The Global Beauty Market: An Overview

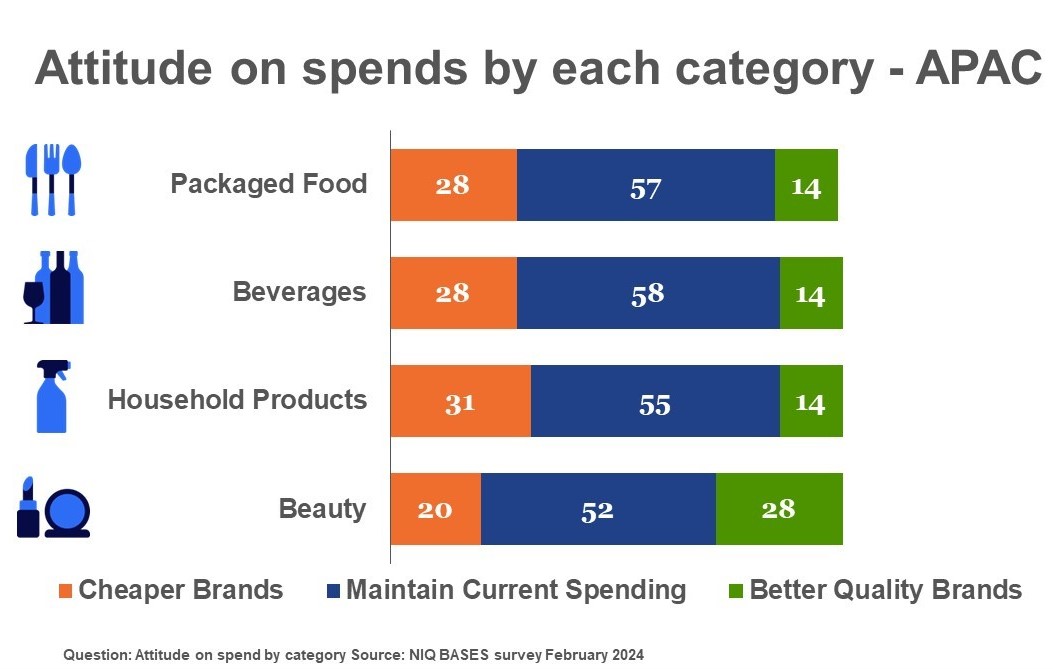

Tara James Taylor, Senior Vice President of NIQ Global Account Development, delivered a keynote speech at a Shanghai event titled “Global Beauty and Personal Care Industry Trends Overview.” Despite global economic challenges, she highlighted that consumers are still prioritizing beauty purchases over other FMCG products, even in tight financial times. In fact, the global beauty industry is thriving in value terms, with major regions seeing annual growth of over 10%. This steady expansion is expected to add another $300 billion to the market over the next decade.

