The potential for hybrid work models has been a topic of debate since the internet launched. And while we had the capacity, not even the most innovative tech companies fully embraced the idea until the coronavirus pandemic began. Since then, this radical way of working has become mainstream — progressing from being a solution to an emergency, to a new flexible, sophisticated, and productive reality. While the coming years won’t see company HQs abandoned, neither will we witness a return to traditional office life. As ever, the future isn’t this or that — it’s this and that.

Each organization will try to find its optimal place on the spectrum between a centralized physical space, and an entirely digital, distributed network. Wherever businesses position themselves, it’s clear that industries have been drastically altered by widespread working from home, and the Consumer Tech and Durables sector is no exception. The sector has thrived — technological innovation and overarching cultural trends have been supercharged by the pandemic to create a perfect storm of demand.

The global surge in home offices has reshaped the Tech and Durables landscape, driving consumers to outfit their houses as both productive work environments, and seamless, upgraded hubs for leisure, education, and health. 2022 still carries the potential for further growth, but there are risks that decision-makers will need foresight and ingenuity to overcome.

How has working from home impacted the Consumer Tech and Durables sector so far?

As lockdowns were implemented across global societies, workers who were able to maintain their income without physical attendance acclimatized to a new remote reality. Office life was substituted for crouching over laptops at kitchen tables and liaising with colleagues on Zoom. For these workers, the home became a place that had to satisfy a never-before-seen demand for both productivity and leisure.

This triggered a sales boom in Tech and Durable products, powered by peoples’ urge to upgrade their homes into all-encompassing hubs. With working from home emerging as a new, permanent way of life, consumers invested and have continued to invest in preparation for a hybrid future. According to GfK data, global sales in the sector reached $646bn between January and September in 2021, an 18.1% increase on the same period in 2020. While this might seem unsurprising, these global sales figures are 14% higher than the first seven months of 2019, a period wholly unaffected by COVID-19.

