The ‘golden quarter’ is here. From Black Friday and Cyber Monday to Christmas and the FIFA World Cup in Qatar, the coming months represent a major opportunity for both brands and retailers in the Consumer Technology and Durables sector to trigger volume sales. By implementing an optimized promotions strategy, they can drive consumer demand and maximize sales.

This bumper period in the calendar has only grown in importance in recent years, with the impact of key shopping events no longer restricted to a single platform or even country. Instead, each one has the potential to spark a halo effect on sales. In the week of Black Friday in 2021, for example, sales across all Technical Consumer Goods categories increased by 113% compared to the 52-week average, generating $5.5bn USD. See more data in our Black Friday infographic.

This year there is extra pressure on business decision makers to make the final quarter count.

Following unprecedented growth fueled by Covid-19 in 2021, a perfect storm of supply chain disruption, inflationary pressures and low consumer confidence dampened performance in the first half of 2022.

On the one hand, that leaves brands and retailers with a clear need to recoup growth. And on the other, it looks set to pique interest further in promotional shopping events that offer greater value to consumers with stretched budgets.

So, what are some of the key strategies that the Consumer Technology and Durables sector should bear in mind as it navigates this peak shopping season?

Understand your shopper

The first step is to rethink consumer profiles in light of the current climate and tailor a promotions strategy accordingly. Don’t make the mistake of opting for a one-size-fits-all approach. The cost of living crisis is fueling a far greater degree of polarization in the market, with widening gaps in consumer confidence and willingness to purchase depending on age, income and region.

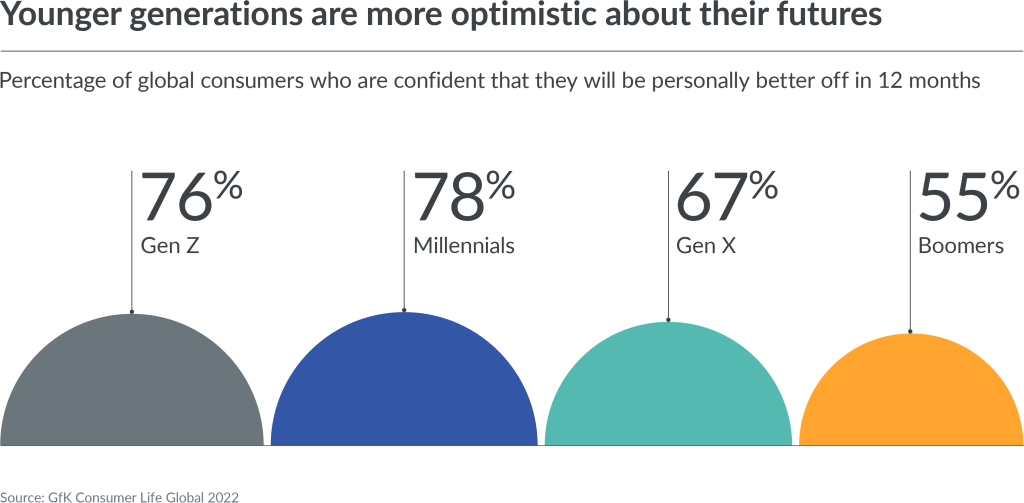

76% of Gen Z-ers are confident they’ll be personally better off in 12 months, for example, compared with just 55% of Boomers. And while in Western Europe the impact of inflation contributed to an 11% deceleration in value growth in Consumer Technology and Durables in H1 2022, in emerging Asian markets, comparably lower inflationary pressures coupled with low penetration saw sales soar by 15% in H1 2022.

“These variations create the potential for brands and retailers to explore a more multidimensional price mix, that pairs affordable premium alongside entry and mid-level products, with higher discounting during this promotional period across all tiers,” says Norbert Herzog, Senior Director, Global Strategic Insights at GfK. “Brands and retailers need to ensure their teams are making consistent use of data and insights to stay on top of these nuanced customer segmentations, and adjust price and promotional pricing and strategies accordingly rather than relying on outdated shopper profiles,” he adds. Read more on how to leverage these insights to build compelling brands here.

Craft product mixes that meet consumers’ priorities

The next step is to focus on product mixes that resonate with consumers in a challenging climate. There is undoubtedly a hesitancy among some shoppers to splash out. 43% of consumers say now is a good time to wait to make any purchases, more than double the percentage who feel it’s a good time to buy. But there are features and functions for which they’re willing to make an investment. In fact, as is explored in more detail here, results from the 2021 Black Friday season suggest there is still opportunity for brands and retailers to benefit from the premiumization trend by offering the right portfolio of products, tapping into higher margins during a challenging period.

