With many of the challenges of 2022 continuing into 2023, the global economy seems set for a bumpy ride ahead. But history shows us that humans can be remarkably adaptable, and that even in the most difficult crises, opportunities can be found. We spoke with Nevin Francis and Norbert Herzog from GfK’s Global Strategic Insights Team about what to expect from the global economy this year and where opportunities might be found amidst the gloom.

Introduction

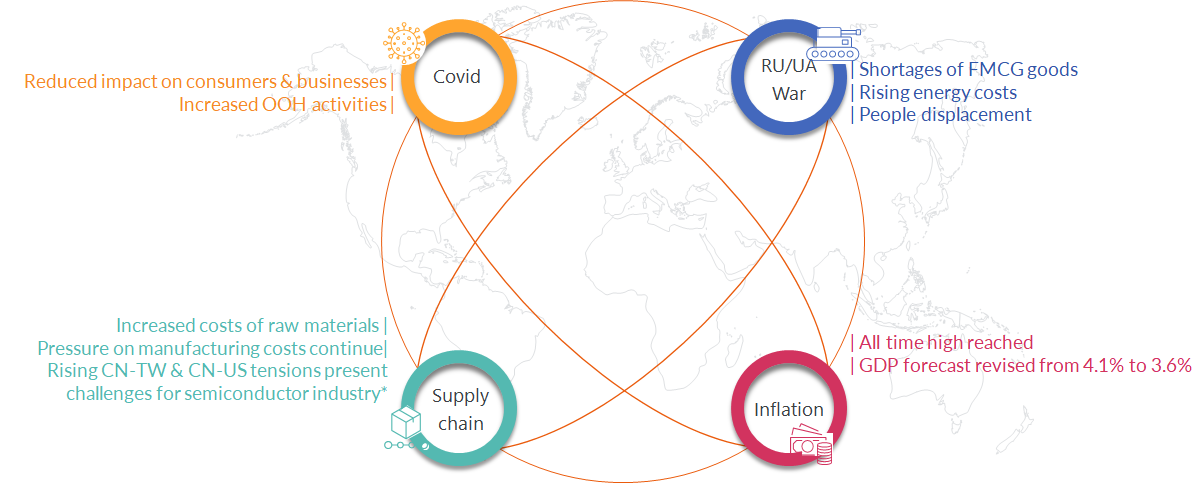

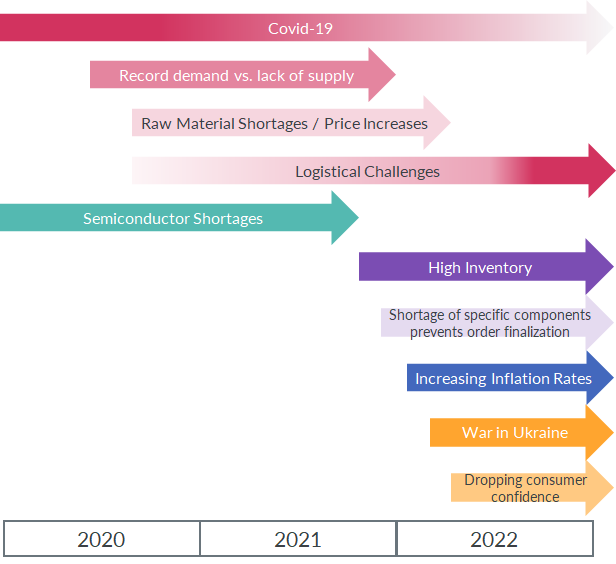

During 2022, consumers were impacted by a series of significant challenges: the aftermath and lingering impacts of the COVID pandemic, disruption to global supply chains, the outbreak of war between Russia and Ukraine, and higher energy and food costs leading to rising inflation. These issues converged to create a difficult environment for brands and retailers with lower sales volume and value over the course of 2022. The results were particularly stark in comparison to the bumper results from 2021, when economies enjoyed a brief post-pandemic boom.

Many of these issues are set to persist into 2023, along with new concerns, as many economies are on the brink of recession and tight labor markets are putting upward pressure on wages, potentially fueling further inflation. Business and consumer confidence have plummeted in the face of this bleaker global economic outlook.

