In an era witnessing the rise of Generative AI, the consumer durable industry is at a transformative juncture. Understanding the unique preferences of distinct generations such as GenZ is imperative in tailoring consumer durables that resonate with these tech-savvy and environmentally-conscious consumers.

This blog delves into the intricate tapestry of consumer preferences, shedding light on the interplay of generational dynamics and the ascendancy of premiumization, fundamentally reshaping the consumer durable landscape. The trend towards premiumization mirrors not only a quest for top-notch quality but also a profound alignment with the modern ethos of technology and sustainability championed by GenZ.

Unpacking the insights from the Global Consumer Life Study survey conducted by GfK, unravels compelling consumer behavior patterns, specifically focusing on the evolving tastes of GenZ. It embarks on a journey through the realms of quality, technology, sustainability, and the burgeoning presence of organized retail channels. Furthermore, it probes into the pivotal role of manufacturers and the demand in lower-tier cities, encapsulating the comprehensive shift towards a circular economy that resonates with the values of these generational cohorts.

Understanding Consumer Preferences in the Age of Gen AI

-

Generational Influences:

Understanding the preferences of distinct generations is pivotal in tailoring consumer durable offerings. Those raised in an AI era prioritize seamless integration of advanced technology into consumer durables, seeking smooth incorporation of high-tech features. Conversely, the digitally native individuals from the succeeding generation, GenZ emphasize sustainability, ethical production, and personalized experiences when it comes to consumer durables, appreciating products that align with their values and lifestyle choices. This understanding is crucial for shaping consumer durable offerings that cater to these varying preferences and expectations.

-

The Rise of Premiumization:

In recent times, a discernible shift in consumer preferences has come to the forefront, the ascendancy of premiumization within the consumer durable industry. These evolving trends reflect a growing inclination among consumers to invest in products that epitomize superior quality while resonating with their contemporary, tech-savvy, and sustainability-driven lifestyles.

