The global economy’s rocky recovery continues as brands, retailers and consumers begin to look ahead to 2024. After a year when world economic growth stagnated, 2024 is predicted to continue this slow and steady upward trajectory. Inflation has cooled significantly after its recent peak in 2022 but remains far above the 2% central banks would like it to fall to.

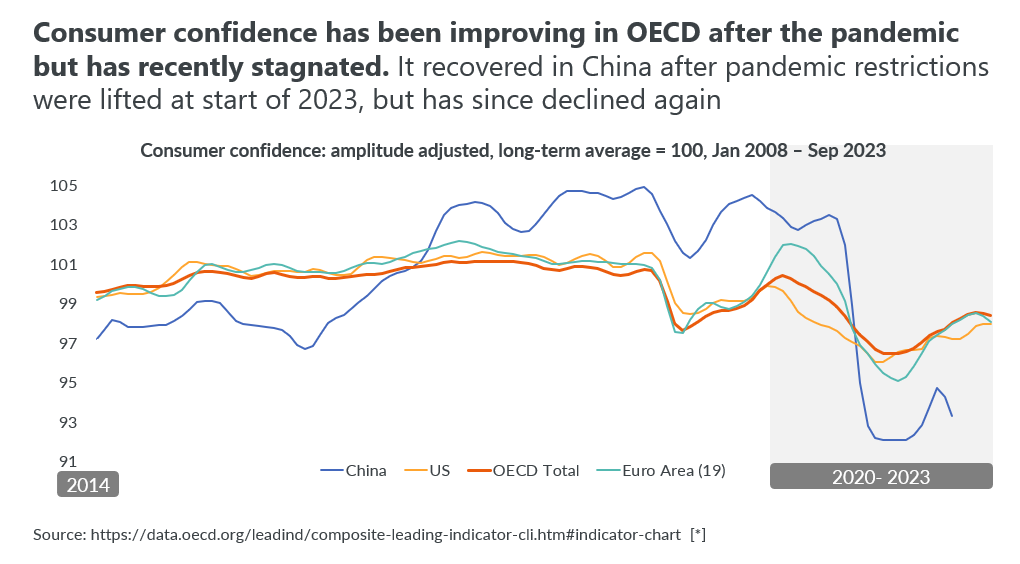

It is perhaps no surprise that market and consumer confidence is low. It is, however, not as low as it was during 2022, showing that it has stabilized after a prolonged period of descent. Consumer trends show that many people are limiting their discretionary spending and thinking carefully about what they spend their money on. For both consumers and brands, the focus area is on value. For brands, this means not only understanding how shoppers currently perceive value but being able to demonstrate that value effectively too.

While the current market environment is complex, there are big opportunities for brands. To take advantage of them and other retail trends, brands need to think about value in broader terms than simply lower prices.

The ‘affordable premium’ trend is growing fast

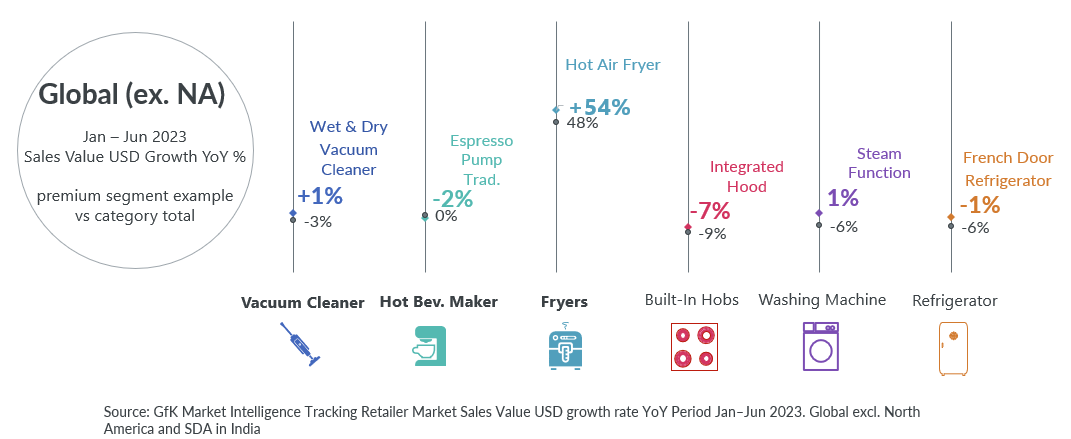

Across a range of home appliances categories, affordable premium is the fastest growing product type. Increasingly, these products are seen by consumers to combine quality with more affordable pricing. Brands in the consumer tech industry are finding success by offering select premium features or form factors at an attractive price point. During 2023, these affordable premium products have seen sales growth that exceeds the category average – or have declined at a slower rate.

