Internet sales in the first half of the year show that, while growth is down in both volume and value on the bumper years of 2020 and 2021, it remains above pre-pandemic levels. However, as household bills soar, consumers’ behavior is polarizing – raising the spectre of a lean ‘golden quarter’ for online retail in 2022 – unless brands can respond with on-point offers.

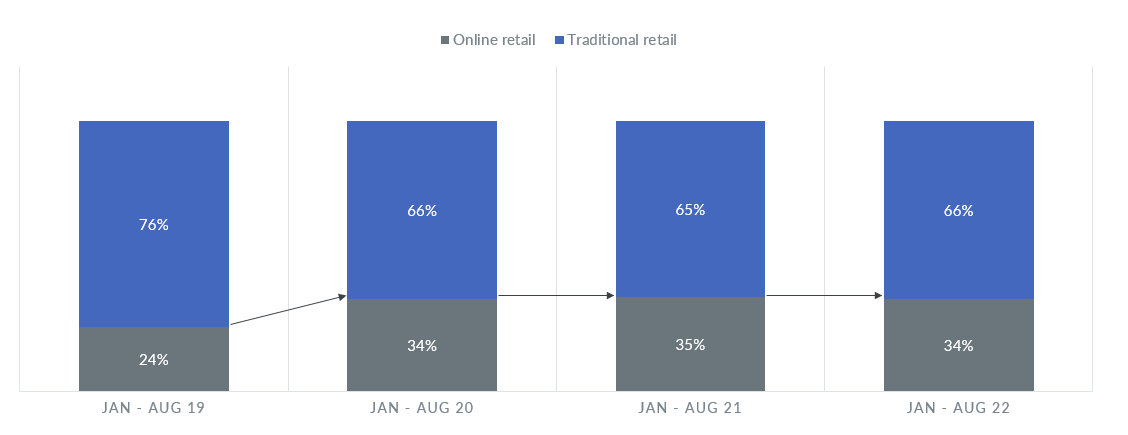

This year, the share of internet sales across all technical consumer goods’ (TCG) categories globally have continued well above pre-pandemic levels. Traditional retail continues to hold onto a clear majority, but the indent caused by expanded online shopping habits learned by consumers and embraced by brands and retailers during lockdowns, have remained.

Online therefore continued to account for over a third of all TCG purchases (by value) made in January to August – level with the same periods in 2021 and 2020, and an increase of 10 percentage points compared to 2019.

Technical Consumer Goods – online vs traditional retail (Sales Value USD)

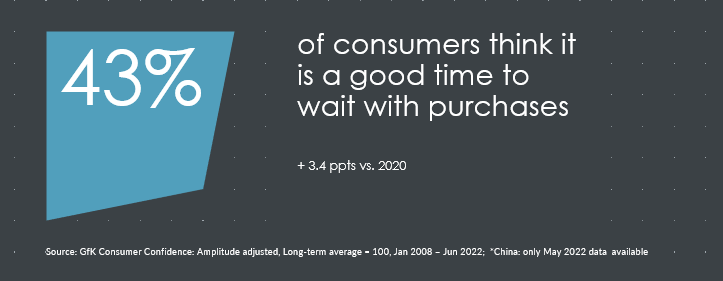

The problem is that this global gain in share is set within a decelerating market of reducing consumer spend. As the cost of day to day living soars, confidence in personal finances is dropping across many key age groups. In fact, 43% of people globally think that now is a better to delay purchases that to make them (up 3.4 percentage points compared to 2020).

Additionally, the “stickiness” of the new online shopping habits varies across the different types of online players and markets. For example, in Europe, the online revenue of pure players (those that only operate online) declined by 13% year to date, while click and mortars (those that operate both online and on the high street) declined by 23%. This was expected as consumers regained access to physical stores after Covid restrictions lifted globally. Equally, click and mortar players had a comparatively higher benchmark for this year’s growth, given that they experienced higher online growth that pure players, during the pandemic years.

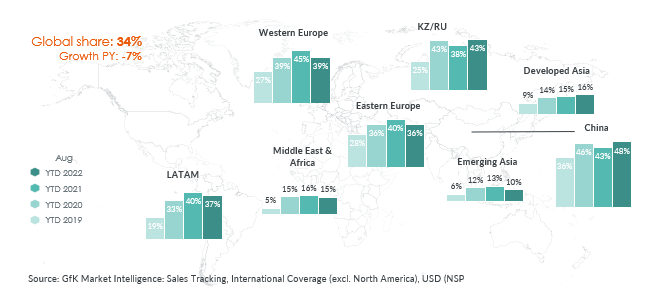

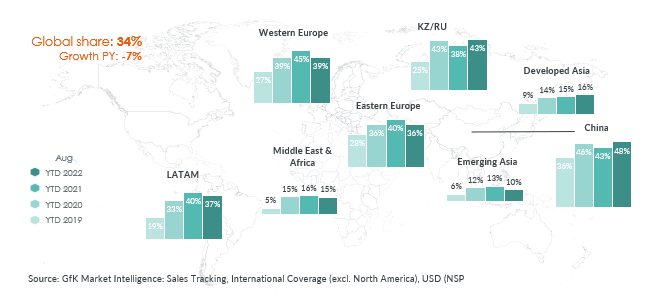

Regionally, the hardest hit has been Western Europe, where TCG saw the online sales value fall four percentage points (pp) for year-to-date 2022 compared to the same period last year. Next hardest hit has been Eastern Europe and Emerging Asia (both down 3 pp), followed by LATAM (down 2 pp), and Middle East & Africa holding relatively steady (down just 1 pp). China, where lockdowns continue across major areas, was one of the few regions to see growth in online sales value.