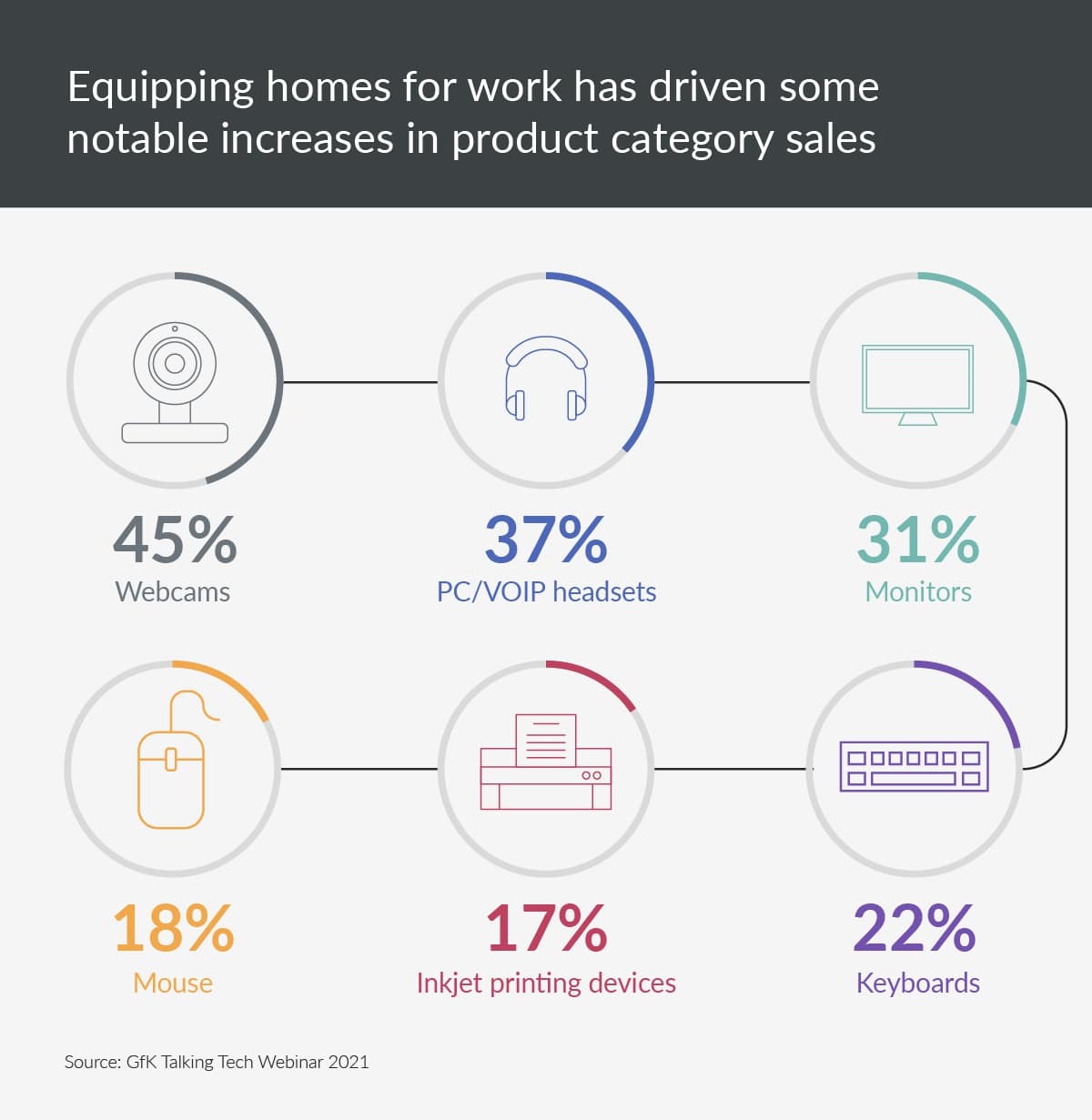

Data shows that shoppers were willing to spend money on essentials that made their home office more productive. When compared to the first nine months of 2020, January to September 2021 saw sales of items that enhance the work from home desk jump: webcams increased 45%, monitors 31%, and PC/VOIP headsets 37%. But beyond the assignments, projects, and meetings, working from home has amplified the demand for some of life’s pleasures too. In the same months, sales of hot beverage makers increased by 44%, while gaming mice saw a 79% increase.

“If I told you at the beginning of 2020 about lockdowns, and school and office closures, you’d have feared a complete economic collapse,” says Warren Saunders, President of Global Sales at GfK. “Without detracting from the terrible hardship experienced by so many, from a purely economic perspective, given the scale of the challenge the industry faced, T&D has remained impressively resilient.”

What do the coming quarters hold for the sector?