But many of the most popular products also highlight that for consumers, value is often about the benefits a product brings to their lives as well as its monetary value. 2023 may yet be dubbed the year of the air fryer, as many consumers have decided that being able to cook healthier meals with less oil in a much simpler way is worth the investment. Products that combine innovation with convenience or simplification are likely to be seen as worth spending money on by more cautious consumers.

Trusted brands are outperforming

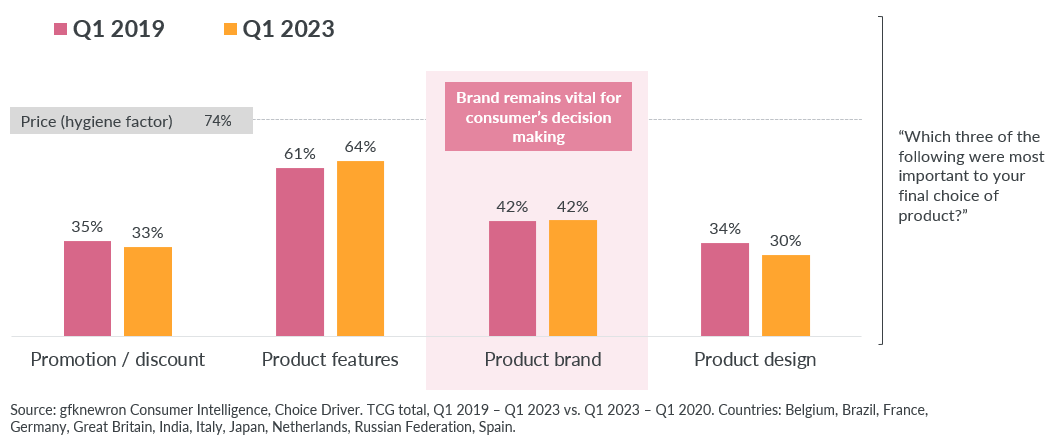

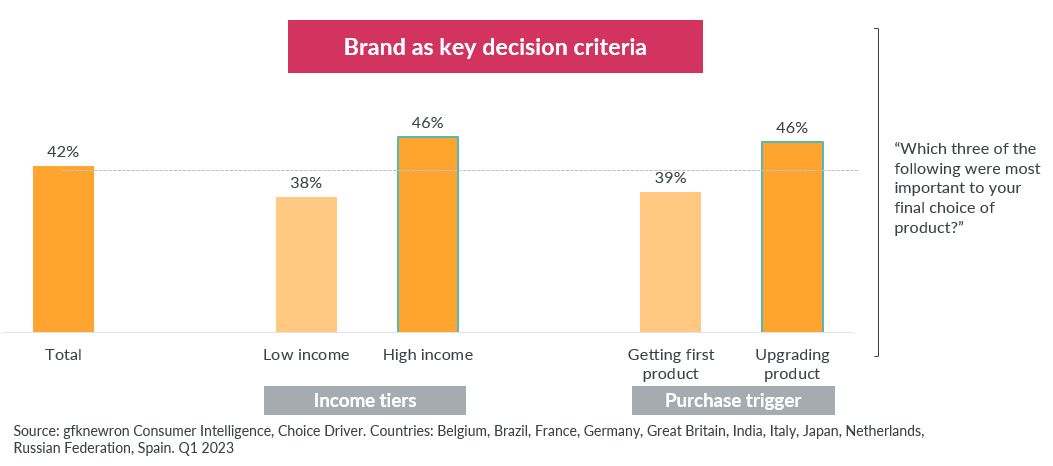

Consumer trends show that if people are only going to be making a few big purchases, they are more likely to choose brands they trust than to take a risk on an unknown entity. It is no coincidence then that the strongest and most dominating brands also happen to be the most trusted by consumers. In fact, compared to 2019, the importance of brand is still the second most important factor behind product features and price as a hygiene factor in consumer decision making. This shows that even in times of economic challenges and inflation, a large section of consumers is willing to stick with brands they trust rather than looking elsewhere.