Yet despite potential challenges ahead, there are signs that businesses, consumers and supply chains are beginning to adapt to more difficult conditions. And although things could be tough for some time to come, there are pockets of opportunities for those ready to seize them.

But, as consumers change their behavior and priorities to respond to the new and continually evolving situation, existing assumptions around how to appeal to them may no longer apply. For brands and retailers looking to capture the opportunities in this market and build resilience for the future, it will be essential to test their understanding of consumers and reassess their strategy and tactics to ensure they are fit for purpose in the current environment.

A weaker outlook locked in

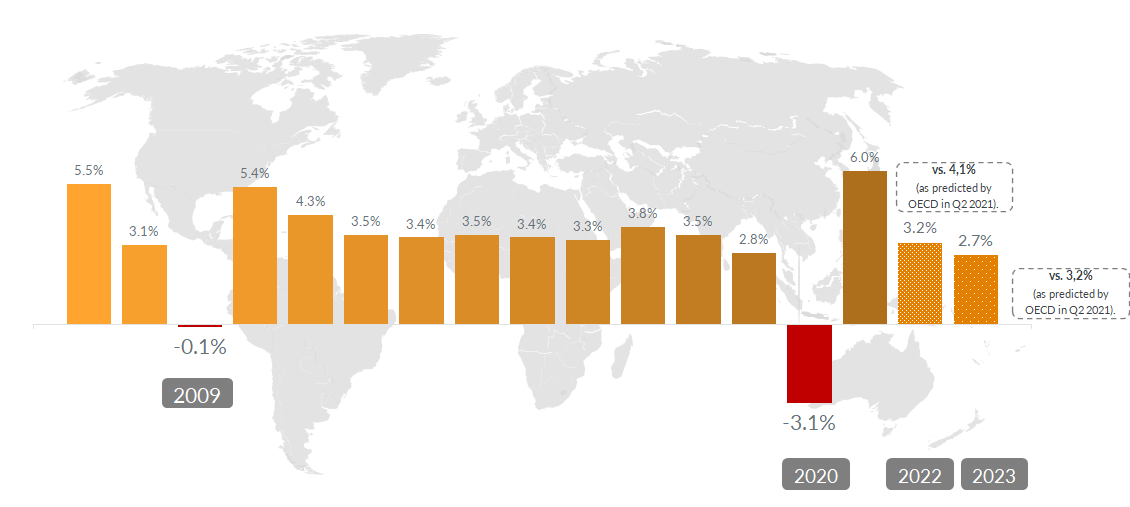

After several years of turbulence, and grappling with a range of converging crises, economies around the world are slowing. And they are slowing more than many initially anticipated. The IMF has lowered its forecast for Global GDP once again, now predicting 2.7% Real GDP growth in 2023, down from the 3.2% growth it predicted in Q2 of 2021.

IMF Global Economy Real GDP growth rates vs. Previous year in %

Source: Real GDP growth annual % change IMF Data Mapper; WEO Oct 2022 World Economic Outlook (October 2022) – Real GDP growth (imf.org)

Advanced economies are expected to be particularly impacted, with the IMF now forecasting only 1.1% growth for this group, but emerging economies have also slowed substantially. Emerging economies’ performance has been impacted by a sharp drop in China’s GDP, from 8.1% in 2021 to just 3.2% expected for 2022.

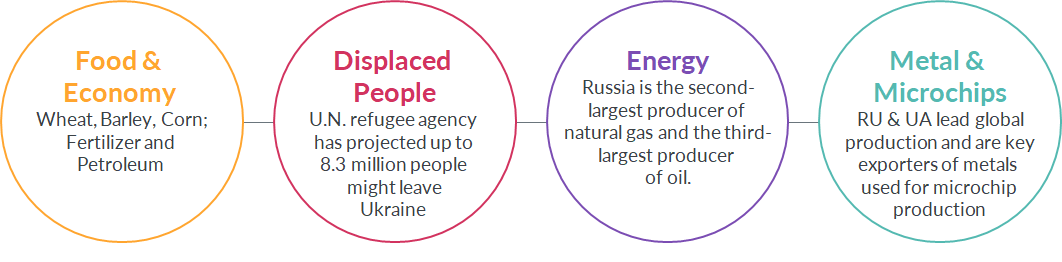

A primary cause of the slowdown in global growth is the Russia-Ukraine war. The conflict has not only contributed to global inflation, but it has also exacerbated disruptions in global supply chains. Unfortunately, even if the conflict were to cease tomorrow, the impact on economies would continue for some time, while trade routes resume and sanctions unwind. So a period of dampened growth is unavoidable as 2023 starts.

