Editor’s Note: This blog post has been updated and was originally published in November 2020.

Demystify your lost shoppers. Understand who they are, why they chose another brand or retailer, and how to win them back in the future.

Deploying targeted strategies that drive repeat purchases in your main segments is crucial. However, without the data-driven insights you need, your rivals gain precious opportunities to convert and retain your consumers.

Lost shoppers — those that consider your brand but don’t convert — are costing you in unrealised revenue and represent a significant opportunity to drive sales and improve retention. Yet, understanding the purchase decision and segmenting them into potential and lost customers quickly gets complicated.

Consumer habits have changed in the last 2 and a half years. From post-pandemic purchases, to budget cuts due to rising inflation — it is difficult to understand how you can efficiently target your buyers.

Human behavior and motivators can seem opaque. Yet to fully understand, and recapture, your lost shoppers, it’s crucial to know what they’re thinking and are influenced by in the months, weeks, and days leading up to a purchasing decision. For example, what process drove a self-partnered young professional in Italy to buy a particular laptop from a certain online retailer at a particular time? Or, how did a German family decide on their new washing machine, out of all their options?

Identifying and recapturing your lost shoppers is key to growth

To profile your existing, potential and lost shoppers on more than gut feel, you need to access and interpret data that sheds light on:

- Who are your customers and lost shoppers?

- What do they buy?

- What motivates them to make a purchase?

- Which stores and websites do they visit?

Consider this: in the first half of 2021, 47% of laptop shoppers in Great Britain researched products online. During their research phase, they primarily visited retail websites (58%) and product review websites (46%). They did their research quickly – 67% bought a product on the same day or within a few days.

With this information, you can refer back to your sales figures and better understand your market share. You might also consider optimizing your online presence to encourage future customers to purchase your products while they’re still researching their options.

Understanding what motivated your customers to purchase, and optimizing that journey, is crucial. But to really grow your market share, you need to know more about the people who did not buy your brand, or from your store.

Thankfully, robust data can help you understand your lost shoppers — those who’ve considered your brand, and decided against it. Knowing who they are, who they ultimately buy from, and why they chose to purchase that product or from can be drawn from data. However, you need powerful tools that can filter out the irrelevant information, convert raw data into actionable insights, and be readily accessible and easy-to-use: without company-wide adoption, even the world’s best tools and largest datasets will fail to deliver value.

Win back lost shoppers with insights from gfknewron Consumer

We can help you simplify complex shopper behaviors into a consistent framework that enhances your existing understanding with a shopper-focused mindset, to identify, understand and recapture lost shoppers.

