In this series of blogs, we have teamed up with MOTIONTAG and leading industry experts to help cities understand the new realities and opportunities in urban mobility after lockdown. This first blog looks at what is currently happening and in our second blog, we’ll present different future scenarios and recommendations for actions that city transport and mobility planners can take.

We all know that the coronavirus has radically changed our previous travel behavior. But which of our new travel habits are likely to continue when urban mobility after lockdown is resumed? To show the size of the change, let’s look at how Germany’s nation-wide contact ban has changed the country’s travel behavior.

How urban mobility has changed and what will last after lockdown

Amongst the terrible harm that coronavirus is causing, there is a thread of opportunity for city transport and mobility planners across the globe. Consumers’ mobility habits are changing drastically as we avoid public transport and turn more often to bicycles or our own feet to make local trips. These new habits give city transport planners an opening to proactively sustain new desirable behavior, such as fostering biking and walking and avoid unwanted scenarios, such as people reverting back to individual cars for longer urban distances.

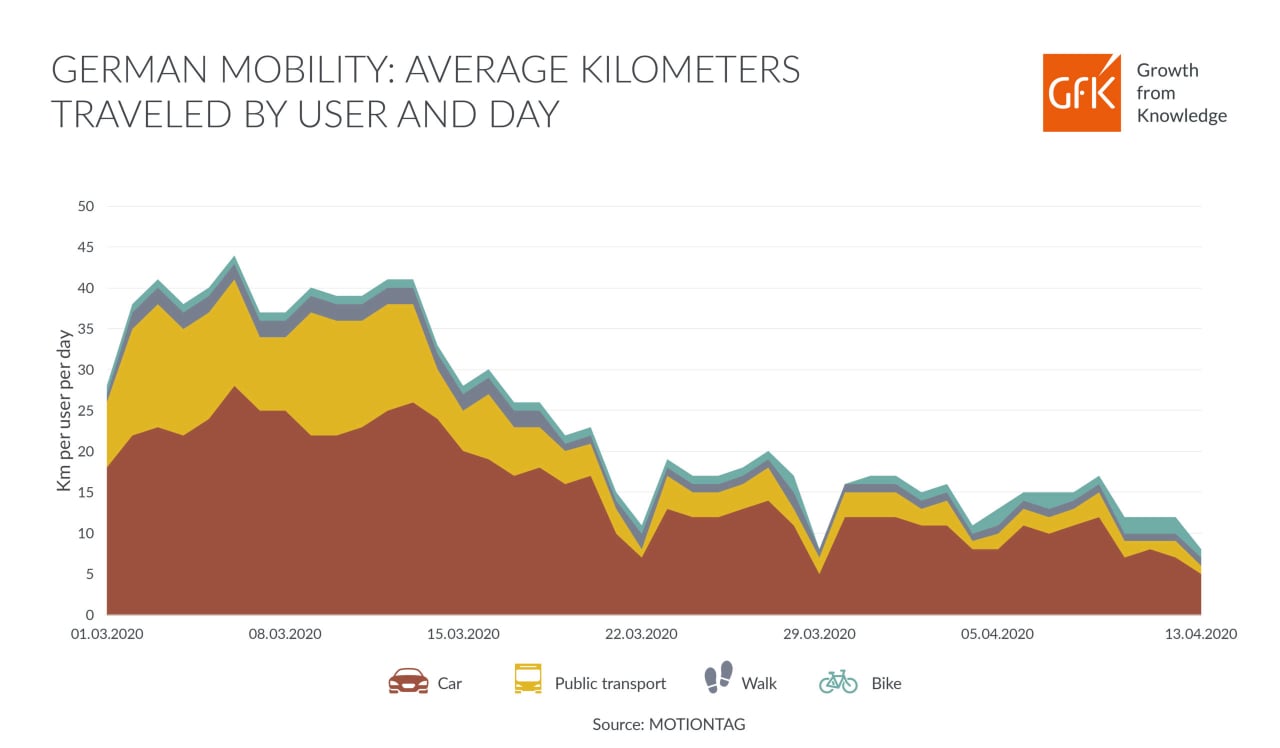

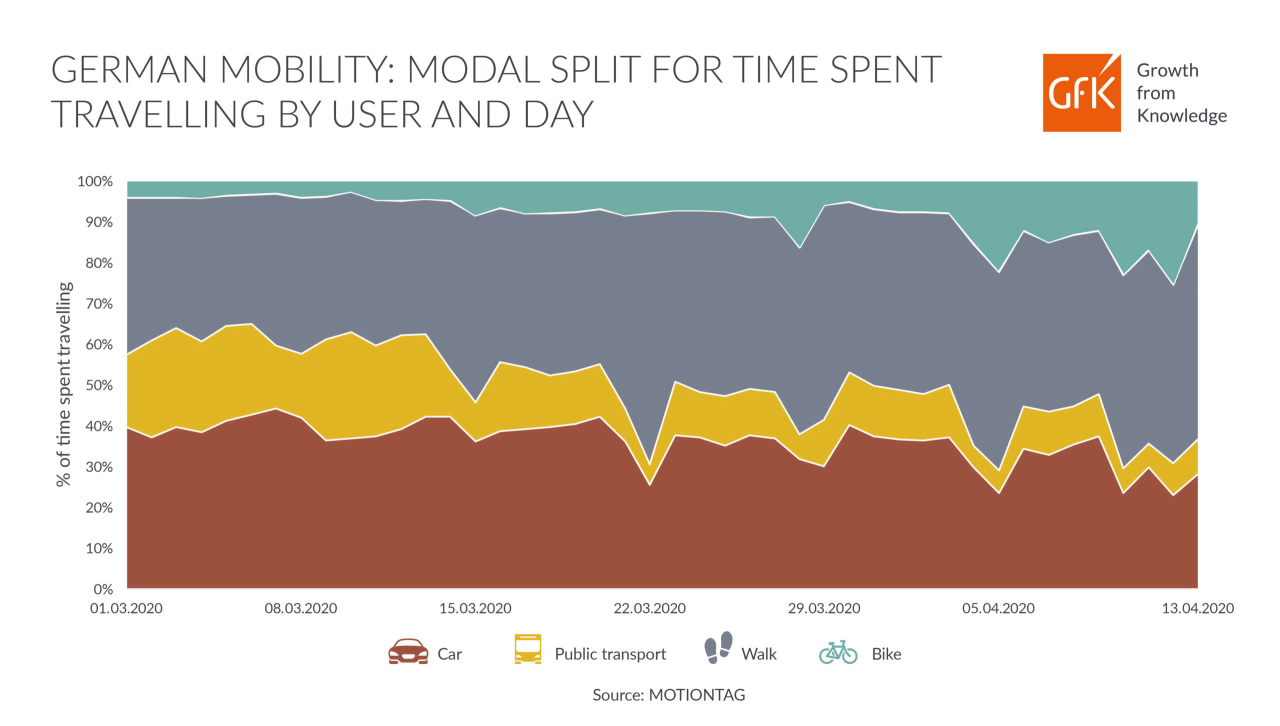

Germany imposed a travel ban on March 23rd and by the first week of April, the distance traveled per person per day fell from the usual average of around 40km to around 15km—and still falling. Added to this, there’s been a dramatic drop in the number of kilometers traveled on public transport, with people covering more distances on foot or bicycle instead.

Looking at this from the time point of view, people are now spending more than 25 minutes a day actively walking or cycling – up from their usual less than 20 minutes per day.

What we are seeing, then, is increased levels of short, local trips made by foot or bicycle, as people combine the need for physical exercise with the requirement to reduce contact and only leave their homes for essential trips. Cars are still in use, but with much-reduced mileage, as people do their food shopping locally, and commuting is restricted to essential workers where working from home isn’t possible.

How will changes in consumer behavior influence urban mobility after lockdown?