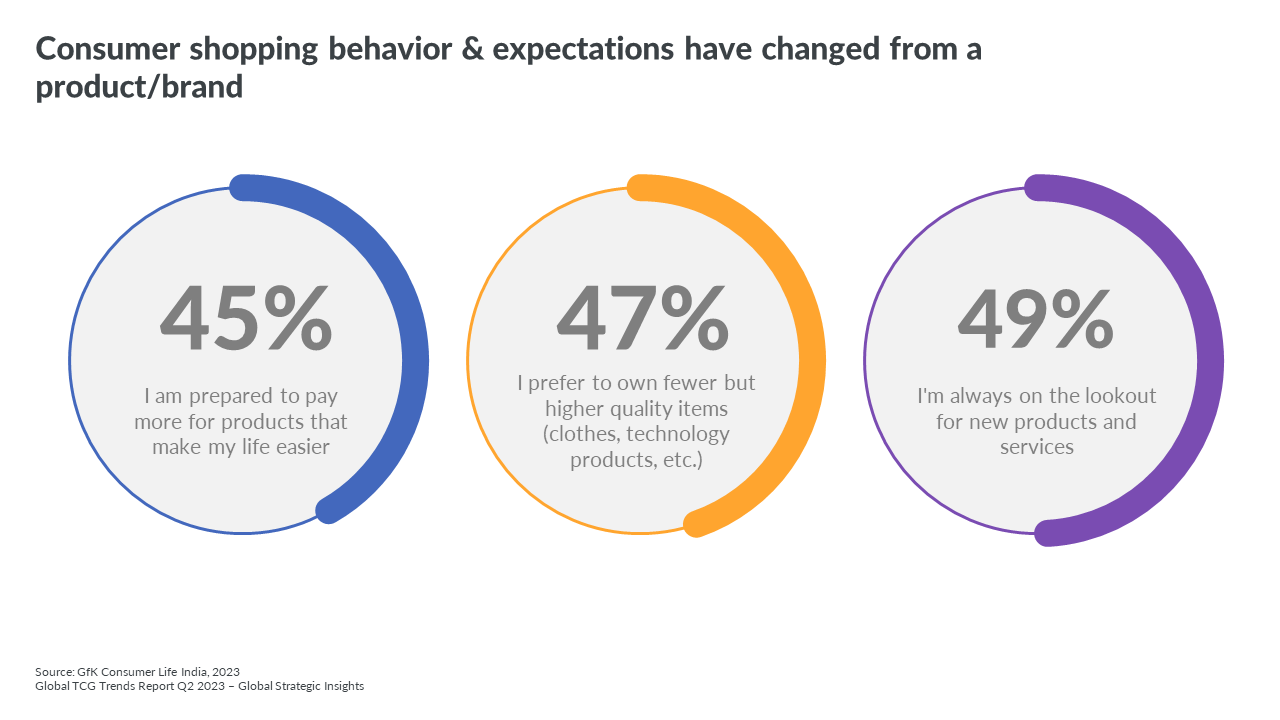

Illustrated in the graph below, derived from the Global Consumer Life Study survey conducted by GfK, we observe a significant inclination among consumers. Approximately 45% of buyers express their readiness to pay a premium for products that streamline and enhance daily life, underlining a desire for convenience and efficiency. Concurrently, 47% of respondents indicate a preference for possessing fewer possessions but of elevated quality, emphasizing a shift towards embracing meaningful acquisitions and long-term satisfaction over mass accumulation. This data underscores the changing consumer mindset, one that prioritizes quality, functionality, and curated ownership experience over mere quantity.

Quality, Value, and Technological Advancements:

A fundamental aspect of premiumization is an increased emphasis on quality within the consumer durable sector. Modern consumers, particularly those known for being discerning and well-informed, prioritize products that boast lasting durability, optimal performance, and an exceptional user experience. This informed consumer base, willing to invest in products that meet these criteria, places significant value on longevity, durability, and overall satisfaction, demonstrating a willingness to pay a premium for consumer durables that deliver on these essential aspects.

For the tech-savvy demographic, including those with a penchant for advanced technology, consumer durables that seamlessly integrate cutting-edge technologies are highly appealing. Growing up in a digitally advanced era, they have become accustomed to technology’s seamless integration into their lives. Hence, they look for consumer durables that not only house the latest technological features but also exude innovation and sophistication.

This inclination is clearly displayed in the graph depicted below. The sales of premium features surpass the category average, illustrating the demand for technologically advanced consumer durables. For instance, while the smartphones category experienced a 16% growth, the 256+ GB storage category witnessed an impressive 66% growth.

Sustainability and Ethical Practices

Beyond quality and technology, sustainability plays a significant role in influencing the preference for premium consumer durables. An increasing number of individuals, especially those cognizant of environmental and social impacts, prioritize products that uphold sustainable manufacturing practices.

This entails using eco-friendly materials and processes. Additionally, ethical considerations are vital for this audience—they value brands that demonstrate fair labor practices, responsible sourcing, and efforts to reduce carbon footprints. These elements are critical factors driving the choice of premium consumer durables for this environmentally and socially conscious demographic.

A Lifestyle Choice

Premiumization has become a lifestyle choice for these generations. Owning premium consumer durables is a way for them to express their identity, values, and aspirations. It is about aligning with a certain lifestyle that values sophistication, innovation, and responsibility. By investing in premium products, they perceive themselves as making a statement and belonging to a community that shares similar values.

Market Dynamics

Acknowledging this shift in consumer behavior, manufacturers and retailers are adapting by introducing a wide array of premium products in diverse consumer durable categories. The latest GfK Market Intelligence demonstrates this trend—high-end smartphones, and smart home devices, have seen a notable increase in demand and market presence. The data also highlights a surge in product differentiation and innovation within companies, driven by a strategic aim to capture and capitalize on the expanding market segment seeking premium consumer durables.

The Role of Retailers

-

Catering to Evolving Consumer Preferences:

Retailers hold a crucial position as intermediaries linking manufacturers to consumers. Their role involves curating experiences by featuring consumer durables aligned with the preferences of the target audience.

Key focus areas include sustainability, functionality, and integration of advanced technology, which particularly appeals to a tech-savvy audience. This strategy ensures that the showcased products cater to the evolving demands of modern consumers seeking enhanced experiences with consumer durables.

-

E-commerce and Omnichannel Strategies:

The rapid growth of e-commerce has transformed the way people shop, particularly noticeable among the younger demographics.