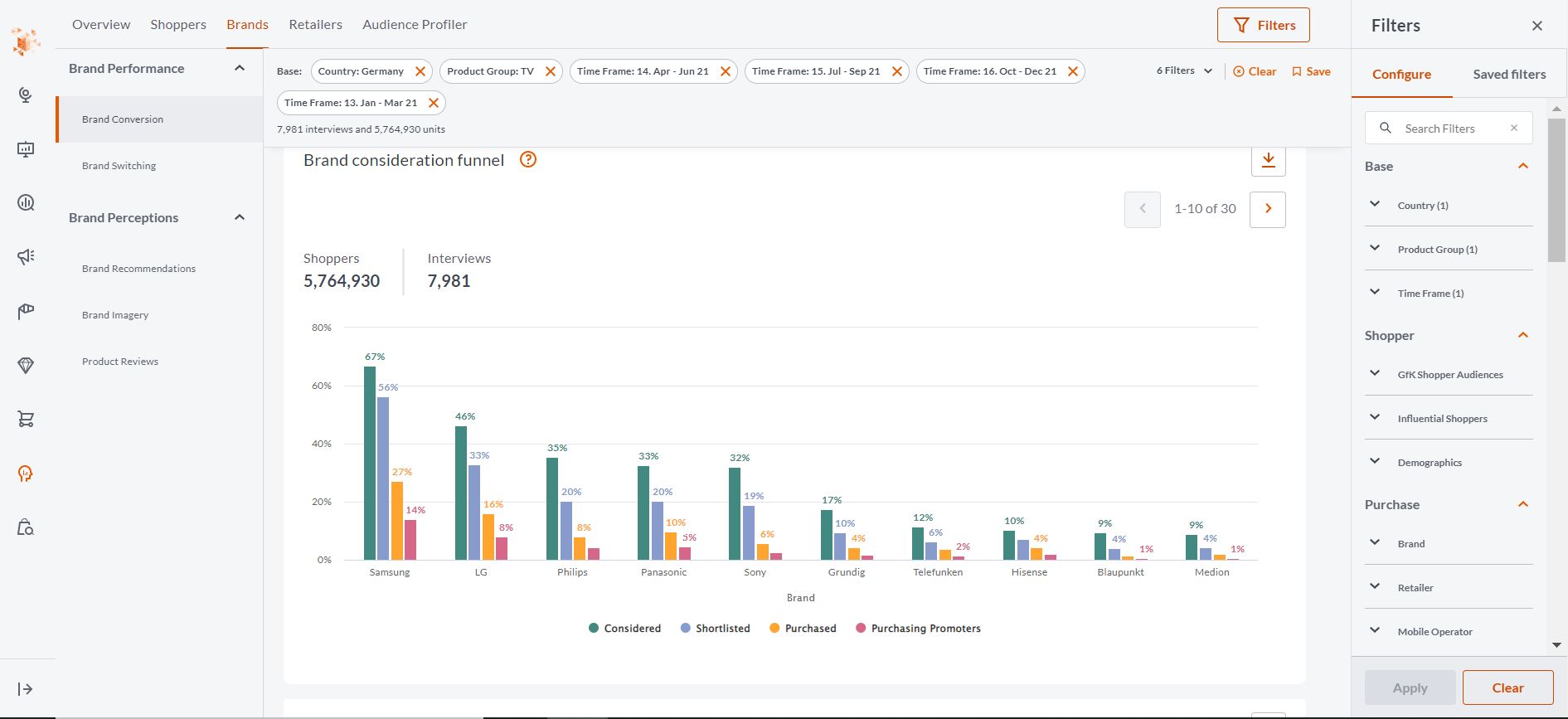

Let’s consider a new scenario. Imagine you’re a German TV manufacturer. You know from gfknewron Consumer that shoppers are considering your brand, but you’re not ranking in the top three in terms of market share.

Through this easy-to-use, always-on platform, you’re able to manipulate the data meaningfully to dig deeper. You can drill down into the details of those lost shoppers, uncovering the number of people you lost, their profiles, the brands they chose instead, and what cemented those decisions. For example, you may see that although 68% of shoppers considered your brand in a given quarter, only 31% went on to buy your TVs, so you lost 55% of your target or around 1.1 million units.

That’s not good. Because gfknewron Consumer combines point of sale data with surveys from millions of recent buyers, and feedback from online customer reviews, you can drill down even further! You find out that these lost shoppers are mostly singles and childless couples who are heavily influenced by the prices and product features of other brands, in particular their display quality.

This enables you to work with your product, marketing, and sales teams to plug any gaps in your own portfolio, to promote the features that matter most to the shoppers you’re hoping to capture, and to develop a pricing strategy that outperforms your competitor’s.

