With consumer and market landscapes dominated by uncertainty, all eyes are on what might or might not happen next.

Globally, consumers are reacting to more volatile market conditions. In particular, the war in Ukraine, rising inflation and the lingering impacts of the COVID-19 pandemic are resulting in increasing energy and food bills for households. The result is a big squeeze on purchasing power.

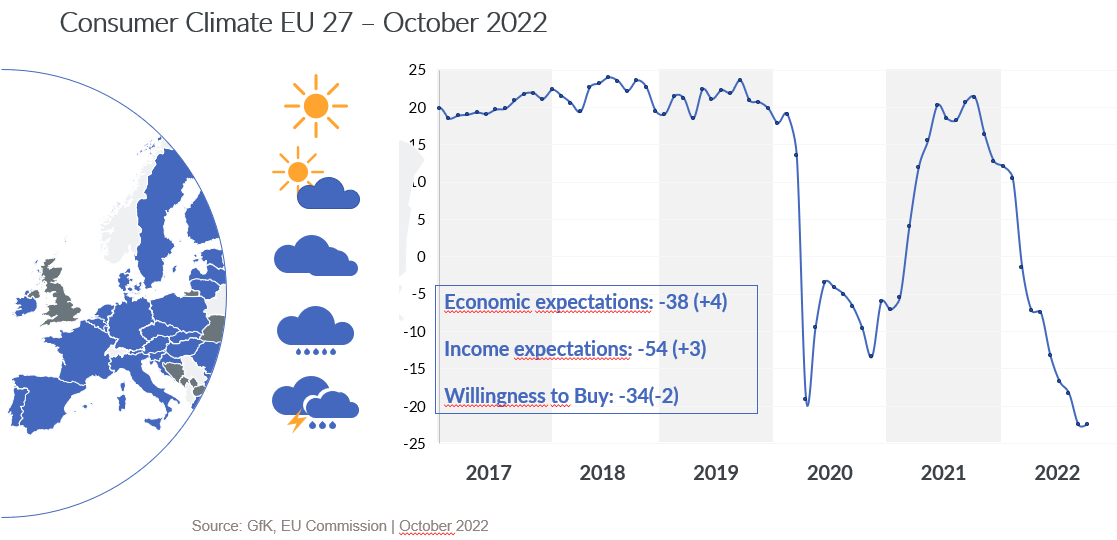

This market uncertainty is directly impacting consumer confidence, which dropped in Europe significantly in 2022 – with income expectations crashing to a record low of -67.7 points in September before stabilizing in October and making a cautious recovery to -54.3 points in November.

In developing markets, 58% of households were impacted by negative economic events in 2021. In China, meanwhile, the number of consumers who are ‘very confident’ or have ‘some confidence’ in the economy declined from 88% to 77% between February 2022 and May 2022.

Households are feeling the pressure, but is this being reflected in consumer behavior? Here are the macro and micro consumer behavior data points that will help brands gauge the direction of travel and respond accordingly.

Is now the time to withhold purchases?

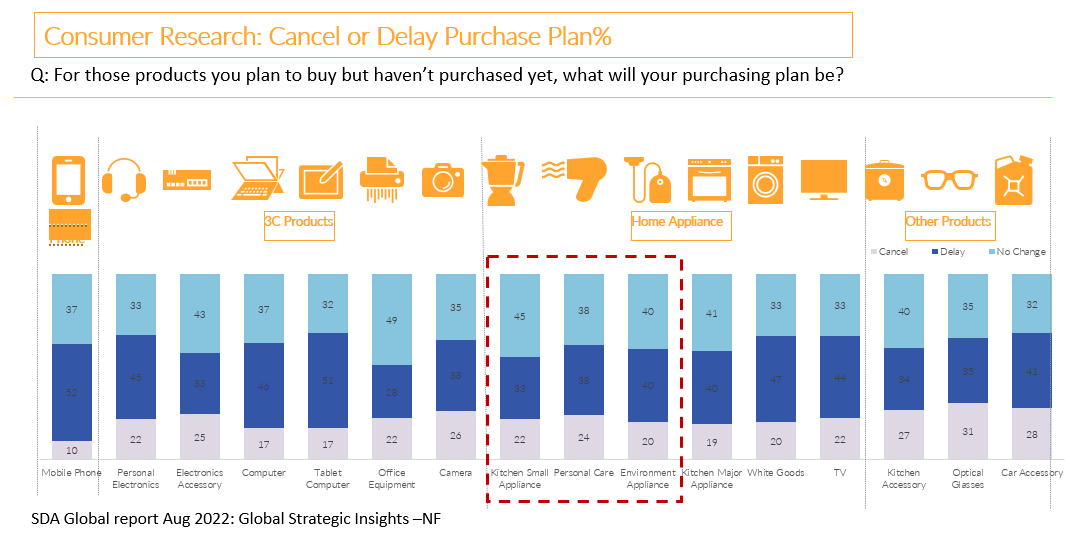

43% of consumers think it is appropriate to cancel or delay planned purchases due to the current economic climate. This is an increase from 2020 when COVID was causing highly volatile market conditions and disruption to personal and professional lives. Moving forward, the picture is likely to stay the same as we move toward the last quarter of 2022. While many governments are putting in place frameworks to ease the impact on consumers, ongoing market uncertainty and high inflation make significantly higher energy and food prices an unavoidable reality for many.

The impact of a drop in consumer spending will be different across product categories. For technical consumer goods (TCG), consumers may hold off purchasing a big-ticket item like a mobile phone or white goods, but are still just as likely to buy less expensive small domestic appliances (SDA). For major domestic appliances (MDA), both lower and medium income consumers were currently more likely to delay a purchase in Q1 2022. And while interest in home and gardening products remains higher than pre-pandemic levels, demand has fallen 2.9% YoY between 2021 and 2022.

