The connected car will be a reality within a few years, as enhanced safety, economy and entertainment become standard features of most new vehicles. So how do the Chinese feel about the car of the future?

In this extensive global project carried out at the end of 2014, we interviewed 5,800 consumers in six key markets – China, Brazil, Germany, Russia the UK and the US – to find out what the future really looks like for consumers, automotive manufacturers and the wider supply chain. We asked Chinese drivers about their attitudes towards driving now and their thoughts about expected future innovations.

Chinese drivers are “happy” drivers but still have worries

Chinese drivers are the most positive about the experience of driving compared to other countries in our survey. Almost two thirds (62%) of Chinese drivers feel happy about driving and 70% describe themselves as “peaceful” behind the wheel. This is despite the fact that 40% of Chinese drivers spend more than seven hours per week behind the wheel compared to an average of 31% of drivers across all markets in our survey.

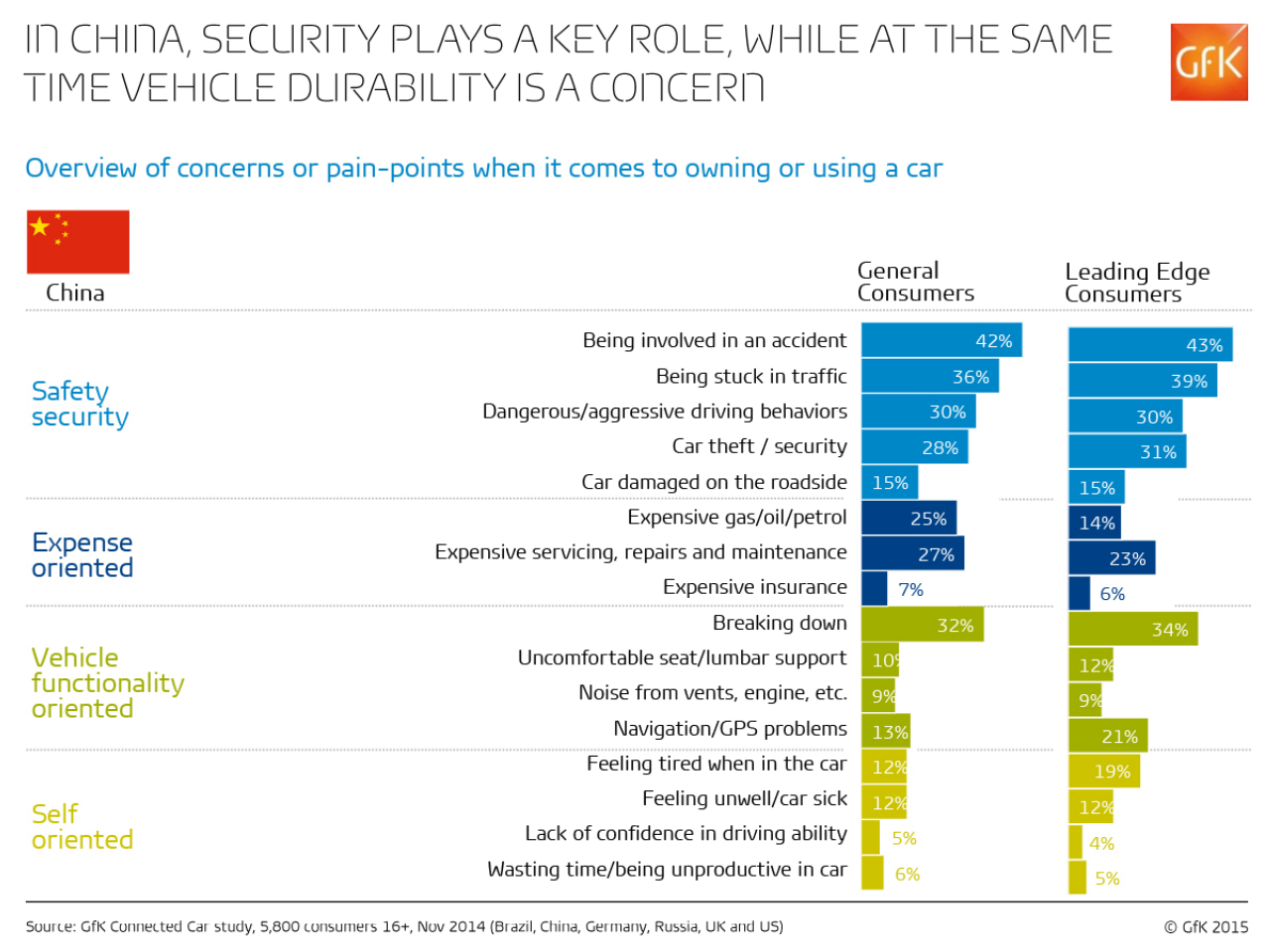

Despite this positivity about the driving experience, there are still pain points. Three of the top concerns for the Chinese relate to car safety and security. For 42%, being involved in an accident is their chief concern – followed by being stuck in traffic (36%) and breaking down (32%). Dangerous/aggressive driving behavior is also a worry for 30%.

There are some differences for Leading Edge Consumers – a group of early adopters and influential consumers. The research shows that for this audience, the cost of fuel and servicing and repairs is less of a worry. For “Vehicle functionality oriented” attributes, problems with navigation/GPS, breaking down and uncomfortable seating are more of a concern for Leading Edge Consumers, as is feeling tired when in the car.