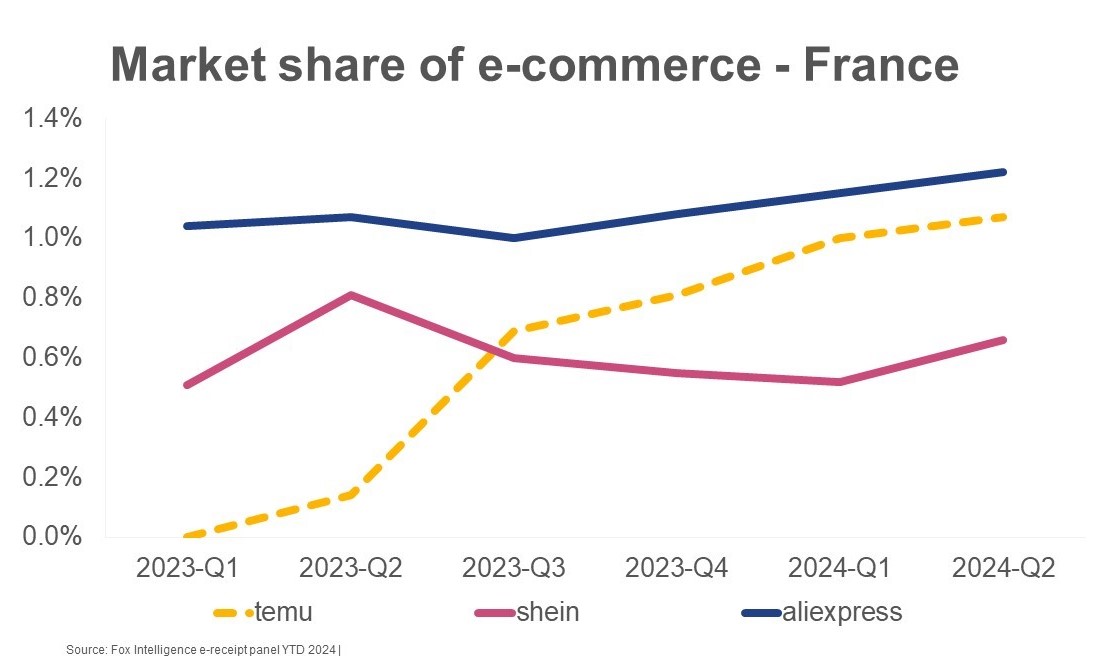

A key trend driving growth is the rise of interest-based e-commerce, with platforms like TikTok Shop contributing significantly. Although TikTok Shop launched relatively late in North America, its growth has been rapid, and by September 2024, nearly 80% of its sales came from beauty and health categories. The intensified global competition in e-commerce, driven by players like Temu, has further fueled the expansion of platforms like Shein and TikTok Shop, pushing the industry to new heights.

From a consumer standpoint, Generation Z is set to become the largest force driving beauty consumption over the next decade. Gen Z consumers are highly engaged with beauty and wellness, showing an active interest in makeup and skincare. NIQ research indicates that Gen Z plan to increase their beauty spending by approximately 11% over the next year—a significant boost compared to other generations.

China’s Beauty Market: A Closer Look

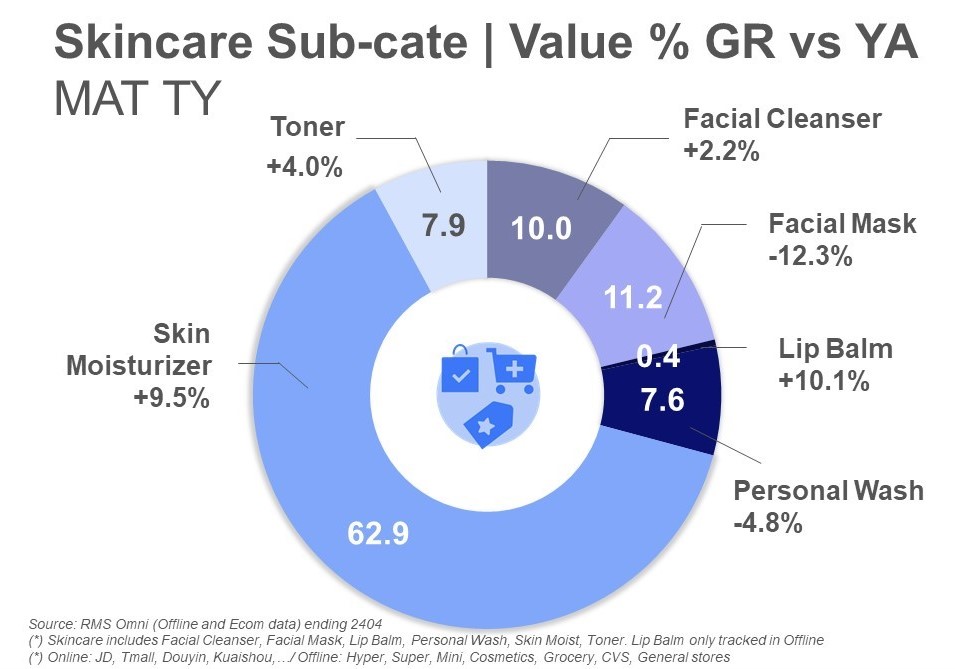

In the context of China’s beauty market, brands need to focus on managing three key areas: consumers, products, and channels. The personal care category in China has seen continuous growth across all channels. As of 2024, moisturizers make up 62.9% of the skincare category, with this segment growing by 9.5%, pushing overall skincare growth to 4.2%. Online sales dominate the skincare market, accounting for over 80% of total sales and continuing to grow.