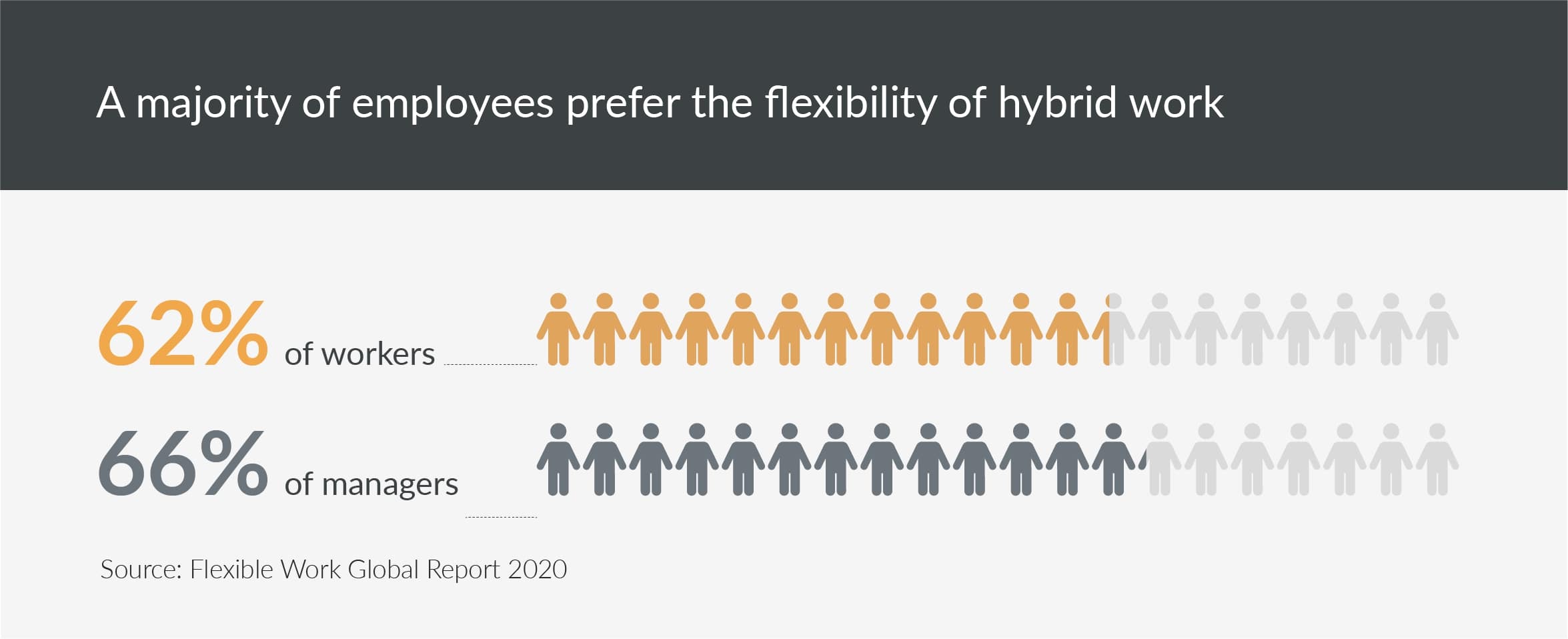

With 2022 in sight, it’s clear that a balance of office and remote work is favored by most. Of staff polled by GfK, 62% of workers and 66% of managers say that while they would prefer to work mostly from home, they would still like to visit the office at least one day a week. In Europe, GfK data reveals 84% French, 74% British, and 72% Germans who worked from home in 2020 would like to continue to do so.

The continuation of hybrid work patterns is good news for the T&D sector, but analysts are beginning to see signs that the rate of growth might slow, at least beneath the double digits experienced in 2021. “In the last months we’ve seen companies announce their work-at-home policies, so people will now know how they’re going to work in 2022,” explains Jan Lorbach, Senior Global Strategic Insights Manager at GfK. “Also the current spikes of new corona cases in many regions, especially in the northern hemisphere, forces many companies to return at least temporarily to stricter work from home policies. This development could mean a short-term renewed lift in sales, but the growth rate is likely to stabilize quickly as the year goes on.”