Broader global impact of Russia-Ukraine war

Cautious consumers wait and see

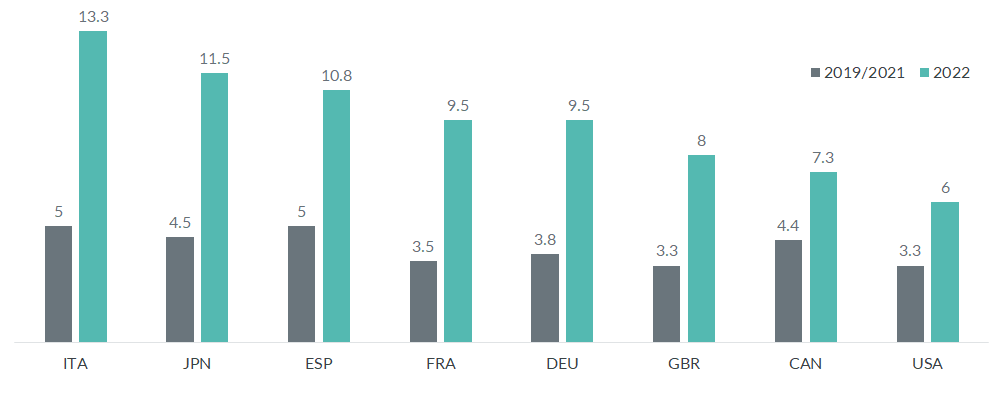

This slowing of GDP growth comes at the same time as inflation reaches a forty-year high in many countries, driven by sharply rising energy and food costs. The high cost of energy, in particular, has impacted consumers as the northern winter takes hold, pushing up economy-wide expenditure on energy.

Energy expenditure in % of GDP

Source: OECD Economic Outlook * Based on two different calculations from IMF and OECD

https://www.oecd-ilibrary.org/sites/ae8c39ec-en/index.html?itemId=/content/publication/ae8c39ec-en#figure-d1e340

Note: Illustrative estimates of 2022 expenditures on coal, oil, natural gas and electricity based on average consumption of 2019 and 2021 except for coal (2019 only), and proxies for average year-to-date energy prices in 2022. For coal, the price used corresponds to the Newcastle coal price; for oil, to Brent; for natural gas, to the TTF hub price for the European countries, the Henry Hub price for Canada and the United States, and the Asia LNG reference price for Japan; for electricity, it corresponds to the market spot price in each country. Source: IEA; OECD Economic Outlook 111 database; EIA; JEPX; IESA; EPSIS; and Refinitiv