What Chinese drivers want from a connected car

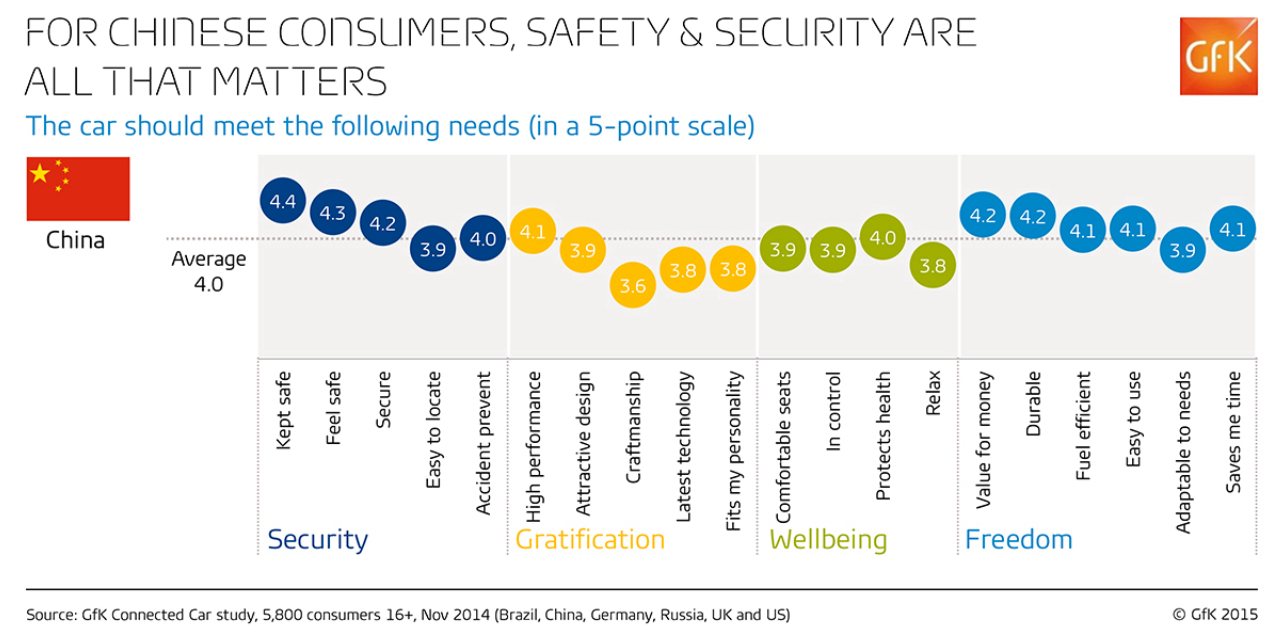

Safety/security and expense are not only prime concerns, but influence what Chinese consumers need and want from a car. Chinese consumers are far less focused on comfort, easy usage and quality than drivers from the other countries in our survey. When considering what they want from a connected car, they rank being kept safe as their number one consideration, followed by feeling safe and secure, value for money and durability. Fuel efficiency, high performance and ease of use follow are all thought to be equally important. The look of the car and whether it has the latest technology are less important to the Chinese than, for example, the Russians, who are highly image conscious when it comes to cars.

When we look at Security, Gratification, Well being and Freedom as an index, we can see which features meet key areas of need. Safety features will become standard hygiene factors, so it’s important for brands to understand that in China, Freedom and Gratification also rank highly. China is the only market where Gratification is considered as almost important as Security and Freedom.

Chinese drivers are interested in safety and security features:

- 82% are interested in emergency braking

- 79% are interested in pre-incident preparation such as automatic seat belts

- 78% are interested in self-parking controls

- 78% are interested in emergency calling

- 76% are interested in a car that can sense and communicate key data

- 75% are interested in automatic steering

- 66% are interested in car-to-car connection

Increased safety is the most appealing element of a self-driving car for Chinese consumers, with 56% rating it as the most appealing element. Of the six countries in our survey, consumers in the US and UK say the idea of autonomous driving makes them feel the most anxious and powerless. Chinese consumers are close behind, with 26% of respondents saying that it makes them feel anxious and 27% that it makes them feel powerless. So while the concept appeals, there are concerns to be addressed.

Of the seven new concepts that the connected car offers, Chinese consumers identify as most appealing “Ultra Safe” (73% – a car that connects with other cars and has integrated safety cameras), followed by “Data Tracker” (61% – a car that tracks usage, runs diagnostics and records accident data), and “Self Driving” (60% –an autonomous car, usually electric). Self Driving is a higher priority for the Chinese than any other nationality in our survey.

Are Chinese consumers prepared to pay for the numerous capabilities of tomorrow’s connected car? The good news for car manufacturers is that most are willing to pay more for any connected car solution. Nearly four fifths (78%) of Chinese consumers would pay more for “Ultra Safe”, while more than two thirds (68%) would pay more for “Data Tracker”. Knowing that the Chinese are safety and cost conscious provides opportunities for manufacturers of connected car vehicles that can meet those needs and provide reassurance about the self-driving experience.

Background Leading Edge Consumer

See our infographic about the Leading Edge Consumers and how they are driving the connected car market. Leading Edge Consumers are the consumers who are most likely to shape the future – those are early buyers, who are passionate about the auto-tech industry, and/or they influence others.

About the author:

Simon Wang is General Manager Automotive APAC & China for GfK.

Get our Connected Car Report:

Download our free preview report or get the full insights in our global report, which is available to purchase now. It contains detailed market-by-market analysis and brand specific insight. For your definitive guide to the road ahead or any further information, contact us.

For more about our offerings, visit our Automotive pages.

AUTOTALK newsletter

Discover latest industry insights, market data and how Auto and Consumer trends will affect your business. Sign-up for AutoTalk.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)