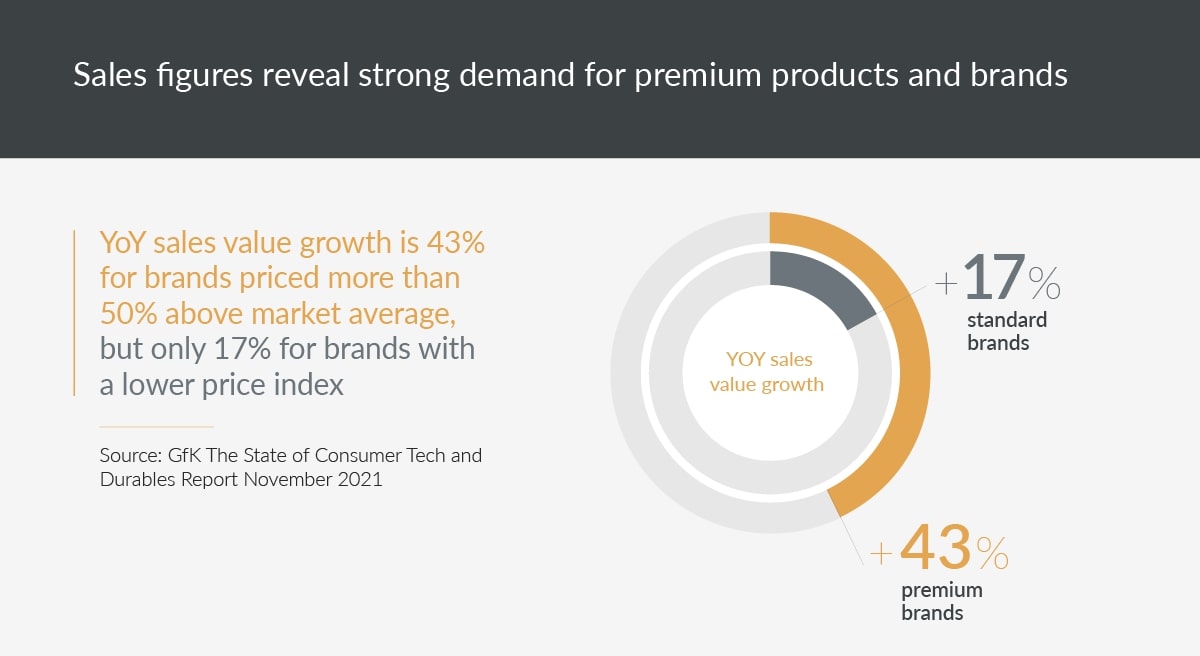

Saunders agrees that growth is likely to be present but slowed, and points to a potential strategy to reach shoppers even as demand wanes — offering them premium products as they seek to upgrade. “Lockdowns have meant consumers had a large amount of disposable income, which has been great for the more premium brands,” he says. “I think we’ll see that continue, certainly into the first half of 2022, before we return to a more normal cadence of work-life or travel.”

What are the obstacles to growth in the coming quarters?

While the pandemic and its aftermath have brought significant gains for brands in T&D sector, the coming quarters present myriad obstacles, and to sidestep them, decision-makers must be prepared.

Supply chain disorder

The most widespread issue is supply chain breakdown, where global and local disruption means that meeting demand will become an intensified challenge. New workforce solutions, logistics networks, and resilience programs are being configured to manage these uncertainties. But such measures take time to form, and in the short term, some companies will feel tempted to hike prices to generate revenue. This will stem demand but could result in damage to brand and market share.

Overstocking is another solution that brands might turn to. But this strategy contains flaws — pre-loading retailers and channels with specific itineraries represents a scattergun approach and is likely to result in products deployed in locations that are not optimized for profit.

A lack of visibility and foresight causes companies to overstock, warns Lisa Wiltshire, Insights & Foresights Principal at GfK. The solution? Better intelligence: “The challenge is gathering the intelligence to make the right inventory calls six to twelve months in advance,” she says. “Therefore, understanding consumer demand and market trends is critical. Predictive, high-frequency data is the only way to navigate the unpredictability of the current environment.”

Market Saturation

Many Tech and Durables products have a lifespan of multiple years, and the consumers who purchase them have had almost two years to equip their new work from home setups. Already, GfK is detecting a deceleration of growth in 2021 in comparison to 2020. For instance, in office products, 2020 saw a jump of +24% in growth on levels recorded in 2019. In 2021, there is forecast to be less growth at +17% by year-end. A similar pattern can be observed in Small Domestic Appliances. These saw a 15% rise in 2020 and a 9% rise for 2021. Consumer electronics, however, exhibited soaring figures between 2020 and 2021 – increasing by 15% year on year. This represents a huge boost in comparison with the year before (2019 to 2020) where growth edged up by 2%.

