Electric Vehicles (EVs) have seen supercharged momentum in the last few years, but as the economy ebbs and flows, consumers are growing increasingly conscious of where they spend money – and EVs are not at the top of the shopping list.

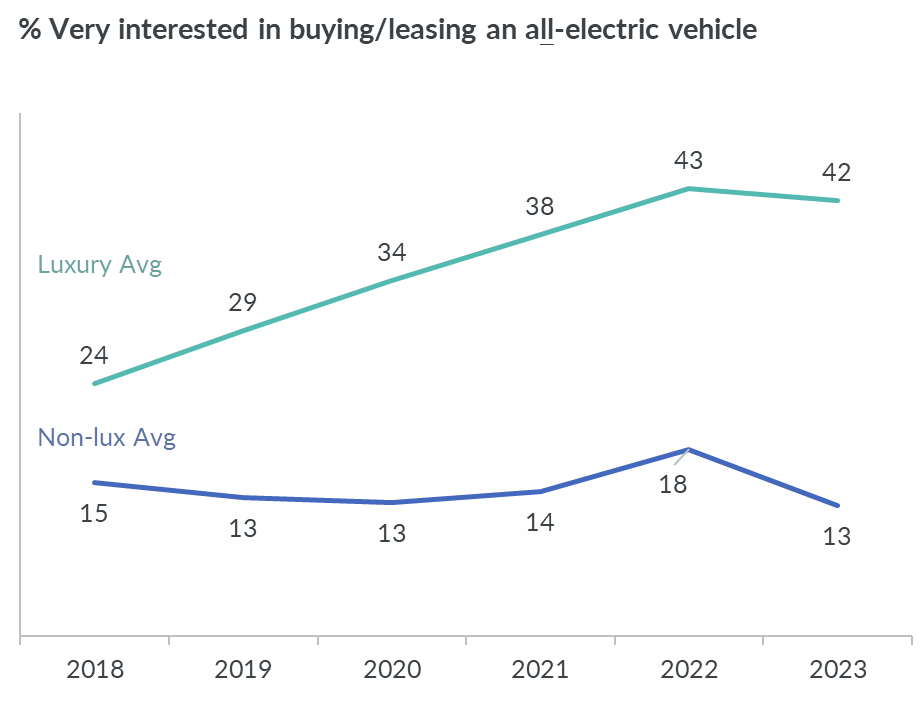

Recent research that we carried out shows there’s been a 5% dip in EV interest since last year, with price taking the #1 spot as the top purchase barrier.

Environmental appeal just isn’t cutting it

This dip in the market is driven by consumers in the non-luxury space who find it harder to warrant purchasing environmentally friendly products in a fluid economy. In fact, 55% now say that eco-conscious products are too costly.

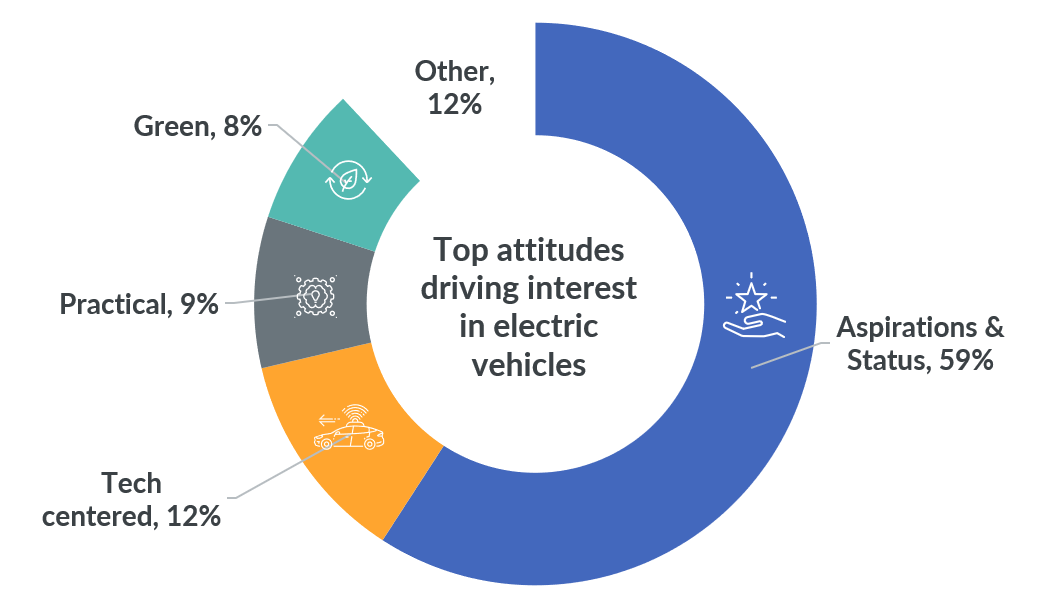

While environmental benefits aren’t the key driver of EV adoption, both automakers and sellers need to think beyond to boost mass appeal, especially as the average price of a non-electric vehicle remains more affordable. The hype behind EVs may still be hype, especially for the practical consumer who needs to prioritize in the face of adversity – and it shows. Interest in purchasing EVs continues to be predominantly driven by aspirational feelings.