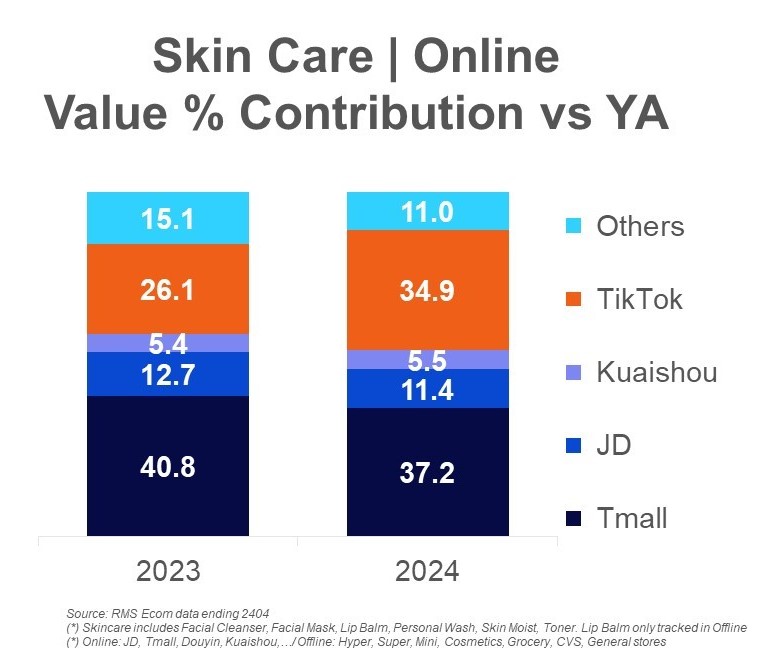

In 2024, online personal care sales grew by 7.3%, with TikTok e-commerce standing out, thanks to a remarkable growth rate of 43.7%. TikTok’s share of online beauty sales increased from 26.1% to 34.9% year-over-year, while traditional e-commerce platforms like JD.com and Tmall saw their market share decline. As a result, focusing on TikTok has become crucial for Chinese beauty brands aiming to capture growth and gain a competitive edge in the digital space.

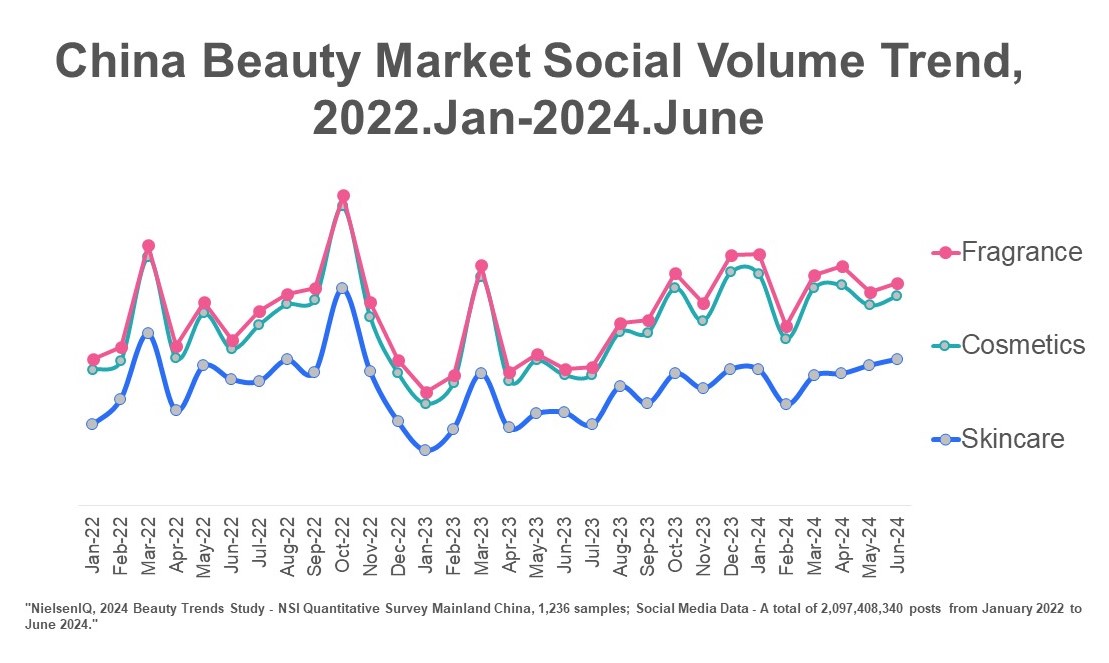

Social media has also become a crucial battlefield for beauty brands, with promotions during key periods helping to amplify brand influence and drive conversions. While the beauty industry’s social media presence experienced some fluctuations during the pandemic in 2022, by June 2024, social media buzz had not only recovered but surpassed pre-pandemic levels. The future looks bright for social engagement in the beauty sector.

When it comes to fragrances, certain keywords resonate more with consumers on social media. Phrases like “scent,” “emotion,” and “limited editions” generate significant engagement, while scenarios such as “dating” and “holiday gifts” continue to drive growth. For brands, creating emotionally resonant fragrances and leveraging specific social scenarios in marketing will be key to attracting consumers and boosting sales.

Despite the challenges posed by the pandemic, China’s beauty market has shown resilience and is set to continue its upward trajectory, with more opportunities for innovation and growth on the horizon. Understanding the full view of the beauty landscape, consumers and trends will be paramount to achieving success and provide the competitive advantage.

Let NielsenIQ be the partner that sets you on a winning trajectory!

Get your beauty business growing the right way…..

At NIQ we help our clients identify strategic pathways to growth with a wide range of solutions to cover all needs.