In response, retailers are compelled to amplify their digital presence, making their mark in the online sphere. Embracing an omnichannel approach is key—an integrated strategy that seamlessly merges the online and offline shopping experiences. It is about presenting a cohesive shopping journey, where customers can effortlessly switch between browsing online catalogs and exploring products in physical stores.

The surge in e-commerce is not just a trend; it is a response to the demand for a smoother shopping journey. As evidenced in the GfK consumer life survey data below, the ease of the purchase experience significantly impacts the uptick in online sales. When consumers were asked, “Did you buy the product online, in-store?” a notable proportion leaned towards online purchases. The seamless and convenient process of buying online is undoubtedly influencing this shift, shedding light on the importance of an enhanced digital shopping experience for boosting sales.

We observe a comparable trend in GfK’s online sensor report, indicating a 38% growth in online sales for refrigerators and a 24% growth for panel televisions in terms of value.

-

Community Engagement and Influencer Collaborations:

Building genuine connections with consumers through community events and influencer partnerships profoundly impacts purchasing decisions. Authenticity and recommendations from trustworthy sources hold substantial sway over how individuals choose consumer durables.

When consumers witness influencers or community members they respect engaging with and endorsing these products, it establishes a connection. It provides credibility and relatability to the consumer durables. Additionally, participating in community events where they can interact with these products and discuss their experiences fosters a sense of involvement and trust.

These strategies humanize the brand and the products, moving beyond a simple transactional relationship. The goal is to establish a sincere connection where consumers can relate to the experiences and recommendations shared by influencers or their community peers. Such authentic engagements significantly influence their choices when considering consumer durables, driving sales, and nurturing a loyal customer base.

“Driving Innovation and Excellence: The Crucial Roles of ODMs, OEMs, and Manufacturers in the Consumer Durable Industry”

Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) play vital roles in propelling the consumer durable industry forward. ODMs, with their expertise in design and efficient manufacturing capabilities, significantly contribute to the creation of innovative products. Brands collaborate with ODMs to bring fresh ideas to life and craft products that align precisely with what consumers are seeking. These collaborations allow for the customization of consumer durables, tailoring them to meet the specific preferences of the target audience. The result is a range of products that stand out in the market, offering not only advanced technology but also unique designs. Such products capture the interest and attention of the modern consumer, particularly those who appreciate and seek out innovative advancements in their purchases.

On the other hand, OEMs play a critical role in the consumer durable industry, ensuring that quality and production capacity remain at optimal levels. Their expertise and capabilities in bringing designs to fruition are instrumental in creating products that meet stringent criteria for functionality, durability, and performance. In a rapidly evolving market, meeting the increasing demand for premium consumer durables is a significant challenge. OEMs rise to this challenge by utilizing their proficiency to deliver products that not only meet the high standards expected but also ensure cost-effectiveness in the production process. By maintaining a delicate balance between quality, scalability, and cost-efficiency, OEMs contribute to the market’s growth and help meet consumer expectations for durable and reliable products. Their role in the production cycle is indispensable, ensuring that the industry keeps pace with advancements and rising demands, benefiting both manufacturers and consumers.

Additionally, manufacturers are key players in the consumer durable industry, guiding its trajectory by keeping pace with shifting trends and evolving consumer preferences. To remain competitive and resonate with consumers, it is vital for manufacturers to emphasize key elements such as innovation, sustainability, and streamlined production. Understanding the unique preferences and expectations of the modern consumer, especially the tech savvy GenZ, is key. Tailoring products to align with their lifestyle and values ensures a targeted and successful approach, gaining a competitive edge in the consumer-durable market. It is about crafting products that resonate with their way of life, setting the stage for sustained success and growth in the industry.

The Growth of Lower Tiers and Organized Channels

-

Growing Demand in Lower Tiers:

A significant trend within the consumer durable industry is the increasing demand emerging from lower-tier cities and rural areas. The appeal of consumer durables is extending beyond urban centers, with a notable rise in disposable incomes within these regions. Consequently, there has been a notable upsurge in the demand for consumer durables.

Manufacturers and retailers must adapt by customizing their products and strategies to cater to these expanding markets.