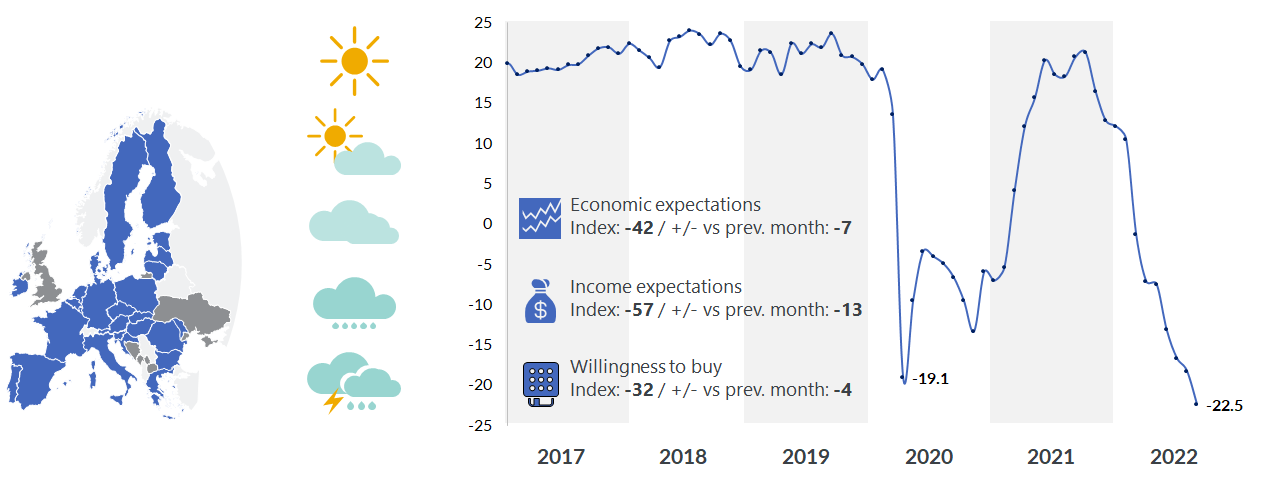

Meanwhile, commodity shortages and supply chain disruptions have also contributed to rising prices, leaving households with less disposable income. As a result, consumer confidence in Europe has fallen sharply to levels below those seen at the beginning of the pandemic.

Source: GfK, EU Commission | September 2022

The cautiousness of consumers can also be seen in household savings rates, which rose during the pandemic and have remained elevated, suggesting that consumers are saving rather than spending as a precaution in the face of growing economic uncertainty.

Confidence is also falling in China, where a slump in the housing market is threatening to expand into a broader economic crisis, dragging the renminbi down against the US dollar, and impacting GDP growth. This could be of particular concern for the global growth outlook according to Norbert Herzog, “We are watching the situation in the housing market in China closely. If the crisis expands further, it will trickle down to impact home appliance sales and could eventually impact the global economy.”

Global supply chains: Broken or just bruised?

Meanwhile, the global supply chain disruptions that began during the pandemic have continued. Shortages of raw materials, ongoing lockdowns in some locations, and bottlenecks in production and logistics have all impacted product availability during 2022.

But although the challenges have highlighted weaknesses and vulnerabilities in the global supply chain, companies are already moving to improve supply chain diversification and finding innovative ways to sidestep bottlenecks. This suggests that the current situation is a hurdle that global supply chains will adapt to overcome, rather than a stumbling block that will disrupt them permanently. Norbert suggests, “Supply chains will look different in the future: less dependent on individual countries, more transparent and more sustainable. We are already seeing companies make these changes.”

For example, many companies are taking steps to diversify their suppliers to reduce country-specific risk. Apple’s decision to increase the production of iPhones in India and reduce its reliance on Chinese manufacturing is an example of how companies are seeking to build resilience in their supply chains. Some manufacturers are also taking control of producing the components they need for their products, reducing their dependence on others. In 2021, Bosch opened a manufacturing facility in Germany to produce semiconductor wafers. Although further processing is required to product a standalone chip, the move demonstrates the company’s intention to reduce its reliance on third-party manufacturers for the vital chips that have experienced a global shortage since 2020.

Global supply chains have also come under pressure with growing scrutiny from consumers looking to understand the environmental and social impacts of the goods they buy and the companies they support. The high level of attention on the Qatar World Cup is an example of the increased public awareness of ethical and sustainability issues within supply chains. The event was scrutinized for alleged poor labor practices involved in the building of new venues and for its claims of carbon neutrality. With younger generations placing a higher priority on sustainability as a personal value, we expect this kind of scrutiny will only grow in coming years.

The difficult environment over the last two years has forced brands to rethink their global supply chains and adapt in order to minimize disruption to their operations. In the long run, we expect such changes to supply chains to be broadly positive. Although there may be some loss of efficiency, over the long term it will make supply chains more resilient to future shocks, more sustainable, more socially responsible and more transparent.

The big question: How will consumers adapt?

Unfortunately, while supply chain disruptions continue in the short to medium term they will contribute to higher prices for consumers. With disposable income already stretched, consumers are showing marked cautiousness about the months ahead and this caution can be seen in their spending decisions.