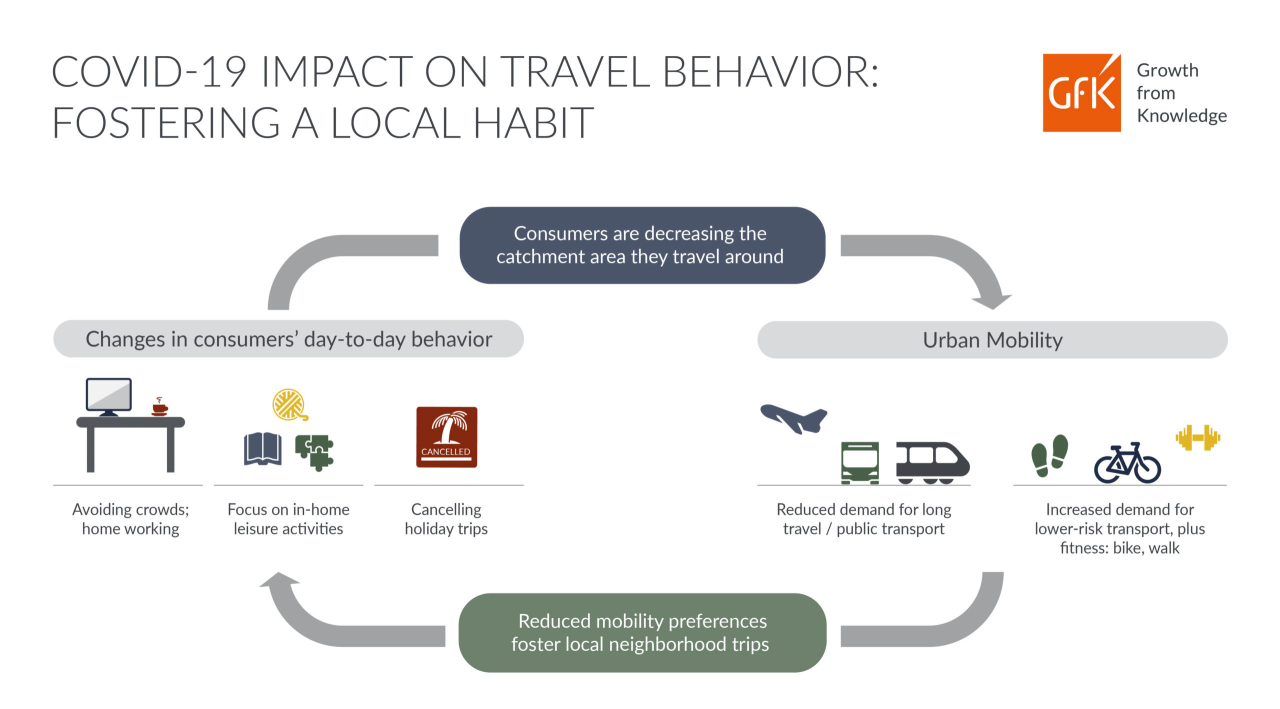

The decreased level of individual mobility is not the only impact, though. Consumers are increasingly adapting their daily behavior as lockdowns are prolonged – such as decreasing their travel radius and catchment area, and instead, spending more time in their local neighborhood and buying items to increase their in-home comfort.

While some of this, such as the commute to work, is likely to return to ‘normal’ when countries lift their restrictions, there are certain urban mobility habits that we’ll see after lockdown—and remain for a longer duration.

People have a new focus on the home as a place of stability and safety in the current deeply uncertain economic landscape. All across Europe, consumers are focusing their spending on in-home comfort and entertainment such as food preparation products—according to GfK Retail Tracking Panel, the total unit grew by 30% in the week ending April 4th (compared to the same time last year) as well as laptops and notebooks (+16%), TVs (+6%) and soundbars (+4%). And in our latest COVID-19 Consumer Pulse report, almost one-third of German and British consumers have already canceled a vacation or holiday trip that they had planned to take.

People have been forced into new ways of thinking

We have found walking and cycling routes to work so we can avoid public transport. The local neighborhood has jumped to the forefront of our focus for essential shopping, as local food shops not only avoid contact with crowds at supermarkets but also offer shorter queues to get inside.

Now that different travel habits have been tried and found acceptable, we expect a significant number of people to continue their local trips by foot and cycle, rather than public transport – especially if we are to enjoy a long summer of good weather. Likewise, the focus on local shops is likely to endure part lockdown as people have valued these during the hard times—plus, the urge to support small local businesses is high.

What is the outlook for city planners and mobility providers?

This is the question we are actively working on now and that’s why we have teamed up with some of the brightest minds and leading experts in this field. Alongside their frontward vision for urban mobility after lockdown, we are combining MOTIONTAG mobility data with our tracking of consumers’ economic confidence, purchases of in-home goods or services, and vacation cancellations or purchases.

Together, we are building future scenarios that mobility stakeholders and travel providers can use as a guiding framework for post-coronavirus crisis times to answer questions like:

- Will the ‘in-home first’ habits wear off quickly when the lockdown is lifted, or will these have a more enduring impact on people’s lifestyle and consumption patterns?

- Will the demand for mobility bounce back to the same level, above or below pre-coronavirus times?

- What will be the role of public transport going forward?

- What will be the role of shared mobility?

Check out our next blog for interviews with leading experts on the ‘new normal’ in urban mobility after lockdown. For more insights to master the crisis, go to our COVID-19 resource center.

About MOTIONTAG: MOTIONTAG creates value from motion data by providing anonymized insights into travel behaviors. This allows our clients to evaluate the profitability of actions – for example, by knowing what incentives are effective in curbing mobility-related CO2 emissions, and steering policy-making with precise, real-time data.

Be the first to read our next blog!