The data presented in the graph below underscores this trend, revealing substantial CAGR growth in town classes 3-6. From 2018 to 2022, these areas experienced higher growth rates compared to the industry average. For instance, the fully automatic washing machine segment witnessed a 17% growth in tier 3 to 6 towns, surpassing the overall industry growth rate of 11%. This data emphasizes the growing importance and potential of consumer durables in lower-tier cities and rural areas.

-

Emergence of Organized Channels:

The burgeoning growth of organized retail channels is significantly impacting the consumer durable industry. These channels are becoming increasingly prominent due to shifting consumer preferences, particularly among the modern demographic.

Customers today, seeking quality assurance, authenticity, and a diverse range of options, are drawn to organized retail. This shift is reshaping the dynamics of how consumer durables are marketed and sold. Manufacturers and retailers are recognizing the importance of adapting their strategies to effectively leverage the opportunities that organized channels present.

As shown in the graph below, the growth pattern witnessed in town classes 3 to 6 is paralleled by the rise in organized retail channels. The substantial increase in town classes 1 to 6, particularly the exceptional 192% growth in town classes 4 to 6, highlights the increasing influence and appeal of organized retail in these segments. This trajectory underscores the emergence and impact of organized channels in the consumer durable industry, reaffirming the need for industry players to align their strategies with this evolving landscape.

Meeting Sustainability Demands with Eco-Friendly Materials and Manufacturing:

Consumer durable companies are evolving their strategies to prioritize the use of sustainable materials and the adoption of eco-friendly manufacturing practices. This shift is driven by a recognition of the environmentally conscious values held by the contemporary consumer base, reflecting a broader societal concern for the planet. By opting for sustainable materials and eco-friendly production methods, these companies aim to meet the expectations of consumers who value responsible and sustainable product choices.

For instance, in the production of washing machines, consumer durable companies are innovating to introduce “eco-bubble” technology. This advancement optimizes water and energy usage, aligning with the ethos of sustainability. These machines create bubbles that enhance detergent penetration, enabling effective cleaning at lower water temperatures. By using less energy and water, they address the eco-conscious concerns of modern consumers. It is a step towards fostering a more eco-conscious approach in the consumer durable industry, aligning with the preferences of a generation that prioritizes sustainability and environmental well-being.

Embracing Circular Economy

-

Product Life Extension and Recycling:

Consumer durable companies are increasingly embracing the principles of a circular economy, particularly focusing on product life extension and recycling as key components of this sustainable approach.

-

Product Life Extension:

Promoting product life extension entails designing consumer durables with durability and longevity in mind. Manufacturers encourage repairs, updates, or upgrades to prolong the lifespan of these products. By making components easily replaceable or upgradable, consumers are more inclined to keep and use the product for a more extended period. This not only reduces the frequency of purchases but also minimizes the overall environmental impact associated with manufacturing and disposing of products.

-

Recycling:

Designing consumer durables for recycling is another vital aspect. Manufacturers are increasingly considering the end-of-life phase of their products during the design process. This involves using materials that are recyclable and ensuring that products can be easily disassembled at the end of their useful life. By doing so, the components and materials can be repurposed and used in the manufacturing of new products. This practice significantly contributes to a circular economy by reducing waste and conserving valuable resources.

By incorporating these strategies into their product development processes, consumer durable companies are not only aligning with sustainable practices but also addressing the growing concerns of environmentally conscious consumers. The shift towards embracing the principles of a circular economy represents a positive trajectory for the industry, aiming to minimize waste, reduce the consumption of finite resources, and promote a more sustainable future.

Conclusion

In this swiftly evolving era, consumers are not merely seeking products—they are looking for a reflection of their values and aspirations in consumer durables. The rise of premiumization signifies a shift towards a lifestyle that combines advanced technology and sustainability. Manufacturers and retailers are at a crucial juncture, tasked with innovating and aligning their strategies to cater to these changing consumer landscapes.

Success in the future of the consumer durable industry hinges on understanding, adapting, and crafting a narrative that resonates with the evolving essence of our times. It is a future promising exciting and transformative possibilities and embracing it with open minds and open hearts is the way forward.

– Dheeraj Mukherjee, Head of Sales, Market Intelligence, India- GfK- an NIQ Company