This retail trend is particularly prevalent with higher income tiers. While the importance of brand in purchasing decisions has remained stable over time, there are important differences among consumer segments. For consumers in higher incomes as well as those looking to upgrade existing products, brand is a key consideration. This is also the case for different product types too – with brand being listed as the most important purchasing factor when it comes to smartphones and laptops or notebooks. This aligns with the retail trend showing that products and segments dedicated to specific use cases have outperformed throughout 2023.

Consumers are still willing to spend

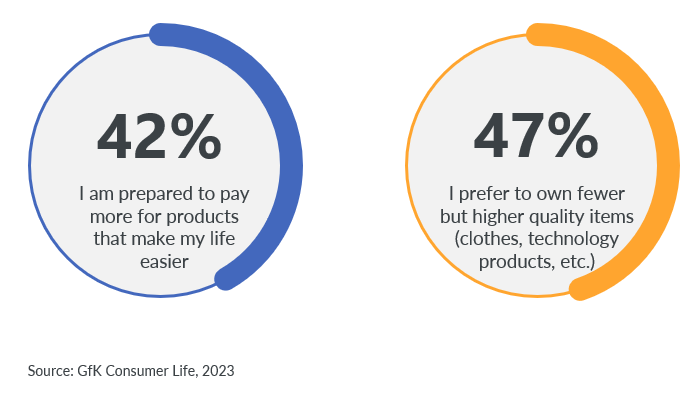

Every individual consumer has a unique idea of what value means to them beyond affordable prices. For some, sustainability and a longer lifecycle may be just as important as premium features or convenience. For brands and retailers, the priority is understanding what features are important to their target audience.

Four core areas have emerged as priorities for consumers across different categories. Brands looking to appeal to more cautious consumers in the coming months should be looking to align their offerings with one or more of the following:

Simplifying chores

The popularity of the air fryer in 2023 is a great example of innovations that help people do routine tasks better – in this case making it easier for consumers to cook healthier meals faster. People are willing to invest in products that make their lives easier and allow them to spend more time doing the things they view as important.

Allowing greater control remotely

As we all continue to live more interconnected and digital lives, consumers are showing interest in products that give them more control wherever they happen to be. Examples of this are doorbell cameras, robot lawnmowers and central heating systems that can all be controlled and monitored by users through digital apps. In fact, lawn mowers with smart app controls saw a sales value growth rate of 44% between January and June 2023.

Aspirational design and affordable premium

Aspirational design holds significant appeal for consumers as it embodies the desire to own, identify with, or be associated with a brand or product perceived as desirable or exclusive. Aspirational branding aims to create a sense of exclusivity and desirability around a brand, differentiating it from competitors and fostering a strong brand image.

Energy efficiency

With energy bills still elevated in many markets at the end of 2023, consumers are on the lookout for products that can provide performance with lower energy usage. In particular, we are seeing a growth in the number of appliances like washing machines and refrigerators with energy saving functionalities.

Conclusion

2024 looks set to start off in much the same way as the previous year. But as inflation continues to fall and the cost-of-living crisis eases in many markets, it could also signal a return to more ‘normal’ rates of growth. This doesn’t mean that consumers are not looking to treat themselves or purchase big-ticket items. It does mean, however, that brands and retailers need to work harder to show why purchasing their product is the right choice.

There are several routes open to brands competing for lower levels of discretionary spend. They can offer premium features or quality at an affordable price, work to build trust with existing customers or try to focus in on particular segments. The goal remains the same though: demonstrating to consumers that your products represent the most value for their money.

Consumer sentiment rarely stays still for very long. Our Consumer Intelligence solutions can help you stay ahead of the curve and adapt to the latest consumer and retail trends.

![]()

[*] This consumer confidence indicator (CCI) provides an indication of future developments of households’ consumption and saving, based upon answers regarding their expected financial situation, their sentiment about the general economic situation, unemployment and capability of savings. An indicator above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to spend money on major purchases in the next 12 months. Values below 100 indicate a pessimistic attitude towards future developments in the economy, possibly resulting in a tendency to save more and consumer less.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)