In a world increasingly active online, more and more questions arise to define the ‘digitally savvy’ population. We know Millennials, those reaching adulthood around the year 2000, have been born into a digital world, but are they more engaged with e-commerce brands?

Using Millennials as a target group has been criticized, as marketers broadly categorize individuals at different life stages, with different interests and attitudes. However, this cohort of digital natives have already shown differentiating behavior in terms of social media usage, gaming and life priorities including health, marriage, having children or buying a house. For all the myths, Millennials are one of the largest consumer groups in history, they have an affinity with technology and are about to reach their prime working and spending years (Goldman Sachs).

The E-commerce Elite

Each year InternetRetailing UK releases a list of the top e-commerce and cross-channel retailers. We have taken the top 50 brands and added them to our GfK Crossmedia Visualizer platform to see how behavior varies among different age groups.

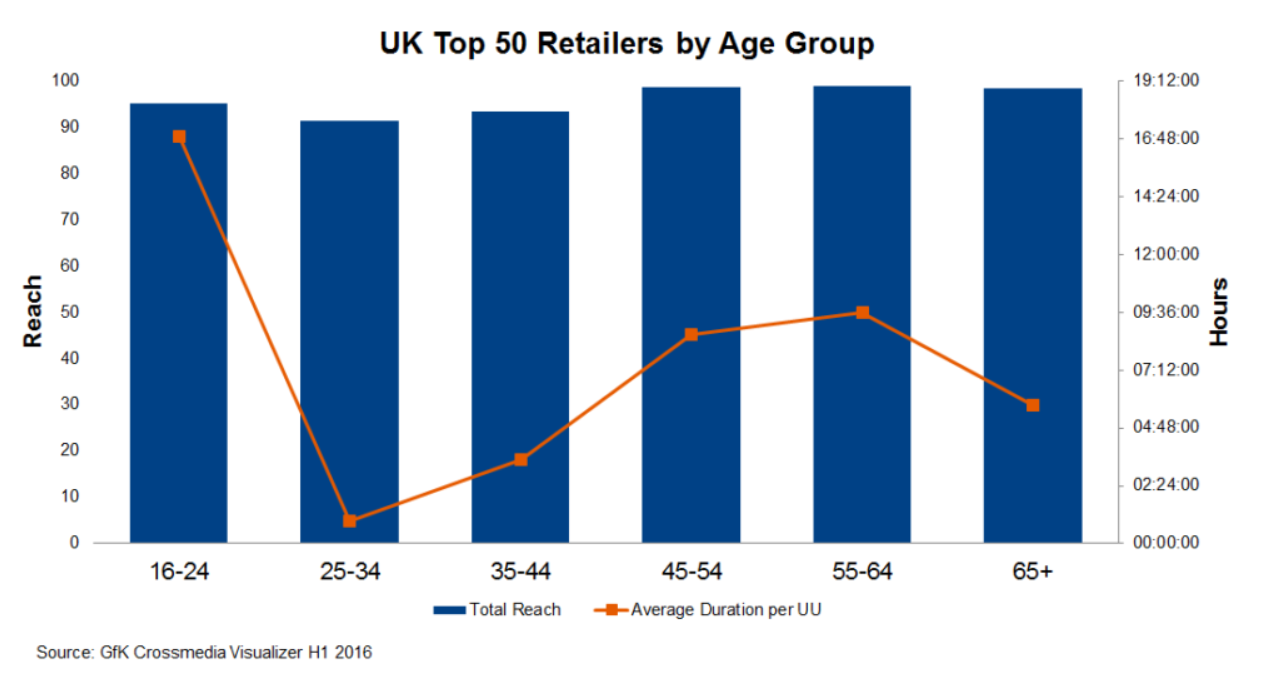

When looking at the UK online population during the first half of 2016, reach is the highest among the over 45’s, particularly females. This questions the extent to which larger e-commerce and cross-channel retailers have moved their marketing focus towards the Millennial demographic, querying the untapped purchasing potential of this target group. However, although reach among Millennials is lower, when looking at the average duration of time spent on these sites those in the young Millennial age group (16-24) over-index significantly. This reflects that although larger retailers don’t reach as high a proportion of Millennials compared to other age groups, those they do reach are more engaged for a much longer duration.

This higher level of engagement is particularly noticeable for retailers in the areas of Fashion, Personal Care/Cosmetics and Animals/Pets.

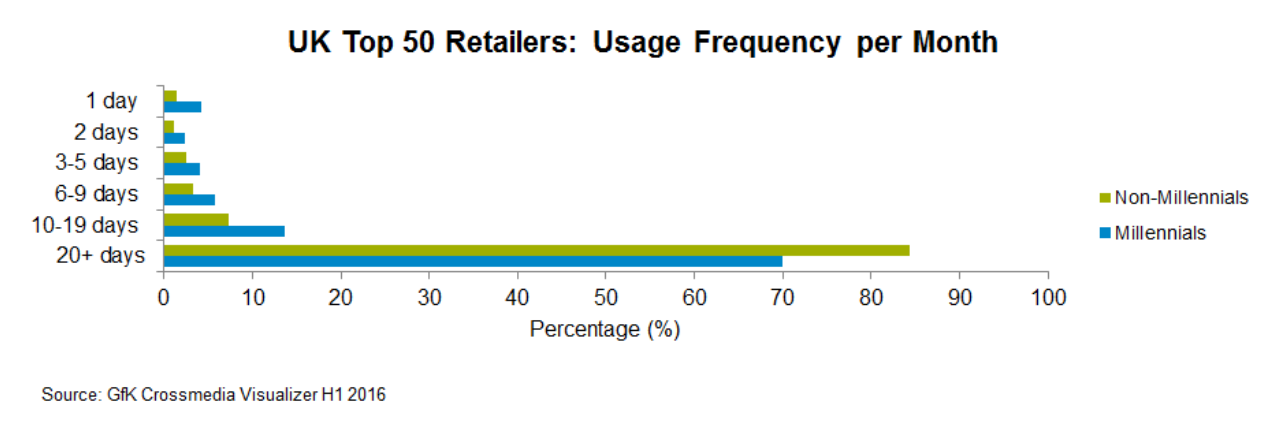

Although young Millennials (16-24) spend more time visiting these sites, they do so less frequently. Younger Millennials therefore may seem difficult to reach, but with engaging content should stay on site for a much greater duration of time.