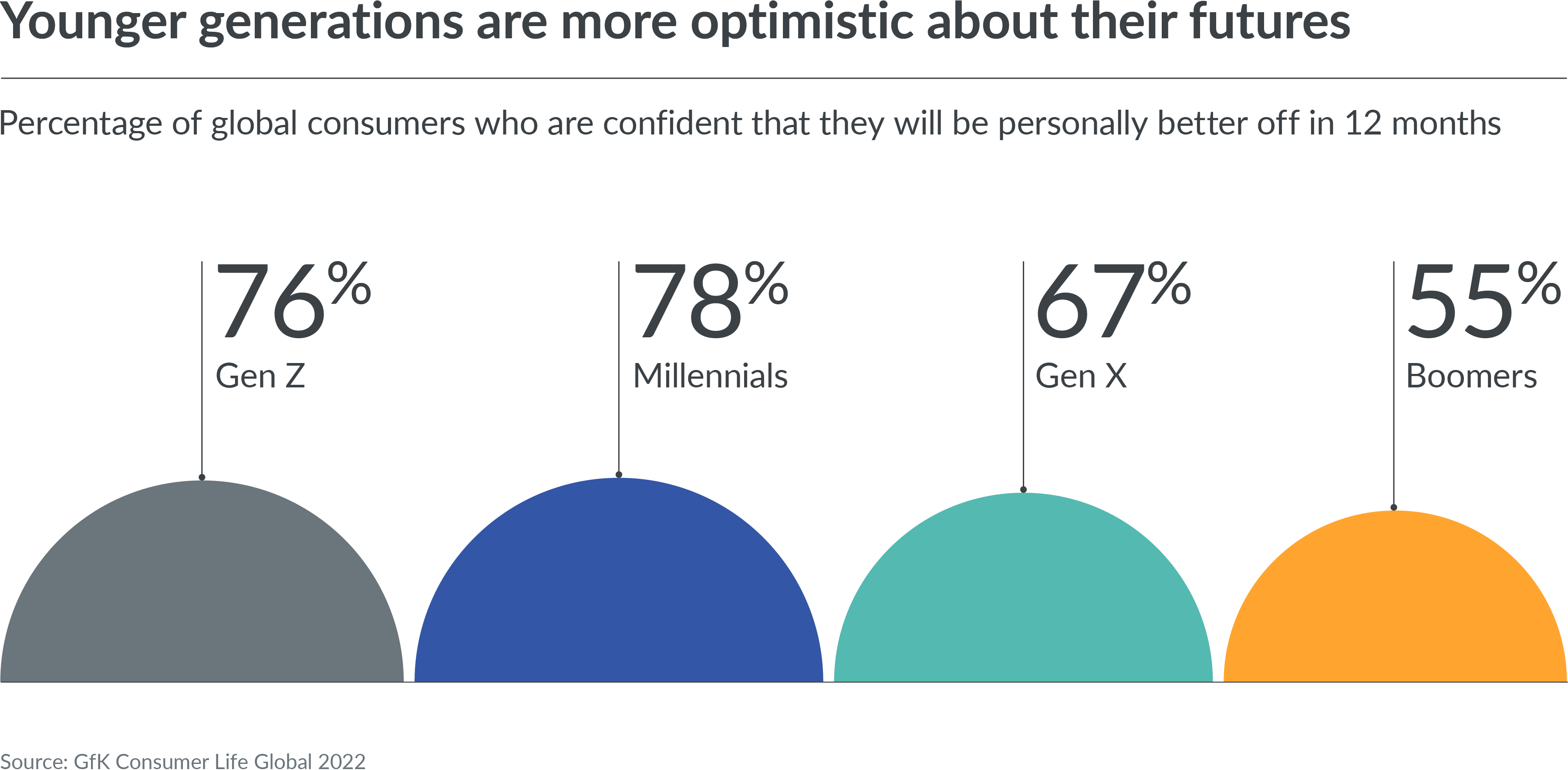

This includes those products that provide added value through cost savings or greater convenience. Already smart thermostats, for instance, have seen a 48% increase in sales in H1 2022 compared with the same period in 2019 thanks to their potential to save consumers money on their bills. In small domestic appliances (SDAs), sales of robotic vacuum cleaners also grew by 101% in the same period. These aren’t inexpensive items but appeal to consumers through their ability to save time and cut out hassle.

Brands and retailers need to tailor their assortment and promotions based on the features and functions that are resonating with consumers, and elevate those characteristics in their promotions strategies this coming quarter. Learn more on how to deliver value for consumers battling inflation here.

