Accelerating a culture shift

The retail shelf is under enormous pressure. How could this be?

We first need to understand that pre-pandemic there was a slow-moving culture shift in shopper behavior. Shoppers were buying more goods online and retailers were devising new ways to deliver goods to consumers both in and out of the store. The pandemic forced shoppers to discover much of what they could buy in a physical store also existed online.

That slow culture shift happening prior to March 2020 suddenly accelerated to light speed. Major retailers that had abandoned curbside pickup brought it back in an effort to stem volume leakage to online-only retailers. Online retailers hired thousands of workers to offset systems that had yet to be automated to get products of all shapes, sizes, and categories out to satisfy consumer demand. And households that never considered the idea of having a personal shopper turned to Instacart™ deliveries.

As an industry we asked ourselves what would stick from all this activity when the “new normal” was finally realized.

They look like shoppers

We are now living in the “new normal.” The next time you’re in a grocery store, look around and see who is shopping with you in the aisle. That person quickly moving through the aisle putting items in their cart while looking at their phone is likely a personal shopper for someone else.

Pay attention to the store associates and what they’re doing. Some are shopping too, filling online orders for in-store or curbside pickup. Still others are running orders to waiting customers in the curbside parking spots outside.

Is there anyone left that works for the store stocking the shelves or working checkout? Yes, but it is a highly transient workforce. In fact, 76% of all retail labor turned over from 2021 to 2022¹, second only to the food and hospitality industry. It’s no secret that it is harder to hire a retail worker and while retail wages have been appreciating, the job market is still in favor of the job seeker, which exacerbates the issue. Further illustration of a retail worker shortage is the number of self-checkout lanes. Shoppers, for a few minutes, become a temporary labor force to check, bag and process payments.

Category management is changing

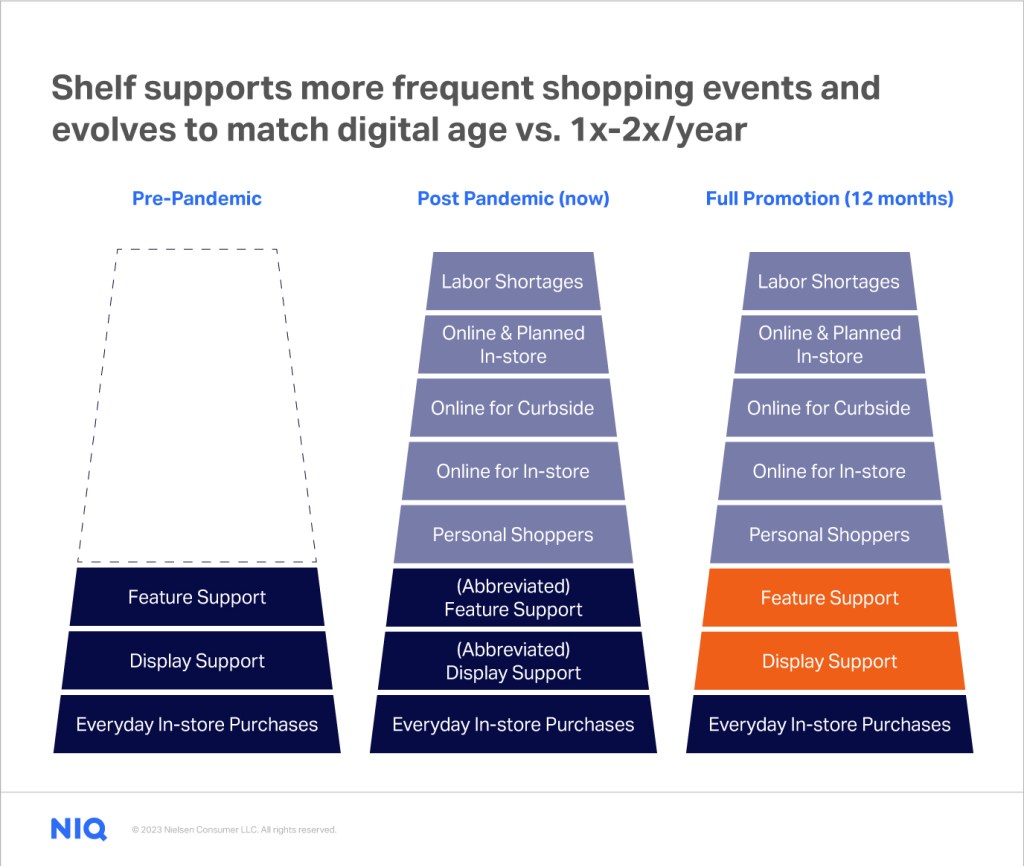

The shelf is potentially becoming a casualty of sorts. Prior to 2020 the shelf supported everyday purchasing, promotions, and additional inventory for displays. But now it supports in-store traffic, online orders, curbside orders; it must have enough holding power to augment less replenishment from store associates and support a very diminished promotion and display environment.

What happens when traditional trade plans return? According to The Food Marketing Institute, 56% of retailers intend to allocate more space in-store to online fulfillment². In the end it means a fundamental shift in how assortments are managed. Longer term it will lead to a change in store footprints, technology advancements and the potential proliferation of micro fulfillment centers that could be attached to stores, demanding separate category management activity from the front of store.

