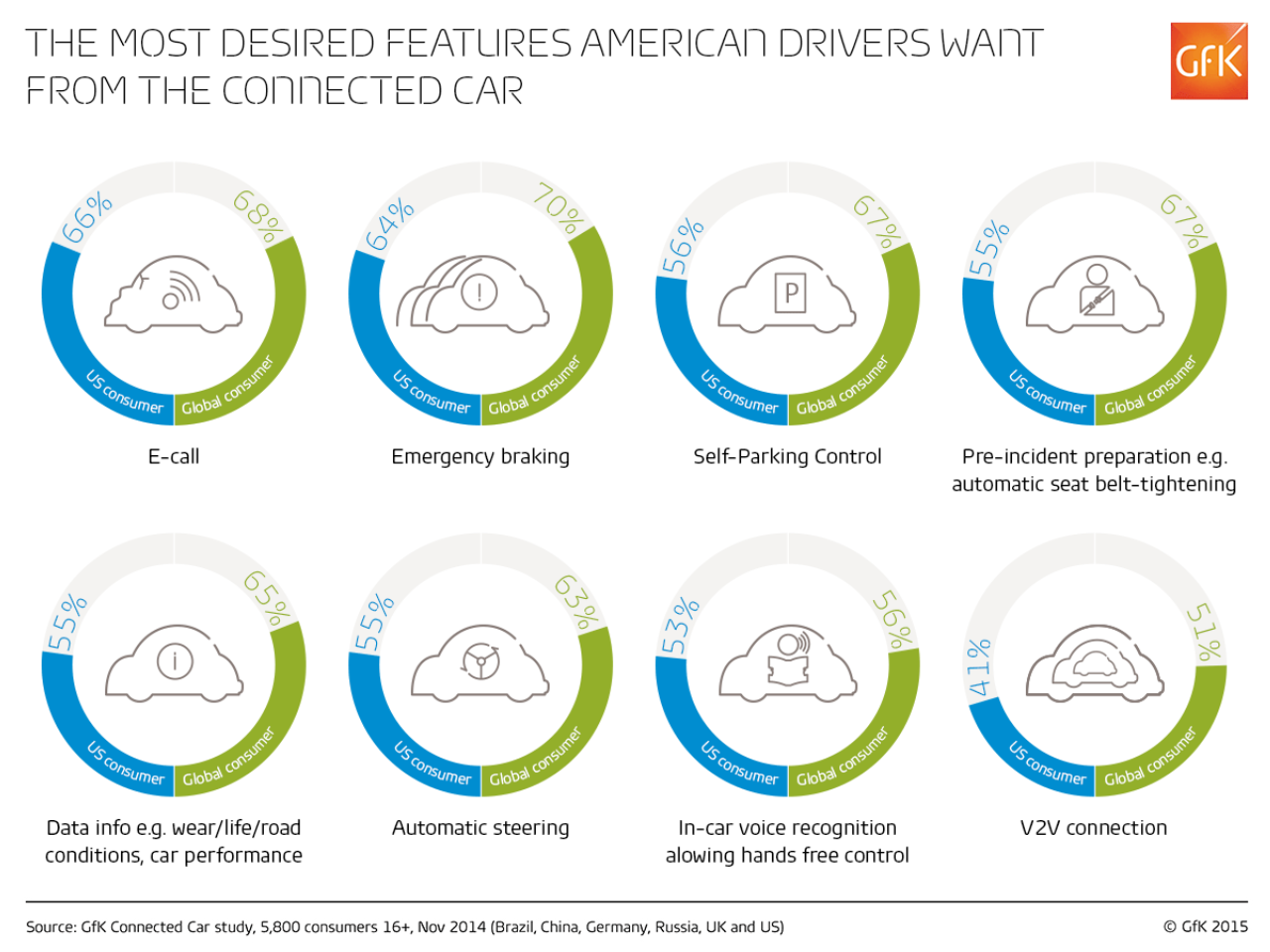

Americans most desired features

- 66% are interested in emergency calling (e-calling)

- 64% are interested in emergency braking

- 56% are interested in self-parking controls

- 55% are interested in pre-incident preparation

- 55% are interested in automatic steering

- 55% are interested in a car that can sense and communicate key data

- 53% are interested in in-car voice recognition

Evaluating transportation concepts in the connected car

Of the seven new concepts that the connected car offers, American drivers rank “Ultra Safe” as most appealing (51% – a car that connects with other cars and has integrated safety cameras), followed by “Data Tracker” (38% – a car that tracks usage, runs diagnostics and records accident data) and “Self Driving” (38% – a car that drives completely autonomously) in joint second place. But are American drivers prepared to pay for the numerous capabilities of tomorrow’s connected car? Less than half (40%) would pay more for Ultra Safe, while less than a third (30%) would pay more for Data Tracker. Knowing that Americans are especially cost conscious provides opportunities for manufacturers of connected car vehicles that can meet the needs of their “wallets”.

Background Leading Edge Consumer

See our infographic about the Leading Edge Consumers and how they are driving the connected car market. Leading Edge Consumers are the consumers who are most likely to shape the future – those are early buyers, who are passionate about the auto-tech industry, and/or they influence others.

Get our Connected Car report:

Don Deveaux is Managing Director Automotive at GfK in USA.

GfK’s Connected Car Report:

Download our free preview report or get the full insights in our global report, which is available to purchase now. It contains detailed market-by-market analysis and brand specific insight. For your definitive guide to the road ahead or any further information, contact us.

For more about our offerings, visit our Automotive pages.

AUTOTALK newsletter

Discover latest industry insights, market data and how Auto and Consumer trends will affect your business. Sign-up for AutoTalk.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)