There is still significant growth for businesses to take advantage of, far above pre-pandemic levels, but these figures are a sign that some deceleration is on the horizon. Markets are unlikely to witness another vast increase in the number of hybrid workers, as they did in 2020. With hybrid work lifestyles already established, and with many of the products that support those lifestyles already bought, brands must prepare to meet consumer demand in new places.

Retail channel disruption

Accepted modes of selling are shifting post-pandemic. According to GfK data, online retail in Tech and Durables was up 25% from January to September this year compared with 2020. A return to pre-COVID brick-and-mortar shopping behavior is highly unlikely – 63% of global respondents surveyed by GfK purchased items online to avoid going into the store last year and say they plan to continue this behavior.

“Strategically, there are several directions for brands in the Consumer Tech and Durables sector to pursue,” says Gonzalo Garcia Villanueva, GfK’s Chief Marketing Officer. “That is brand growth, market understanding, and forecasting. But at the top of these moves is the rolling out of e-commerce.”

A renewed consumer focus on value for money

While hybrid working has yielded a favorable environment, there are signs that a more prudent spirit is returning to consumers who are becoming more focused on value for money. GfK’s Consumer Life 2020 report found that globally, ‘Thrift’ — being economical, careful with money and avoiding excesses — was ranked 32 of 57 guiding principles of life. In the following year’s Consumer Life 2021 report, it had risen 2 places in relative importance, to number 30. The same report from 2021 picks up on themes of decluttering: 36% of global consumers agree “I prefer to own fewer but higher quality items (clothes, technology products, etc.)”.

Rising sustainability standards

There are rewards for brands that develop sustainability as a core pillar of their product, business practices, and marketing, but at the same time, there are very real risks to those that fail to meet increasingly stringent consumer sustainability standards. Customers are more rigorous than ever in the products they choose, seeking out information on everything from materials used in production and packaging, to energy and transport miles required for delivery.

The demand is inconsistent across geographies and demographics, but the direction of travel is clear. In 2011, 30% of millennials considered the environment when making purchase decisions, but in 2021, 49% of Gen Z does. GfK’s Green Consumer Europe report shows that consumers are actively searching for brands that make environmental action easy and affordable — these consumers represent a huge opportunity for proactive brands.

Four strategies businesses can use to overcome these challenges

The market conditions approaching will be defined by instability and unpredictability. But strategies can be implemented by smart business leaders, with access to the right data and analysis, to help them thrive in the approaching quarters.