Assortment planning is everyday

It’s not hard to extrapolate that assortment planning is changing from an episodic once or twice a year event, to a more frequent, supply chain driven activity. The last mile in the chain has become the new challenge. The question to ask is, are you ready to lead the change?

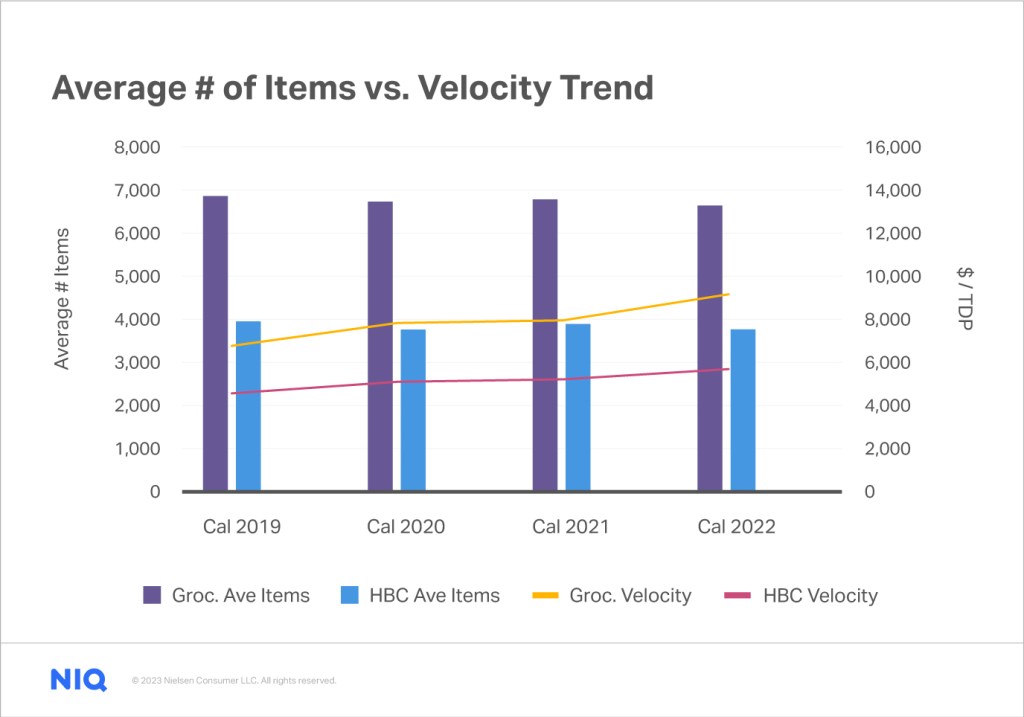

Brands and retailers that lead must understand the evolution occurring at the shelf and how shoppers are using the store. Almost equally important is understanding how the retailer views the role of their stores now and aspirationally. More than 50% of food retailers intend to allocate more labor to data analytics³. NIQ BASES data shows retailers begin looking at new items 3 months after shelf placement and begin reducing distribution by 6 months if they are not performing. New item performance evaluation periods have been steadily getting shorter over the last 5 years, increasing the premium put on shelf placement. Across grocery and HBC categories, the average number of items carried has declined since 2019.

Become a trusted partner

There’s a lot of pressure on shelf: shorter evaluation times for new items, retail labor shortages, and smaller store footprints. Plus we have more shopping traffic supporting online, curbside, and in-store pickup. But this doesn’t mean retailers are less interested in actual shopper footfall in their stores — they want to see it grow. After all, the expenditure in physical locations is heavy and needs to return on the investment.

The shelf needs to have holding power to support all this additional activity, but equally important and that is shelf variety. Not just any variety, but meaningful variety that is incremental to categories and shapes the shopper experience. Knowing how items fit in a category to optimize performance can drive shopper loyalty and create real value. Shoppers can easily curate the same shopping list every week or month if they’re online ordering, but variety and discovery are what shoppers want when they visit the store.

Real growth opportunities lie in understanding brand and item incrementality to the category and proving that your brand is accretive to the retailer’s category. Show them what your brand brings to the table in terms of incremental dollars and margin. Even more powerful is showing that the shopper that buys your brand spends more in the category and has a larger total store basket versus the average category shopper.

Small brands have a role

Placement at retail is a “pay to play” sport and it is expensive. But more retailers have realized that smaller brands can add profitability, attract new shoppers to their doors, drive trials, and grow topline sales. You can break though and here’s how:

- Know the retailer’s strategy and the shopper they aspire to have

- Know the shopper you are bringing in the door and their worth in profit and across the store

- Know the retailer’s processes cold

- Incrementality, incrementality, incrementality

Adding variety with a data-based approach with a clear understanding of what kinds of shoppers a retailer wants to retain is how you become a trusted brand partner. This is where a tool like NIQ Shelf Architect® can give you the edge you need to proactively understand item-level incrementality within an always-on analytics platform.

Sources:

¹ “Retail Employee Turnover On The Rise” Korn Ferry survey November 2022

²,³ “FMI, The Food Retailing Industry Speaks, 2022, page 41, 42

Is your business growing the right way?

Incrementality analytics can show you how to grow your business without undercutting your existing sales. While sales figures alone can’t reveal the answer, the right assortment and merchandising solution will.