Technical Consumer Goods, Online retail share, Sales Value USD

Namrata Gotarne, Global Strategic Insights Director at GfK explains,

“On top of the overall fall in spend as shoppers react to the increasing cost of living, online sales have also been affected by the lifting of COVID-19 restrictions in most countries. Certain shoppers are reveling in their returned ability to shop in-store. Even though they are increasingly researching online for the best deals, they are choosing to buy instore more often in 2022 compared to 2021. But we have to consider this as a kind of normalization after unprecedented times for online retail; it does not mean that the long-term trend towards online shopping is broken.”

Retailers’ websites and social media playing a bigger role in online retail

A silver lining is that retailers’ own websites are playing a bigger role with shoppers than before. This gives retailers a direct voice with these shoppers, and the ability to deliver an omnichannel offer and experience that brings shoppers from their online touchpoints into their stores.

In the first quarter of the year, 3 out of every 5 shoppers globally (61%) went online to actively research which product to buy. And, looking the TCG shoppers, 48% (+14 pp compared to 2019) of those went onto retailers’ own websites to do their research. That makes retailer websites the most popular online source used by shoppers researching products in this category, followed by search engines at 42%, and then product review sites at 38%.

Social media, too, is playing an increasingly big part, creating awareness and inspiring consumers to purchase.

For TCG shoppers, 26% (+14 pp compared to 2019) went onto social media while researching which product to buy, and 18% confirmed that advertisements seen on social media inspired them to purchase a new product. In fact, 15% of shavers were purchased via social media platforms in China. In future, digitally native brands will be able to directly engage with consumers via social media and not be dependent on retailers to drive their sales revenue.

Premiumization on pause as demand drops

During 2020 and 2021, the average price of TCG sales shot up. This was driven by the huge surge in online demand during lockdowns, coupled with supply chain challenges, which lead to product shortages. This naturally hit products in the lower and standard price bands first, forcing consumers into more premium options.

Since the end of 2021, however, price rises have been driven more by inflationary pressure as manufacturers and retailers pass on the rising costs of materials, core components, production and transport. And this has hit the value of online sales, as consumers react to rising costs with a sharp fall in year-on-year demand. In fact, if we compare the average price of TCG online sales to that seen in January 2020, we find that the upward trend of 2020 and much of 2021 is now flattening, when taken overall.

Consumers are more price sensitive this year, retailers are hesitant to increase prices, and manufacturers will not be able to push through another round of price increases without a struggle.

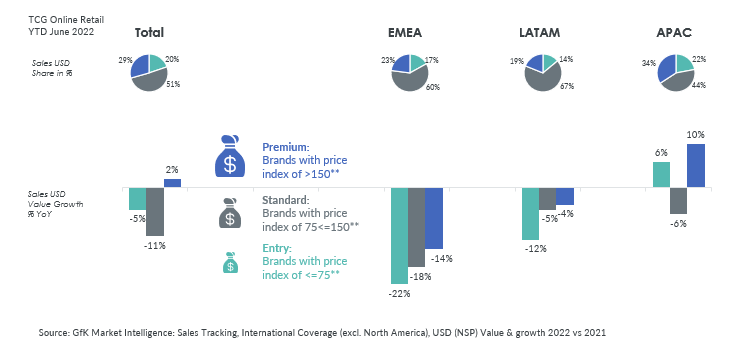

Despite this, there are some areas within online retail where consumers are still making increasing levels of purchases in the premium end. For example, in APAC, over a third of all TCG sales online were premium level (brands with a price index of 150 or more), and returned a 10% increase in value compared to premium sales the year before. For EMEA and LATAM, there was negative year-on-year growth across all price brackets in terms of the value, although premium brands suffered less severely than standard and entry level brands.

Premiumization on pause at a broader level, but visible within TCG segments

Conclusion

In a landscape of falling demand and tight budgets, brands must put themselves in front of consumers in the channels that are currently being preferred by their target audiences. With retailers’ websites and social media playing a bigger role in the TCG shopper journey, investment in omni-channel integration and development continues to be a must-have for retailers in this area.

The other big question is price discounts. Promotions and discounts offered over the first half of this year have continued to be at a low level compared to pre-pandemic days. With supply chain disruptions and spiraling costs, manufacturers and retailers alike have aimed at avoiding cutting into margins. Discounts up to 10% were the norm until early this year, but it won’t be a successful strategy for Q4. With the sharp fall seen in demand, and no let-up in the increased pressure on consumers’ wallets, more substantial promotions and discounts in Q4 can help retailers and brands push consumers to spend a bit more than planned.

The critical sum lies in projected what level of promotion will stimulate demand in the critical ‘golden quarter’, without cutting margins more than necessary. Getting this right means combining market data on top of consumer insights, to identify the mindsets of the new shopper segments and target them with the right, product-specific promotions. “One size fits all” will not work, given the market disruptions of this year.

Keen to make the most of Q4 and plan with precision for 2023? Fine-tune your strategies and tactics with our very latest, data-backed insights:

Download your free copy of our State of Consumer Tech and Durables Report here.

![]()