Use digital tools to craft a promotions strategy that generates excitement

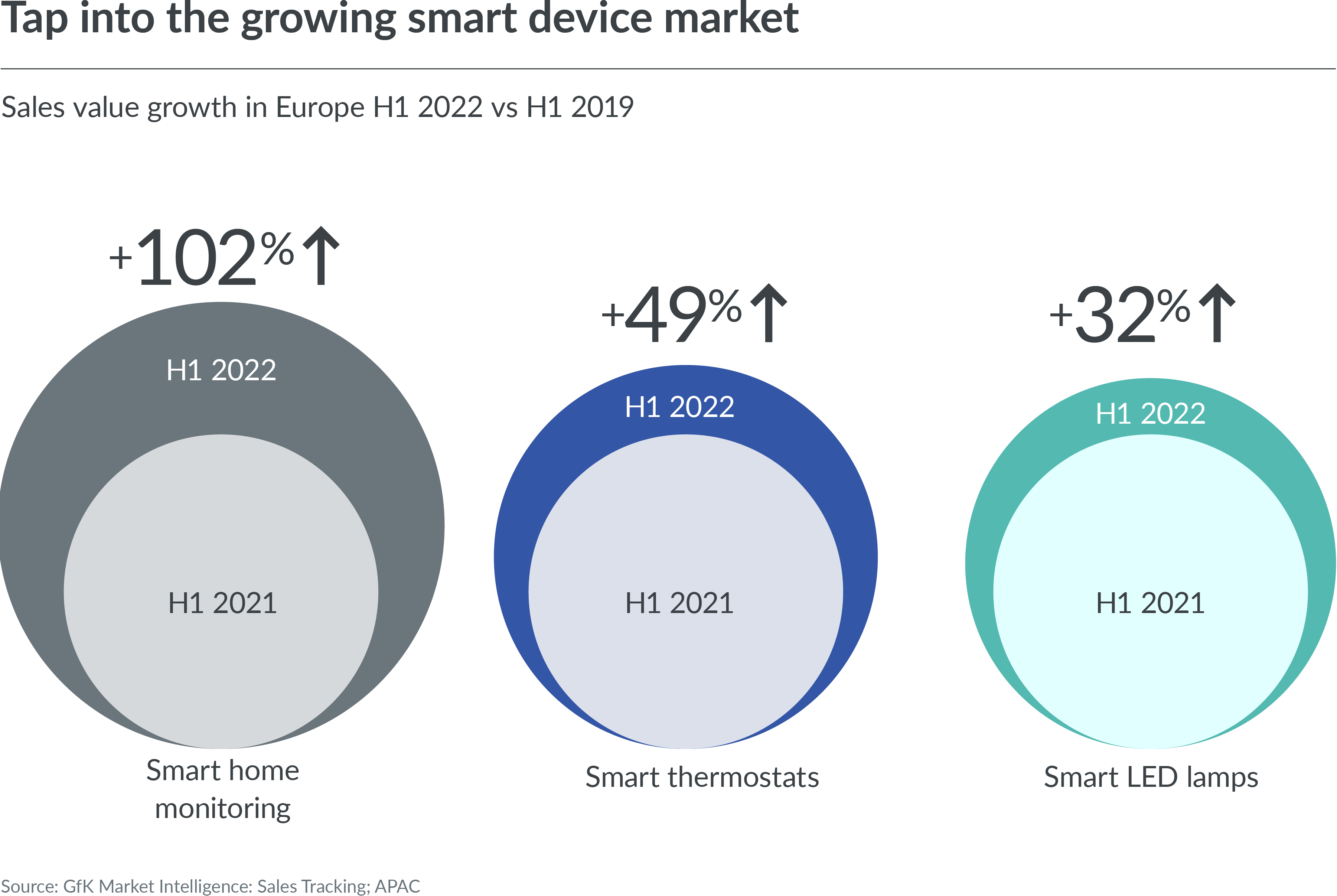

The third step is to elevate omnichannel strategies, leveraging next-gen digital tools to build up anticipation and demand ahead of key promotional events. The growing dominance of online-only shopping events heightens the need to do so. APAC’s ‘618’ festival, for example, generated $3.4bn in sales in the week of 18 June this year, compared to $2.7bn in 2019.

Look to Asia Pacific markets here, where the emergence of live shopping platforms is now a key sales strategy to generate excitement and engagement around promotions, utilizing limited edition product drops, discounts and events. Ahead of Singles Day 2021, 97% of Chinese shoppers said they planned to watch livestreams broadcast during the promotional event and 76% said they would do so ahead of the actual date to preview products, seeking out inspiration, reviews, and information.

Nonetheless, bricks and mortar stores continue to have a dominant share of sales – 61% of sales in Consumer Technology and Durables still took place in stores in H1 2022. But as these digital channels gain traction, there is a need for brands and retailers to rethink these spaces too. Move away from omnichannel strategies that create only a transactional relationship with consumers, and instead transcend channel boundaries to create rich experiences instead. Doing so will allow businesses to meet the growing expectations of digitally savvy shoppers. Read more on how to deliver a compelling experience across all consumer touchpoints here.

Make the most of this peak promotional period

As both businesses and consumers in Consumer Technology and Durables face stiff economic headwinds in the final quarter of 2022, and into 2023, this coming ‘golden quarter’ is an opportunity that no brand or retailer can afford to miss. With the right promotions strategies in place, underpinned by the latest data and insights, decision makers can use this period to deliver tailored promotions, across targeted product mixes, and generate maximum sales uplift in the process.

For a detailed look at how brands and retailers can achieve this, download our latest State of Consumer Technology and Durables report.

The data in this article has been collected from GfK Market Intelligence: Sales Tracking and GfK Consumer Life Global.

![]()