So which retail sites have the greatest Millennial reach?

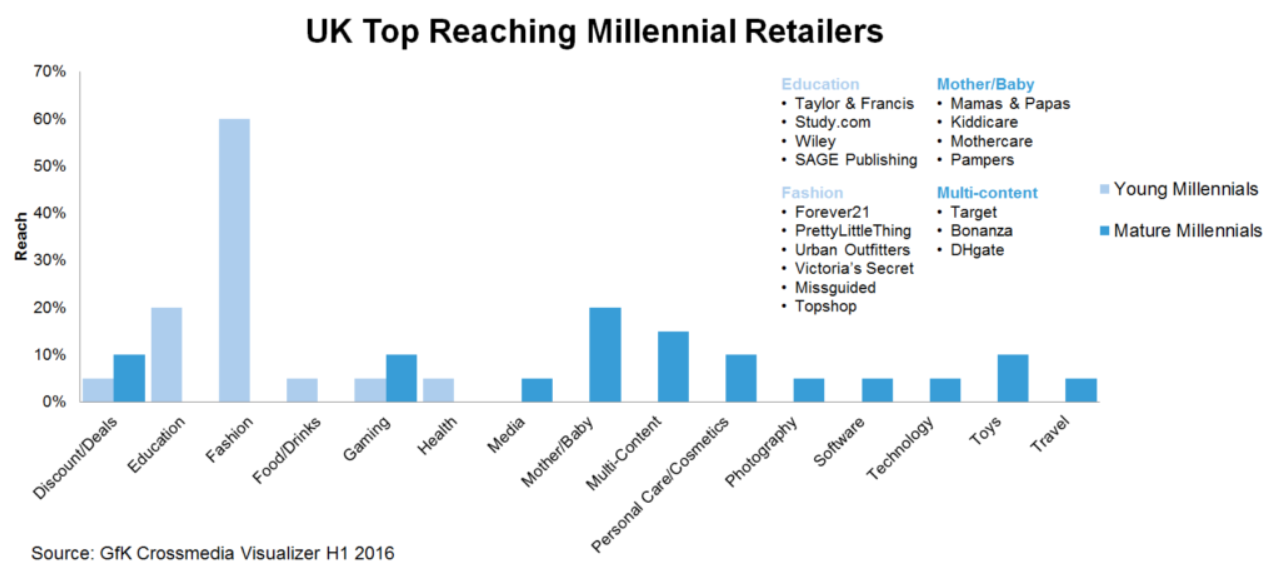

No demographic group is homogeneous, yet we still find distinct differences for young Millennials compared to other age groups. When looking at the top 20 retail sites that over-index for a Millennial target group compared to the average reach for the total UK online population, sites related to Fashion and Education have much greater reach for young Millennials (16-24). Combined these industries account for 80% of the top 20 sites.

In comparison, more mature Millennials (25-34) are attracted to a wider variety of e-commerce sites, visiting more general retailers including department stores and multi-content pure play brands. Mature Millennials also shop more for other people including children, engaged with sites relating to Mother/Baby and Toys. This pattern also follows for Millennial retail sites with the greatest level of engagement.

Young Millennials are the only demographic where the top 20 sites in terms of audience engagement are mutually exclusive to all other age groups. This implies that Millennials are primarily engaged with brands that directly target their age cohort, including Topshop, Forever21 and Student Beans.

Do Millennials need all or nothing?

When looking at the top 20 e-commerce retailers with the greatest Millennial reach and engagement we have found that sites are directly targeted at this specific demographic. Therefore if retailers want to target Millennials they will generate significantly greater levels of engagement with relevant, targeted content.

However, this is only the case for younger Millennials. We have found key differences in the e-commerce activity of young Millennials (16-24) and more mature Millennials (25-34). Younger Millennials spend a significantly greater amount of time per month visiting the top 50 retailers according to InternetRetailing UK. This is primarily due to Fashion, a key e-commerce industry appealing to young Millennials with brands providing targeted content. This demonstrates an opportunity for e-commerce brands to increase awareness and purchase intent, as the first digitally native demographic reaches its prime.

Deep drills into the UK’s top e-commerce and cross-channel retailers is just a starting point when getting familiar with your audience’s cross-media and cross-device usage. The above case study on Millennial e-commerce behavior is fully based on data provided by the GfK Crossmedia Visualizer. This cutting edge tool offers up to date, clear and deep insights into all relevant indicators of online usage across different devices (PC, smartphone and tablet). Moreover the internet usage data from this platform is linked to unique users’ consumer profiles, including all relevant socio-demographic data and further profiling attributes such as media usage, TV consumption and lifestyle data.

Amy Warwick is a digital senior research executive at GfK. For more information or to share your thoughts, please email amy.warwick@gfk.com.