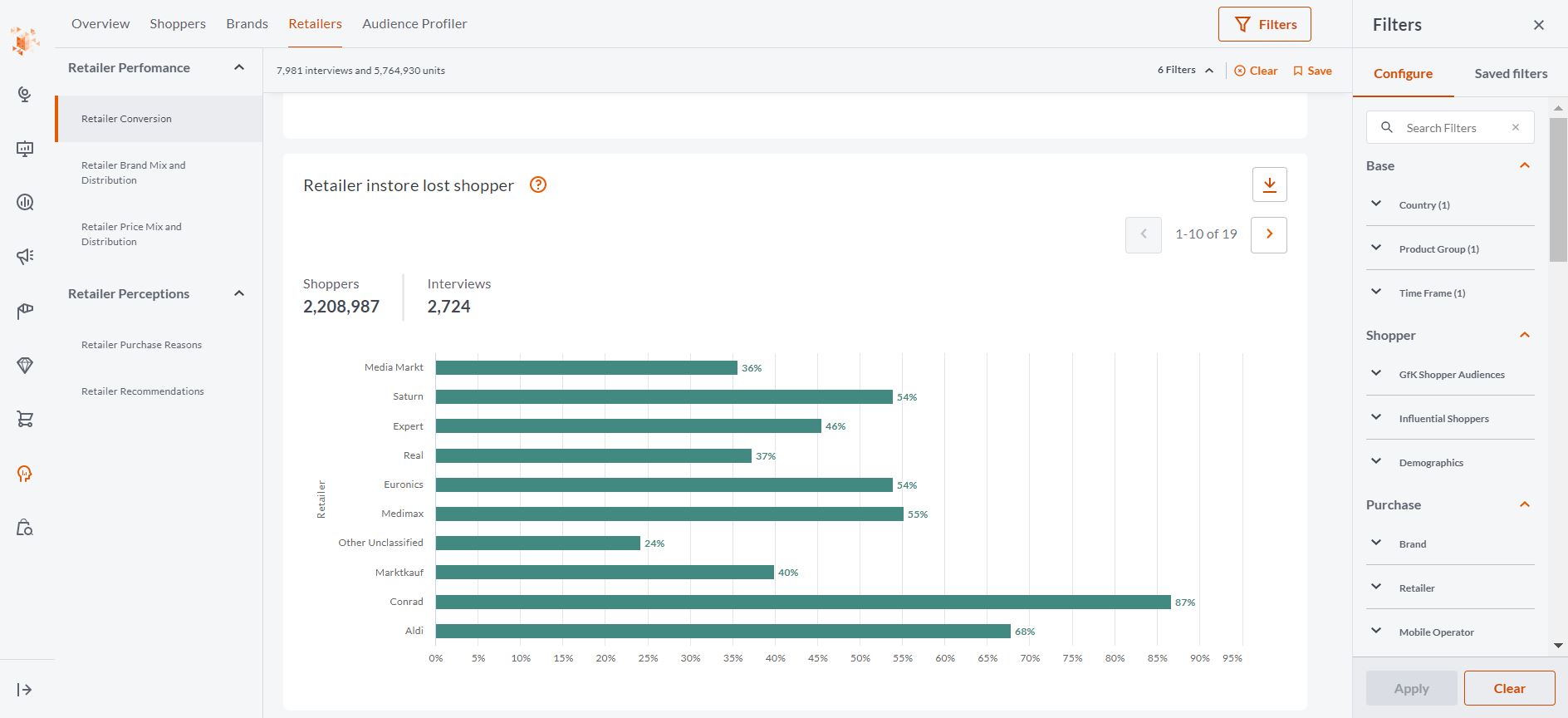

Likewise, if you’re a retailer, you can understand the shoppers who researched a product with you online or in-store, or a combination of both, but ultimately didn’t buy from you. You might spot that, you’re missing opportunities online — even more than in store.

Again, not good. But, gfknewron Consumer can help you get to the root of the problem so that you can fix it quickly.

You identify that prices, promotions, and stock availability pushed people — particularly Baby Boomers — into the arms of your rivals. So, you look further into that segment and how they shop, to create a more appealing experience and product catalog for them.

In this way, gfknewron Consumer insights help you quickly and easily access the right information, cutting through the noise to get to the heart of consumer needs and behaviors. You can identify trends and changes to keep ahead of the game, and refine and tailor products to convert browsing into sales, wherever it happens.

Whether you’re a brand or the retailer that stocks them, gfknewron Consumer lets you explore and understand the lost shopper opportunity, identifying who you’re losing to and why. You can then take the steps needed to anticipate and avoid such missed opportunities in future: boosting real revenue potential.