In times of great need and uncertainty, consumers expect more from brands, and may be quick to judge those that fall short. How can brands deepen their value to consumers? Many marketers, brand managers, and others are asking this question every day, searching for insight and inspiration. Our recent study of brand value and promise (GfK’s What’s Next 4 Consumers research series) revealed some striking discoveries about Americans today – and served as the basis for a far-reaching discussion with GfK experts on brand strategy, consumer trends, and digital transformation in the new marketplace.

The new shape of everyday life

Our research shows a polarization in US consumers, with some saying they have returned to their pre-pandemic lifestyle, others that they will be cautious for a long time to come – perhaps never returning to the life they led before.

We found that 57% of Americans plan to be cautious about resuming a more familiar, social way of life, while 21% “can’t wait” to do the things they used to. Yet US consumers are almost evenly split on how they are living now, with 53% saying they are “living normally as they did before,” while 47% report that “life has been very different”.

The disruptions and difficulties of the past year have also given many consumers new confidence and appetite for experimentation. Click-and-collect and contactless payments have become second nature. For brands, this can be a double-edged sword – an opportunity to gain ground or lose it.

The changing face of brand loyalty

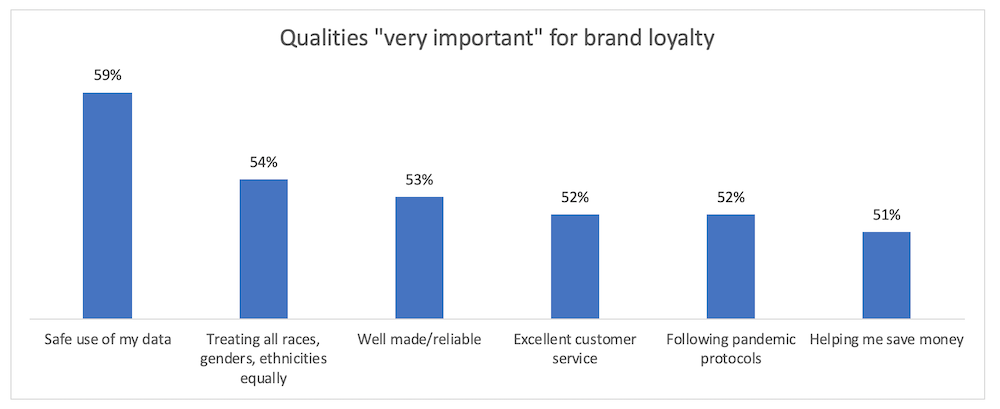

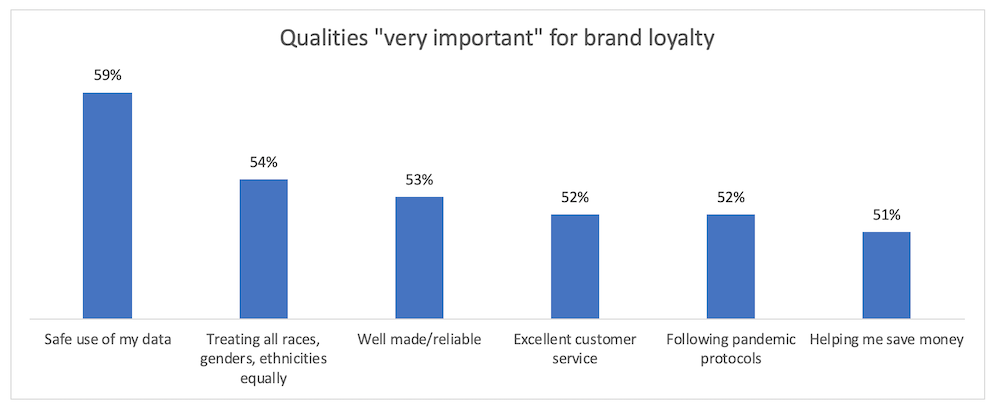

The pandemic, the social justice movement, and the economic collapse of the past year have rewritten the rules of brand loyalty. The good news is that brands still have great pull with consumers; almost nine in 10 Americans have at least a few favorite brands, and over four in 10 say they have “a lot of favorites.” When GfK asked people to rank the characteristics that make them loyal to brands today, the top concern was “safe use of my data” – cited by 59% – followed by “treating all races, genders, and ethnicities equally” (54%). Overall, four of the six highest-scoring brand benefits fell outside traditional considerations (such as product quality, customer service) and reflected 2020-centric concerns.

The past year has also seen consumers forced to try new products because of shortages. People who could not have imagined buying any other brand of paper towel or laundry detergent grabbed whatever was available. Similarly, shopping exclusively online made many realize that brand selections on ecommerce site are different than those in-store – meaning more adjustments. The implications for brand loyalty are profound.

“Let’s not look for a new status quo. I think what we’ve learned from all of this is that brands need to continue innovating. If the discussion is, “How do we get back to normal?” you’re missing the point. What we learned from the pandemic is that we need to pre-empt situations by keeping the innovation channel open at all times.”

—Eric Wagatha

Resonating with new consumer concerns

There have always been consumers who looked to brands for leadership and action in social causes – and mostly companies have responded with traditional, somewhat predictable activities. But the past year has put brands in a sometimes-uncomfortable spotlight; they are expected to act more urgently and with greater sincerity, but also at risk of criticism across social media for any missteps. So how can brands move forward wisely to become winning brands?

GfK found that Americans are divided on brands and social activism. While over half said that treating all races and genders equality is essential for establishing brand loyalty, one-third said they “frequently” avoid certain products or services because of their social positions. This split is also clearly generational, with research from GfK Consumer Life showing that Millennials and Gen Z look to brands to take social action – even if they disagree with their positions – while older consumers would rather brands stay neutral.

“I think what consumers are really looking for from brands is not to take a definitive stand on one side of an issue or the other, but just to position themselves with some humanity, with some decency.”

—Amy Wills

What we really know about tomorrow’s consumers and the new marketplace

So many of the hopes and plans of today’s brands revolve around tomorrow’s buyers. Millennials, and especially Gen Z, have become nearly the sole focus of many mainstream companies – and marketers may have felt that they were beginning to understand the youngest generation of consumers. The events of 2020 have changed all that.

Americans in the 16-to-35 age group were 60% more likely to be affected by layoffs and furloughs during the past year versus those aged 35 to 50. And even though they are more likely to have had their hours restored, the longer-term impact of this experience will continue influencing their behavior as consumers.

Younger consumers also appear divided about their shopping strategies. While they are slightly less likely than average Americans to say they will buy “whatever is convenient or inexpensive”, they are also more likely to say they will switch away from a favorite brand. In our recent study of consumer attitudes, they scored lower on all characteristics of brand loyalty – meaning that brands have a harder time “sticking” to this group.

Step towards a richer future

What should brands remember as they make plans for 2021 and beyond? Clearly, brands still hold huge influence – but no one should be feeling like they have the post-pandemic world fully mapped and charted. Remember:

- Loyalty matters but the terms are constantly evolving and shifting.

- Different types of consumers are moving ahead at different paces.

- Risk is welcome, so keep innovating and evolving.

- Engaging with the world is essential, but don’t overestimate the license consumers have given you to speak out and act up.

- Measure more often to be attuned to unfamiliar signals from groups you thought your understood. Consumers are changing all the time.