Invest in insight and foresight

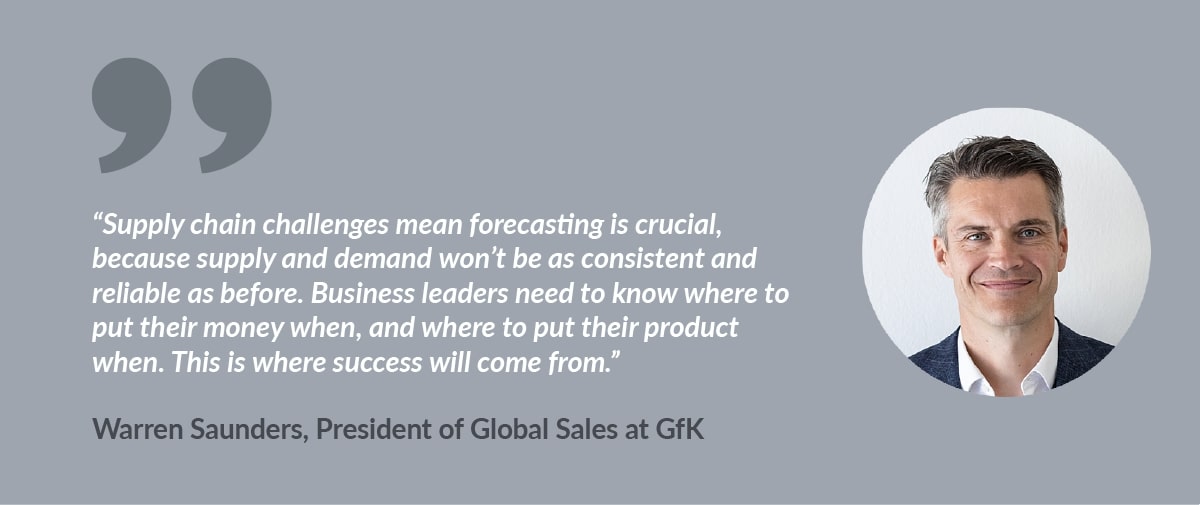

Problems with inconsistent supply must be managed and balanced with demand so that purchasing and resourcing decisions can be made with agility. The only way to achieve this will be through accurate, reliable, and real-time point-of-sale data. “Supply chain challenges mean forecasting is crucial because supply and demand won’t be as consistent and dependable as before,” says Saunders. “Business leaders need to know where to put their money when, and where to put their product when. This is where success will come from.”

Premiumization can help mitigate market saturation

As market saturation causes a slowdown across categories, premiumization will emerge as a tried-and-tested means of encouraging sales. Devising smart marketing messages and emphasizing functionality and ease of use can inspire customers to upgrade their home office.

This approach is demonstrated by the robust growth of the premium category in recent years. As noted in GfK’s “The State of Consumer Technology and Durables” report, global brands with an average product sales value 50% or more above market average witnessed a 2021 YoY value growth of 43%, while standard brands — those with prices closer to the market average — saw growth of only 17%.

Focus on providing seamless retail experiences

A borderless, convenient and ideally enjoyable retail experience is of ever-increasing importance. Shoppers moving away from lockdown-enforced e-commerce are cherry-picking where and when they engage with different sales channels. No doubt the future is in large part digital: of online buyers surveyed by GfK, 51% would recommend the retailer. Of offline buyers, only 42% would. Brands who accurately gauge how their consumers are buying — they could be shopping in social media, click-and-mortar, or even cross realities — and then meet them there, can tap into substantial wells of demand.

Credible sustainability messaging and product development

Sustainability is increasingly an issue that more consumers are focused on, but brands cannot meet their expectations with marketing messaging alone. Any attempt to cut corners is likely to be caught and punished. Shoppers were once put off by green messaging because it suggested a dearer price, but GfK research shows that cost is declining as a barrier to green consumption. In 2011, 61% of global respondents agreed that “the environmentally friendly alternatives for many of the products I use are too expensive.” In 2020, 52% agreed with this statement.

Intelligent data and insights are the way forward

The positive growth we have seen in consumer demand for Tech and Durables over the last years is set to continue. But because many consumers have already equipped their work from home setups with the right technology, overall demand for products will eventually flatten. Businesses will need to watch market and consumer trends carefully and have access to as close to real-time data as possible to understand what is driving demand, and forecast where it will shift to next. Bold leadership, guided by the right intelligence, can tap into this demand, and capitalize on the new hybrid future.

Learn how the current industry landscape is shifting

FAQs

What is hybrid working?

Hybrid work is a combination of work from home and more traditional office-based work. Different organizations have different hybrid work policies, but, since the COVID-19 pandemic, offering workers flexibility on where they work from is becoming increasingly common.

How has work from home affected Consumer Tech and Durables?

The Tech and Durables sector has witnessed exceptional growth since work from home became more widespread, with global sales figures 14% higher than they were in pre-pandemic 2019. Sales have not been limited to home office essentials – more time spent at home has meant demand for leisure products like TVs and hot beverage makers has also shot up.

What are shoppers buying to improve their work from home setups?

Consumers have turned to products that enhance their home office, such as webcams, sales of which increased 45% between January and September 2021 compared to the same period of 2020. Monitors were also up 31%, and PC/VOIP headsets 37%.