Regional differences in consumer behavior

This nervousness about spending is reflected differently in consumer behavior data across regions, with people only willing to buy products that are very important to them. For example, 74% of UK consumers plan to renovate or decorate their homes in the next 12 months – compared to 57% of German consumers. In Asia, consumers are still willing to go premium when it comes to SDA or personal grooming. In Japan in particular, the Hair Iron market is expanding with the entry of brands like Salonia and Panasonic. Gaming Notebooks have seen strong growth in Emerging APAC (without China) of +20% in USD – while gaming in other regions has decreased. For Smartphones, 5G has been a growth driver in many regions, but highest growth rates are in Eastern Europe with +47% growth (in USD revenue). In WEU, hobs with integrated hoods, grew by 16% (value USD), while hobs in total decreased by 3%.

How are retailers responding to market uncertainty?

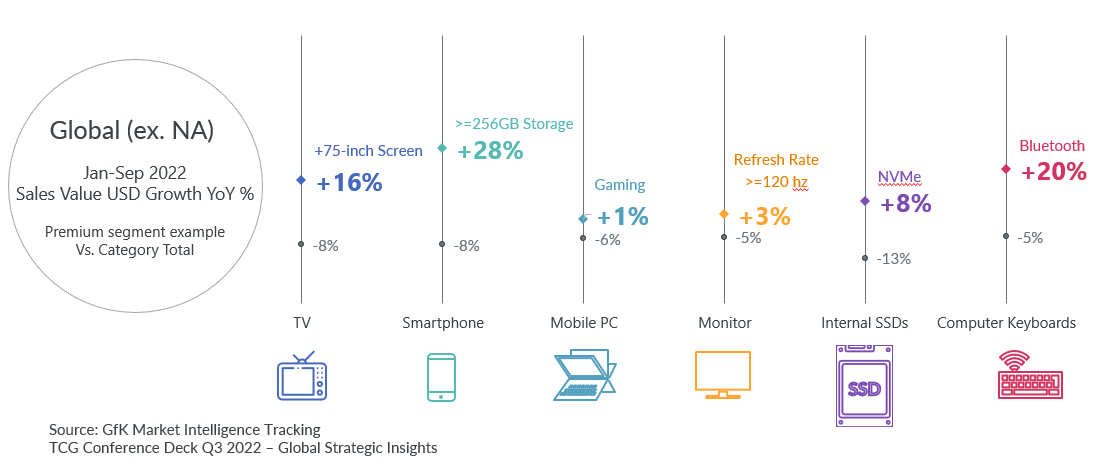

While promotional events are still important, they are also going to be impacted by decelerating demand. In the EU, during the first of two 2022 Prime Week events, spending on most product categories aside from consumer electronics was higher than in 2021. The first-ever second Prime event of 2022 also shows total sales being up compared to the same period last year in which no sales event took place. As in recent promotions, an upward movement of prices could be observed hinting at the fact that consumers value premium features. From fryers and refrigerators to monitors and computer keyboards, products with premium features outperformed other segments.

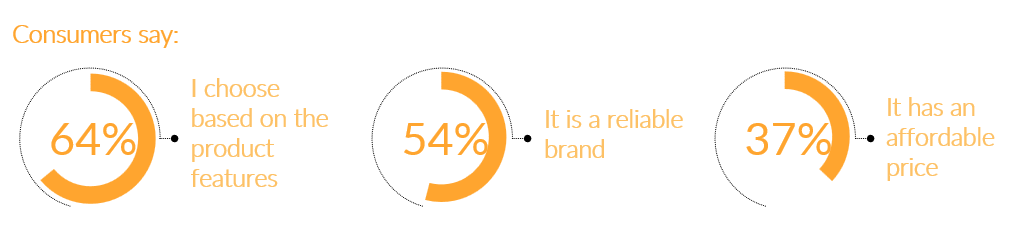

That means consumers are still willing to make purchases – even big-ticket ones. But the selection criteria is becoming much stricter. Simplification and premiumization are key factors in deciding what to buy, with 46% of respondents saying they will pay more for a product that makes their lives easier. This means there are opportunities for retailers that communicate strong brand identities or desirable product features.

A continued trend towards price polarization

Another important trend brands need to be aware of is price polarization. Both the entry level and premium price segments are performing better than products with standard pricing. On one side of the equation are consumers looking to save. This group is displaying a continued preference towards more affordable brands offering similar functionalities to more expensive products. On the other side are consumers who always opt for premium. An ongoing period of market uncertainty is likely to continue to fuel this trend toward price polarization.

Consumer behavior data shows that people still want to treat themselves and are willing to pay for premium if the product is right. For example, while sales revenue of TVs generally dropped by 8%, sales of 75+ inch screen models saw a 16% jump. Other examples include coffee machines: products catering to coffee connoisseurs such as Espresso Pump Traditionals grew by 13% compared to a total market decrease of -6%. And for Smartphones, models with a higher integrated storage capacity could record growth of +28% compared to a total smartphone decrease of – 8%.

Conclusion

Many households are heading into the last few months of 2022 wondering where the global economy goes next. Higher food and energy prices mean that many will be taking a close look at their spending – but this doesn’t mean that they are halting every planned purchase. With the holiday season fast approaching and many people choosing to spend more time at home, people still intend to pamper themselves. The brands that come out on top will be the ones able to best communicate the value of their products in these uncertain times.

Make sure you stay ahead of evolving consumer behavior and market uncertainty with gfkconsult.

![]()

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)