Sales volumes and values have continued to fall over 2022, compared to 2021’s bumper performance. Sales value declined by 7% in USD terms, while sales volume declined by 6% for period Jan-Sep 2022. Price polarization is also evident, with many cost-conscious consumers opting for value options while affluent consumers are still spending on premium products. This has led to a ‘hollowing out’ of middle-of-the-range options.

But as Nevin points out, “Inflation will play out very differently across regions and categories. Consumers have proven resilient to previous crises, but we don’t know yet whether that will be the case this time.” Norbert agrees, stating, “Don’t underestimate consumers’ ability to adjust. Consumer confidence can recover very quickly when conditions improve.”

Historically, consumers have shown remarkable resilience in the face of inflation and other economic turmoil. In Argentina, which has grappled with rapidly rising prices for the last five years, consumers have been forced to adopt of a range of tactics and workarounds to hedge against runaway inflation. The current levels of inflation in developed economies are much lower than those experienced by Argentines, suggesting that consumers in more developed countries should have the financial safety net to weather this current storm.

With the northern winter well underway, consumers will be learning in the first few months of 2023 whether the worst-case scenarios of sky-high energy bills come true or whether the outcome is not as harsh as they feared. There are many variables that could impact consumer confidence during this time, so it’s essential to keep monitoring consumer sentiment for signs of a significant shift.

Opportunities within the uncertainty

Despite a generally weaker outlook for 2023, there will certainly be bright spots within the gloom for those that are able to identify them and ready to grasp them when they do arise. Here is our advice to brands and retailers looking capitalize on the opportunities ahead.

-

Adapt your approach for regions and markets. Economic challenges will play out differently across regions and categories. Understanding how consumers are responding in different markets will be essential to tapping into growth opportunities. For example, developed markets are predicted to see lower GDP growth than their emerging counterparts, so brands could explore entering new markets, or adjust their marketing spend to focus more on the emerging markets they sell to. There may also be different levels of product uptake across categories and regions, so it will pay to understand where there are opportunities to increase market penetration of certain products. Finally, countries where average household debt per household is lower might prove more resilient to economic turmoil. This was apparent after the Global Financial Crisis, when households with larger debt obligations made larger adjustments in spending.

-

Know your consumer (and how they are changing). This is more important than ever as consumer behavior is changing rapidly in the face of economic uncertainty. Remarkably, premium product features are still driving growth among affluent consumers – understanding why they are stimulating demand could unlock growth. Meanwhile, it is essential to understand the categories that cost-conscious consumers will still spend their money on despite cost of living pressures. Although they might cut back on certain spending items, consumers still believe it’s important to indulge themselves, even if they might be more careful about selecting these indulgences. As Nevin notes, “Brands will need to cater for both ends of the price spectrum in their product mix and provide different entry points to appeal to both the budget conscious and more affluent consumers.”

- Another interesting consumer behavior to monitor is ‘revenge shopping’ where consumers have been known to splurge after a period of restraint to make up for lost time. Brands and retailers will need to be ready to capitalize as soon as consumer confidence rallies.

- Embrace the consumer demand for sustainability. Consumer demand for ethical and sustainable products and services is expected to rise inexorably over the coming years. Norbert suggests, “Sustainability and brand purpose are opportunities for brands to position themselves in line with consumers’ changing views. Some brands have demonstrated this already by refusing to take part in promotional activities linked to the Football World Cup.” Many solutions to the current economic uncertainty can also be linked to improved sustainability benefits. Companies grappling with supply chain challenges could tap into a market for renovated second-hand products or highlight repairability as a product feature, taking steps towards a more circular economy.

Conclusion

Although brands and retailers will likely face a tough environment for some time to come, there are good reasons to be optimistic that the current challenges will build long-term resilience for the industry. In the meantime, there will undoubtedly be opportunities within difficulty. Ultimately, consumers and supply chains could also emerge from the current situation more resilient to future shocks. But as consumers adapt to the new conditions, retailers and brands will need data and insight more than ever to understand the fast-moving situation and stay ahead of trends that can turn on a dime.

Discover AI-powered marketing intelligence and consulting service powered by GfK.