Pandemic lockdowns may be a fading memory in many countries, but consumers around the world are still spending more time at home than they were before Covid-19.

The hybrid working model that took off in 2020 as offices tentatively reopened after lockdowns is here to stay, with almost two out of three professionals saying they would prefer to work from home between one and four days a week.

Having been pushed towards e-commerce during the pandemic, consumers are now more accustomed to shopping and researching products from the comfort of their own homes – 63% say they have purchased online to avoid going to a store and plan to continue doing so. While young, urban shoppers are discovering the joys of in-store experiences, older generations who once favored the same are now increasingly comfortable in the virtual sphere and are engaging with brands through free online tools such as garden design planners.

This focus on the home environment is having a significant impact on consumer purchasing decisions, judging by movements in the Home & Living market. Here we look at four trends and how brands can tap into them.

Interest in home improvement and gardening remains strong

Consumer confidence has been severely dented by high inflation as a result of post-pandemic supply, demand imbalances and the war in Ukraine. With 43% of global consumers believing they should hold off from making purchases, we expect to see discretionary spending fall, particularly on out-of-home activities such as travel, entertainment and dining out.

Yet it’s clear that consumers are still willing to invest in their homes and gardens, despite cost-of-living pressures. The Home & Living segment is showing resilient growth, with global turnover up by 3% compared to the same period in 2021 to reach €31.1 billion in January-October 2022.

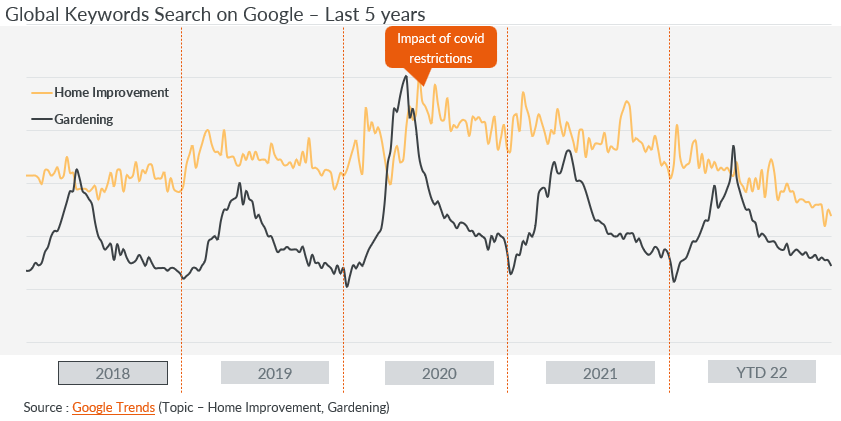

Judging by the keywords used in global Google searches, the interest in home improvement amplified by pandemic lockdowns remains strong around the world. This level of focus only began to drop below that of pre-pandemic years in the second half of 2022, despite the inflationary pressures that have pushed up living costs for people around the world. Interest typically spikes around promotional events such as Mother’s Day and Black Friday.

Similarly, interest in gardening rocketed during the first lockdowns of 2020 and remained at elevated levels into summer 2022.

Desire for DIY fuels interest in high-performing and easy-to-use products

The pandemic clearly made people reassess their home environment and make plans to improve it. In an October 2022 survey, 66% of Brits and 52% of Germans told us they planned to renovate and/or decorate their homes within the next year. Of these respondents, most of the Germans (64%) and 49% of Brits planned to do the work themselves rather than call in the experts.

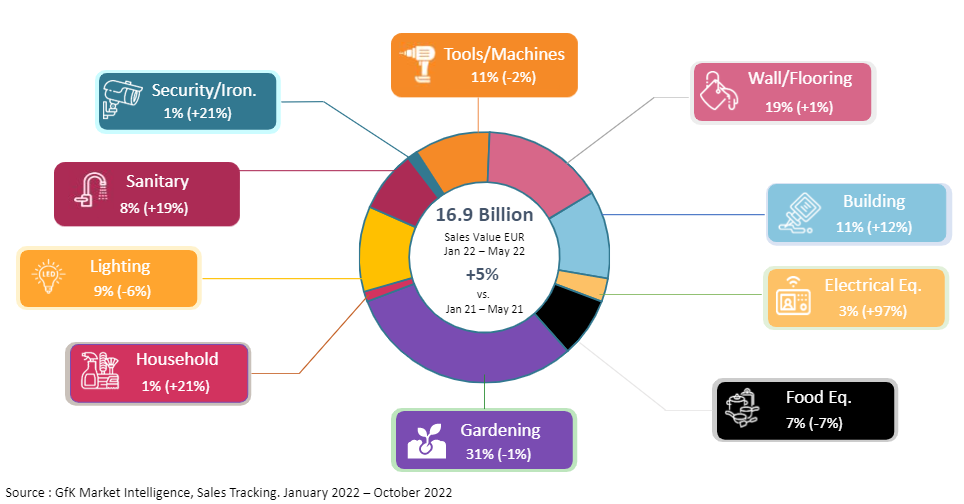

This DIY trend is feeding into the appeal of decoration and renovation categories such as wall/flooring and building, although some of the growth here is due to the increased cost of raw materials. However, the demand for DIY and gardening products remains higher than in 2019, showing that people continue to take pride in tending their indoor and outdoor spaces.