Our research confirms the economy’s influence on the consumer mindset, with 47% agreeing that financial security and well-being take precedence over environmental issues. The data gets specific, too.

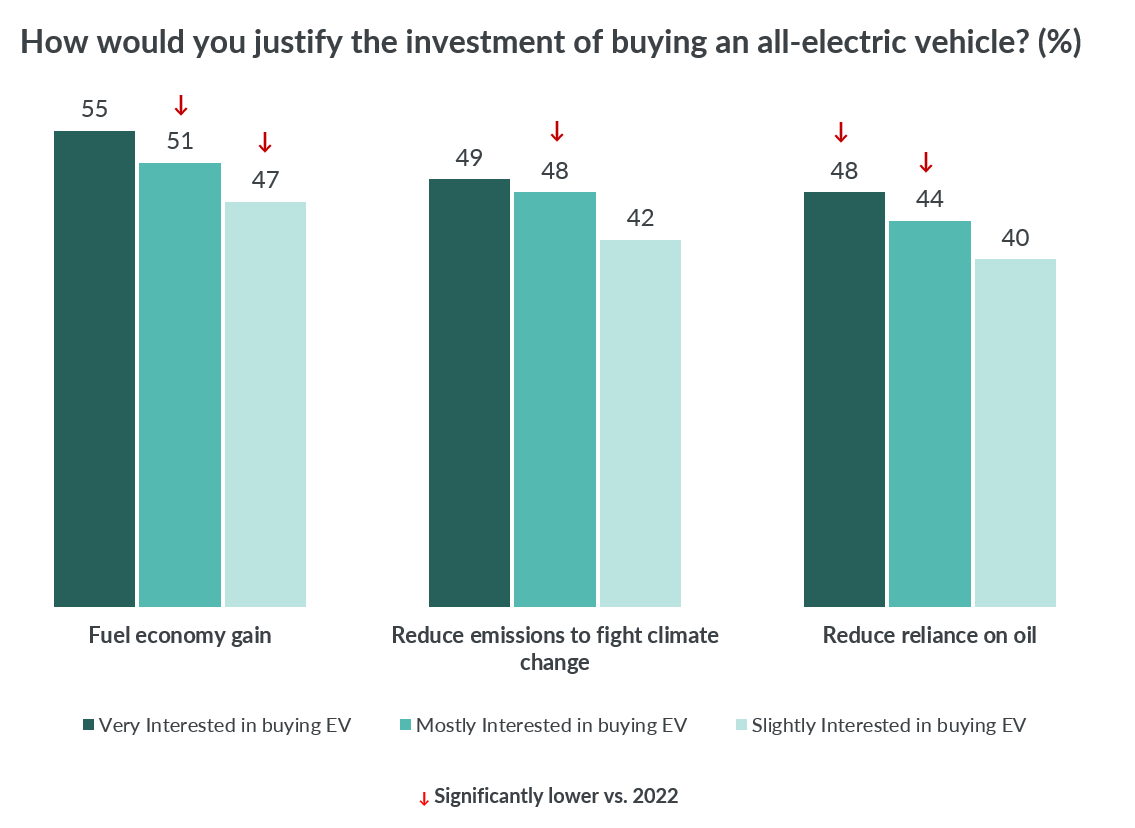

Compared to 2022, the way consumers justify an EV purchase is changing:

- Savings on fuel as a justification dropped 7 pts

- Reduced reliance on oil dropped 5 pts

- Fighting climate change through emission reduction dropped 3 pts.

However, it stretches beyond pricing and the economy.

EVs are less reliable than conventional vehicles as it stands, which might be contributing to this flux in demand. Even as consumers research EVs and gain first-hand experience riding in or driving one; reduced range, cold weather performance, and battery management rise as potential barriers to owning one.

EVs are not the norm for the everyday consumer (yet)

Demand is not completely lost though, as luxury shoppers remain a bright spot in the market. 42% of luxury intenders, those considering a new vehicle, are still very interested in buying or leasing an EV. This is for a few reasons: affluent shoppers have more flexibility in their purchasing decisions, especially because they have more resources when it comes to charging infrastructure, disposable income, and owning a complementary vs primary vehicle.

EVs are here to stay; and as technology, infrastructure, and tax incentives improve, it’s only a matter of time until brands see a rebound in demand for EVs, beyond the luxury consumer.

What will boost EV sales?

Today is all about accessibility – and availability. Non-luxury shoppers said the only thing that would sway them right now is seeing EVs sell for the same price as a non-EV. Quick charging, free public charging infrastructure, and battery warranties would also help. There’s hope for Automakers and sellers now that EV owners can access Tesla’s national network of 50,000+ Superchargers – bridging the infrastructure accessibility gap.

In the short term, appeal for hybrid and plug-in hybrid segments continues to thrive across both luxury and non-luxury markets. These models tend to offer the most flexibility for all consumers, not just in terms of affordability, but because range and infrastructure are no longer pain points – consumers can still enjoy the perks of an EV, yet avoid the high premiums and rest assured they can travel with peace of mind.

Learn more in GfK’s The Future of Mobility report, which offers a deep dive into the connections between vehicle intenders and the evolving automobility space – from EVs to brand innovation and new technology.

![]()

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)