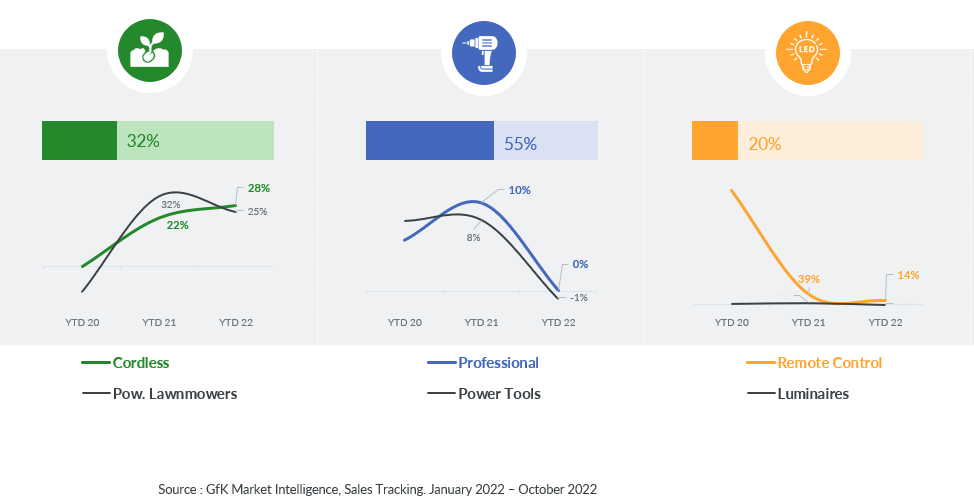

Brands can leverage the interest in DIY and gardening by responding to consumer appetite for high-performing yet easy-to-use products that make people’s lives easier. Cordless lawnmowers, for example, have performed better than standard versions so far in 2022, as have professional-grade power tools and remote control lights. Robot lawnmowers are taking off in a big way, and not necessarily for enormous gardens. In France, four in 10 robot lawnmowers are purchased for gardens that are less than 750m2, with revenue having doubled between 2019 and 2021.

Consumers are looking for smart home products that increase security

Electrical equipment bucked the deceleration trend of 2022 to achieve staggering growth, up by 97% on 2021, while the security category grew by a robust 21%. This was fueled by the explosive interest in smart home technology.

Global spend on smart home and living devices has doubled over the last three years to €332 million, with home automation products particularly popular.

Brands that help consumers control their environment and navigate everyday activities through voice control, apps or switches stand to gain, especially with internet-connected devices that improve safety or home security. Smart doorbells that send owners an alert so that they can speak to visitors, for example, have seen massive growth in 2022, leading the smart connect category of Home & Living products. Alert detectors, intruder security systems, motion sensors and keyless driveway gates with fingerprint touch or mobile app access have also been popular this year, showing that consumers are keen to invest in innovative products that protect their properties.

At a time when consumers are tightening their belts and brands feel pressured to pass on at least some of their higher supply chain costs, innovative and smart products are a way for them to justify this premiumization. The energy crisis has fuelled a 76% rise in revenue for smart electric water heaters in 2022, for example. Robot lawnmowers are commanding prices more than 10 times the average of their category, and smart driveway gates more than five times.

Interest in eco-friendly products and solutions continues to grow

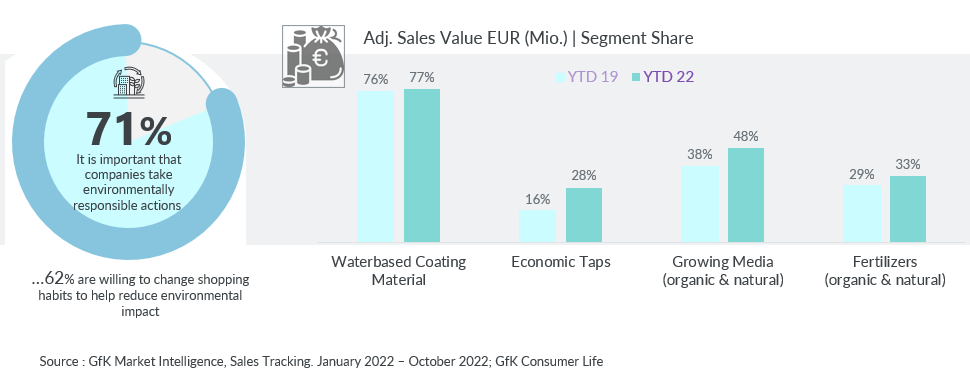

You might assume that appetite for green goods would wane when incomes are squeezed, but our research shows 83% of consumers are demanding sustainable solutions for their homes.

For example, 40%-50% of electrical installations in the Netherlands, Spain, the UK, Belgium and Poland involve consideration of sustainability factors such as energy efficiency, carbon footprint, recycled materials or complying with regulations. And the figures are similar for heating, ventilation and air conditioning installations.

The segment share of eco-friendly Home & Living products continues to grow, now making up 78% of water-based coating material sales, 28% of economic tap sales, 48% of compost sales and 33% of fertilizer sales – all increases on 2019 sales.

2023 outlook for Home & Living

Low consumer confidence and tight budgets will push DIY projects down the priority list this year, while travel and tourism will claim a share of consumer budgets as post-pandemic mobility increases.

However, we expect consumers to continue working on home improvement and gardening projects over the next year as hybrid working culture beds in and online channel growth continues to meet the needs of digital consumers. Products enabling ease of use and digitization will drive growth and give brands a justification for premiumization. And even in a cost-of-living crisis, sustainability remains a brand imperative.

![]()